After completing this reading, you should be able to:

- Within the economic capital implementation framework, describe the challenges that appear in:

- Defining and calculating risk measures.

- Risk aggregation.

- Validation of models.

- Dependency modeling in credit risk.

- Evaluating counterparty credit risk.

- Assessing interest rate risk in the banking book.

- Describe the BIS recommendations that supervisors should consider to effectively use internal risk measures, such as economic capital, that are not designed for regulatory purposes.

- Explain the benefits and impacts of using an economic capital framework within the following areas:

- Credit portfolio management.

- Risk-based pricing.

- Customer profitability analysis.

- Management incentives.

- Describe best practices and assess key concerns for the governance of an economic capital framework.

What is Economic Capital?

Economic capital refers to the methods and practices banks employ to consistently assess risk and attribute capital to cover the economic effects of risk-taking activities. Initially, economic capital was a tool used exclusively for capital allocation and performance measurement. For this purpose, accuracy is not paramount, and less importance is attached to the measurement of the overall risk level. In recent years, however, new applications that attach much more importance to accuracy have emerged. For example, the quantification of the amount of internal capital needed by a bank is an especially important endeavor that has to be accurate because it has implications for a firm’s performance.

Firms can analyze economic capital at various levels— from firm level to risk-type or business-line level, or even further down at the level of individual portfolios.

