CFA® Level 1 Study Material

Master Every CFA Level 1 Learning Outcome – Without the Overwhelm

Let’s face it, the CFA Level 1 curriculum is huge—over 5,000 pages of material across 10 topic areas! It can feel pretty overwhelming, especially when you’re juggling work, life, and everything in between.

But don’t worry, we’ve got your back.

We’ve taken those massive textbooks and created easy-to-read, bite-sized CFA Level 1 study notes that cover every Learning Outcome Statement (LOS). Plus, we’ve added question examples to ensure you understand the material, not just memorize it.

Here’s why our CFA study notes will help you ace the exam:

- Clear and concise summaries of all key concepts, so you can focus on what really matters.

- Example questions with each topic, helping you practice and apply what you’ve learned.

- Organized by topics, so you can easily advance through the curriculum’s 10 areas.

According to the CFA Institute, most candidates spend at least 300 hours studying for the exam. That’s about 6 months of preparation! And with only about 40% of candidates passing each year, you want to be in that top tier, right?

Here’s the secret: According to a 2015 CFA survey, over 60% of candidates use third-party study materials (like ours!) to boost their chances. Why? Because relying solely on the CFA Institute’s official books can be time-consuming and hard to digest.

With our CFA Level 1 prep materials, you’ll be studying smarter, not harder. So, why not give yourself an edge and start learning efficiently today?

