Difference between MBA, Masters in Finance (MF), CFA® Program and FRM

Now the world is going digital. This increase in online tools, services, and various platforms has led to a high jump in material available on-the-line. Since you’ve come to our page, you are probably a student, wondering how to succeed…

Time To Rethink the Classic 60/40 Portfolio

The Federal Reserve is continuously tightening and affecting fixed-income investments. It has decided to reduce the rate of return for bonds with at least five years of maturity. Generally, the 60/40 portfolio has delivered excellent performance. However, tough times must…

Writing an Effective Preparation Plan for the Level III of the CFA® Exam

You’ve invested a lot of hard work, study hours, and time into passing the level I and level II CFA® exams. You’ve succeeded and now it’s time for the final stage. You can almost see the finish line and now…

7 Reasons People Fail Level I of the CFA® Exam

The financial services industry is filled with career opportunities. There are company-employed financial analysts, CFO’s, and advisors, investment managers, freelance financial planners, personal budget consultants, and, of course, all possible professional careers in the banking and insurance industries. What gets…

Evolution of Portfolio Theory Efficient Frontier to SML (Calculations for CFA® and FRM® Exams)

Evolution of Portfolio Theory In theory, we could form a portfolio made up of all investable assets, however, this is not practical and we must find a way of filtering the investable universe. A risk-averse investor wants to find the…

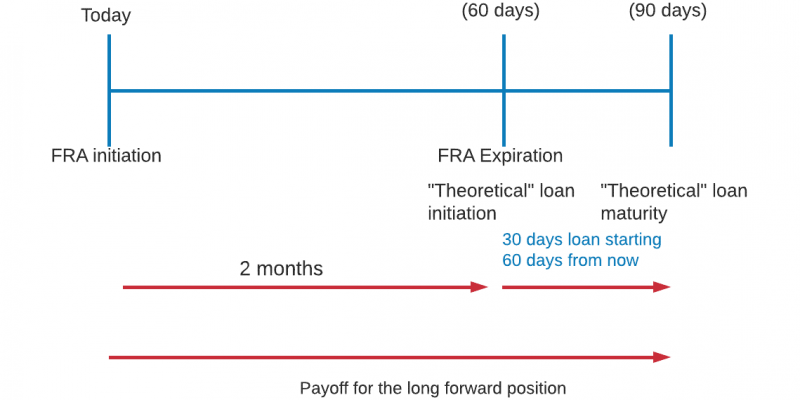

Timelines – Your Best Friends (Calculations for CFA® and FRM® Exams)

What is a timeline? A timeline is an physical illustration of the amount and the timing of cash flows associated with an investment project. Some of the applications of a timeline include: Quantitative Methods: Time Value of Money Capital Budgeting…

Beta and CAPM

Quick Reference: CAPM Beta Formula Formula: $$ \beta = \frac{\text{Cov}\left(\text{R}_{\text{i}}, \text{R}_{\text{m}}\right)}{\text{Var}\left(\text{R}_{\text{m}}\right)} $$ $$\begin{array}{c|l} \textbf{Term} & \textbf{Meaning} \\ \hline \text{R}_{\text{i}} & \text{Return of individual asset} \\ \hline \text{R}_{\text{m}} & \text{Return of the market portfolio} \\ \hline \text{Cov}\left(\text{R}_{\text{i}}, \text{R}_{\text{m}}\right) & \text{Covariance between…

Necessary Skills Needed to Pass the CFA® Exams

In this article, we are assuming that you are already enrolled in the CFA® Program, and if not, you are an aspiring CFA Program candidate. Most, if not all, CFA Program candidates wish to pass their CFA exams on their…