CFA Level 1 Practice Questions by AnalystPrep

Get Access to 3,000 Exam-Style Questions

Join Over 20,000 Candidates Who Trust Our Exclusive CFA Question Bank Each Year

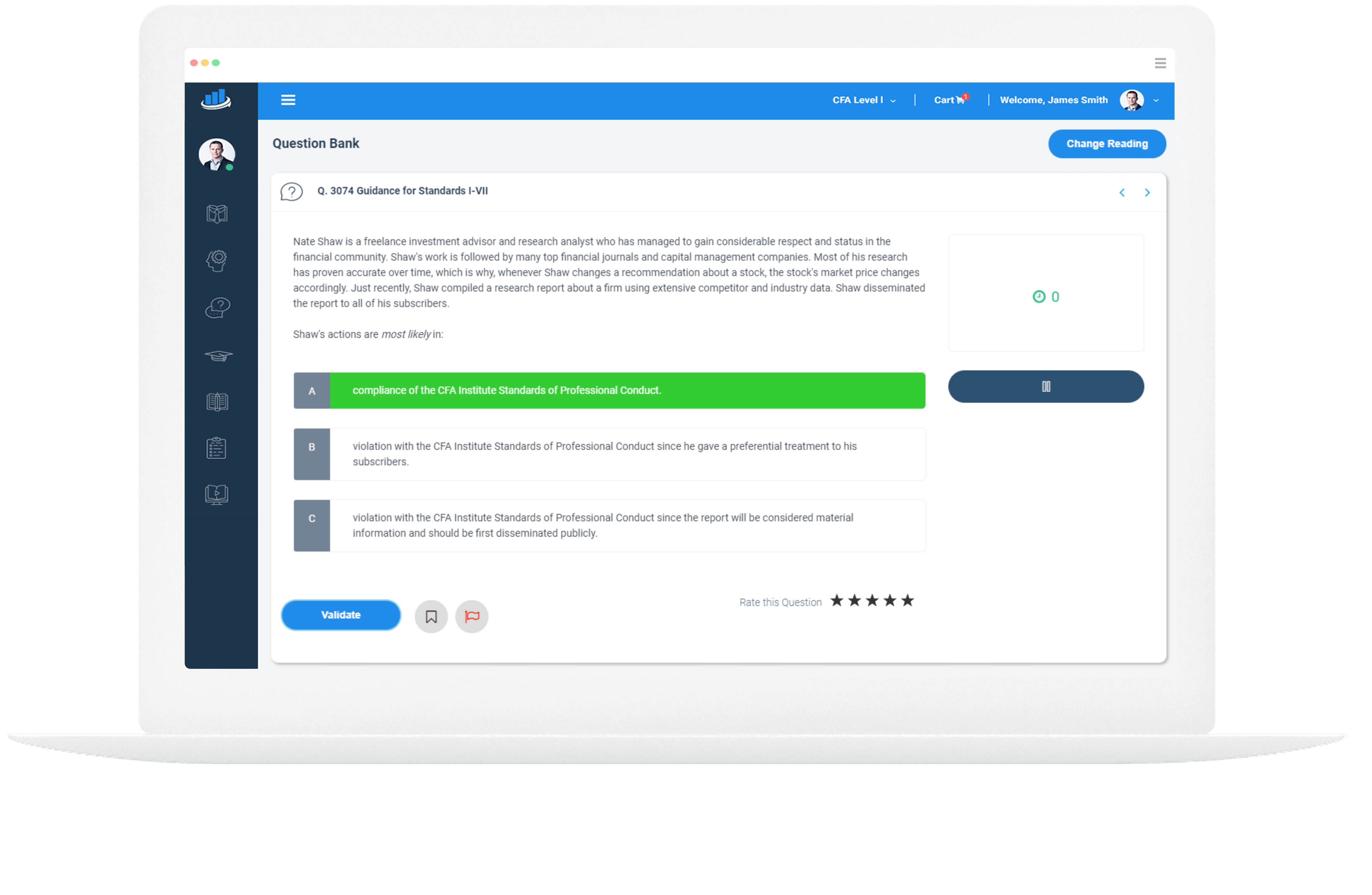

Our question bank has been developed by certified CFA charter holders with first-hand experience of the CFA exam. With their proven expertise, our instructors know what it takes to pass and have crafted unparalleled CFA Level 1 practice questions to ensure your success.