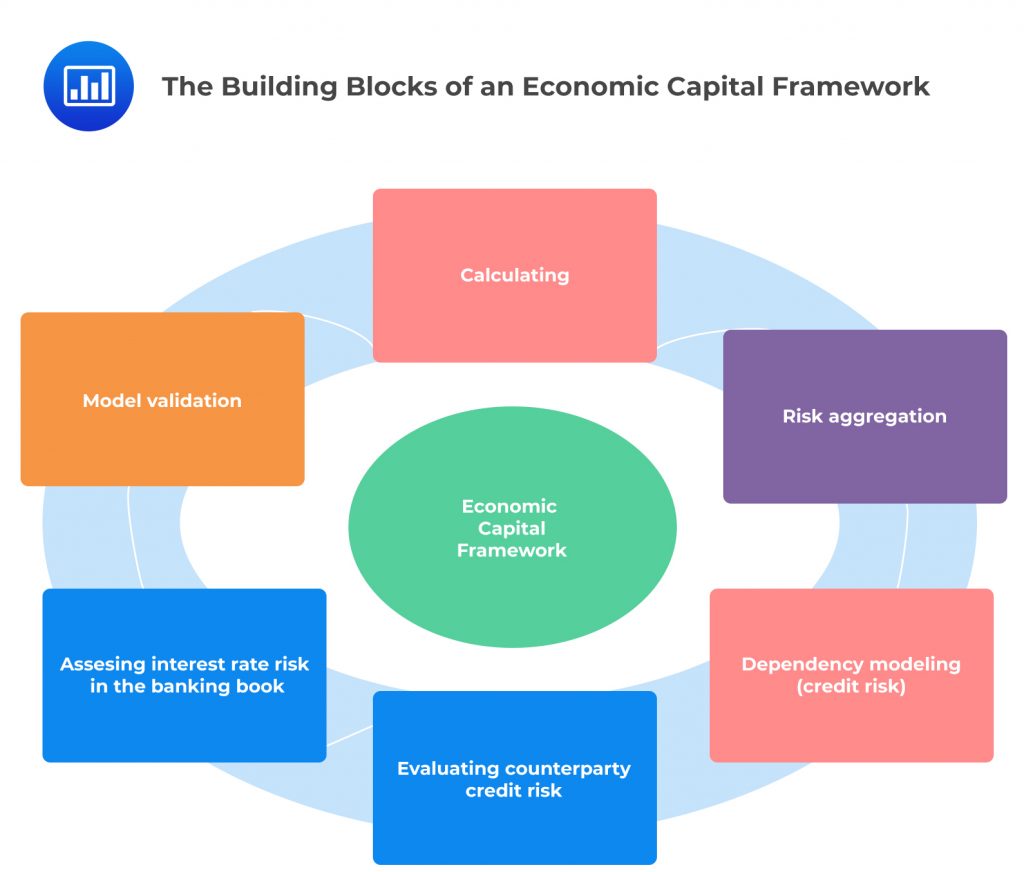

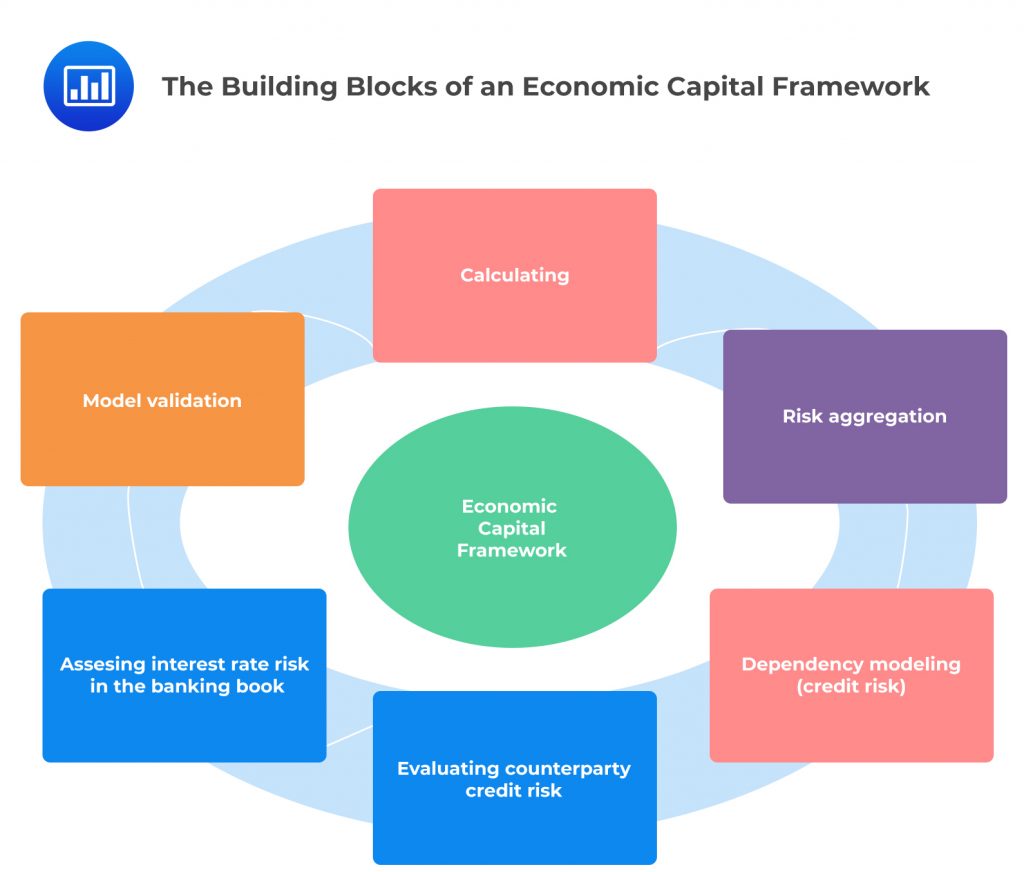

The implementation of a robust economic capital framework involves several processes. It covers issues related to the use and governance of economic capital, the choice of risk measures, aggregation of risk, and validation of economic capital. In addition, it covers three important building blocks of economic capital (dependency modeling in credit risk, counterparty credit risk, and interest rate risk in the banking book).

We will now look at the challenges experienced by firms while implementing economic capital in relation to each of the above building blocks.

Challenges in Defining and Calculating Risk Measures

Banks have a variety of risk measures to choose from. However, the risk measure chosen depends upon several factors, such as:

- Properties of the risk measure.

- Risk or product being measured.

- Tradeoffs between complexity and usability.

- The intended use.

- Availability of data.

The most common risk measures considered include value at risk (VaR), expected shortfall (ES), standard deviation (σ), and spectral risk measures. However, there’s no clear preference for any one of these over another because each type of risk measure comes with its own set of strengths and weaknesses.

The following are the main challenges encountered with respect to each risk measure.

Value at Risk (VaR)

- It does not describe the losses in the left tail. It indicates the probability of a value occurring but stops short of describing the distribution of losses in the left tail.

- It is not stable because the underlying set of assumptions heavily influences it.

- It is incoherent because it fails to satisfy the subadditivity axiom.

