Everything You Need to Know About FRM Exams

The Financial Risk Manager program (FRM) is an exam certification that is offered to individuals interested in working in the financial risk management department of firms. It is an internationally recognized certification that is administered by the Global Association of…

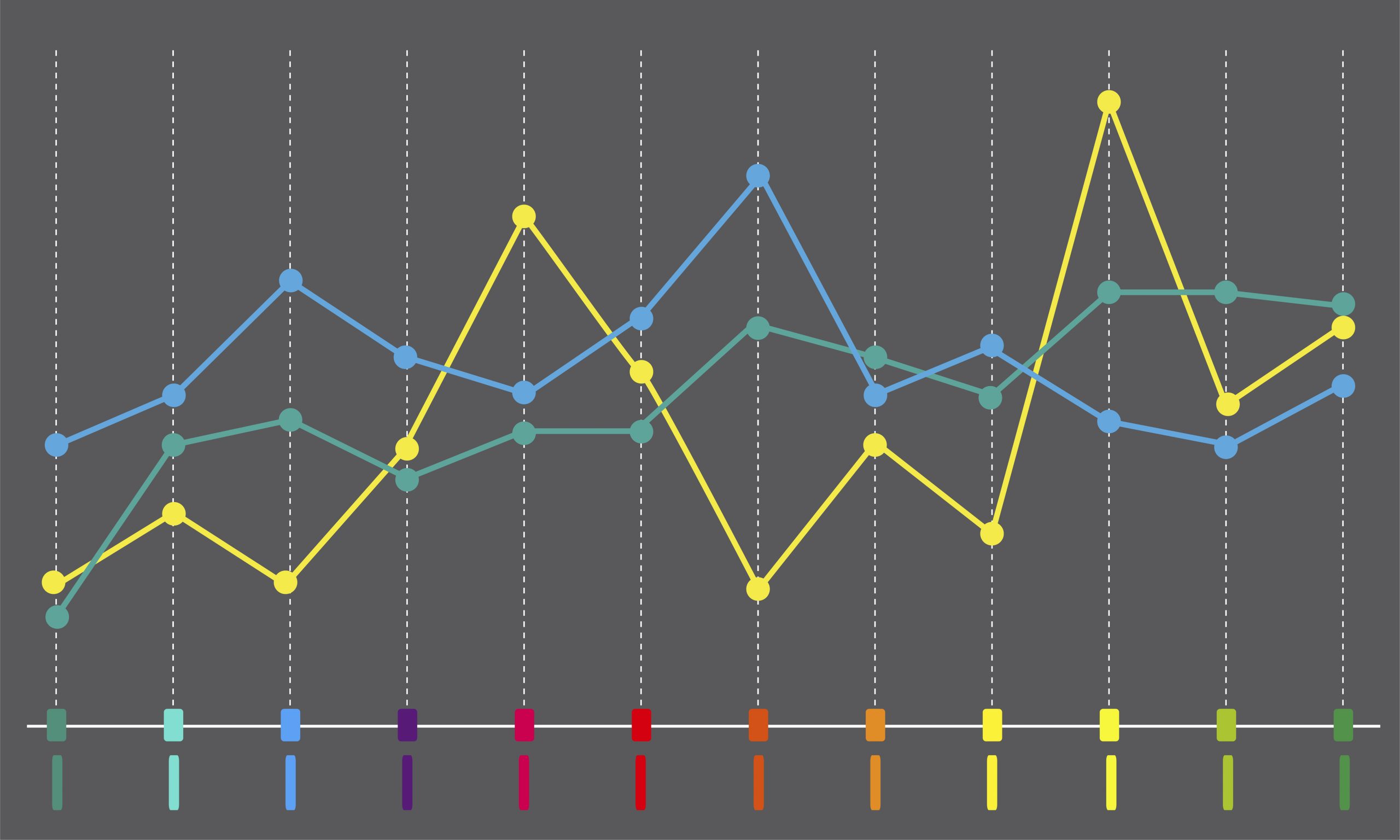

Financial Models

A “financial model” can be a lot of things. The phrase is usually used to describe a representation of a real financial situation. Financial models typically use a set of assumptions and inputs to generate an output or set of…

FRM Part 1 Exam – 3-Month Study Plan

I sat and passed FRM Part 1 in May 2018, in Frankfurt. Easy as that sounds, make no mistake – it was a tough ride! Even with an MSc. In Business Administration and specialty in corporate finance, I still knew I…

The FRM Program: Expectations, Benefits, and Tips

Introduction A Financial Risk Manager (FRM) that desires to be recognized by the Global Association of Risk Professionals (GARP) is required to pass an exam that grants hopefuls the right of passage into fulfilling careers within the world of finance….

Central Counterparties

Central counterparties, also known as CCPs, protect market participants from counterparty /credit/default risk and settlement risk by guaranteeing the trade between a buyer and a seller. By doing so it helps avert the cascading impact a counterparty default could have…

Open Market Operations – A Tool for Inflation and Interest Rate Targeting

OMOs or Open Market Operations are a commonly used tool by Central Banks to administer the monetary policy. Central Banks try and control the price and quantity of money in the economy through the implementation of the monetary policy, price of money being interest…

CFA vs FRM: Which One is Better

Financial professionals who want advancements in their career always find it difficult to decide which courses can offer more facilities to get more lucrative job offers. In this situation, two courses come into their preference, CFA, and FRM. Both these…