Futures Markets

After completing this reading, you should be able to: Define and describe the... Read More

After completing this reading, you should be able to:

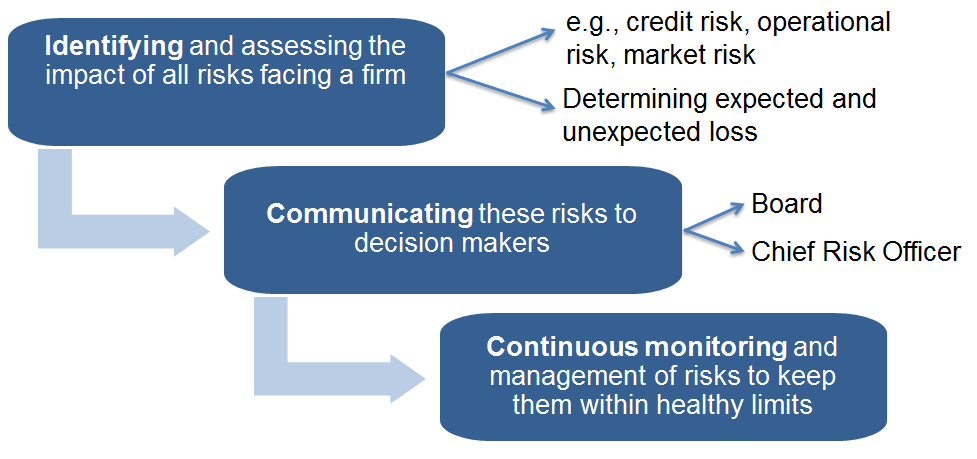

Risk management entails three key steps:

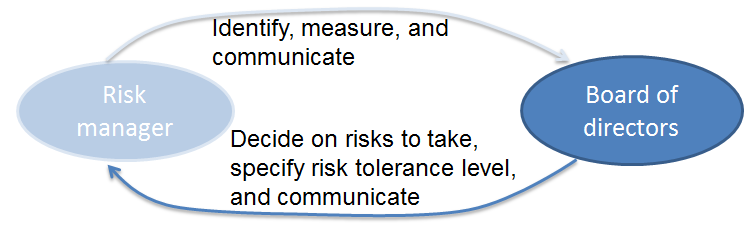

To manage risks, firms work with the output of a given risk measurement tool such as duration, beta, and the value at risk (VaR). Once the firm has established the possible loss amounts, it has to ensure that all its activities take into account the target risk amount. If the risk taken is less than the amount considered safe, the firm should take a bit more risk to maximize shareholder value. If the amount of risk taken exceeds the sale levels, the firm should cut back and reduce its exposure.

To manage risks, firms work with the output of a given risk measurement tool such as duration, beta, and the value at risk (VaR). Once the firm has established the possible loss amounts, it has to ensure that all its activities take into account the target risk amount. If the risk taken is less than the amount considered safe, the firm should take a bit more risk to maximize shareholder value. If the amount of risk taken exceeds the sale levels, the firm should cut back and reduce its exposure.

A large loss is not always indicative of risk management failure. As long as a firm assesses the risks it faces and develops risk management policies that guide all its operations, the risk management function is considered effective.

In other words, the purpose of risk management is not to reduce losses to zero. Rather, the goal is to establish a loss appetite and keep loss levels at non-threatening amounts which the firm can comfortably withstand. However, firms are also expected to develop contingency plans for extra-large losses that have the potential to threaten a firm’s very existence as a going concern.

Several events could constitute a risk management failure. These include the inability to:

It is imperative to understand the correct distribution of returns. Only then can loss estimates be considered reliable.

Failure to recognize risks can be expanded further to include:

Risk metrics provide managers with a target to achieve. VaR is the most widely used risk metric. For example, the management could strive to keep the 99% VaR at, say, $100 million. Monitoring the VaR allows managers to manage risk appropriately.

However, VaR has several shortcomings: