AnalystPrep

FRM® Part I

FRM® Part I Study Materials and Question Bank

Trusted by thousands of candidates each year

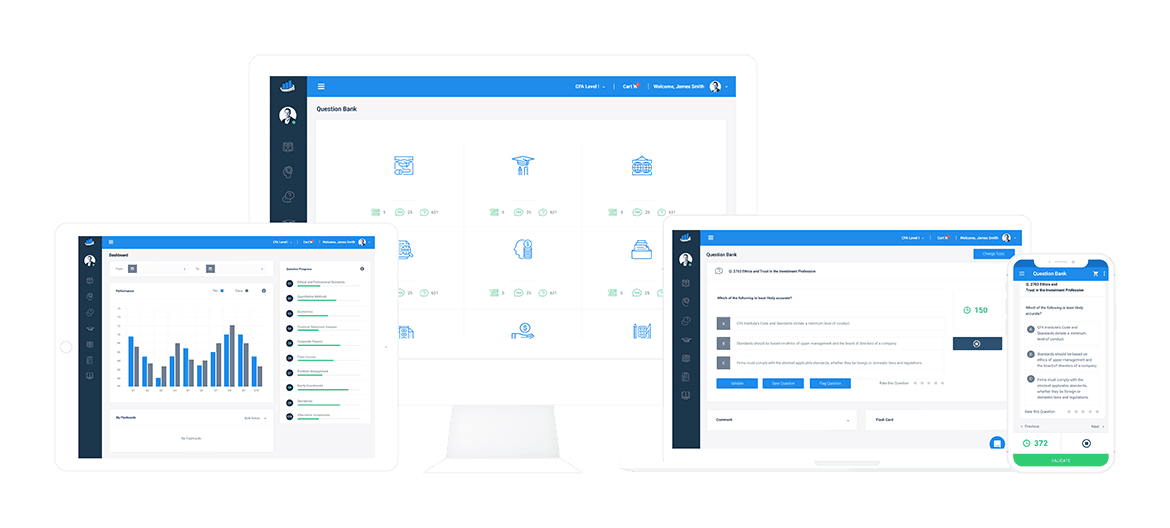

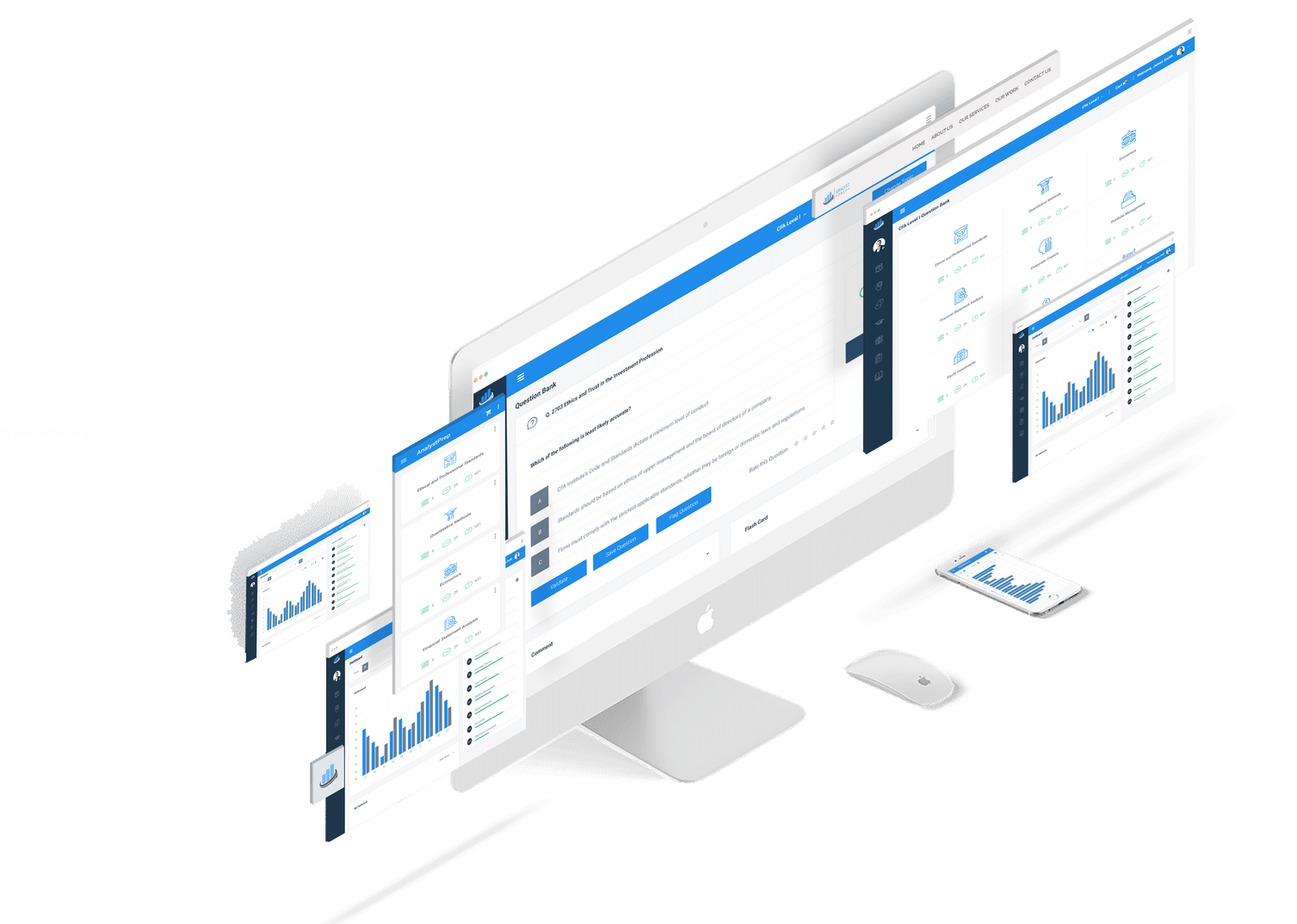

Our Platform

AnalystPrep's Comprehensive Study Materials for FRM Part 1

Preparing for the FRM Part 1 exam requires a solid grasp of quantitative concepts, risk management frameworks, and valuation models—and that’s exactly what AnalystPrep delivers.

What’s Inside Our FRM Part 1 Study Package?

- 1,800+ Practice Questions:

- Master core risk management concepts with exam-style practice questions.

- Cover key topics like Hypothesis Testing and the Black-Scholes-Merton model, ensuring you’re comfortable with the calculations needed on exam day.

- Unlimited Custom Quizzes:

- Build personalized quizzes to test yourself on specific books or topics.

- Reinforce weak areas with targeted practice.

- Realistic FRM Part 1 Mock Exams:

- Simulate the actual exam difficulty with full-length mock exams.

- Follow the same weightings as GARP, so you’re exam-ready.

- Concise FRM Part 1 Study Notes:

- Summarized study guides to accelerate learning and simplify complex topics.

- Focus on what really matters—practice questions and application.

- Expert-Led Video Lessons:

- Short, to-the-point videos (approx. 40 minutes each).

- Created by Prof. James Forjan, PhD, these lessons break down complex concepts with real-world examples.

Why Choose AnalystPrep?

- Engaging, to-the-point content – No fluff, just the key takeaways.

- Learn at your own pace with structured study plans.

- Test your knowledge repeatedly with quizzes and full-length mocks.

Get access to high-quality FRM Part 1 prep materials and take the next step toward earning your FRM certification!

FRM® Part 1

Our Learn + Practice package include study notes and video lessons for $499.

Combine FRM Part I and FRM Part II Learn + Practice for $799. This package includes unlimited ask-a-tutor questions and lifetime access with curriculum updates each year at no extra cost.

FRM Part 1 Practice Package

$

349

/ 12-month access

- Question Bank (Part 1)

- CBT Mock Exams (Part 1)

- Formula Sheet (Part 1)

- Performance Tracking Tools

FRM Part 1 Learn + Practice Package

