CFA® Level III Exam

CFA Study Materials and Question Bank offered by AnalystPrep

Trusted by thousands of candidates each year

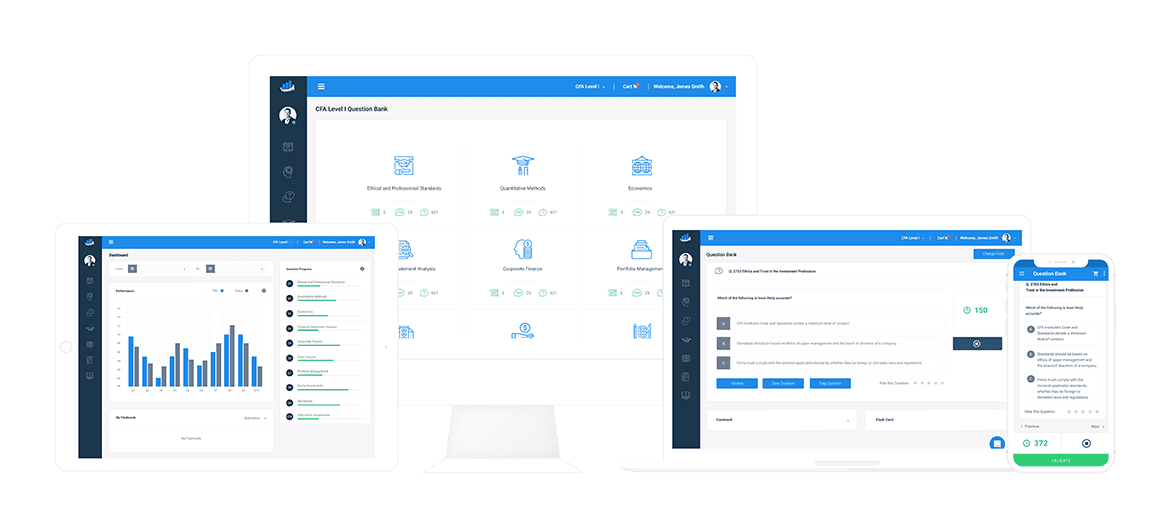

Our Platform

What Should You Expect from CFA Level III Exams?

As you can see, the CFA level 3 curriculum is much different from previous levels:

| Section | Exam Weight |

| Core Topics (Mandatory for All Candidates) | 65 – 70% |

| – Asset Allocation | |

| – Portfolio Construction | |

| – Performance Measurement | |

| – Derivatives & Risk Management | |

| – Ethics | |

| Specialized Pathway (Choose One) | 30 – 35% |

| – Portfolio Management (Traditional CFA Focus) | |

| – Private Markets (Private Equity & Alternative Investments) | |

| – Private Wealth (Wealth Planning & Estate Management) |

This section ensures candidates have a strong foundation in financial decision-making and portfolio strategies.

Three Specialized Pathways: Tailor Your CFA Focus

Candidates now have the opportunity to choose a Specialized Pathway that aligns with their career goals:

- Portfolio Management – The traditional CFA pathway, focused on institutional and individual portfolio strategies.

- Private Markets – Geared toward alternative investments, private equity, venture capital, and illiquid assets.

- Private Wealth – Specializing in wealth preservation, estate planning, and tax-efficient investment strategies for high-net-worth individuals.

At AnalystPrep, our CFA Level 3 Question Bank has been updated to reflect this curriculum change.

- Our item sets and essay-style questions now include pathway-specific case studies, ensuring candidates can practice for both the Core topics and their chosen pathway.

- Whether you’re focusing on Portfolio Management, Private Markets, or Private Wealth, you’ll find practice questions tailored to real-world financial scenarios that align with your specialization.

Not sure which pathway to choose? AnalystPrep’s question bank and mock exams allow you to explore different question styles, helping you make an informed decision.

Prepare for the 2025 CFA Level 3 exam format with AnalystPrep’s specialized question bank!

CFA® Level III Exam

AnalystPrep’s practice packages for CFA Level 3 exam start as low as $349 with 12-month access.

Level III of the CFA Exam - Practice Package by AnalystPrep

$

349

/ 12-month access

- Question Bank (Item Sets)

- Essay-Type Questions

- Performance Tracking Tools

- 5 Ask-A-Tutor Questions

Becoming a CFA Charterholder

The Level 3 question paper is the final milestone in the CFA Program, conducted by the CFA Institute. Upon passing this exam, candidates with 4 years of relevant experience can officially earn the prestigious CFA designation, placing those powerful “CFA” letters after their names.

Here’s what earning the CFA charter means:

✅ Unmatched Prestige and Recognition

The CFA charter is widely recognized and respected across the global finance and investment industry, making it a significant career asset.

✅ Comprehensive Knowledge and Confidence

The rigorous journey to becoming a CFA charterholder ensures that candidates build an extensive knowledge base—like a “walking financial encyclopedia”—that boosts confidence in professional settings and job interviews.

✅ Networking Opportunities

At networking events, meeting other CFA charterholders who have followed the same challenging path creates immediate professional connections and camaraderie.

✅ Global Demand and Recognition

The CFA designation is valued by financial institutions and corporations worldwide, especially those requiring efficient resource allocation and financial expertise. It’s common to see CFA requirements or preferences listed in finance job postings.

✅ High Ethical Standards

Demand for CFA charterholders is on the rise, as they continue to bring value to the industry by upholding strict ethical standards, contributing positively to the finance profession.

Becoming a CFA charterholder isn’t just about career growth—it’s a testament to your expertise, ethics, and commitment to excellence in the financial world.

