SOA Exam FM Study Notes

Online and Printable Prep Books for Actuarial Exam FM

Exam FM is a three-hour, 35 multiple-choice questions exam designed to test your knowledge of fundamental concepts of financial mathematics. AnalystPrep has developped concise study notes focusing on exactly the learning objectives tested in the Society of Actuaries exams.

SOA Exam FM’s syllabus comprises of 8 topics and each one of them contributes a certain percentage of questions to the exam. With AnalystPrep’s concise study notes for Exam FM, you can simply read on your tablet, computer, or print each concept before jumping into the question bank portion of the platform.

Questions Answered by our Users

Satisfied Customers

Preparation Platform By Review Websites

What are the Eight Topics?

The first fours topics are quite straightforward and most actuarial students should have seen the most part of this in their undergraduate degree:

- Time value of money (10-15%)

- Annuities/cash flows with non-contingent payments (15-20%)

- Loans (10-20%)

- Bonds (10-20%)

The next two topics relate mostly to the investment world and can be a little more tricky for actuarial students:

- General cash flows and portfolios (15-20%)

- Immunization (10-15%)

And the last two topics are based on interest rate and interest rate theory, but weight a bit less on the overall exam:

- Interest rate swaps (0-10%)

- Determinants of interest rates (0-10%)

Here, it is important to note that having great fundamentals in the first few topics will help you solve more easily questions from the later topics.

How Should I Study for Exam FM?

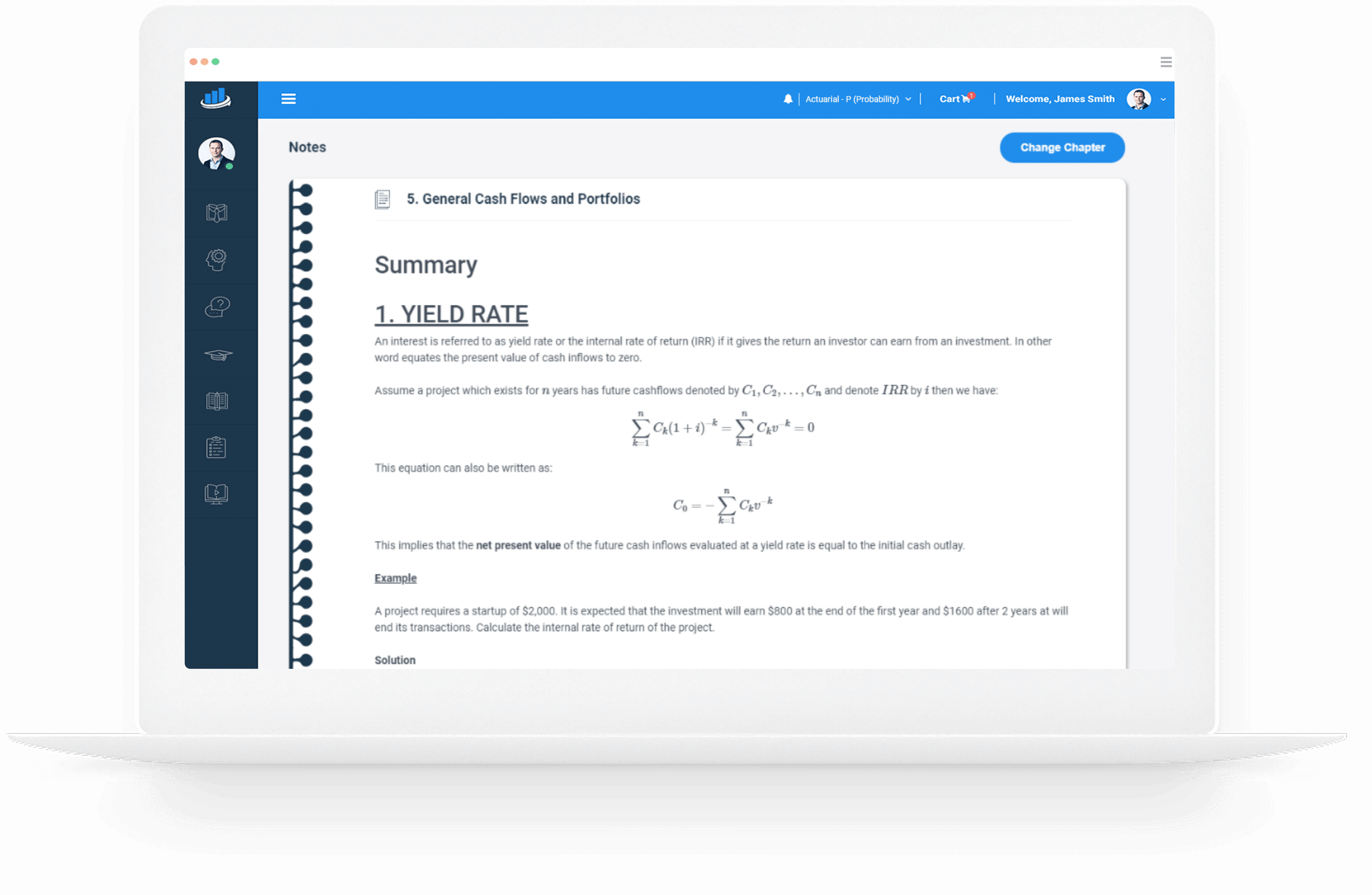

Example Learning Objective from AnalystPrep's SOA Exam P Prep Notes

Topic 2: Loans

Actuarial Exams Study Packages

Exam P (Learn + Practice Package)

$

349

/ 6-month access

- Video Lessons

- Study Notes

- Question Bank and Quizzes

- Performance Tracking Tools

- 6-Month Access

Exam FM (Learn + Practice Package)

$

349

/ 6-month access

- Video Lessons

- Study Notes

- Question Bank and Quizzes

- Performance Tools

- 6-Month Access

Unlimited Actuarial Exams Study Package

Unlimited Actuarial Exams Access

$

549

/ lifetime access

- Exams P & FM Video Lessons

- Exams P & FM Study Notes

- Question Banks and Quizzes

- Performance Tracking Tools

- Lifetime Access

- Unlimited Ask-a-Tutor Questions