"Thanks to your program I passed the first level of the CFA exam, as I got my results today. You guys are the best. I actually finished the exam with 45 minutes left in [the morning session] and 15 minutes left in [the afternoon session]... I couldn't even finish with more than 10 minutes left in the AnalystPrep mock exams so your exams had the requisite difficulty level for the actual CFA exam."

James B. / Level I of the CFA® ExamWith AnalystPrep

Get More Insights & Clear Study Guidelines

FRM Study Notes & Video Lessons

Our FRM study materials include 2,000 pages of efficient summaries and 93 hours of video lectures allowing you to pinpoint the necessary concept covered in the official GARP books.

FRM Question Bank

Practice with over 4,000 exam-style FRM practice questions designed to build up your knowledge base step by step and prepare you for the real test.

FRM Mock Exams

AnalystPrep’s study resources include a total of five FRM mock exams (in CBT or PDF format) written with the unique goal to simulate exam day.

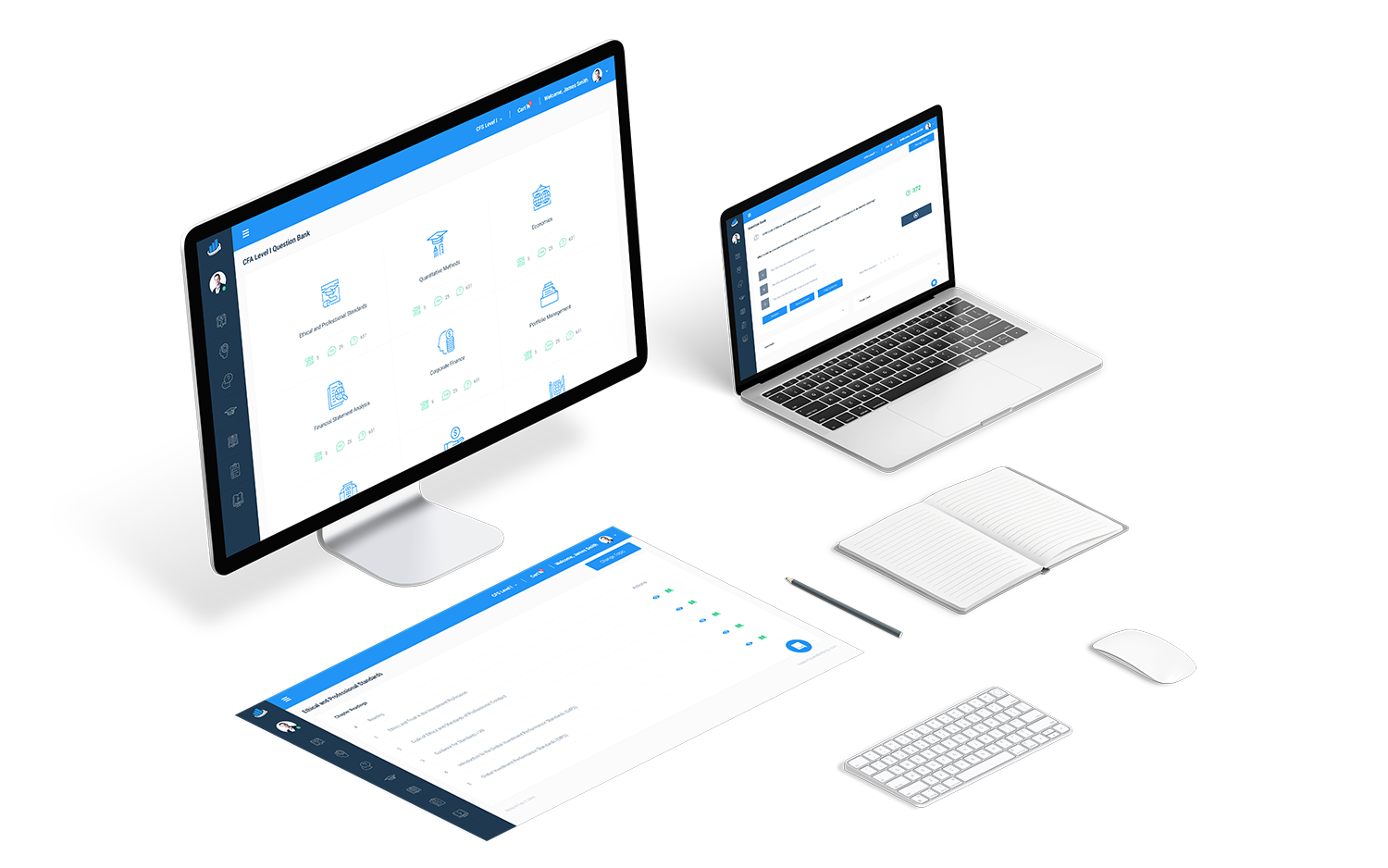

Bring your Study Experience to New Heights with AnalystPrep

AnalystPrep for the FRM® Program

Why AnalystPrep?

