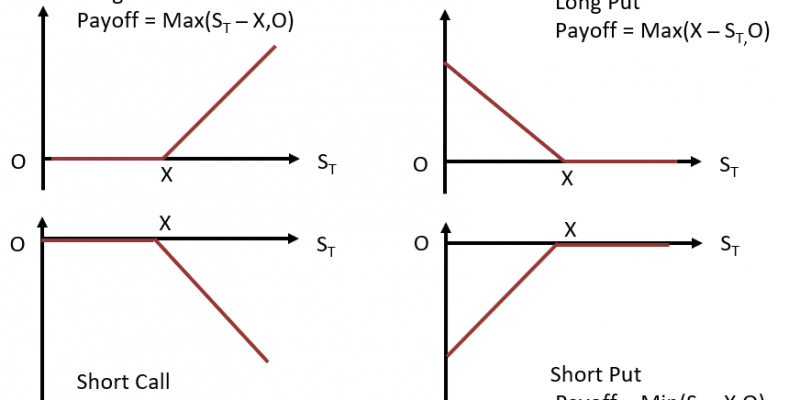

Options Payoffs and Profits (Calculations for CFA® and FRM® Exams)

Understanding call and put option payoffs is a must for mastering derivatives in the CFA® or FRM® exams—and for real-world trading strategies. This guide breaks down option payoff and profit formulas, shows you how to calculate each, and includes cha1rts…

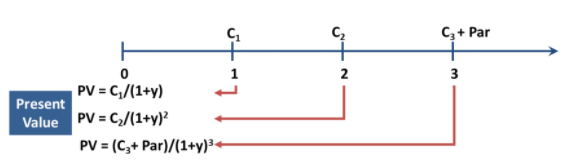

Bond Valuation (Calculations for CFA® and FRM® Exams)

Bond valuation is an application of discounted cash flow analysis. The general approach to bond valuation is to utilize a series of spot rates to reflect the timing of future cash flows. Value, Price, and TVM Value can be described as…

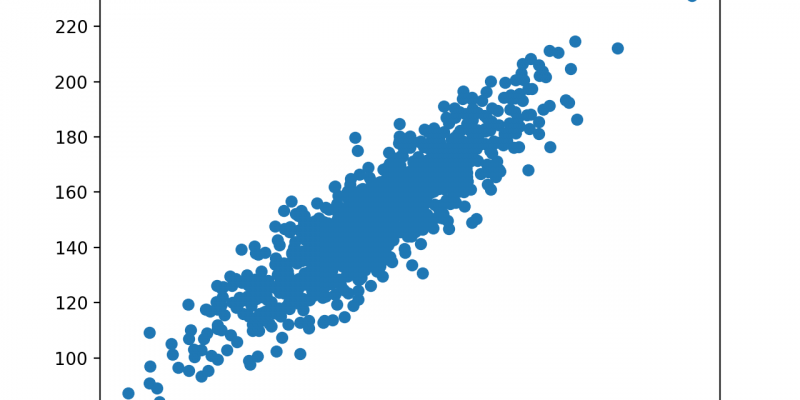

Covariance and Correlation (Calculations for CFA® and FRM® Exams)

The covariance is a measure of the degree of co-movement between two random variables. For instance, we could be interested in the degree of co-movement between the variables X and Y, where we can let: The general formula used to…

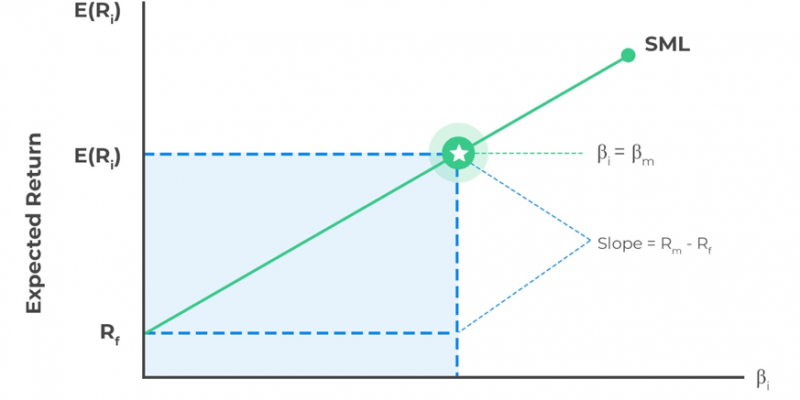

Sharpe Ratio, Treynor Ratio and Jensen’s Alpha (Calculations for CFA® and FRM® Exams)

Portfolio Performance Measures Portfolio management involves a trade-off between risk and return. Most amateur investors mistakenly focus only on the return aspect and lose sight of the risk taken to achieve the return. The portfolio performance measures are intended as…

Spot Rate vs. Forward Rates (Calculations for CFA® and FRM® Exams)

Understanding how to calculate forward rates from spot rates is a must for CFA and FRM candidates. This guide breaks down the forward rate formula step by step, showing you exactly how it appears on the exams. With simple examples…

Financial Models

A “financial model” can be a lot of things. The phrase is usually used to describe a representation of a real financial situation. Financial models typically use a set of assumptions and inputs to generate an output or set of…

FRM Part 1 Exam – 3-Month Study Plan

I sat and passed FRM Part 1 in May 2018, in Frankfurt. Easy as that sounds, make no mistake – it was a tough ride! Even with an MSc. In Business Administration and specialty in corporate finance, I still knew I…

The FRM Program: Expectations, Benefits, and Tips

Introduction A Financial Risk Manager (FRM) that desires to be recognized by the Global Association of Risk Professionals (GARP) is required to pass an exam that grants hopefuls the right of passage into fulfilling careers within the world of finance….

Central Counterparties

Central counterparties, also known as CCPs, protect market participants from counterparty /credit/default risk and settlement risk by guaranteeing the trade between a buyer and a seller. By doing so it helps avert the cascading impact a counterparty default could have…

Open Market Operations – A Tool for Inflation and Interest Rate Targeting

OMOs or Open Market Operations are a commonly used tool by Central Banks to administer the monetary policy. Central Banks try and control the price and quantity of money in the economy through the implementation of the monetary policy, price of money being interest…