$

499

/ 12-month access

- Question Bank (Part 1)

- CBT Mock Exams (Part 1)

- Formula Sheet (Part 1)

- Performance Tracking Tools

- Video Lessons (Part 1)

- Study Notes (Part 1)

FRM Unlimited Package (Part 1 and Part 2)

$

799

/ lifetime access

- Question Bank (Part 1 & Part 2 )

- CBT Mock Exams (Part 1 & Part 2 )

- Formula Sheets (Part 1 & Part 2)

- Performance Tracking Tools

- Video Lessons (Part 1 & Part 2 )

- Study Notes (Part 1 & Part 2 )

What to Expect from the FRM Part 1 Exam?

The FRM Part 1 exam is designed to test your understanding of risk management fundamentals, requiring both conceptual knowledge and quantitative problem-solving skills.

Exam Structure & Weighting

The exam consists of 100 multiple-choice questions covering four key topics:

- Foundations of Risk Management – 20%

- Quantitative Analysis – 20%

- Financial Markets and Products – 30%

- Valuation and Risk Models – 30%

This computer-based exam is offered three times a year, with an average pass rate of 45-50%—making it a highly competitive certification.

Key Concepts to Master

To succeed in the FRM Part 1 exam, you must be comfortable with essential risk management concepts, financial models, and mathematical techniques. Some of the most tested topics include:

- Modern Portfolio Theory (MPT) – Understanding risk-return trade-offs.

- Arbitrage Pricing Theory (APT) – Multi-factor models of asset pricing.

- Monte Carlo Simulation – Risk modeling and scenario analysis.

- Value at Risk (VaR) – Measuring potential portfolio losses.

- Volatility & GARCH Process – Modeling time-varying risk.

- Black-Scholes Model – Options pricing fundamentals.

- Delta Hedging – Risk-neutral portfolio management.

These concepts form the foundation of the FRM Part 1 exam, and AnalystPrep’s question bank ensures you not only understand their definitions but also apply them effectively.

How AnalystPrep Helps You Master FRM Part 1

- Concept breakdowns for every key topic.

- Formula retention techniques to help you memorize equations.

- Real-world examples to reinforce your understanding.

- Targeted practice questions that mirror exam difficulty.

Boost your exam readiness with AnalystPrep’s comprehensive FRM Part 1 study package!