General Information about CFA Level 3 Exam

The exam is unique and challenging, marking the final step in the CFA journey. Here’s what candidates need to know:

- Exam Timing

- The Level 3 exam is only offered once a year, in June.

- Afternoon Session: Item Set Questions

- Similar to the Level II exam, the afternoon session includes 10 item sets.

- Each item set contains 6 multiple-choice questions, testing a range of topics in a structured format.

- Morning Session: Essay Format

- The morning session is distinct, requiring candidates to respond in an essay format.

- This section includes 8 to 12 questions, each with multiple sub-parts, challenging candidates to demonstrate depth and application of knowledge.

- Curriculum Focus

- Level III centers on Portfolio Management and Wealth Planning, unlike earlier exams.

- Topics like Quantitative Methods, Economics, Corporate Finance, Financial Reporting, and Analysis are no longer included.

- Ethics, Alternative Investments, Derivatives, Equity Investments, and Fixed Income retain similar weightings from previous levels.

- Portfolio Management and Wealth Planning now account for a significant 45%-55% of the exam’s focus.

Level III’s specialized structure and focus on real-world applications make it a vital step toward becoming a CFA charterholder, emphasizing skills essential for portfolio and wealth management.

Answering Essay Format Questions

Mastering the essay questions is a crucial skill for success in the CFA Level III exam. Here’s what candidates need to know:

- Keep It Concise

- Avoid writing long sentences or focusing on grammar and vocabulary; answering in essay format is not required. Stick to brief, clear responses that directly address the points CFA Institute aims to assess.

- Focus on Key Concepts

- The CFA exam doesn’t evaluate English proficiency, so don’t stress over word choices. The priority is to make answers clear and to the point, concentrating on key concepts.

- Practice Self-Grading for Improvement

- Success with essay questions relies heavily on evaluating your answers accurately. Practice self-grading with objectivity to identify any knowledge gaps and develop a structured response style.

- Leverage Partial Credit

- For essay questions, unlike multiple-choice, partial credit is given for showing calculations. Display each step, even if you’re uncertain, as this can earn points.

- Don’t skip questions you’re unsure about; make your best guess and move forward without wasting time.

Get comfortable with bullet-point answers and direct responses when practicing essay questions. This technique keeps your responses organized, saves time, and aligns with what the CFA Institute expects from candidates. Practicing this approach consistently can make a significant difference in your performance on exam day.

CFA Level 3 Exam Results

The Level III exam stands out with its unique topic weightings, new question format, and a different timeline for results. Here’s what you can expect:

Result Timing

Unlike Levels I and II, where results are available 60 days post-exam, Level III results are issued 90 days after the test date. This additional 30-day period allows time for grading the essay format questions, which require careful assessment.

Pass Rates and Success Factors

Level III has the highest pass rates among all CFA exams, averaging above 50% in recent years. This higher success rate reflects the dedication of Level III candidates who have already conquered Levels I and II, equipping them with the essential skills needed to pass the final stage.

Understanding the exam’s unique timeline and the success rates can help candidates better prepare for their journey to becoming CFA charterholders.

Why AnalystPrep?

What sets AnalystPrep apart is not just our question banks and mock exams. It’s the way we help you understand the why behind each answer. We provide detailed explanations that allow you to learn from mistakes and fine-tune your understanding of each topic. Plus, we offer personalized feedback so you can track your progress against thousands of other candidates!

And, this is not us just tooting our horn. It’s what past candidates have said about us. Read this:

We walk with you every step of the way!

What Makes AnalystPrep Stand Out?

Here’s why thousands of candidates turn to us for their CFA Level 3 preparation:

- Realistic Exam Simulations: Our mock exams are designed to closely mirror the real exam. We replicate the exact format and difficulty of the CFA Level III exam, so when you sit for the real thing, you’ll feel fully prepared, with no surprises. Think of it as taking the actual test before exam day!

- Expertly Crafted Question Bank: With hundreds of item sets, each created by CFA charterholders and instructors, our question bank focuses on helping you understand and retain critical concepts. You’ll not only learn how to answer questions but also gain insight into the logic behind the correct answers.

- Detailed Explanations for Every Question: We don’t just tell you the right answer. Every question comes with a detailed explanation so you know why it’s correct and how to improve your approach for next time. This kind of feedback is key to mastering the exam format and boosting your score.

- Performance Tracking and Analytics: Stay on top of your progress with our advanced analytics dashboard. It tracks your results, highlights strengths and weaknesses, and even compares your performance with other CFA candidates. You can see exactly where you need to focus your efforts, ensuring that you’re studying smarter, not harder.

Curious to see what it’s like?

You can try out 10 free test item sets (that’s 60 CFA level 3 practice questions) when you register for a free account. Plus, with our built-in analytics, you’ll be able to track your performance, monitor your strengths and weaknesses, and adjust your study strategy accordingly.

| Success is in the Numbers | Affordable Without Compromise | Practice Makes Perfect! |

|

With thousands of candidates using AnalystPrep to prepare for the Level III exam, we’ve earned a reputation for delivering high-quality, effective, and affordable study solutions. Don’t just take our word for it—ask around, and you’ll see why we’re one of the most trusted and cost-effective CFA prep providers. |

Quality prep materials shouldn’t break the bank. We offer affordable pricing that gives you access to all the tools you need to succeed without the high costs you might expect from other providers. | Remember, there’s no magic formula for passing the CFA Level 3 exam. It takes consistent practice, effective study techniques, and using the right tools. With AnalystPrep, you’ll have everything you need to stay ahead of the game and increase your chances of success. |

This section ensures candidates have a strong foundation in financial decision-making and portfolio strategies.