Simple Steps to Take to Get Your FRM® Certification

Getting an FRM certification will help you advance your career as a risk manager. The certification is offered globally by the Global Association of Risk Professionals (GARP). Having an FRM certification has several benefits; Being a certified FRM shows that…

Frequently Asked Questions on the FRM® Certification

You may have just enrolled for the FRM course, or maybe you are considering registering for the course to advance your career, and you probably have a lot of questions about FRM certification. Let us answer the most frequent questions…

How Easy is it to Pass the FRM® Exam?

Suppose you have just enrolled in the FRM program; you probably want to know how hard the exam is. The FRM curriculum is challenging; therefore, you will need to put in hard work and a lot of time to succeed….

What is the Difference Between FRM® Certification and CFA® Charter? All you need to Know

If you are planning on joining the finance world and working as a financial analyst or with investments, the FRM certification or CFA charter could help you achieve your career goals. To make the right choice, you need to know…

Difference between MBA, Masters in Finance (MF), CFA® Program and FRM

Now the world is going digital. This increase in online tools, services, and various platforms has led to a high jump in material available on-the-line. Since you’ve come to our page, you are probably a student, wondering how to succeed…

Evolution of Portfolio Theory Efficient Frontier to SML (Calculations for CFA® and FRM® Exams)

Evolution of Portfolio Theory In theory, we could form a portfolio made up of all investable assets, however, this is not practical and we must find a way of filtering the investable universe. A risk-averse investor wants to find the…

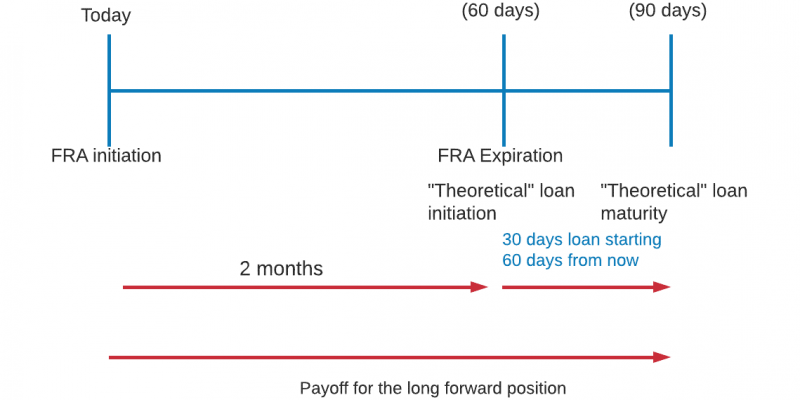

Timelines – Your Best Friends (Calculations for CFA® and FRM® Exams)

What is a timeline? A timeline is an physical illustration of the amount and the timing of cash flows associated with an investment project. Some of the applications of a timeline include: Quantitative Methods: Time Value of Money Capital Budgeting…

Beta and CAPM

Quick Reference: CAPM Beta Formula Formula: $$ \beta = \frac{\text{Cov}\left(\text{R}_{\text{i}}, \text{R}_{\text{m}}\right)}{\text{Var}\left(\text{R}_{\text{m}}\right)} $$ $$\begin{array}{c|l} \textbf{Term} & \textbf{Meaning} \\ \hline \text{R}_{\text{i}} & \text{Return of individual asset} \\ \hline \text{R}_{\text{m}} & \text{Return of the market portfolio} \\ \hline \text{Cov}\left(\text{R}_{\text{i}}, \text{R}_{\text{m}}\right) & \text{Covariance between…

Best Tips and Tricks for Preparing and Successfully Passing FRM Exams

Passing your Financial Risk Management (FRM) exam on the first try isn’t impossible – it is however quite difficult. FRM exams are detailed and involve complex calculations and thinking from each exam candidate. A financial risk manager is expected to…