Expected Shortfall (ES)

- Despite ticking all the boxes on matters of coherence, it fails on elicitability, i.e., the ability of a risk measure to rank models’ performance based on a scoring function.

- It’s not easy to interpret, and its link to a firm’s desired credit rating is somewhat obscure.

Standard Deviation (σ)

- It is not stable because it is heavily influenced by the type of distribution assumed.

- It is not forward-looking since it is based on historically observed data. This can cause problems for actively managed portfolios that show a much larger scope for variance due to flexibility in investment strategies.

- It is not coherent because it violates the monotonicity axiom.

Spectral Risk Measures

- They can be complex and difficult to understand and are actually not widely used.

- They are not stable because the results depend on the loss distribution assumed.

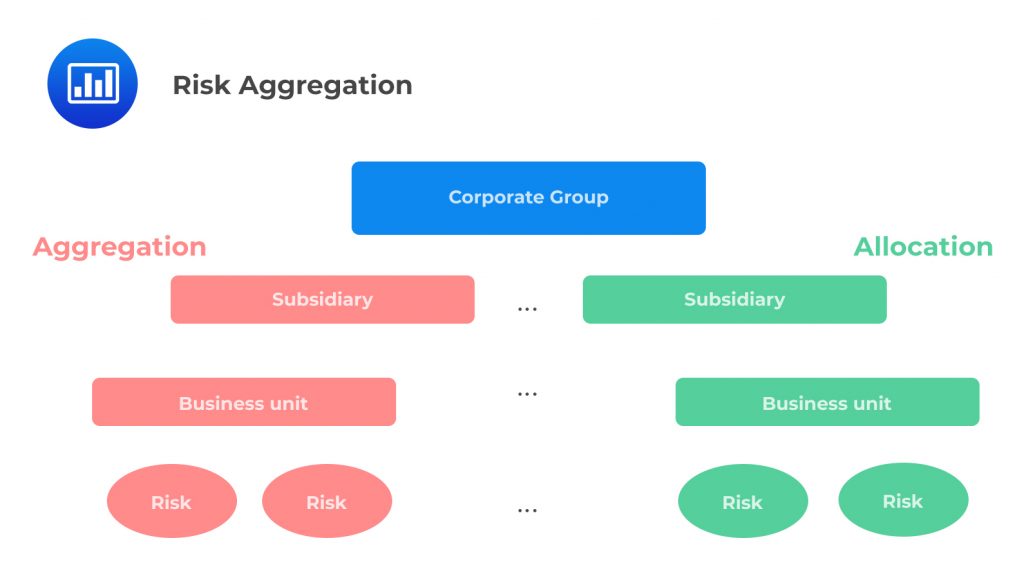

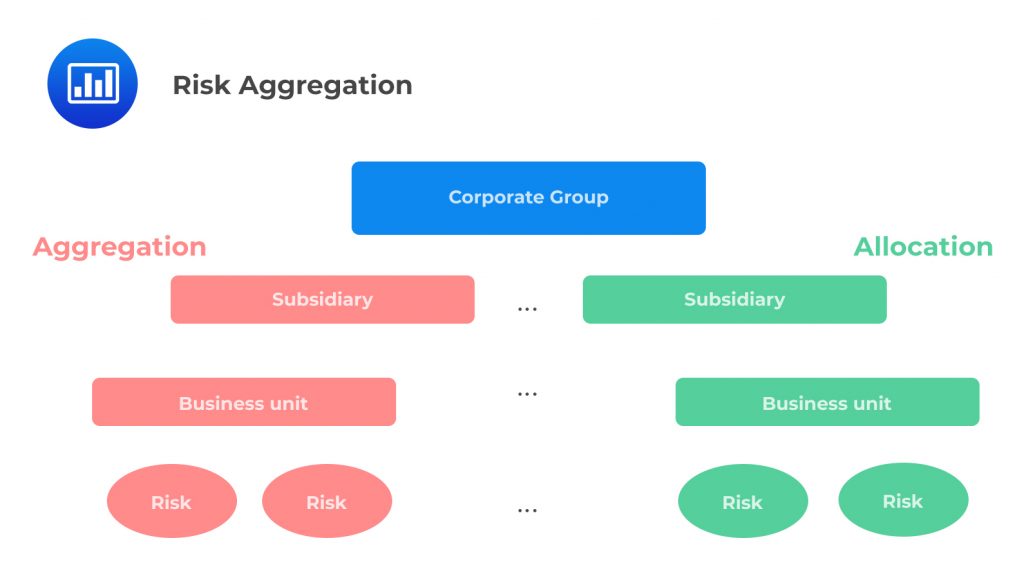

Challenges in Risk Aggregation

Risk aggregation is the process of pooling risk data with respect to different risks with the aim of obtaining an integrated risk profile for a firm. A bank gathers risk data from all the business units and attempts to identify any co-movement between risks.