Each question is repeatedly validated to ensure you get the most out of the platform.

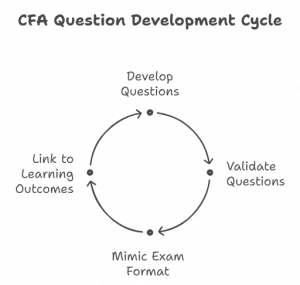

To truly excel in the CFA® Program exam, you need more than just knowledge—you must be intimately familiar with the exam format and the types of questions you’ll encounter. That’s why, at AnalystPrep, we’ve developed CFA exam sample questions that precisely mimic the structure of the actual exam.

All the CFA questions feature a stem—whether it’s a question, statement, or table—and includes three distractors labelled A, B, and C, just like the real test.

Our distractors are carefully crafted to align grammatically with the stem, providing an authentic testing experience. Moreover, every question is linked to one or more Learning Outcome Statements (LOSs), ensuring you’re effectively covering all the essential material.

Description: Image showing the CFA exam 1 practice questions Development Cycle

To ensure you achieve a comprehensive understanding of the curriculum, our CFA test bank is meticulously divided into specific topics, including:

✅ Ethical and Professional Standards

✅ Quantitative Methods

✅ Economics

✅ Financial Statement Analysis

✅ Corporate Issuers

✅ Portfolio Management

✅ Equity Investments

✅ Fixed Income

✅ Derivatives

✅ Alternative Investments

Each question is accompanied by a detailed solution to reinforce your learning, and if you need further clarification on any concept, our instructors are available 24/7 to assist you.

Note! The Level I exam includes multiple-choice questions, each with three possible answers. Some questions are straightforward statements, while others require looking at and evaluating data and information.

We regularly update all our CFA Level 1 practice exams to align with the current CFA® Program curriculum and difficulty level.

Join the 20,000 candidates who register annually to access our exclusive free resources on our platform.

