Ace Your CFA ESG Exam with AnalystPrep's Study Notes

Every Learning Outcome Statement (LOS) Summarized with Question Examples

Questions Answered by our Users

Satisfied Customers

Cfa Preparation Platform By Review Websites

Why Candidates Love AnalystPrep's Study Notes the CFA ESG Exam

Navigating the intricate world of the CFA ESG exam is made more approachable with AnalystPrep’s specialized ESG Study Notes, crafted by experts with deep knowledge in ESG principles and sustainable finance. Our materials are tailored to demystify the complex ESG concepts covered in the exam, fostering a more efficient and impactful study process.

Our ESG study notes are the epitome of clarity and relevance, offering concise summaries of each chapter from the latest CFA ESG Program curriculum. We emphasize the most crucial information, presenting it in a straightforward and accessible manner. The focus is on distilling the core principles of ESG investing, ensuring you understand the key concepts without getting overwhelmed by unnecessary details.

The journey through ESG topics is enriched with practical insights and strategies, thoughtfully integrated to help you comprehend and apply ESG criteria more effectively. Our end-of-chapter questions, tailored to ESG learning outcomes, are essential for testing your understanding and solidifying your knowledge.

What truly distinguishes our ESG study notes is the personalized support provided. Our dedicated instructors, experts in ESG and sustainable finance, are always ready to offer additional guidance and clarification, ensuring you have all the support you need in your learning journey.

Opt for AnalystPrep’s ESG Study Notes for your CFA ESG exam preparation. It’s about studying not just harder, but smarter and more strategically, with a focus on the future of sustainable finance.

