CFA® Level II Exam

CFA Study Materials and Question Bank offered by AnalystPrep

Trusted by Thousands of Candidates each year

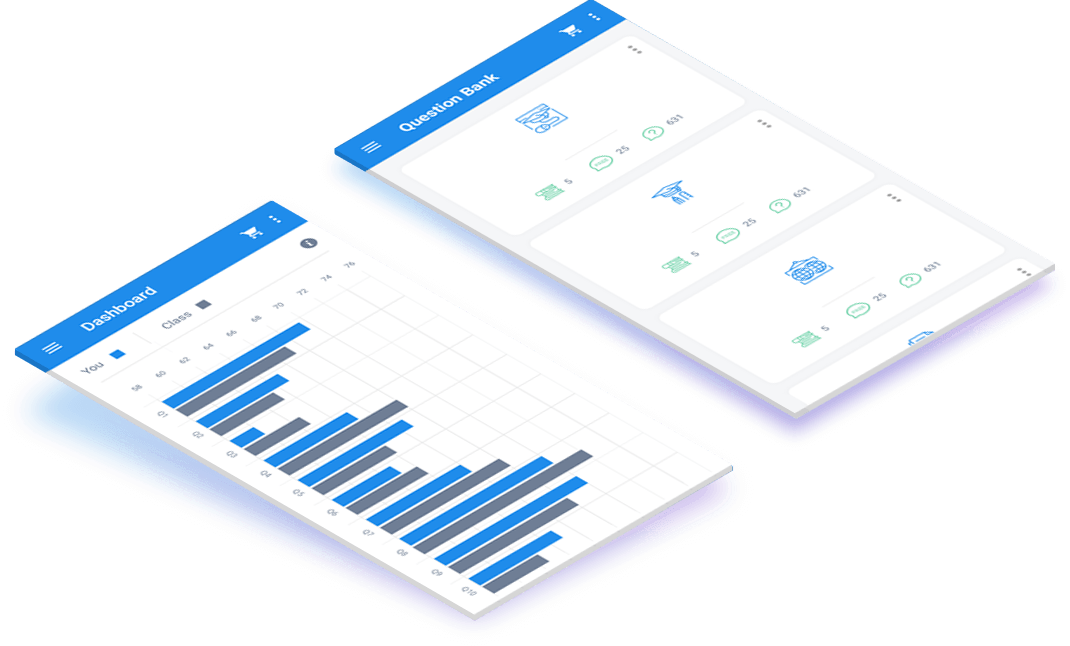

Our platform

Thousands of Candidates Have Passed with AnalystPrep’s Support!

At AnalystPrep, we’ve helped thousands of CFA candidates ace their CFA Level II exam, guiding them every step of the way. The Level II exam is the next big hurdle on your journey to earning the prestigious CFA designation. Whether you’re just starting your Level II prep or getting ready for the final stretch, we’ve got the resources to make sure you’re not just ready, but confident.

How is the CFA Level II Exam Different from Level I?

The CFA Level II exam shifts gears from Level I, where you mastered fundamental concepts. Here’s what sets them apart:

- Level I focuses on the basics—think of it as understanding the “what.”

- Level II: This is where the rubber meets the road! It tests your ability to apply concepts in real-world scenarios. You’ll dive deeper into investment management and portfolio strategies through real-life quantitative and qualitative case studies. It’s not just theory anymore—it’s about connecting the dots and using that knowledge practically.

Let’s say, in Level I, you learned about valuation models. In Level II, you’ll apply those models to evaluate portfolios, assess risks, and make investment decisions under different market conditions.

Pro Tip: Since the CFA Level II exam is all about application, make sure you’re practicing with vignette-style questions that mimic the real exam format.

Level II Exam Structure: What You Need to Know

The Level II CFA exam is structured around item sets (vignettes) with multiple-choice questions based on each vignette.

Here’s a breakdown:

- 88 item-set questions total, split evenly between morning and afternoon sessions.

