After completing this reading, you should be able to:

- Define, compare, and contrast VaR and tracking error as risk measures.

- Describe risk planning, including its objectives, effects, and the participants in its development.

- Describe risk budgeting and the role of quantitative methods in risk budgeting.

- Describe risk monitoring and its role in an internal control environment.

- Describe the objectives and actions of a risk management unit in an investment management firm.

- Describe how risk monitoring can confirm that investment activities are consistent with expectations.

- Describe Liquidity Duration Statistics and how it can be used to measure liquidity.

- Describe the use of Alpha, benchmark, and peer group as inputs in performance measurement tools.

- Describe the objectives of performance measurement.

VaR vs. Tracking Error

Value-at-Risk (VaR)

VaR is the maximum dollar-earnings potential associated with a given level of statistical confidence over a given period. In other words, VaR represents the maximum possible loss on a portfolio over a specified period in the future with a given degree of confidence. So, for example, a 95% five-day VaR is the maximum loss on a portfolio over five days with 95% confidence, i.e., there is a 5% probability of a greater loss.

VaR is expressed as dollar value-at-risk by finding the product of VaR and the assets under consideration. Therefore, for a specified duration and level of confidence, the capital owners can approximate the effect of the losses that are likely to occur. They can also spread capital among the asset classes to attain their expected levels of dollar VaR.

Tracking Error

Tracking error, also known as active risk or tracking risk, is the standard deviation of the active return. Active return is calculated as the difference between the portfolio return and the return on the benchmark. If the difference is normally distributed, 67% of all outcomes will be within the benchmark’s returns plus or minus a unit standard deviation.

$$ \text{Active return}={ \text{R} }_{ \text{P} }-{ \text{R} }_{ \text{B} } $$

Where:

\({ \text{R} }_{ \text{P} }\) is the portfolio return.

\({ \text{R} }_{ \text{B} }\) is the benchmark return.

$$ \text{Tracking error} = \sqrt {{ \text{R} }_{ \text{P} }-{ \text{R} }_{ \text{B} }}= \sqrt{ \text{Active return} } $$

Both VaR and Tracking Error are risk measures. Moreover, both measures may assume a normal distribution of returns. VaR is measured for shorter periods. On the other hand, tracking error is measured in terms of monthly returns.

While VaR is usually measured as a dollar amount of loss that can occur with a given probability, tracking error is measured in percent relative to the benchmark. However, “tracking VaR can be calculated,” which is also measured relative to the benchmark. Tracking VaR is usually expressed in terms of return, rather than an absolute amount of money the portfolio may lose.

Therefore, the tracking error can be seen as a special case of tracking VaR, where the confidence level and holding period are fixed.

Risk Planning

Risk planning is one of the three pillars of risk management. The other risk management pillars include risk budgeting and risk monitoring. Each of them is responsible for the overall achievement of an organization.

Objectives of Risk Planning

While the strategic plan of an organization gives the targets for earnings among other aspirations of that particular organization, a risk plan is a framework designed to control the impacts of risky events. A risk plan must be treated as a distinct section of the strategic plan and should be scrutinized like any other section of the plan.

The following are the five risk planning objectives that any entity should consider.

- Setting the expected return and volatility goals: An organization’s risk plan may entail setting acceptable levels of tracking error and VaR. Moreover, it should employ scenario analysis to find out the possible causes of business failure.

- Defining points of success or failure: A firm can define these points by setting acceptable levels of performance measures such as return on equity (ROE). Risk capital is determined using VaR measures to serve document planning purposes. However, there must be distinct VaR measures for each time range because organizations report and also budget over different time intervals. Measuring the risk capital associated with each activity helps management to understand the uncertainty levels associated with each activity in the plan.

- Portraying how risk capital should be utilized to meet the organization’s goals: A risk plan should generalize the minimum acceptable return on risk capital (RORC) for every allocation; thus, ensuring that the minimum standards for every activity in the organization are met. The plan must also consider the correlation between the RORCs and must have a diversification policy to distribute the organization’s risk capital.

- Differentiating between events that cause ordinary damage and those that cause severe damage: The risk plan should highlight the types of losses that are so severe that require insurance coverage for downside risks, for example, fire insurance. Moreover, some losses endanger the long-term viability of an organization, regardless of their frequency and probability of occurrence. For example, in the event of substantial stock market losses, firms with large equity holdings can incur significant losses. In such a case, the risk plan should include financial insurance. Additionally, self-insurance for downside portfolio risk has to be considered from a cost-benefit perspective, accounting for the severity of losses.