Questions Answered by our Users

Satisfied Customers

CFA PREPARATION PLATFORM BY REVIEW WEBSITES

Why Candidates Love AnalystPrep's Study Notes

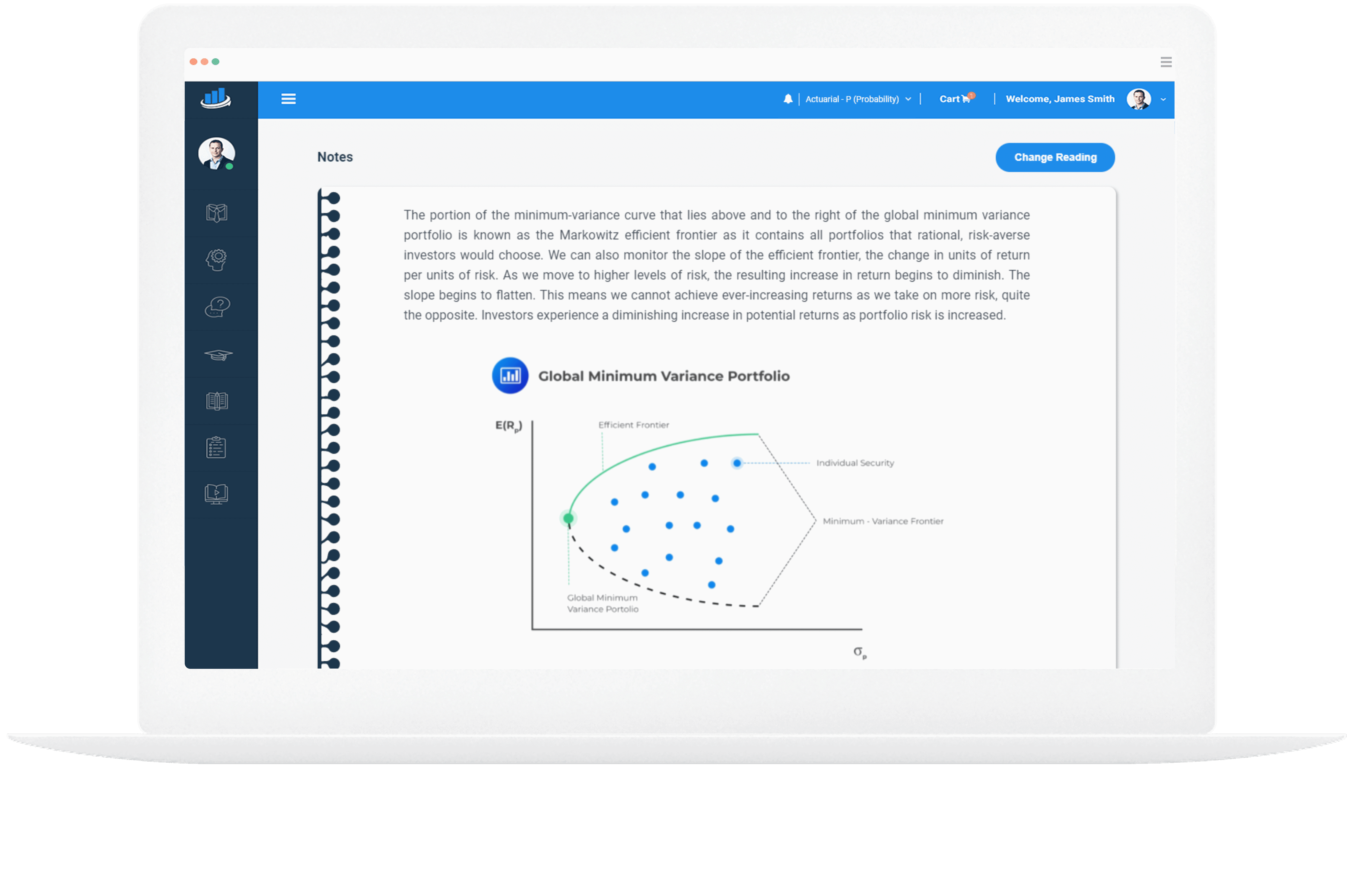

We get it—preparing for the CFA Level 1 exam is no small task. But that’s exactly why we’ve crafted our CFA Level 1 study notes with you in mind, making it easier, faster, and way more efficient to grasp those tricky concepts.

Here’s what makes our study notes a game-changer:

- Created by CFA charterholders who know the exam inside and out. They’ve been where you are, so every note is designed to simplify even the toughest topics.

- Concise chapter summaries straight from the latest CFA Program curriculum, with clear explanations that break down difficult concepts into bite-sized, digestible pieces.

- Handy tips and tricks sprinkled throughout to speed up your learning and help you ace those topics that usually trip people up.

But we didn’t stop there!

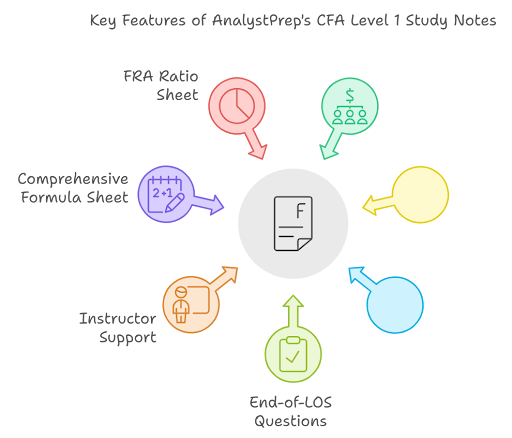

To make sure you’re really mastering the material, we’ve included end-of-LOS questions that test your understanding and build your confidence as you go.

Need extra help? Our instructors are always ready to jump in with additional explanations. It’s like having a CFA expert by your side whenever you need them.

And because we know how crucial formulas are to your success, we’ve got you covered with:

- A comprehensive formula sheet that puts all the key formulas at your fingertips.

- A Financial Reporting and Analysis (FRA) ratio sheet, making it super easy to memorize the ratios you’ll need on exam day.

With AnalystPrep, you’re not just studying—you’re preparing to pass.

This isn't a Sprint

Stay on Course With Our Study Plans

Think of your CFA journey like training for a marathon. You wouldn’t just jump into the race without a plan, right? The same goes for the CFA exam. That’s why we’ve crafted flexible study plans that fit into your busy lifestyle, so you can pace yourself and stay on track. Whether you’re aiming for a one-month sprint to the finish or a steady two-month pace, we’ll guide you through the chapters that matter most.

And remember—not all topics carry the same weight on the exam. Some are like the hills in a marathon; they need more of your energy and focus. We’ll help you identify those high-weighted areas so you can tackle them head-on.

If you need a more personalized approach?

Our coaching package offers five hours of one-on-one guidance, during which we craft a study plan tailored just for you.

