Secrets to FRM Success: Your Guide to ...

Risk is everywhere in finance. Markets crash. Companies default. Volatility? It’s a given.... Read More

Central counterparties, also known as CCPs, protect market participants from counterparty /credit/default risk and settlement risk by guaranteeing the trade between a buyer and a seller. By doing so it helps avert the cascading impact a counterparty default could have on the financial markets as was seen in 2008 in the wake of the collapse of Bear Stearns.

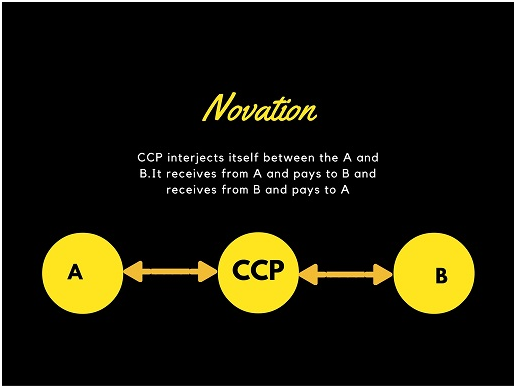

A central counterparty interjects itself between a buyer and a seller through a process called ‘Novation’ and becomes a seller to the buyer and a buyer to the seller. By novating the trade the CCP guarantees settlement of the trade even if one of the parties were to default on their obligation, thereby eliminating counterparty risk.

In order to provide the guarantee, the CCP needs to cover itself first. This it does through a collection of collaterals and margins from its members. Whenever a member does a trade the collaterals placed by him with the CCP are blocked in its account and they remain blocked until the trade is successfully settled. In the event the member defaults on his obligation, the CCP will sell the collaterals and make good the obligation to the counterparty of the member.

Let’s take an example. Supposing member A agrees to lend 100 million to member B. On striking of the deal, the CCP will block 100 million worth of collateral in the account of member B. If on the day of repayment, member B fails to return the money borrowed with interest, the CCP will sell the blocked collateral of member B and return the money to member A, thus making good the obligation to him though his counterparty has defaulted.

The second line of defense for a CCP is the Default Fund. The default fund is a fund constituted to prevent the CCP from failing and avert the impact it would have on the financial markets.

The default fund is drawn upon when the collaterals provided by the defaulting member are insufficient to meet the obligation owed to the counterparty. Every member is required to contribute to the default fund at the time of taking membership to the CCP. When the defaulting member’s contribution to the default fund is also not sufficient to meet the amount owed, the other non-defaulting members’ contribution is drawn upon. But before that the CCP may contribute some of its own resources towards meeting the default. This is called the CCP’s ‘skin in the game’. It incentivizes the CCP to ensure that the losses are limited to an amount covered by the collaterals contributed by the member.

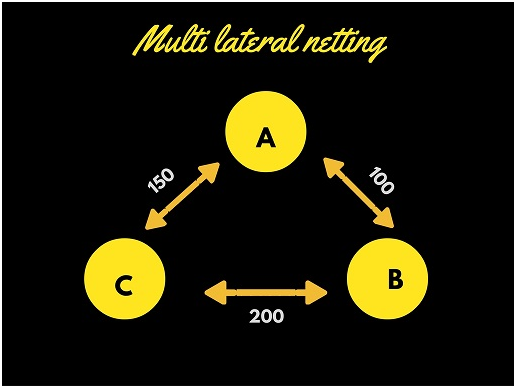

Besides guaranteeing trades, a CCP also provides the benefit of multilateral netting. Under multilateral netting, a member’s individual trades are netted together to arrive at a single pay or receive position for each member. This reduces the volume being settled and also brings down the intraday liquidity needs of the market for settlement of the trades.

Let’s take the example of multilateral netting. Supposing A has lent to B 100 million. B has lent C 200 million. C has lent to A 150 million. Now if these transactions are to be settled separately, A will first have to pay 100 million to B and then receive separately 150 million from C, which increases the liquidity requirement of A. Also, A may not be in a position to pay 100 million before receiving 150 million due to him, which increases the chances of default. Therefore, instead, if all these transactions were netted together to arrive at a single position for each of the participants, it reduces the liquidity needed for settlement drastically and also reduces the chances of default. Let us see how.

Now if multilateral netting were to be applied to our transactions, A would net receive 50 million (he wouldn’t have to first pay out 100 and then receive 150), B would have to net pay only 100 million and C would net receive 50 million. So now B pays 100 and A and C receive 50 each and thus the debits and credits are balanced and life is so much simpler.

Like multilateral netting, CCPs provide the facility of portfolio compression for non-guaranteed trades. Trades which are concluded in the OTC derivatives market such as IRS and not through a CCP are not provided guaranteed settlement. However, to provide benefits similar to multilateral netting, portfolio compression services are provided. Under portfolio compression, multiple trades between the same counterparties are terminated and replaced by a new trade having a smaller notional outstanding than the total notional outstanding of the trades terminated. This helps to reduce the volume of outstanding trades. Portfolio compression is provided on a bilateral as well as a multilateral basis.

In order to manage its risks well, a CCP has to place stringent requirements on its members in terms of creditworthiness, their ability to meet margin calls, and their operational soundness. Clearing trades via a CCP is therefore limited to members with adequate financial and technical resources. Firms that are not members of CCPs can nevertheless benefit from central clearing as clients of clearing members. Clearing members are direct members of a CCP who clear and settle trades on their own behalf as well as on behalf o their clients.

Acknowledging their importance in the smooth functioning and stability of financial markets, worldwide, CCPs are now being given the status of ‘systemically important financial market infrastructure’. Financial market infrastructures play a pivotal role in the clearance and settlement of financial transactions and the movement of money and securities around the world.

There is a worldwide move to shift OTC derivatives, which have been identified as one of the main causes for the financial market turmoil that began in 2007, from the bilateral market to the CCP settled multilateral market in order to secure them. This new infrastructure, implemented for the OTC Derivative market will considerably reduce counterparty risk globally.

_______________________________

This article has been written by Aarwin’s Guide to CFA.

Photo by Aditya Vyas on Unsplash

All 3 Levels of the CFA Exam – Complete Course offered by AnalystPrep

Risk is everywhere in finance. Markets crash. Companies default. Volatility? It’s a given.... Read More

What is a timeline? A timeline is an physical illustration of the amount... Read More