Everything You Need to Know About FRM Exams

The Financial Risk Manager program (FRM) is an exam certification that is offered to individuals interested in working in the financial risk management department of firms. It is an internationally recognized certification that is administered by the Global Association of…

Level I of the CFA® Exam – Topics and Weights

A Word from the Author This article is meant for individuals who have decided to pursue the CFA® charter. It is also meant for individuals who are still indecisive on whether to pursue CFA® exams or not. I will start…

All you Need to Know About the 2020 CFA® Exams

Is there a Need to Pursue Professional Courses? With the rising number of college graduates and a limited supply of jobs, an undergraduate college degree is slowly losing its value. Professional certifications from various professional bodies serve the vital purpose…

FRM Part 1 Changes from 2019 to 2020

Here are the major changes for FRM part 1 for 2020: Book 1 – Foundations of Risk Management Chapter 1: The Building Blocks of Risk Management (Previously: Risk Management: A Helicopter View) ADDED: Explain how risk factors can interact with each other and…

Questions to Ask When Hiring New Graduates

Although many employers think that new graduates are not ready for challenges that modern workplaces represent, this is usually not the case. Hiring someone who just finished their studies can actually be an excellent decision for your company. One of…

Society of Actuaries Membership: FSA or CERA?

First, what is an Actuary? An actuary is a professional who identifies and analyses the financial impact of various uncertainties. Actuaries apply mathematical, analytical and computer programming skills to come up with models that identify and manage potential risks. That…

Five Industries Actuaries Can Work in Apart From Insurance

For the actuarial profession, there is no denying that things are looking up – that is in terms of employment opportunities. According to the US Bureau of Labor Statistics, it is estimated that by the year 2028, the absorption of…

Derivatives – CFA Level 1 Essential Review Summary

Reading 48 – Derivative Markets and Instruments Derivative securities are an asset class where they derive (hence the name) their value from an underlying asset. These underlying assets can be financial assets like equities or bonds or real assets like…

Portfolio Management – Level I CFA® Program Essential Review Summary offered by AnaystPrep

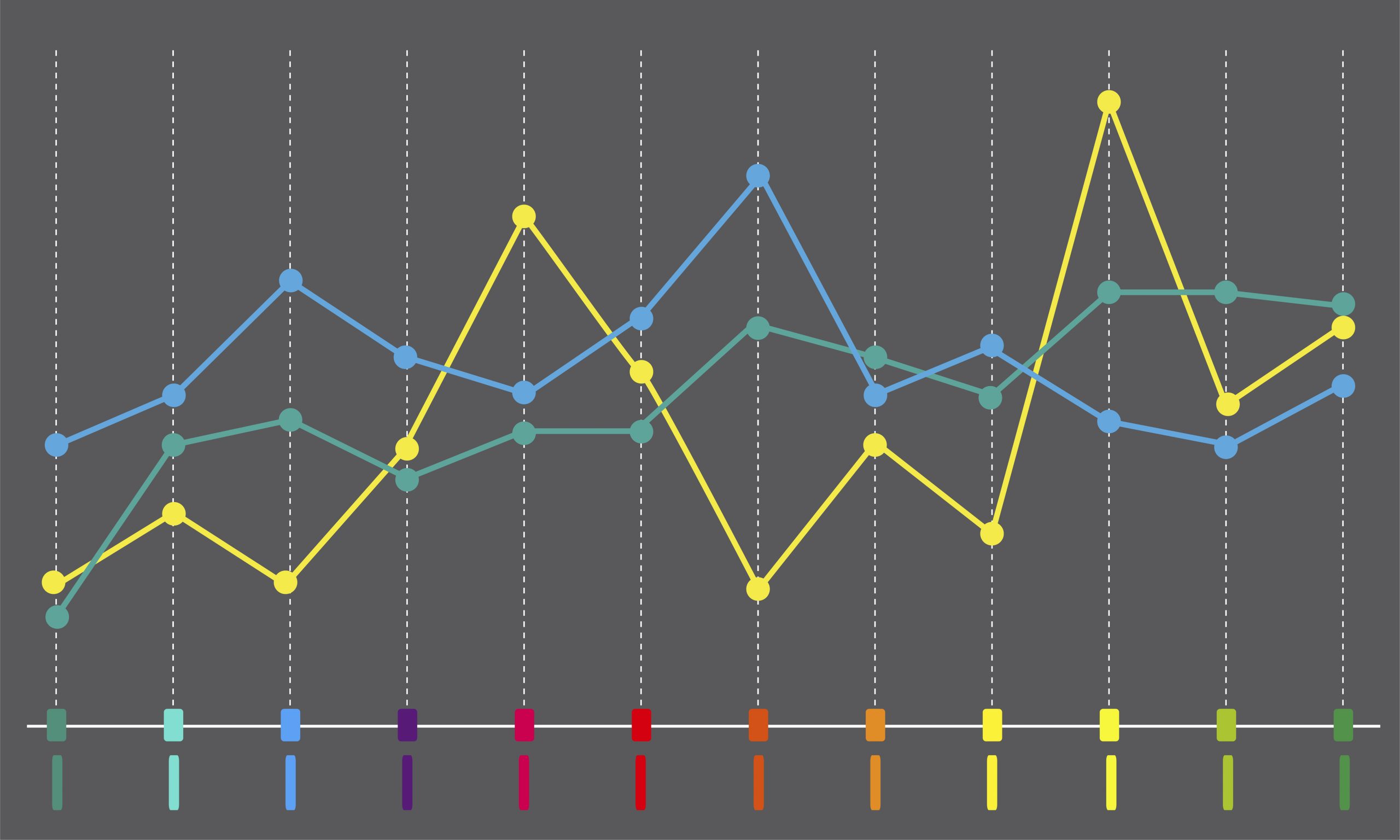

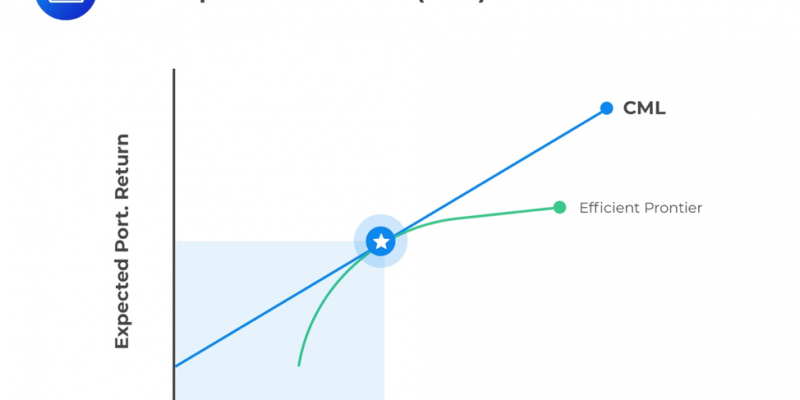

Reading 51 – Portfolio Management: An Overview Portfolio management is about creating a diversified approach to meet one’s investment goals. Diversification involves avoiding too much exposure to a single asset or asset type. Diversifying the risks of a portfolio helps…

Alternative Investments – Level I Essential Review Summary

Reading 58: Introduction to Alternative Investments The CFA Program curriculum is always changing and this last reading of Level 1 has been completely overhauled by the Institute and is considered a new reading. There is only this one reading regarding…