Factor Theory

After completing this reading, you should be able to: Give examples of factors that... Read More

After completing this reading, you should be able to:

Model validation is defined as the set of processes and activities intended to verify that models are performing as expected, in line with their design objectives, and business uses.

According to the Basel Committee (2004), a rating model “comprises all of the methods, processes, controls, and data collection and IT systems that support the assessment of credit risk, the assignment of internal risk ratings, and the quantification of default and loss estimates.”

During the validation process, a bank has to verify whether the results generated by the rating system are reliable, taking the existing regulatory requirements and operational needs into account. A bank also periodically reviews validation instruments and methods to ensure that they remain appropriate because market variables and operating conditions are always evolving. According to the ‘proportionality principle’, the scope and depth of quantitative and qualitative validation should be commensurate with the overall complexity of a bank, the type of credit portfolios examined, and the level of market volatility.

Rating systems must undergo a validation process consisting of a set of formal activities, instruments, and procedures for assessing the accuracy of the estimates of all material risk components and the predictive power of the overall performance system.

According to Basel II regulation, “the institution shall have a regular cycle of model validation that includes monitoring of model performance and stability, review of model relationships, and testing of model outputs against outcomes.” (Basel Committee, 2004, §417).

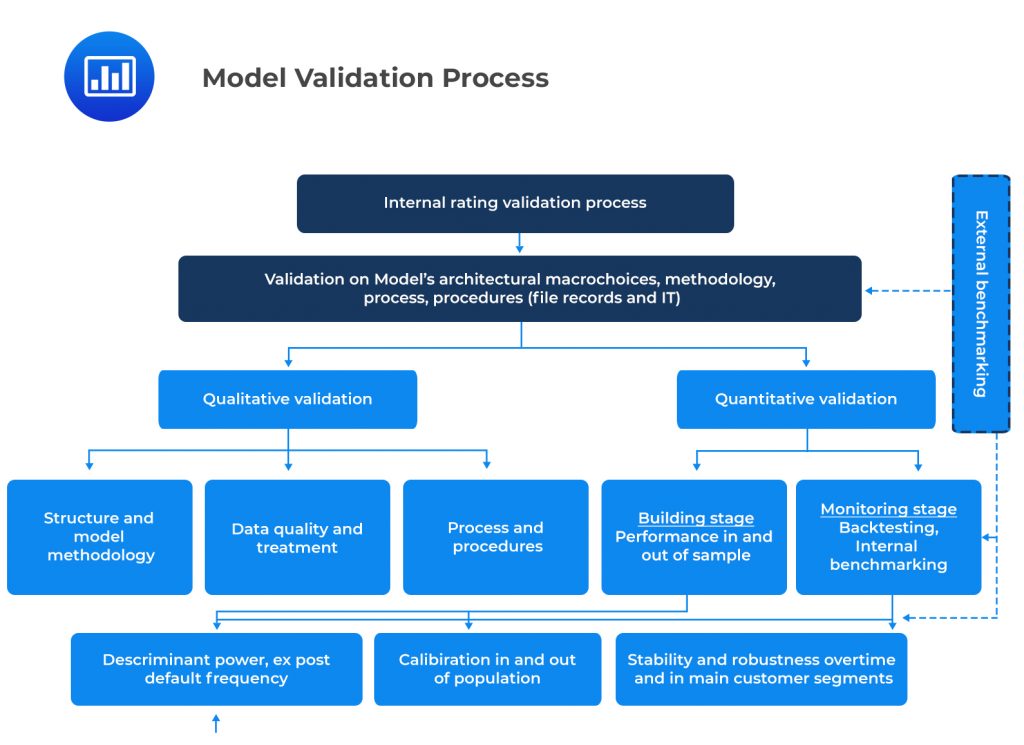

The validation process has both quantitative and qualitative elements.

Therefore, validation also requires the assessment of the model development process, with particular reference to the underlying logical structure and the methodological criteria supporting the risk parameter estimates.

The other important part of the validation involves verifying that the rating system is actually used (and how it is used) in the various areas of bank operations. This is known as the ‘use test’, also required by Basel II. The results of the validation process need to be adequately documented and periodically submitted to the internal control functions and the governing bodies. The reports shall specifically address any problem areas.