Access Your Exclusive Free Sample CFA Questions Today

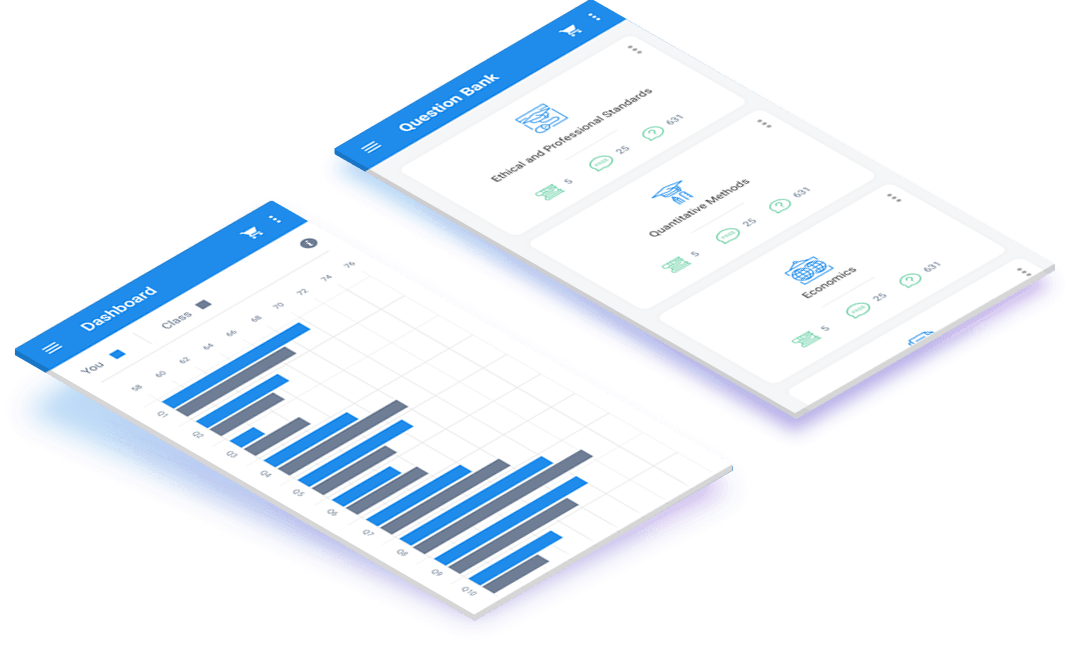

Performance Tracking Lets you Find your Strengths and Weaknesses

The Level I CFA exam consists of 10 topics covering a broad range of skills in a large volume of material. Testing your knowledge in each specific area by using the practice questions helps you understand where your strengths and weaknesses are. You can track your performance over time and monitor your progress with our FREE performance tracking tool.

Performance tracking is part of our complete set of analytics tools that gives you invaluable insights into your performance, including the ability to compare your results with more than 50,000 users worldwide. Adjust your study plan according to the given results and improve your performance by revising the topics you need to master. Efficient studying begins with knowing which topics you need to put more effort into so as to maximize your chances of passing.

Questions Answered by our Users

Satisfied Customers

Cfa Preparation Platform By Review Websites

Some Free Exam-style Level I CFA Program Practice Questions offered by AnalystPrep

Ready?

Attempt the CFA level 1 practice questions below to assess your exam readiness. Then, read the detailed answers to understand the concept.

Let’s Go!

Question 1

Ethical and Professional Standards

Nayri Avaikan, CFA, is working as an investment advisor with Allstar Investors. She has recently finished her report on Ocado Inc. and concluded that it is a great ‘buy’ with 35% upside potential at the current market price. She wrote to all her suitable clients: “At current market prices, based on my research, I believe Ocado Inc. is massively underpriced, and I would recommend a ‘strong buy’ with 35% upside potential. Please find attached my detailed research report. I have also included all the relevant data used in my research and formed the basis for this decision. Please let me know if you need further explanation or documentation.” After sending the email, she informed her major clients about Ocado Ins. by calling them individually.

Avaikan has most likely:

A) violated Standard III(B): Fair Dealing.

B) violated Standard I(C): Misrepresentation.

C) not violated any CFA Institute Code and Standards.

The correct answer is: C)

Avaikan has not violated any standards because she sent an email to all of her clients simultaneously. After sending the email, she called her major clients directly. The CFA Institute Standard III(B): Fair Dealing does not prohibit members and candidates from providing extra services for higher fees or major clients. However, all clients must be dealt with fairly and objectively, which Avaikan did by sending an email to all of them at the same time.

A is incorrect. Standard III(B): Fair Dealing relates to members and candidates dealing fairly and objectively when providing investment analysis, making investment recommendations, taking investment action, or engaging in other professional activities. Avaikan did not violate Standard III(B): Fair Dealing of the CFA Institute Code and Standards.

B is incorrect. The recommendation was presented as an opinion and not a fact and was well documented. Standard I(C): Misrepresentation relates to members and candidates misrepresenting investment analysis, recommendations, actions, or other professional activities. Avaikan did not violate Standard I(C): Misrepresentation.

Question 2

Ethical and Professional Standards

Melissa Jacobs is an Analyst for ABC Investments. She is an expert in the area of agriculture production in the United States. In her free time, Jacobs maintains a blog related to the food industry. She uses a pseudonym for the blog, in order to maintain her privacy. Her latest blog post includes a negative review of Market Basket Corporation in which she suggested to her readers that they sell the company’s stock. Jacobs knows from inside sources that within the following week, Market Basket’s stock will be listed as a ‘sell’.

With regard to the CFA Institute Code and Standards, which of the following is least likely accurate?

A) Jacobs violated no standards since she maintains her blog under an artificial identity.

B) Jacobs violated IV(A): Loyalty by sharing private information that is proprietary to Market Basket Corporation.

C) Jacobs violated Standard II(A): Material Non-public Information by making a recommendation based on the knowledge that was material and non-public.

The correct answer is: A).

Jacobs has violated Standard II(A): Material Non-Public Information by publishing non-public information on her blog and Standards IV(A) Loyalty by sharing private company information.

B is incorrect. Standard IV(A): Loyalty relates to an employee depriving their employer of the advantage of their skills and abilities, divulging confidential information, or causing harm to their employer.