Risk aggregation is a challenge in several ways:

- Establishing the degree of risk diversification between distinct risk types is subject to technical and conceptual difficulties. As a result, most banks rely heavily on ad-hoc solutions and judgments that may not be consistent with the measurement of the individual risk components. For example, they may assume that no diversification effects exist at all, meaning that risks do not show co-movement, and a firm’s total risk is simply the sum of all individual risks. They may also choose to work with a constant value of the correlation.

- Validation of risk aggregation relies on subjective “expert judgment” because there’s no clear way to measure the relationships between risks.

- Risk aggregation may end up underestimating the overall risk even if zero diversification is assumed. That’s because the individual risk components are measured without regard to interactions between risks (e.g., credit risk and market risk).

- It is difficult to harmonize the risk measurement horizon. For example, banks will usually have to use the square root of the time rule to extend the shorter horizon applied to market risk and work out an estimate of the annual economic capital required. This simplification can distort the calculation and result in values that do not reflect the ‘true’ level of capital required.

Challenges in Validation of Models

Validation is the “proof ” that a model works as intended. Model validation is important for several reasons:

- Models are usually complex, embodying many components, and it is important to ensure that all the parts are working as they should.

- It helps to single out any assumptions that may not be in line with reality or those that may not hold in all circumstances (e.g., under periods of stress).

- It increases the confidence of users in the outputs of the model.

Model validation, however, comes with its own challenges:

- Validation of economic capital models is still a work in progress, and most validation techniques for this particular purpose are at a very preliminary stage.

- Although many techniques are coming up, none provides evidence for all of the desirable properties of a model.

- Validation techniques generally show some performance imbalance. Most of them do well in areas such as risk sensitivity but not in other areas such as overall absolute accuracy or accuracy in the tail of loss distribution.

In order for model validation to produce meaningful results, there is a need for firms to combine validation techniques with good controls and governance.

Dependency Modeling in Credit Risk

Dependency modeling attempts to establish the extent to which obligors tend to default on their obligations simultaneously. The correlation between obligors impacts the tail of the loss distribution. The more correlated the obligors, the more extended the tail. This, in turn, increases the amount of economic capital a bank needs.

Dependency modeling poses several challenges:

- There hasn’t been a significant advancement in the methodologies applied by banks in the area of dependency modeling over the past ten years. However, improvements have been made in the infrastructure supporting these methodologies. For example, we now have improved databases that house and document the underlying concepts, and there’s also been better integration with internal risk measurement and risk management.

- Modeling the correlation between obligors continues to be an uphill task, particularly during times of stress. At the moment, values being used by banks are nothing more than estimates that depend heavily on explicit or implicit model assumptions.

Challenges in Evaluating Counterparty Credit Risk

Measurement and management of counterparty credit risk play a critical role in an economic capital framework. The higher the counterparty credit risk, the higher the economic capital required. However, the measurement of counterparty credit risk represents a complex exercise:

Market-Risk-Related Challenges

In order to come up with estimates of counterparty risk, an institution conducts a series of simulations of market risk factors. This helps map out all the possible scenarios. While at it, the following challenges may be experienced.

- The simulation models combine all positions in a portfolio into a single simulation such that losses in another position in the same simulation run can offset gains from one position. However, netting across counterparties is not permitted in practice, and therefore, a firm has to estimate its obligations at the legally enforceable level of netting. This increases the complexity of the process.

- A firm has to estimate counterparty risk exposure for multiple periods. However, market risk VaR models usually narrow down the analysis to a single short-term period. As such, a firm has to keep re-evaluating its positions from time to time.

Credit-Risk-Related Challenges

- In case a bank hasn’t transacted with a given counterparty in the past, it has to compute the probability of default and loss given default for the counterparty and transaction.

- When a counterparty is a hedge fund (whose transparency is limited), estimating fund volatility, leverage and getting information about investment strategies employed can be a big challenge.