Best Practices

Best PracticesBasel II rules serve two main purposes:

Specific requirements are set for senior management and those who have roles in corporate governance and oversight:

‘All material aspects of the rating and estimation processes must be approved by the bank’s board of directors or a designated committee thereof and senior management. These parties must possess a general understanding of the bank’s risk rating system and detailed comprehension of its associated management reports. Senior management must provide notice to the board of directors or a designated committee thereof of material changes or exceptions from established policies that will materially impact the operations of the bank’s rating system’

‘Senior management also must have a good understanding of the rating system’s design and operation and must approve material differences between established procedure and actual practice. Management must also ensure, on an ongoing basis, that the rating system is operating properly. Management and staff in the credit control function must meet regularly to discuss the performance of the rating process, areas needing improvement, and the status of efforts to improve previously identified deficiencies.’

In line with these requirements, there are certain best practices that can be adopted by internal organizational units:

$$ \textbf{A summary of the Validation and Control Processes} $$

$$\small{\begin{array}{l|l|l|l|l} {} & \textbf{models} & \textbf{procedures} & \textbf{tools} & {\textbf{Management } \\ \textbf{decision}} \\ \hline { \text{Basic } \\ \text{controls} } & { \textbf{Task} \text{; model} \\ \text{ developing and} \\ \text{back testing} \\ \textbf{Owner} \text{; credit risk} \\ \text{ models development} \\ \text{unit} } & { {\textbf{Task; } \text{credit }\\ \text{ risk procedures} \\ \text{maintenance} } \\ {\textbf{Owner; } \text{lending } \\ \text{units/internal } \\ \text{control units}}} & {{\textbf{Task;} \\ \text{operations} \\ \text{maintenance} } \\ {\textbf{Owner; } \\ \text{lending } \\ \text{units/IT/internal} \\ \text{audit} }} & { { \textbf{Task;} \\ \text{lending} \\ \text{policy} \\ \text{applications} } \\ { \textbf{Owner;} \\ \text{central} \\ \text{and} \\ \text{decentralized} \\ \text{units/internal} \\ \text{control} \\ \text{units} } } \\ \hline {\text{Second } \\ \text{controls} \\ \text{ layer} } & { { \textbf{Task; } \\ \text{continuous} \\ \text{ test of} \\ \text{ models/processes/tools} \\ \text{performance} } \\ { \textbf{Owner;} \text{ lending} \\ \text{unit/internal audit} } } & {{ \textbf{Task;} \\ \text{lending} \\ \text{policy} \\ \text{suitability} } \\ { \textbf{Owner;} \\ \text{validation} \\ \text{unit/internal unit} }} & {} & {} \\ \hline { \text{Third} \\ \text{control layer} } & {} & \text{Risk management/CRO} & \text{Organisation/ COO} & { \text{Lending} \\ \text{unit/CLO/COO} } \\ \hline { \text{Accountability} \\ \text{for supervisory} \\ \text{purposes}} & { \text{Top } \\ \text{management/surveillance} \\ \text{board/board} \\ \text{of directors} } & {} & {} & {} \end{array}}$$

They are the two main areas of validation that basically complement each other: quantitative validation and qualitative validation.

The assumptions and evaluations that form the basis of the rating design must be transparent and the rating approach assessed.

The areas listed below have to be investigated:

The main requirements in qualitative validation are:

There are four main elements of qualitative validation:

A sample is said to be representative of a population when its characteristics match those of the population. Some loan portfolios (in certain industries or business sectors) are characterized by very few defaults. Since risks of these ‘low-default portfolios’ have to be assessed in any case, it is important to develop and validate rating systems

Discriminatory Power is the ability of a rating model to discriminate between defaulting and non-defaulting borrowers over the forecasting horizon.

A rating model’s dynamic properties usually refer to its rating stability and migration matrices. In practice, rating stability can be assessed by observing migration matrices, which can be built once a rating system has been operational for, at least, two years.