Get Support Whenever You Need It

As a premium member, you’ll have access to exclusive support that makes a real difference in your CFA journey. Here’s what you get:

- Direct Access to Expert Support:

Got a tricky exam question or stuck on a concept? Our dedicated AnalystPrep support team is just a message away, ready to respond within 24 hours to help you stay on track and move forward. - Exclusive In-App Forum Access:

Connect with a global community of fellow CFA candidates, CFA charterholders, and even AnalystPrep founders. Whether you need study tips, motivation, or advice, our forum is your go-to resource for staying motivated and engaged. - 24/7 Learning Community:

You’re never alone on your journey. Tap into the collective knowledge of other candidates and experts, share insights, and stay motivated as you push toward your CFA Level 1 exam goal.

With AnalystPrep’s premium membership, you’ll have a full support system behind you—like a team of marathon runners, all striving to reach the finish line together.

We’ll be with you every step of the way.

Example Learning Objective from AnalystPrep's CFA Level 1 Study Notes

LOS 28b: demonstrate the use of net present value (NPV) and internal rate of return (IRR) in allocating capital and describe the advantages and disadvantages of each method.

Several important decision criteria are used to evaluate capital investments. The two most comprehensive and well-understood measures of whether or not a project is profitable are the net present value (NPV) and the internal rate of return (IRR). Other measures include the payback period, discounted payback period, average accounting rate of return (AAR), and the profitability index (PI).

Net Present Value (NPV)

The net present value (NPV) of a project is the potential change in wealth resulting from the project after accounting for the time value of money. The NPV for a project with one investment outlay made at the start of the project is defined as the present value of the future after-tax cash flows minus the investment outlay.

$$

\mathrm{NPV}=\sum_{t=1}^{n} \frac{C F_{t}}{(1+r)^{t}} \text { – Outlay }

$$

Where:

\(CF_t\) = After-tax cash flow at time t

\(r\) = Required rate of return for the investment

\(\text{Outlay}\) = Investment cash flow at time zero

Many projects have cash flow patterns in which outflows occur not only at the start of the project (at time = 0) but also at future dates. In these instances, a better formula to use is:

- to invest in the project if NPV > 0;

- not to invest in the project if NPV < 0; and

- stay indifferent if NPV = 0.

In other words, positive NPV investments are wealth increasing, while negative NPV investments are wealth decreasing.

Example: Net Present Value of a Project

Suppose Company A is considering an investment of $100 million in a capital expansion project that will return after-tax cash flows of $20 million per year for the first 3 years and another $33 million in year 4, the final year of the project. If the required rate of return for the project is 8%, what would the NPV be, and should the company undertake this project?

$$

\begin{align*}

\mathrm{NPV} &=\frac{20}{1.08^{1}}+\frac{20}{1.08^{2}}+\frac{20}{1.08^{3}}+\frac{33}{1.08^{4}}-100 \\

&=18.519+17.147+15.877+24.256-100 \\

&=-\$ 24.201 \text { million }

\end{align*}

$$

Since the NPV < 0, the project should not be undertaken.

Internal Rate of Return

The internal rate of return (IRR) is the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. For a project with one initial outlay, the IRR is the discount rate that makes the present value of the future after-tax cash flows equal to the investment outlay.

The IRR solves the equation:

$$

\sum_{t=1}^{n} \frac{C F_{t}}{(1+I R R)^{t}}-\text { Outlay }=0

$$

It looks very much like the NPV equation except that the discount rate is the IRR instead of \(r\), the required rate of return. Discounted at the IRR, the NPV is equal to zero.

The decision rule for the IRR is:

- to invest in the project if the IRR exceeds the required rate of return for the project, i.e., invest if IRR > \(r\); and

- not to invest if IRR < \(r\).

In instances where the outlays for a project occur at times other than time 0, a more general form of the IRR equation is:

$$

\sum_{t=0}^{n} \frac{C F_{t}}{(1+I R R)^{t}}=0

$$

Example: IRR of a project

Here is a follow-up on the above NPV example. If company A is considering an investment of $100 million in a capital expansion project that will return after-tax cash flows of $20 million per year for the first 3 years and another $33 million in year 4, the final year of the project, what is the IRR for this project and should it be undertaken given that the required rate of return for the project is 8%?