- Even for counterparties with which a bank has some prior exposure, a bank still needs to work out a specific loss-given default for a new transaction.

Interaction between Market Risk and Credit Risk—Wrong-Way Risk

In most banks, the estimation of exposure at default (EAD) is independent of the estimation of the probability of default (PD) and the loss-given default (LGD). Different teams may even carry out the two processes. However, the PD and LGD may rise at the same time, giving rise to wrong-way risk. This type of risk is difficult to identify and quantify because it requires a good understanding of the market risk factors the counterparty is exposed to. Quantifying wrong-way risk is even more of a challenge for banks that separate EAD estimation from PD-LGD estimation.

Operational-risk-related Challenges

When transacting with counterparties, a bank has to constantly monitor counterparty risk through activities such as margining, marking-to-market, collateral calls, and more. These activities require specialized computer systems and people.

Quantifying operational risk is especially challenging when dealing with a new product or process. A bank, in such an instance, also has to estimate losses that would result from infrequent but severe events.

Differences in Risk Profiles between Margined and Non-Margined Counterparties

There are two counterparty categories: Those that have agreed to margin via a credit support annex and those that have not. For both categories, a bank has to model counterparty risk and attempt to forecast the most likely scenarios over a look-ahead period. For margined counterparties, the forecasting period is short, associated with a reasonable “cure period” between when a counterparty misses a margin call and when the underlying positions can be closed out. For non-margined counterparties, the forecasting period is generally much longer – sometimes as long as the contract’s life.

This variation in modeling horizons makes it difficult to aggregate risks across these two classes of counterparties since most risk models take a single modeling horizon (e.g., one day for VaR models and one year for economic capital models) for all positions.

Challenges During the Assessment of Interest Rate Risk in the Banking Book

Interest rate movement affects an institution’s earnings by altering interest-sensitive income and expenses. Interest rates also affect the value of the underlying assets, liabilities, and off-balance sheet instruments. This is because the present value of future cash flows changes when interest rates change. As such, a bank has to calculate the economic capital for interest rate risk.

Modeling interest rate risk is particularly challenging when the banking book items have embedded optionality.

- A bank may have extended consumer loans that give a borrower the option to pay back the principal earlier than scheduled, i.e., prepayment risk.

- Deposits usually have no withdrawal restrictions, and the depositor has the option to withdraw up to the entire balance with no penalty.

Such options make it difficult to predict future cash flows, complicating efforts to model interest rate risk.

The interest rate charge attached to a bank’s products is also affected by changes in the market rate. A bank may have to reprice its products when the market rate changes in order to remain competitive.

BIS Recommendations for Internal Risk Measures

In order to make the most of internal risk measures that are not designed out of the need to meet regulatory requirements, supervisors should consider the following recommendations.

-

When Assessing Capital Adequacy, Economic Capital Models Should be Used.

A bank should be in a position to demonstrate how such models are used in the corporate decision-making process so as to assess how the model impacts the risks the bank takes on. In addition, it is important that the board has a basic understanding of gross (stand-alone) and net (diversified) enterprise-wide risk when assessing the bank’s net risk tolerance.

-

Senior Management

Senior management should set the tone at the top and understand why it is important to use economic capital measures when conducting a bank’s business. Senior management should take measures to ensure the meaningfulness and integrity of economic capital measures.

-

Transparency and Integration into Decision-making

A bank should have sufficient documentation for its economic capital models and incorporate them into decision-making in a transparent manner. Economic capital model results should be taken seriously in order to be useful to senior management for making business decisions and for risk management.

-

Risk Identification

The bedrock of successful risk measurement is a robust, comprehensive, and rigorous risk identification process. The quantification engine for economic capital must identify the relevant risk drivers, positions, or exposures. Failure to do so creates room for slippage between inherent risk and measured risk.

-

Risk Measures

A bank should understand that all risk measures have their strong and weak points and that the use of each measure has its own implications.

-

Risk Aggregation

A bank should understand that the accuracy of the aggregation process depends upon the quality of the measurement of individual risk components, as well as on the interactions between risks embedded in the measurement process. For an effective and informative aggregation of individual risk components, the measurement parameters, such as the confidence level or measurement horizon, should be harmonized across a bank.