C is incorrect. Melissa Jacobs has shared an investment recommendation based on material, non-public information that could influence the stock’s price; therefore, he has violated Standard II (A). It makes little difference that she published the blog under a pseudonym. Her integrity as a CFA member or candidate must be preserved regardless of how she represents herself online.

Question 3

Quantitative Methods

You have a choice to take your retirement benefit either as a lump sum or as an annuity. You can take a lump sum of $4.5 million or an annuity with 15 payments of $400,000 a year with the first payment starting today. The interest rate is 7% per year compounded annually. Which option is preferable, on the basis that it has the greater present value?

A) Annuity payment.

B) Lump-sum payment.

C) There is no significant difference between the two options.

The correct answer is: B).

The question requires calculating the present value of a series of equal cash flows compared to the lump sum payment.

The annuity payment qualifies as an ordinary annuity since it has equal annuity payments, with the first payment starting at time t=1.

Hence the formula is as follows;

$$PV=A+A\left[\frac{1-\frac{1}{{(1+r)}^{N-1}}}{r}\right]$$

Where;

A = Annuity amount.

r = The annual interest rate per period corresponding to the frequency of annuity payments.

N = Number of annuity payments since the first payment is currently due for payment at time t=1.

Therefore;

$${{{\rm PV}_{Annuity}}_t}_{14}=$400,000+$400,000\left[\frac{1-\frac{1}{{(1+0.07)}^{14}}}{0.07}\right]=$400,000\times8.745=$3,898,187.19$$

We can also use Using the BA II Plus Pro Calculator. First, set the calculator to BGN by pressing 2ND PMT then 2ND ENTER then 2ND CPT (because the payments start today), then proceed as follows;

N= 15; I/Y= 7; PMT=400,000; FV = 0; CPT => PV = 3,898,187.19

The total annuity payment amount of $3,898,187.19 is less than the lumpsum payment of $4.5 million; hence settle for a lump sum payment.

Alternatively, consider the equation:

$$PV=A+A\left[\frac{1-\frac{1}{{(1+r)}^{N-1}}}{r}\right]$$

We can clearly solve the second part of the right-hand side of the equation using Using the BA II Plus Pro Calculator. In this case,

N= 14; I/Y= 7; PMT=400,000; FV = 0; CPT => PV = -3,498,187.19

Then we add $400,000 to the result, to arrive at the same answer:

$$ \$3,498,187.19+\$400,000=\$ 3,898,187.19$$

Note: Remember to remove the minus sign on the resulting PV before adding $400,000.

A is incorrect. The present value of the lump sum is greater than the present value of the annuity payments, as evidenced in Choice B.

C is incorrect. The present value of the lump sum is greater than the present value of the annuity payments.

Question 4

Economics

The following table shows the number of hours necessary to produce one unit of electronics in both England and India:

$$\begin{array}{c|c|c}\textbf{Country} & \textbf{Ipads} & \textbf{Personal Computers} \\ \hline

\text{England} & 200 & 170 \\ \hline

\text{India} & 160 & 150 \\

\end{array}$$

Which of the following statements is the most accurate?

A) India has an absolute advantage in producing both iPads and personal computers.

B) England has an absolute advantage in producing both iPads and personal computers.

C) England should specialize in the production of personal computers and exchange them for iPads produced in India.

The correct answer is: A).

India can produce both goods at a lower cost than England. India needs 160 (150) hours to produce one iPad (Personal Computer), whereas England needs 200(170) hours. Therefore, India has an absolute advantage for both iPads and PCs.

B is incorrect. England does not have an absolute advantage in iPads production or personal computers because India can produce both products at a lower cost than England.

C is incorrect. India has a comparative advantage for PCs over iPads. It takes them 1.06 times more hours \((\frac{160}{150}=1.06)\) to build a PC but 1.17 times more hours \((\frac{200}{170}=1.17)\) to build an iPad. As a result, both countries can maximize their use of resources if India specializes in building PCs and exchanges them for iPads built in England.

