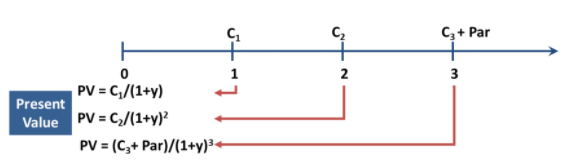

Bond Valuation (Calculations for CFA® and FRM® Exams)

Bond valuation is an application of discounted cash flow analysis. The general approach to bond valuation is to utilize a series of spot rates to reflect the timing of future cash flows. Value, Price, and TVM Value can be described as…

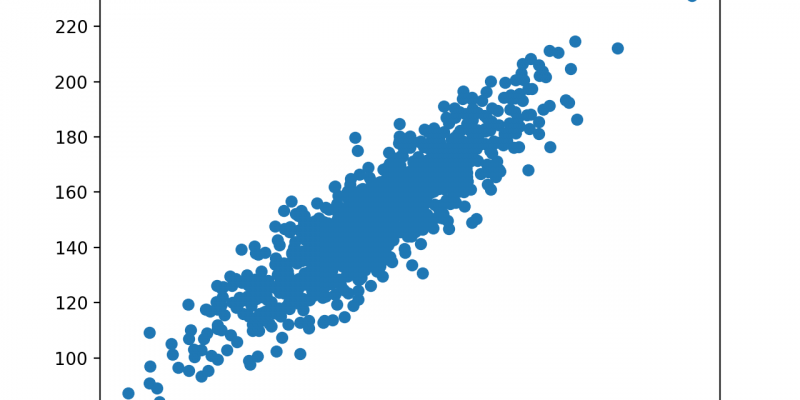

Covariance and Correlation (Calculations for CFA® and FRM® Exams)

The covariance is a measure of the degree of co-movement between two random variables. For instance, we could be interested in the degree of co-movement between the variables X and Y, where we can let: The general formula used to…

How LinkedIn Can Help a CFA® Program Student for Career Growth

Studying to become a Certified Financial Analyst isn’t a cakewalk by any standards. It requires years of extra effort to learn various accounting processes, laws and regulations, complex calculations, and more. However, all the efforts and resources you invest in…

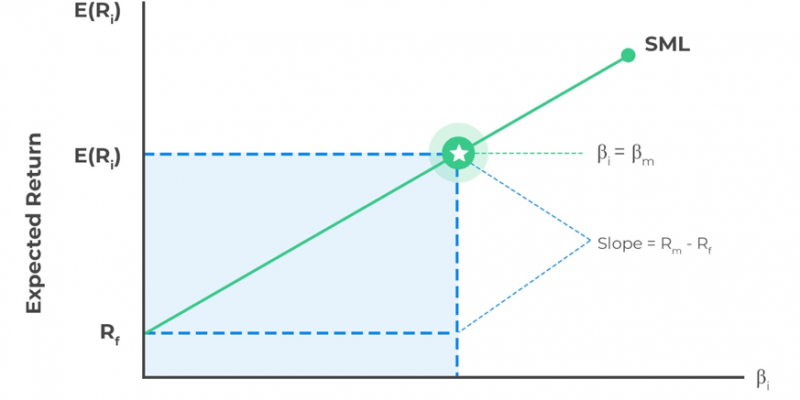

Sharpe Ratio, Treynor Ratio and Jensen’s Alpha (Calculations for CFA® and FRM® Exams)

Portfolio Performance Measures Portfolio management involves a trade-off between risk and return. Most amateur investors mistakenly focus only on the return aspect and lose sight of the risk taken to achieve the return. The portfolio performance measures are intended as…

Spot Rate vs. Forward Rates (Calculations for CFA® and FRM® Exams)

Understanding how to calculate forward rates from spot rates is a must for CFA and FRM candidates. This guide breaks down the forward rate formula step by step, showing you exactly how it appears on the exams. With simple examples…

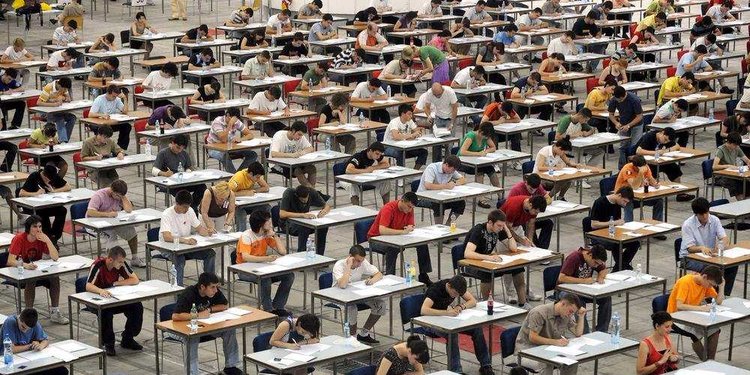

Level I CFA® Exam: 7 Best Tips to Help You Pass

Level I of the CFA exam is the first step towards receiving your CFA designation. In the level I exam, you’ll be tested in 10 topic areas. The combination of a variety of topics, along with exam anxiety, is the…

Corporate Finance – Level I CFA® Program Essential Review Summary offered by AnaystPrep

Reading 31 – Introduction to Corporate Governance and ESG Considerations Corporate Governance is the managerial system by which a company is controlled. There are two primary theories that drive corporate governance structures, though they have been converging more closely together…

How to Study and Pass the CFA® Exam on your First Attempt

CFA exams are written twice annually in June and in December. It is, however, disheartening to know that the failure rate recorded in this exam is very high. According to results released, the failure rate at the June 2015 Level…

What is a Question Bank and How Should CFA® Program Candidates Use It?

A question bank is a collection of exam-style questions used by thousands of students to adequately prepare for the exam. They are designed to reflect the current CFA exam curriculum, exam standards and by extension, the examiners’ approach. The questions…

CFA®, FRM® and SOA Exams Postponed because of Coronavirus (COVID-19)

Following the coronavirus outbreak, various professional bodies have resulted in pushing forward the exam dates of various professional examinations. CFA® Exam The Chartered Financial Analyst Institute has postponed the June CFA® exam globally as according to an email received by CFA®…