Solve IRR in the following equation:

$$

-100+\frac{20}{(1+I R R)^{1}}+\frac{20}{(1+I R R)^{2}}+\frac{20}{(1+I R R)^{3}}+\frac{33}{(1+I R R)^{4}}=0

$$

The solution can be arrived at through trial and error. However, a simpler approach is to use a financial calculator:

Step 1: Entering the Initial Cash Outlay

Press the Cash Flow [CF] key to open the cash flow register. The calculator should read CF0=, which tells you to enter the cash flow for time 0. Since you need to send cash out of the company to make the initial $100 investment, this value has to be negative. Type in -100 for CF0, and hit the [ENTER] key.

Step 2: Entering the Cash Inflows

Next, enter the cash flow values for the subsequent periods. This is done by hitting the down arrow once. The calculator should read CF1=. Type in the amount for the first cash flow, 20, and hit [ENTER]. The calculator should now say C01=20.

To enter cash flow from Year 2, hit the down arrow twice. The calculator should read CF2=. If it says F1=, hit the down arrow one more time.

Type in the second year’s cash flow, 20, and hit [Enter]. The calculator should read CF2=20. Hit the down arrow twice again and do the same thing for the third cash flow period, CF3.

Do this once more and for the last time to enter the last cash flow, 33.

Step 3: Calculating the IRR

Once the cash flow values have been fed into the calculator, you are ready to calculate the IRR.

To do this, press the [IRR] key. The screen will read IRR=0.000. To display the IRR value for the data set, press the [CPT] key at the top left corner of the calculator. If you have followed this process correctly, the calculator will display the correct IRR. The IRR is computed to be -2.626%. Since -2.626% < 8%, the project should not be undertaken.

Simply computing a project’s NPV and IRR to determine which of several projects to undertake is not always as straightforward as it seems. The IRR and NPV can produce different ranking outcomes whenever mutually exclusive projects are involved. Other challenges may occur.

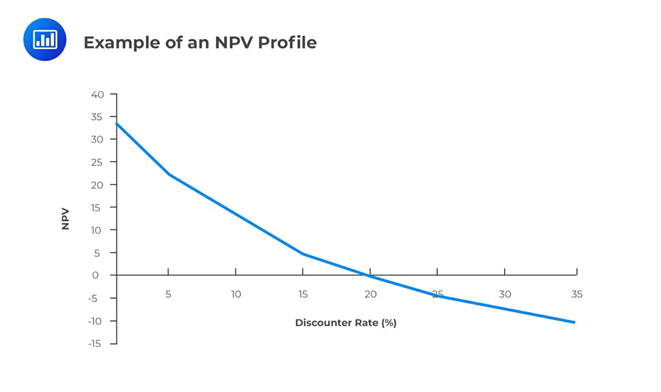

Graphical Illustration

The NPV Profile is a graphical illustration of a project’s NPV graphed as a function of various discount rates. The NPV values are graphed on the vertical or y-axis, while the discount rates are graphed on the horizontal or x-axis.

- The graph crosses the y-axis (vertical axis) when the discount rate = 0%; and

- The graph crosses the x-axis (horizontal axis) when the NPV = 0 and the discount rate is the IRR.

NPV and IRR Comparison

For independent, conventional projects, the decision rules for the NPV and IRR will both draw the same conclusion on whether to invest or not. However, in the case of two mutually exclusive projects, sometimes the decision rules will draw different conclusions. For example, project X might have a larger NPV than project Y, but project Y might have a larger IRR. This conflict usually stems from differences in the cash flows of the two projects, which leads to a different ranking between the NPV and IRR. Whenever this conflict arises, the NPV and not the IRR should be used to select which project to invest in.

Another circumstance that may cause mutually exclusive projects to be ranked differently according to NPV and IRR criteria is the scale or size of the project.

Multiple IRR and No IRR Problem

It is quite possible, although rare, for a project to have more than one IRR or no IRR at all. Multiple IRRs, however, cannot occur for conventional projects which have outlay followed by cash inflows, but they may occur for non-conventional projects which have cash flows which change signs (negative, positive) more than once during the project’s life.

The net present value (NPV) and the internal rate of return (IRR) are both techniques that can be used by financial institutions or individuals when making major investment decisions. Each method has its strengths and weaknesses. However, the net present value method comes out on top, and here’s why. When dealing with independent projects, both NPV and IRR will yield the same investment decisions. By independent, we mean that deciding to invest in one project does not rule out or affect investment in the other project.

However, the challenge comes when the projects are mutually exclusive. If two or more projects are mutually exclusive, the decision to invest in one project precludes investment in all the others. With such projects, the IRR method may provide misleading results if used in isolation.