Question 5

Financial Reporting & Analysis

\begin{array}{l|r|r}

\textbf{Balances as of Year Ended 31 Dec} & \textbf{2017} & \textbf{2018} \\

\hline

\text{Retained Earnings} & \text{150} & \text{175} \\

\text{Accounts Receivable} & \text{68} & \text{73} \\

\text{Inventory} & \text{75} & \text{78} \\

\text{Accounts Payable} & \text{66} & \text{59} \\

\end{array}

$$In 2018, the company paid cash dividends of $40 million and recorded $55 million in depreciation expense. The company considers dividends paid a financing activity. Given this information, the company’s 2018 cash flow from operations (in $ millions) was closest to:

A) $105.

B) $110.

C) $112.

The correct answer is: A)

$$\begin{align*}\text{Net income for 2018}& = \text{Increase in retained earnings} + \text{Dividends paid}\\& = \$25 + \$40 = \$65\end{align*}$$

Depreciation of $55 is a non-cash expense and is added back to net income.

Increases in accounts receivable, $5, and in inventory, $3, are uses of cash. Thus, they ought to be subtracted from net income.

The decrease in accounts payable is also a use of cash and, therefore, a subtraction from net income.

Thus, cash flow from

operations is:

$$\$65 + \$55 – \$5 – \$3 – \$7 = \$105$$

B is incorrect. Adds the increase in accounts receivable to the net income.

C is incorrect. Adds the accounts payable to the net income.

Question 6

Corporate Issuers

A) increase.

B) decrease.

C) not be affected.

The correct answer is: A)

Recall the WACC formula:

$$\text{WACC} = w_dr_d(1-t) + w_sr_s + w_pr_p$$

Where,

\(w_d\) = the target proportion of debt in the capital structure when the company raises new funds.

\(r_d\) = the before-tax marginal cost of debt.

\(t\) = the company’s marginal tax rate.

\(w_p\) = the target proportion of preferred stock in the capital structure when the company raises new funds.

\(r_p\) = the marginal cost of preferred stock.

\(w_e\) = the target proportion of common stock in the capital structure when the company raises new funds.

\(r_e\) = the marginal cost of common stock.

If the tax rate decreases the cost of debt will increase. Hence, the WACC will also increase.

Random number, say 5, to be the before-tax cost of debt, and assuming an initial tax rate of, say, 30%, then decreasing the tax rate to, say, 25%, we can understand the relationship between WACC and tax rate.

Tax rate of 30%: \(\text{After tax cost of debt} = 5\times\left(1-0.3\right)=3.5\)

Tax rate of 25%: \(\text{After tax cost of debt} = 5\times\left(1-0.25\right)=3.75\)

As seen above, the after-tax cost of debt increases with a decrease in the tax rate. An increase (decrease) in the after-tax cost of debt increases (decreases) the WACC.

B is incorrect. An increase (decrease) in the after-tax cost of debt increases (decreases) the WACC.

C is incorrect. The tax has an overall effect on WACC has its impacts on the after-tax cost of Debt.

Question 7

Portfolio Management

Bruce Craig is in the business of trading steel in Chicago, which he inherited from his father one month ago. His financial adviser notes the following aspects of his situation:

- He is 24 years old;

- His investment horizon is 10-20 years;

- His primary objective for investing is aggressive growth;

- His business returns are not stable as he is not being able to take prudent business decisions.

Given the information above, which of the following statements is most likely correct? Craig has a:

A) low ability to take risk, but a high willingness to take risk.

B) high ability to take risk, but a low willingness to take risk.

C) high ability to take risk, but a high willingness to take risk.

The correct answer is: A)

As Craig’s business returns are not stable, he has a low ability to take the risk. However, his age, time horizon, and investment goal suggest a high willingness to take the risk.

B is incorrect. The unstable nature of Craig’s business creates a low ability and not a high ability to take a risk.

C is incorrect. Craig has a high willingness to take a risk, but the unstable nature of the business creates a low ability to take a risk.

Question 8

Equity Investments

Joe Timberlake is a trader who trades equities in the United Arab Emirates (UAE). Timberlake is consistently able to earn abnormal profits by using fundamental data, but when he uses only technical analysis, he is not profitable. UAE’s market efficiency is most likely?

A) Weak-form efficient.

B) Strong-form efficient.

C) Semi-strong form efficient.