-

Validation

The validation of economic capital models should be conducted rigorously and comprehensively. Besides, it should be aimed at demonstrating that a model is fit for its purpose.

-

Dependency Modeling in Credit Risk

A bank should pay attention to the level of dependency embedded in portfolio credit risk models. This is because dependency impacts the determination of economic capital needs for credit risk.

-

Counterparty Credit Risk

A bank should understand that there are tradeoffs to be considered in making a decision between the available methods of measuring counterparty credit risk. Additional methods, such as stress testing, need to be used to help cover all exposures.

-

Interest Rate Risk in the Banking Book

Any financial instrument with embedded options needs to be examined closely in order to control risk levels.

Benefits and Impacts of Using an Economic Capital Framework

Credit Portfolio Management

Benefits

- The incremental risk contribution is an important yardstick when evaluating the concentration of a loan portfolio.

- Credit portfolio management offers protection against risk deterioration.

Constraints

- The credit quality of each borrower is determined in the context of the portfolio, not on a stand-alone basis.

Risk-based Pricing

Benefits

- A bank can maximize its profitability. For example, a bank can do so by making pricing changes that focus on customer relationships and the enhancement of its reputation.

Constraints

- All business units and projects have to be evaluated on the basis of the risk-adjusted return on capital, meaning that some projects may not make the cut.

Customer and Product Profitability Analysis

Benefits

- Economic capital is used to maximize the risk-return trade-off.

- If a bank is able to overcome measurement obstacles, then it should be in a position to profile customer segments on the basis of its profitability. Segments that are barely profitable can be dropped in favor of more profitable units.

Constraints

- Analyzing many risks and aggregating them at the customer level may result in more workload for staff and more complicated analysis.

- Coming up with segments of customers on the basis of the net return per unit of risk can be quite difficult.

Management Incentives

Benefits

- Implementation of a robust economic capital model provides senior management with an opportunity to motivate staff by attaching performance sweeteners to implementation targets.

Constraints

- Evidence suggests that compensation schemes rank quite low among the actual uses of economic capital measures at the business unit level.

Best Practices for the Governance of an Economic Capital Framework

Controls and governance have a major impact on the success of an economic capital framework. Senior management has a duty to ensure that controls are put in place and used as intended and that there’s a well-established governance structure that covers the entire economic capital process. For economic capital to be effective, it should include the following:

- Strong controls for changing risk measurement.

- Sufficient documentation for all tools used to measure risk and allocate capital.

- Strong policies that serve to ensure that the established economic capital guidelines are observed.

- An outline of just how the established economic capital guidelines ought to be applied when making daily business decisions.

Best Governance Practices

- Senior management should be actively involved in the implementation of the economic capital framework.

- A bank may opt for a centralized economic capital function that’s responsible for implementing the economic capital framework. Alternatively, it can decentralize the process where each business unit manages its risk in accordance with the amount of capital allocated.

- A bank should measure economic capital and conduct assessment tests regularly – either monthly or quarterly.

- There should be formal policies and procedures governing ownership, development, validation, and application of economic capital models.

Key Concerns for the Governance of an Economic Capital Framework

- Although most banks apply stress tests to individual risks, the practice is not widespread enough. In addition, there’s a need for integrated stress tests that allow a bank to assess the impact of various scenarios on economic capital.

- Economic capital should not be the sole determinant of the required capital. Shareholders’ needs and industrial norms and standards should also be considered.

- There’s no common definition of available capital across banks, either within a country or across countries. Many banks’ definition of available capital is Tier 1 capital or the capital definitions used by rating agencies.

- Without management buy-in, the implementation of an economic capital framework can be difficult.

- Economic capital model results need to be transparent and taken. This way, they will be useful to senior management in business decision-making and risk management.

Practice Question

Which of the following risk measure(s) is (are) NOT coherent because it (they) violate(s) the monotonicity axiom?

A. Value at risk.

B. Expected shortfall.

C. Standard deviation.

D. Both value at risk and standard deviation.

The correct answer is C.

Standard deviation is not coherent because it violates the monotonicity axiom.

Options A and D are incorrect. Value at Risk is incoherent because it fails to satisfy the subadditivity axiom.

Option B is incorrect. Expected Shortfall (ES) is a coherent risk measure, but it fails on elicitability, i.e., the ability of a risk measure to rank models’ performance based on a scoring function.