- Each item set starts with a vignette (think of it as a mini case study) followed by 4 to 6 multiple-choice questions that dig into the details of the case.

Why is this important? The questions aren’t standalone, they require you to understand the vignette thoroughly, making it essential to practice time management during your prep.

Key Differences from Level I:

- Complexity: Level II is more focused on interdependencies between questions. You won’t get questions in isolation; instead, questions are connected to each vignette, often testing your understanding of multiple concepts within one case.

- Vignette format: This case-study approach means you need to master reading comprehension alongside financial theory—analyzing, digesting, and answering based on large chunks of data.

Pro Tip: Use CFA mock exams that simulate the vignette-style questions you’ll face on exam day. This will help you get comfortable with both the format and the pressure of applying theory to real-world scenarios.

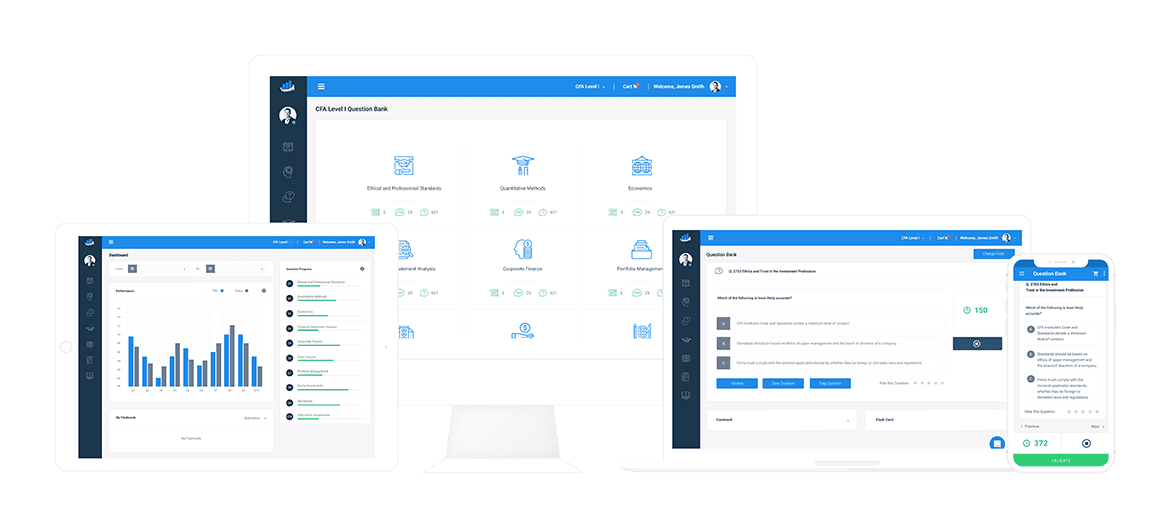

Why Choose AnalystPrep?

What sets AnalystPrep apart is not just our question banks and mock exams. It’s the way we help you understand the why behind each answer. We provide detailed explanations that allow you to learn from mistakes and fine-tune your understanding of each topic. Plus, we offer personalized feedback so you can track your progress against thousands of other candidates!

And, this is not us just tooting our horn. It’s what past candidates have said about us. Read this:

We walk with you every step of the way!

What Should You Expect from the Level II CFA Exam?

The curriculum is divided into 10 key topics, each of which plays a critical role in shaping your understanding of investment and portfolio management.

Here’s what you can expect:

| Topic | Exam Weight |

| Ethical and Professional Standards | 10 – 15% |

| Quantitative Methods | 5 – 10% |

| Economics | 5 – 10% |

| Financial Reporting and Analysis | 10 – 15% |

| Corporate Finance | 5 – 10% |

| Equity Valuation | 10 – 15% |

| Fixed Income | 10 – 25% |

| Derivatives | 5 – 10% |

| Alternative Investments | 5 – 10% |

| Portfolio Management | 5 – 15% |

Understanding Topic Weights

The topic weights listed above can fluctuate slightly from year to year, but the main takeaway is that Fixed Income, Equity Valuation, and Financial Reporting and Analysis are the heavyweights. These sections carry the most weight, so you’ll want to allocate more time to mastering these areas.