The correct answer is: A)

Fundamental analysis analyzes the intrinsic value of a company’s stock using micro and macroeconomic factors. It comprises three parts: Industry Analysis, Economic Analysis, and Company Analysis. Fundamental analysis relies on public data, for example, a company’s historical earnings and profit margins, to predict future growth. Traders cannot earn abnormal profits by using fundamental analysis if the security prices of the markets they trade in already reflect public information.

On the other hand, Technical analysis analyzes statistical trends, such as price movements and volume, to identify trading opportunities. Technical analysts use historical (past) trading activity and a security’s price changes as valuable indicators of the security’s future price movements.

The market is weak-form efficient if a trader can earn abnormal profits using fundamentals but not technical analysis. An investor cannot earn abnormal profits by using technical analysis in all forms of market efficiency.

The table below summarizes the possibility of earning abnormal returns through various strategies and active management, assuming different types of market efficiency.

$$\begin{array}{l|c|c|c|c}{}&\textbf{Technical Analysis}&\textbf{Fundamental Analysis}&\textbf{Insider Trading}&\textbf{Active Management}\\ \hline \text{Weak}&\text{No}&\text{Yes}&\text{Yes}&\text{Yes}\\ \hline \text{Semi-strong}&\text{No}&\text{No}&\text{Yes}&\text{No}\\ \hline \text{Strong}&\text{No}&\text{No}&\text{No}&\text{No}\\ \end{array}$$

B is incorrect. Investors in the strong form of market efficiency cannot use any trading strategy to consistently earn abnormal profits because the security prices reflect all information. Investors can earn abnormal profits only by being lucky.

C is incorrect. Investors in the semi-strong form of market efficiency can earn abnormal profits only by using insider information.

Question 9

Fixed Income

A 3-year bond offers a 7% coupon rate with interests paid annually. Assuming the following sequence of spot rates, the price of the bond is closest to:

$$

\begin{array}{c|c|c}

\textbf{Time to Maturity (Years)} & \textbf{Spot Rate (%)} \\

\hline

\text{1} & \text{4} \\

\text{2} & \text{5} \\

\text{3} & \text{5.5} \\

\end{array}

$$

A) 98.24

B) 104.05

C) 104.20

The correct answer is: C)

The price of the bond is calculated using the general formula for calculating a bond price given the sequence of spot rates as follows;

$$PV=\frac{PMT}{{{(1+Z}_1)}^1}+\frac{PMT}{{{(1+Z}_2)}^2}+\frac{PMT+FV}{{{(1+Z}_3)}^3}$$

$$\Rightarrow \text{price}=\frac { 7 }{ { (1+0.04) }^{ 1 } } +\frac { 7 }{ { (1+0.05) }^{ 2 } } +\frac { 107 }{ { (1+0.055) }^{ 3 } } =104.20$$

Tip: In an exam situation; this calculation can be easily done as one calculation by using brackets at each step. $$\left(7/\left({1.04}^1\right)\right)+\left(7/\left({1.05}^2\right)\right)+\left(107/\left({1.055}^3\right)\right)=104.20$$

A is incorrect. It excludes the coupon payment in the last year:

$$PV=\frac{7}{{1.04}^1}+\frac{7}{{1.05}^2}+\frac{100}{{1.055}^3}=98.24$$

B is incorrect. It uses the three-year spot rate only.

$$\text{price}=\frac { 7 }{ (1+0.055)^{ 1 } } +\frac { 7 }{ (1+0.055)^{ 2 } } +\frac { 107 }{ (1+0.055)^{ 3 } } =104.05$$

CFA® Program

Level I Study Packages by AnalystPrep

Add video lessons and study notes for only $150 extra.

Combine all three levels, with lifetime access and unlimited ask-a-tutor questions for only $799.

Practice Package

$

349

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

Learn + Practice Package

$

499

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

- Video Lessons

- Study Notes

- Essential Review Summaries

Unlimited Package (All 3 Levels)

$

799

/ lifetime access

- Question Banks for all three Levels of the CFA Exam

- Mock Exams for all three Levels of the CFA Exam

- Performance Tracking Tools

- Video Lessons for all three Levels of the CFA Exam

- Study Notes for all three Levels of the CFA Exam

- Essential Review Summaries