This isn't a Sprint

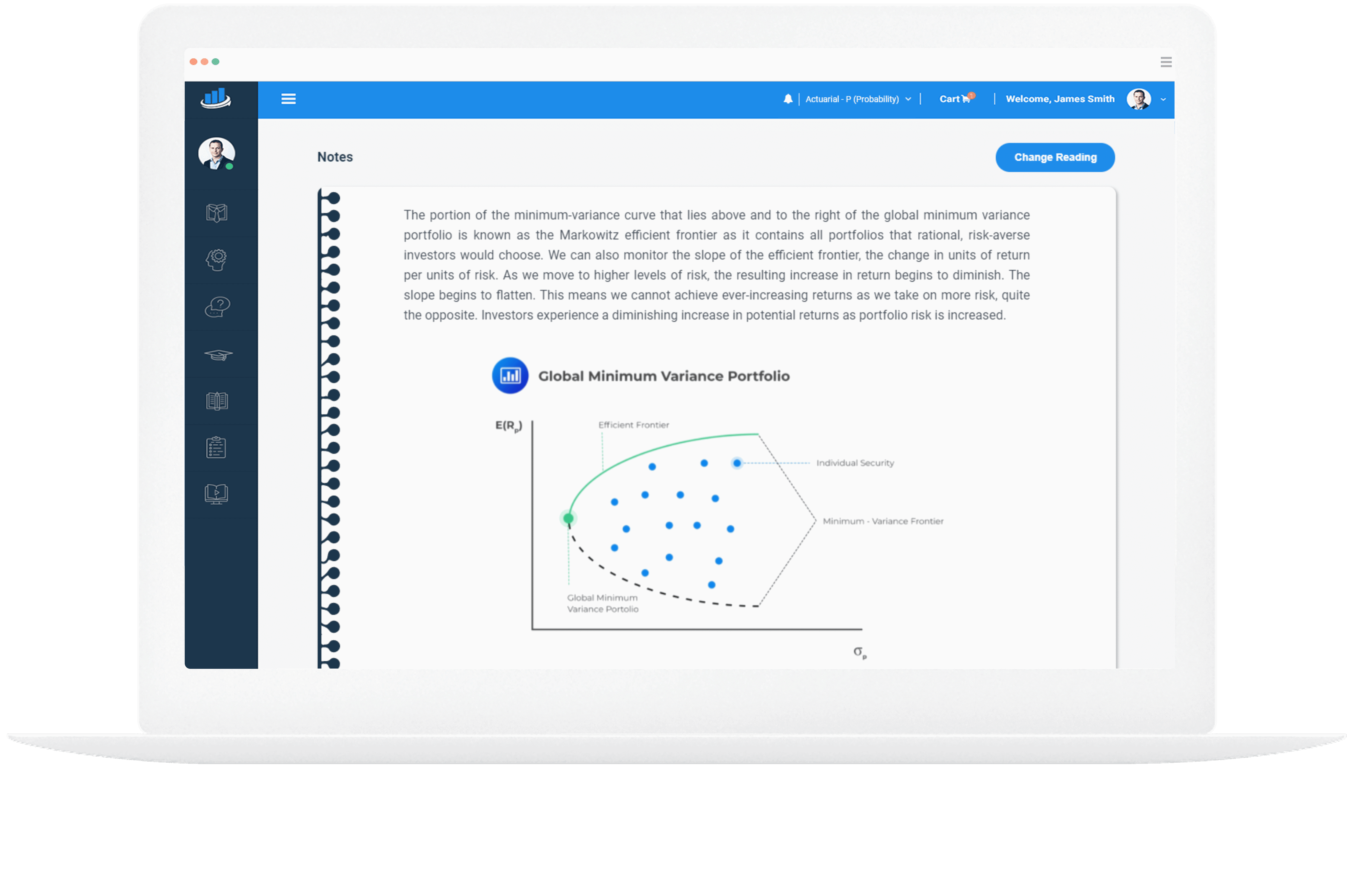

An Example from our Study Notes

TYPES OF RESPONSIBLE INVESTMENT

1.1.2. define the following sustainability-based concepts in terms of their strengths and limitations: corporate social responsibility and triple bottom line (TBL) accounting

Corporate Social Responsibility and Triple Bottom Line (TBL) Accounting

ESG Investing: An approach to managing assets where investors explicitly incorporate environmental, social, and governance factors into their investment decisions with the long-term return of an investment portfolio in mind. ESG investing is part of a group of approaches collectively referred to as responsible investing.

Responsible Investment: An umbrella term for the various ways in which investors can consider ESG factors within security selection and portfolio construction. As such, it may combine financial and non-financial outcomes and complements traditional financial analysis and portfolio construction techniques.

Socially Responsible Investment (SRI): Refers to approaches that apply social and environmental criteria in evaluating companies. Investors implementing SRI generally score companies using a chosen set of criteria, usually in conjunction with sector-specific weightings.

Best-in-class Investment (also known as “positive screening”) involves selecting only the companies that overcome a defined ranking hurdle, established using ESG criteria within each sector or industry.

- Typically, companies are scored on a variety of factors that are weighted according to the sector.

- The portfolio is then assembled from the list of qualified companies.

Bear in mind, though, that not all best-in-class funds are considered “responsible investments.” Due to its all-sector approach, best-in-class investment is commonly used in investment strategies that try to maintain certain characteristics of an index. In these cases, security selection seeks to maintain regional and sectorial diversification along with a similar profile to the parent market-cap index while targeting companies with higher ESG ratings. The tracking error for MSCI World SRI, which is designed to represent the performance of companies with high ESG ratings and employs a best-in-class selection approach to target the top 25% companies in each sector, is only 1.79%.

Sustainable investment refers to the selection of assets that contribute in some way to a sustainable economy—that is, an asset that minimizes natural and social resource depletion. It may include best-in-class and/or ESG integration, which considers how ESG issues impact a security’s risk and return profile.

Thematic investment is investment in themes or assets specifically related to ESG factors, such as clean energy, green technology, sustainable agriculture, gender diversity, or affordable housing. This approach is often based on needs arising from economic or social trends.

Green investment refers to allocating capital to assets that mitigate climate change, biodiversity loss, resource inefficiency, and other environmental challenges. Social investment refers to allocating capital to assets that address social challenges. These can be products that address the bottom of the pyramid (BOP). “BOP” refers to the poorest two-thirds of the economic human pyramid, a group of more than four billion people living in poverty. Examples can include 1) Microfinance 2) basic access to telecommunication 3) access to improved health and nutrition 4) access to clean energy. Social investing can also include social impact bonds.

Impact investing refers to investments made with the specific intent of generating positive, measurable social or environmental impact alongside a financial return (which differentiates it from philanthropy). Ethical and faith-based investment refers to investing in line with certain principles, often using negative screening to avoid investing in companies whose products and services are deemed morally objectionable by the investor or certain religions, international declarations, conventions, or voluntary agreements. Typical exclusions include: tobacco, alcohol, pornography, weapons, and significant breach of agreements, such as the Universal Declaration of Human Rights or the International Labor Organization’s Declaration on Fundamental Principles and Rights at Work.

CFA® ESG

ESG Study Packages by AnalystPrep

Learn + Practice Package

$

299

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

- Video Lessons

- Study Notes

- 5 Ask-A-Tutor Questions

- 12-month Access