Example: If you’re studying Fixed Income, you might see questions about bond valuation, interest rate risk, or yield curves. In Portfolio Management, you could be asked to apply asset allocation strategies or evaluate portfolio performance in various market conditions.

Why Are Topic Weights Important?

- Efficient Study Planning: Knowing which topics carry more weight helps you plan your study time effectively. Spend more time on the high-weight topics like Fixed Income and Financial Reporting, while ensuring you have a solid understanding of lower-weighted topics like Economics and Corporate Finance.

- Real-World Application: Topics like Ethics and Portfolio Management may seem abstract, but in the CFA Level II exam, they’re presented in real-world scenarios. This could be an ethical dilemma faced by an investment manager or a decision about asset allocation for a client’s portfolio.

How to Tackle the Curriculum

- Start with Heavier Weights: Begin your prep with topics that carry higher weights like Fixed Income and Equity Valuation. This way, you’re addressing the most impactful material early on.

- Practice Vignette Questions: Since the exam focuses on vignette-style questions, practice is key. Use mock exams and question banks that mirror the vignette format to get comfortable analyzing large amounts of information quickly.

- Leverage Study Resources: At AnalystPrep, we offer CFA leve 2 notes, video lessons, and mock exams to help you master these critical areas. Plus, our personalized performance tracking ensures you know where to focus your efforts.

Pro Tip: Ethics is a deceptively tricky section, so don’t neglect it, even though the weight may seem lower. The Ethical and Professional Standards section can often be a deciding factor in whether you pass or fail, so make sure to review it thoroughly!

Item Set Format: Mastering Vignettes for CFA Level II

In the CFA Level 2 exam, all questions are presented in vignette (item set) format. This is what makes the exam so unique and challenging. Here’s what you need to know:

- Average Vignette Length: Each vignette is around 1.5 pages, but don’t be surprised if you encounter much longer vignettes, especially ones that include tables, financial statements, or charts. These longer vignettes demand even more attention to detail.

- Questions are Linked to the Vignette: Every multiple-choice question (typically 4-6 per vignette) is directly tied to the information in the vignette. This means you cannot answer the questions based on memory alone – you need to read and absorb the vignette carefully.

How to Approach Vignette-Style Questions:

- Skim the Questions First: Before diving into the vignette, quickly skim the accompanying questions to understand what kind of information you’ll need to focus on. This saves you time and helps guide your reading.

- Focus on Key Data: Financial statements, calculations, or comparative data tables are common in vignettes. Train yourself to pick out key figures and relevant details, especially when they relate to Equity Investments, Fixed Income, or Financial Reporting topics.

- Practice, Practice, Practice: The more vignette-style questions you practice, the better you’ll get at managing time and understanding what’s important. Make use of AnalystPrep’s mock exams and question banks to sharpen these skills.

Pro Tip: Don’t be Fooled by Length

Longer vignettes might look intimidating, but sometimes they contain irrelevant details designed to trip you up. Learn to distinguish between critical information and filler content by practicing regularly.

Where Should You Focus Your Attention?

The CFA Level II exam emphasizes certain topics more than others. Based on the topic area weights provided by CFA Institute, your key focus areas should be:

- Equity Investments: (10-15%)

- Fixed Income: (10-25%)

- Financial Reporting and Analysis: (10-15%)

Together, these topics make up 40-65% of your exam, meaning that a significant portion of your prep should be dedicated to mastering these areas. Here’s why:

- Equity Investments: This is all about valuation models and financial statement analysis. You’ll be expected to apply concepts like discounted cash flow models and price multiples.

- Fixed Income: Understanding interest rates, bond pricing, and credit analysis will be critical. Since Fixed Income has the potential to weigh up to 25%, this section can heavily influence your overall score.