Shortcomings of IRR

As seen, there are some problems associated with the IRR method:

- The method assumes that all proceeds from a project are immediately reinvested in projects offering a rate of return equal to the IRR – this is very difficult in practice.

- It gives different rankings when the projects under comparison have different scales.

- Sometimes, the method may not provide a unique solution, especially when a project has a mixture of positive and negative cash flows during its productive life.

Question 1

You have been provided the following cash flows for a capital project:

$$

\begin{array}{c|c|c|c|c|c|c}

\text { Year } & 0 & 1 & 2 & 3 & 4 & 5 \\

\hline \text { Cash flow }(\$) & -50,000 & 10,000 & 10,000 & 15,000 & 15,000 & 15,000

\end{array}

$$

Given a required rate of return of 8 percent, the NPV and IRR of the project are closest to:

- NPV: $1,023; IRR: 10.64%.

- NPV: $974; IRR: 8.68%.

- NPV: $2,400; IRR: 7.12%.

Solution

The correct answer is B.

$$

\begin{align*}

\text{NPV}&=-50,000+\frac{10,000}{1.08^{1}}+\frac{10,000}{1.08^{2}}+\frac{15,000}{1.08^{3}}+\frac{15,000}{1.08^{4}}+\frac{15,000}{1.08^{5}} \\

&=-50,000+9259.26+8573.39+11,907.48++11,025.45+10,208.75 \\

&=\$ 974.33 \text { million }

\end{align*}

$$

Question 2

In an NPV profile, the point at which the profile crosses the x-axis is best described as the:

- project’s IRR.

- point at which the NPV is highest.

- point at which the discount rate = 0% and the NPV is the sum of the undiscounted cash flows for the project.

Solution

The correct answer is A.

At the horizontal axis, the NPV = 0, and by definition, this occurs whenever the discount rate is the IRR.

Question 3

Suppose you have three independent projects – X, Y, and Z. Assume that the hurdle rate is 12% for all three projects. Their NPVs and IRRs are shown below.

$$

\begin{array}{c|c|c|c}

& \textbf { Project X } & \textbf { Project Y } & \textbf { Project Z } \\

\hline \text { NPV } & \$ 20,000 & \$ 21,400 & \$ 23,000 \\

\text { IRR } & 20 \% & 32 \% & 18 \%

\end{array}

$$

Assuming the projects are mutually exclusive, which of the following is the most economically feasible project?

- Z

- X

- Y

Solution

The correct answer is A.

$$

\begin{array}{c|c|c|c}

& \textbf { Project } \mathbf{X} & \textbf { Project Y } & \textbf { Project } \mathbf{Z} \\

\hline \text { NPV } & \$ 20,000 & \$ 21,400 & \$ 23,000 \\

\text { IRR } & 20 \% & 32 \% & 18 \% \\

\text { Decision } & \text { Accept } & \text { Accept } & \text { Accept }

\end{array}

$$

If the IRR criteria is used, all the three projects would be accepted because they would all increase shareholders’ wealth. Their NPVs are all positive, and again, the three are all acceptable.

However, if the projects are mutually exclusive, then only one project would be chosen. If one were to pick one project based on internal rates of return of the projects, then one would go for Y. This is because its IRR is the highest compared to the other projects.

This decision would be wrong when we consider the sizes of the NPVs of the projects. While Y has the highest IRR, its NPV is lower than that of Z. The best decision would be to go for the project with the highest NPV, and that is project Z. Therefore, if projects are mutually exclusive, the NPV method should be applied.

CFA® Program

CFA Level I Study Packages by AnalystPrep

Add video lessons and study notes for only $150 extra.

Combine all three levels, with lifetime access and unlimited ask-a-tutor questions for only $799.

Practice Package

$

349

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

Learn + Practice Package

$

499

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

- Video Lessons

- Study Notes

- Essential Review Summaries

Unlimited Package (All 3 Levels)

$

799

/ lifetime access

- Question Banks for all three Levels of the CFA Exam

- Mock Exams for all three Levels of the CFA Exam

- Performance Tracking Tools

- Video Lessons for all three Levels of the CFA Exam

- Study Notes for all three Levels of the CFA Exam

- Essential Review Summaries