FRM Exam Preparation

The world is currently in a dark place with the ongoing rise in coronavirus cases. The adverse effects brought about by the pandemic are despicable. People and industries alike have been affected. There is an imminent risk of companies going…

Best Tips and Tricks for Preparing and Successfully Passing FRM Exams

Passing your Financial Risk Management (FRM) exam on the first try isn’t impossible – it is however quite difficult. FRM exams are detailed and involve complex calculations and thinking from each exam candidate. A financial risk manager is expected to…

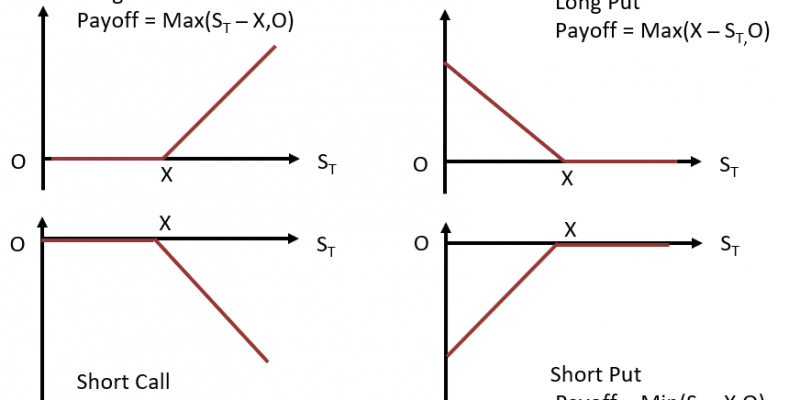

Options Payoffs and Profits (Calculations for CFA® and FRM® Exams)

The buyer of an option has the right but not the obligation to exercise the option. The maximum loss to the buyer is equal to the premium paid for the option. The potential gains are theoretically infinite. To the seller (writer), however, the maximum gain is limited…

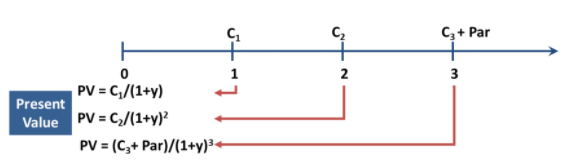

Bond Valuation (Calculations for CFA® and FRM® Exams)

Bond valuation is an application of discounted cash flow analysis. The general approach to bond valuation is to utilize a series of spot rates to reflect the timing of future cash flows. Value, Price, and TVM Value can be described as…

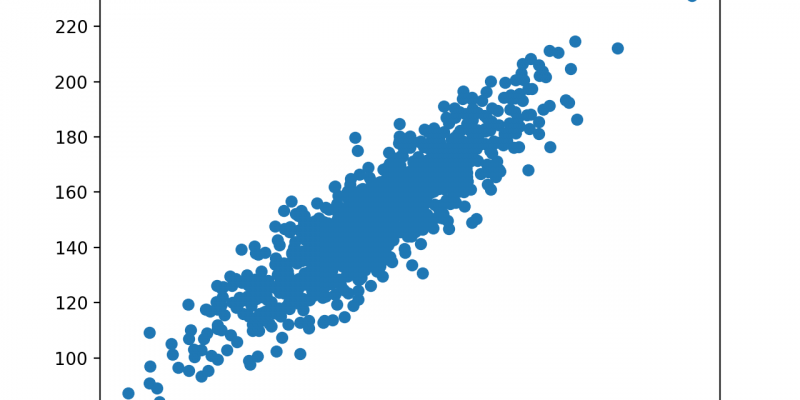

Covariance and Correlation (Calculations for CFA® and FRM® Exams)

Covariance The covariance is a measure of the degree of co-movement between two random variables. For instance, we could be interested in the degree of co-movement between the rate of interest and the rate of inflation. X = interest rate…

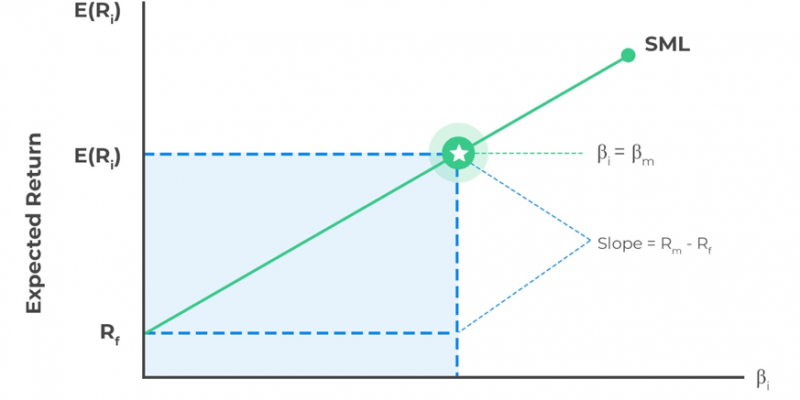

Sharpe Ratio, Treynor Ratio and Jensen’s Alpha (Calculations for CFA® and FRM® Exams)

Portfolio Performance Measures Portfolio management involves a trade-off between risk and return. Most amateur investors mistakenly focus only on the return aspect and lose sight of the risk taken to achieve the return. The portfolio performance measures are intended as…

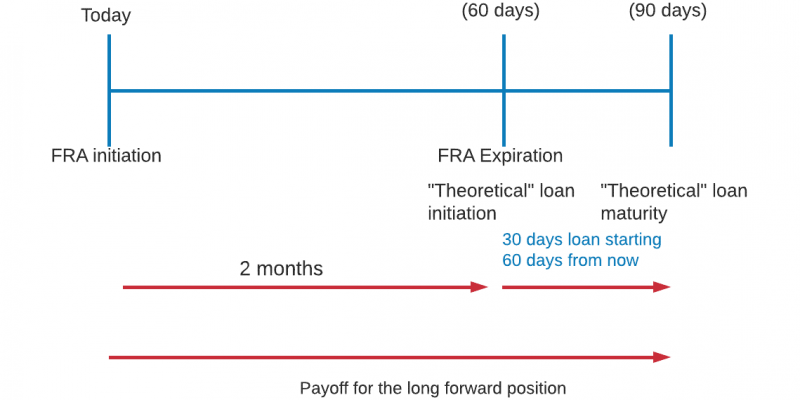

Spot Rate vs. Forward Rates (Calculations for CFA® and FRM® Exams)

Spot Rates A spot interest rate gives you the price of a financial contract on the spot date. The spot date is the day when the funds involved in a business transaction are transferred between the parties involved. It could…

Everything You Need to Know About FRM Exams

The Financial Risk Manager program (FRM) is an exam certification that is offered to individuals interested in working in the financial risk management department of firms. It is an internationally recognized certification that is administered by the Global Association of…

FRM Part 1 Changes from 2019 to 2020

Here are the major changes for FRM part 1 for 2020: Book 1 – Foundations of Risk Management Chapter 1: The Building Blocks of Risk Management (Previously: Risk Management: A Helicopter View) ADDED: Explain how risk factors can interact with each other and…