- Financial Reporting and Analysis: This section involves analyzing financial statements in depth, so brushing up on financial ratios, accounting methods, and consolidation techniques will be vital.

AnalystPrep’s Question Bank Focuses on What Matters Most

Our CFA Level II question bank has been crafted by CFA charterholders who understand the nuances of the exam. With calculation-based questions and conceptual questions designed to test your application of knowledge, you’ll be well-prepared to tackle even the trickiest vignettes. Whether you’re reviewing mock exams or practicing vignette-style questions, the focus is on real-world scenarios that mimic the exam.

Pro Tip: Prioritize Based on Exam Weight

Since Equity, Fixed Income, and Financial Reporting account for a large chunk of the exam, prioritize these areas first. Then, circle back to other sections like Derivatives and Portfolio Management to round out your study.

Why is AnalystPrep Popular Among CFA Leve=l 2 Candidates?

Make no mistake—the Level II CFA exam is one of the toughest exams you’ll ever take. With pass rates typically between 45% and 50%, it’s clear that the exam demands dedication, smart study techniques, and the right resources. In fact, only 20% of candidates who begin the CFA program actually earn the charter. That’s why it’s crucial to use the best prep tools available, and that’s where AnalystPrep shines.

What Makes AnalystPrep Stand Out?

Here’s why thousands of candidates turn to us for their CFA Level II preparation:

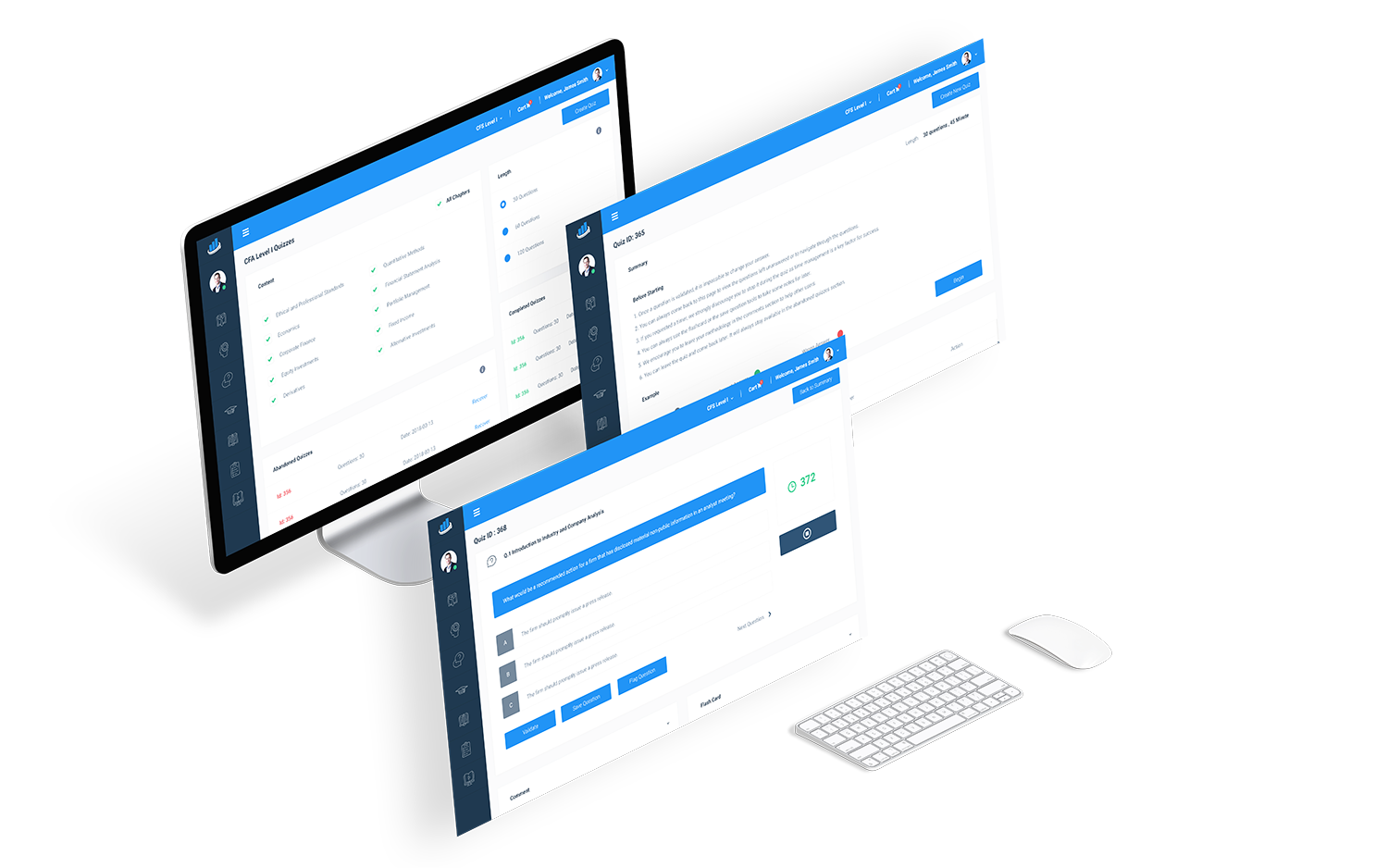

- Realistic Exam Simulations: Our mock exams are designed to closely mirror the real exam. We replicate the exact format and difficulty of the CFA Level II exam, so when you sit for the real thing, you’ll feel fully prepared, with no surprises. Think of it as taking the actual test before exam day!

- Expertly Crafted Question Bank: With hundreds of item sets, each created by CFA charterholders and instructors, our question bank focuses on helping you understand and retain critical concepts. You’ll not only learn how to answer questions but also gain insight into the logic behind the correct answers.

- Detailed Explanations for Every Question: We don’t just tell you the right answer. Every question comes with a detailed explanation so you know why it’s correct and how to improve your approach for next time. This kind of feedback is key to mastering the exam format and boosting your score.

- Performance Tracking and Analytics Stay on top of your progress with our advanced analytics dashboard. It tracks your results, highlights strengths and weaknesses, and even compares your performance with other CFA candidates. You can see exactly where you need to focus your efforts, ensuring that you’re studying smarter, not harder.

Curious to see what it’s like?

You can try out 10 free test item sets (that’s 60 practice questions) when you register for a free account. Plus, with our built-in analytics, you’ll be able to track your performance, monitor your strengths and weaknesses, and adjust your study strategy accordingly.

Success is in the Numbers

With thousands of candidates using AnalystPrep to prepare for CFA Level II, we’ve earned a reputation for delivering high-quality, effective, and affordable study solutions.

Don’t just take our word for it—ask around, and you’ll see why we’re one of the most trusted and cost-effective CFA prep providers.

Affordable Without Compromise

Quality prep materials shouldn’t break the bank. We offer affordable pricing that gives you access to all the tools you need to succeed without the high costs you might expect from other providers.

Pro Tip: Practice Makes Perfect!

Remember, there’s no magic formula for passing the CFA Level II exam. It takes consistent practice, effective study techniques, and using the right tools. With AnalystPrep, you’ll have everything you need to stay ahead of the game and increase your chances of success.

Questions Answered by our Users

Satisfied Customers

Cfa Preparation Platform By Review Websites

CFA® Level II Exam

AnalystPrep’s practice packages for CFA Level 2 exam start as low as $349 with 12-month access.

You can add video lessons and study notes for an extra $150. The content will be updated each year to reflect the changes in the curriculums.

Level II of the CFA Exam - Practice Package by AnalystPrep

$

349

/ year

- Question Bank (Item Sets)

- Mock Exams

- Performance Tracking Tools

Level II of the CFA Exam - Learn + Practice Package by AnalystPrep

$

499

/ lifetime

- Video Lessons

- Study Notes

- Question Bank (Item Sets)

- Mock Exams

- Performance Tracking Tools