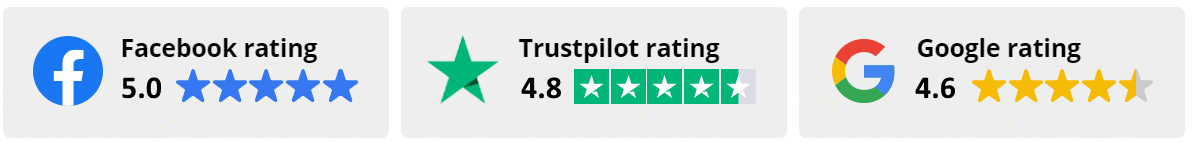

In a world where dynamic learning has become the new norm, AnalystPrep has emerged as a premier destination for FRM preparation. With an emphasis on flexible study options, we have tailored our platform to be accessible from anywhere, and on any device. We know that every candidate has unique learning preferences, hence, in addition to our comprehensive online study materials, we also offer FRM prep materials in print format, catering to those who prefer traditional paper-based learning.

Our quality of instruction is second to none, and it all comes down to the exceptional individuals leading our FRM courses. Each of our instructors is FRM certified, bringing to the table not just theoretical knowledge, but also practical insights gleaned from years of industry experience. This blend of academic acumen and real-world understanding ensures a learning experience that is not just rigorous, but also relevant and relatable.

When it comes to FRM preparation, we believe that exceptional quality need not be accompanied by an extravagant price tag. For a modest investment of $249, candidates gain 12-month access to our question bank, mock exams, and performance tracking tools.

With AnalystPrep, your success is our commitment. Over the years, thousands of candidates have put their trust in our study materials and successfully passed the FRM exam. We pride ourselves on our consistently high pass rates and the positive feedback we receive from our students. This track record of success is a testament to the effectiveness of our materials and the dedication of our instructors.

Track your Performance

Through our in-depth performance statistics, you will be able to keep tabs on your progress in every topic. Our specially designed dashboard summarizes your scores per chapter studied. It will help you to identify your strong and weak points and inform where you need to spend more time.

In addition, you can view charts and graphs that will give you relevant statistics on performance and time management – an important aspect to consider. You may have four hours to spend in the exam room, but from experience, time flies! You need to be mean with your time, and that calls for practice.

All our performance tracking tools will increase your likelihood of obtaining a desirable score on the FRM exams.

Don’t hesitate to check out what AnalystPrep has to offer! AnalystPrep’s FRM study materials are either free or a low-cost option, with no pressure to upgrade to a premium plan if you just want to practice using the free FRM question bank! AnalystPrep’s mission is to provide excellent service on your way to a rewarding and fulfilling career in financial risk management. All we want is to see FRM hopefuls succeed in their post-graduate exams with as much ease as possible.

About the FRM Exams

FRM is a rigorous 2-part exam offered by the Global Association of Risk Professionals (GARP). It’s the most esteemed and widely accepted risk management certification. If you wish to make a name for yourself in the financial world, your journey has to begin with the FRM exam.

Today, the FRM certification is considered a major requirement in international finance and economics. Certified FRM professionals command respect from employers, peers, and clients. Recent events like the 2007/2009 financial crisis and the Greek debt crisis have reinforced the central role risk managers have to play in the modern world.

In order to become a certified Financial Risk Manager, you need to pass two challenging exams. FRM Part I consists of 100 multiple choice questions, while Part II carries 80 multiple choice questions. On top of that, you’ll be expected to accumulate two years of work experience in a field related to risk management.

We Prepare You For What You Expect in FRM Part I & II

FRM Part I Exam Format

FRM Part I Exam Format

FRM Part I tests your understanding of the tools used in financial risk assessment. The exam questions focus on four key test areas, including Quantitative Analysis, Fundamental Risk Management Concepts, Financial Markets and Products, and Valuation and Risk Models. FRM Part I contains 100 multiple-choice questions. The exam is usually administered in the morning, and candidates are required to complete the exam within four hours or less. The current pass rate for FRM Part I is about 50%.

FRM Part II Exam Format

FRM Part II Exam Format

FRM Part II tests your ability to apply the tools used in financial risk assessment as introduced in Part I. The topics covered are Market Risk Measurement and Management, Credit Risk Measurement and Management, Operational Risk and Resiliency, Liquidity and Treasury Risk Measurement and Management, Risk Management and Investment Management, and Current Issues in Financial Markets. The part II exam carries 80 questions, slightly less than part I. However, there’s more ground to cover. The historical pass rate for FRM Part II has been averaging around 55%.

FRM® Part 1

Our FRM® study packages start as low as $349 with a one exam Practice package. Our Learn + Practice package include study notes and video lessons for $499

Combine FRM Part I and FRM Part II Learn + Practice for $799 This package includes unlimited ask-a-tutor. questions and lifetime access with curriculum updates each year at no extra cost.

FRM PART 1 PRACTICE PACKAGE

$

349

/ 12-month access

- Question Bank (Part 1)

- CBT Mock Exams (Part 1)

- Formula Sheet (Part 1)

- Performance Tracking Tools

FRM PART 1 LEARN + PRACTICE PACKAGE

$

499

/ 12-month access

- Question Bank (Part 1)

- CBT Mock Exams (Part 1)

- Formula Sheet (Part 1)

- Performance Tracking Tools

- Video Lessons (Part 1)

- Study Notes (Part 1)

FRM UNLIMITED PACKAGE (PART 1 AND PART 2)

$

799

/ lifetime access

- Question Bank (Part 1 & Part 2 )

- CBT Mock Exams (Part 1 & Part 2 )

- Formula Sheets (Part 1 & Part 2)

- Performance Tracking Tools

- Video Lessons (Part 1 & Part 2 )

- Study Notes (Part 1 & Part 2 )