What are some of the desirable properties of annual migration matrices?

$$ \textbf{Example of an Annual Migration Matrice Consistent With the Desirable Properties Listed Above} $$

$$\begin{array}{l|cccccccc}

& & & &\textbf{Rating at year end} & & & & \\ \hline

\textbf{Initial Rating} & \textbf{AAA} & \textbf{AA} & \textbf{A} & \textbf{BBB} & \textbf{BB} & \textbf{B} & \textbf{CCC} & \textbf{Default} \\

\textbf{AAA} & 90.81\% & 8.33\% & 0.68\% & 0.06\% & 0.12\% & 0.00\% & 0.00\% & 0.00\% \\

\textbf{AA} & 0.70\% & 90.65\% & 7.79\% & 0.64\% & 0.06\% & 0.14\% & 0.02\% & 0.00\% \\

\textbf{A} & 0.09\% & 2.27\% & 91.05\% & 5.52\% & 0.74\% & 0.26\% & 0.01\% & 0.06\% \\

\textbf{BBB} & 0.02\% & 0.33\% & 5.65\% & 86.93\% & 5.30\% & 1.17\% & 0.12\% & 0.18\% \\

\textbf{BB} & 0.03\% & 0.14\% & 0.67\% & 7.73\% & 80.53\% & 8.84\% & 1.00\% & 1.06\% \\

\textbf{B} & 0.00\% & 0.11\% & 0.24\% & 0.43\% & 6.48\% & 83.46\% & 4.07\% & 5.20\% \\

\textbf{CCC} & 0.22\% & 0.00\% & 0.22\% & 1.30\% & 2.38\% & 11.24\% & 64.86\% & 19.795

\end{array}$$

If the migration matrix is stable, the indication is that the model is mainly centered on the counterparty’s fundamentals (less sensitive to credit cycles and to transitory circumstances). Therefore, the rating system is considered to be forward-looking.

Validating calibration is the process of analyzing differences between forecasted probabilities of default (PDs) and realized default rates. Basel guidelines allow financial institutions to validate calibration using a number of tests, including the binomial test, Chi-square test (or Hosmer-Lemeshow), normal test, and traffic lights approach.

A comprehensive dataset is an essential prerequisite for quantitative validation. Good data give outstanding model results, but poor data quality can be problematic, particularly when dealing with advanced models.

In this context, a number of qualitative aspects have to be considered:

To validate a model’s data quality, the validation unit has to focus on two critical aspects:

Lending technology can be defined as the rules and regulations used in credit origination and monitoring. It encompasses all the tools used to make lending decisions. In modern banking, banks have developed algorithms and other IT tools that help analyze borrower information fast and can even be programmed to reach a decision by themselves. Validation would be less of a problem if lending technology remained stable for a prolonged period, but in practice, this is almost impossible. Lending technologies rarely remain stable for more than a few years. The world of tech changes constantly, and so do the tools used in credit analysis.

If a model is not re-calibrated after a change in lending technology, the model continues to apply old criteria to new states of business.

If the observed in-sample default rate diverges from the total population, then calibration should reflect this divergence because the sample’s central tendency would be different from the population’s central tendency.

As mentioned earlier, validating calibration is the process of analyzing differences between forecasted PDs and realized default rates.

Basel guidelines allow financial institutions to validate calibration using a number of tests, including:

The discriminatory power of a model is assessed ex-post using data on defaulted and non-defaulted cases (backtesting).

Validating discriminatory power can be done using any of the following methods as outlined by the Basel Committee (2005a):

Practice Question

In the qualitative validation process, a rating approach’s general suitability for specific rating segments needs to be assessed. The following are areas that should be investigated. Which of the areas given below is NOT among the ones that should necessarily be addressed?

A. The model development processes and methodologies’ consistencies.

B. Adequate calibration of the model output to default probabilities.

C. Sample representativeness of the population referred to at the estimation time and in subsequent periods.

D. The rating process’ analytical description, with a description of the key personnel’s duties and responsibilities.

The correct answer is C.

In the qualitative validation process, it is a must for options \(A\), \(B\), and \(D\) to be investigated as far as the rating systems design is concerned. However, it is not necessary to investigate the sample representativeness of the population referred to at the time of estimation and in subsequent periods.