- Identifying critical dependencies within and outside the organization: The risk plan should explore the behavior of key dependencies in good and bad environments.

Effects of Risk Planning

The effect of risk planning include:

- Companies can identify potential risks that are likely to occur: When a company is aware of the underlying potential risks, it becomes easier for its managers to develop a plan for lessening or avoiding the impact. Moreover, they can analyze the risks and make logical decisions regarding how to deal with them.

- A risk plan holds the company’s standards and reputation high: A risk plan creates a good image for the business. This is because the employees have confidence that they are working for a responsible company. Nevertheless, the customers are assured that they are trading with a responsible company.

- Managers can run projects smoothly: Project managers use a risk plan to operate smoothly and to communicate with the project sponsors, thus enabling them to set their expectations.

- The management can evaluate the entire project: Defining risk management processes for a company makes success more likely by minimizing and eliminating risks.

- Managers can maximize outputs and meet deadlines: A risk plan gives a clear statement on what should be done at any particular time. This enables managers to fulfill their objectives and meet their budgets. Moreover, an effective risk management strategy allows a company to maximize profits and minimize expenses on projects.

- Managers can plan for success: A risk plan makes this possible by establishing a list of internal and external risks, and estimates of their costs.

- A risk plan protects a company’s resources: It enables managers to focus their attention on projects that generate returns for the organization. It tells them what to prioritize, thus, saving the company’s time, finances, and even physical resources.

Participants of Risk Plan Development

- The project’s owner: It is the role of the owner to ensure that timely risk identification is made. A timely risk identification gives room for timely plans on how to manage and mitigate them.

- Suppliers of capital, management, and oversight boards: These parties describe the context for the allocation of risks and capital, as well as assist the organization in ensuring that such allocations reflect their strengths and weaknesses.

- Senior management: For effective risk planning, senior leadership must be actively involved. Senior management ensures that risk and return issues are addressed and understood by the other participants.

Risk Budgeting

A risk budget is designed to give form to the risk plan. After creating a risk plan, the budget must be brought in to provide a proper allocation of risk capital to help the organization meet its objectives. For the return on equity (ROE) and return on risk capital (RORC) to be acceptable, they must outstep their minimum levels.

When developing a risk plan, the organization should factor in the following guidelines:

- Establish the acceptable levels of RORC as well as ROE for distinct time intervals, based on the risk and the business plans.

- Determine the appropriate weights for each asset class by the use of a mean-variance optimization approach.

- Simulate portfolio performance based on the weights and for various periods. This is followed by sensitivity testing on the performance of the portfolio based on changes in return and covariance.

- Ensure suitable levels of risk at the individual asset class and the entire portfolio.

Role of Quantitative Methods in Risk Budgeting

Risk budgeting makes use of elements of mathematical modeling. Quantitative methods may be seen as not sufficiently reliable for use as risk control tools. This is because they are prone to failure in worst-case scenarios. However, budget variances occur consistently in financial and risk budgeting. Budget variances may be due to inefficiencies or completely unforeseen anomalies.

Quantitative methods in risk budgeting include:

- Multivariate statistical models: These are also referred to as regression analysis, and are derived from past data. They do not rely on subjective probability distributions. Although these models are desirable, they require a large database of projects which many owners may not be able to acquire.

- Event trees (Probability trees): These are often utilized in probabilistic risk assessment. Every event tree represents a particular occurrence at the top and the conditions causing it. The method can be adapted for project costing and risk assessment.

- Sensitivity analysis: Sensitivity analysis is vital in quantitative risk analysis. It is used to establish the variables with the greatest influence on the risks in cases where probabilities for risk cannot be determined. This enables managers to allocate capital in a financial budget as desired.

- Stochastic simulation models: These include the Monte Carlo simulation. Their objective is to determine the empirical probability distributions based on subjective probability distributions. They are used to combine the risks from many risk factors hence determining the appropriate amount of contingency.

- Additive models: They involve the summation of cost elements to produce the total cost of the project. Therefore, the managers can determine the amount to be allocated to the project.

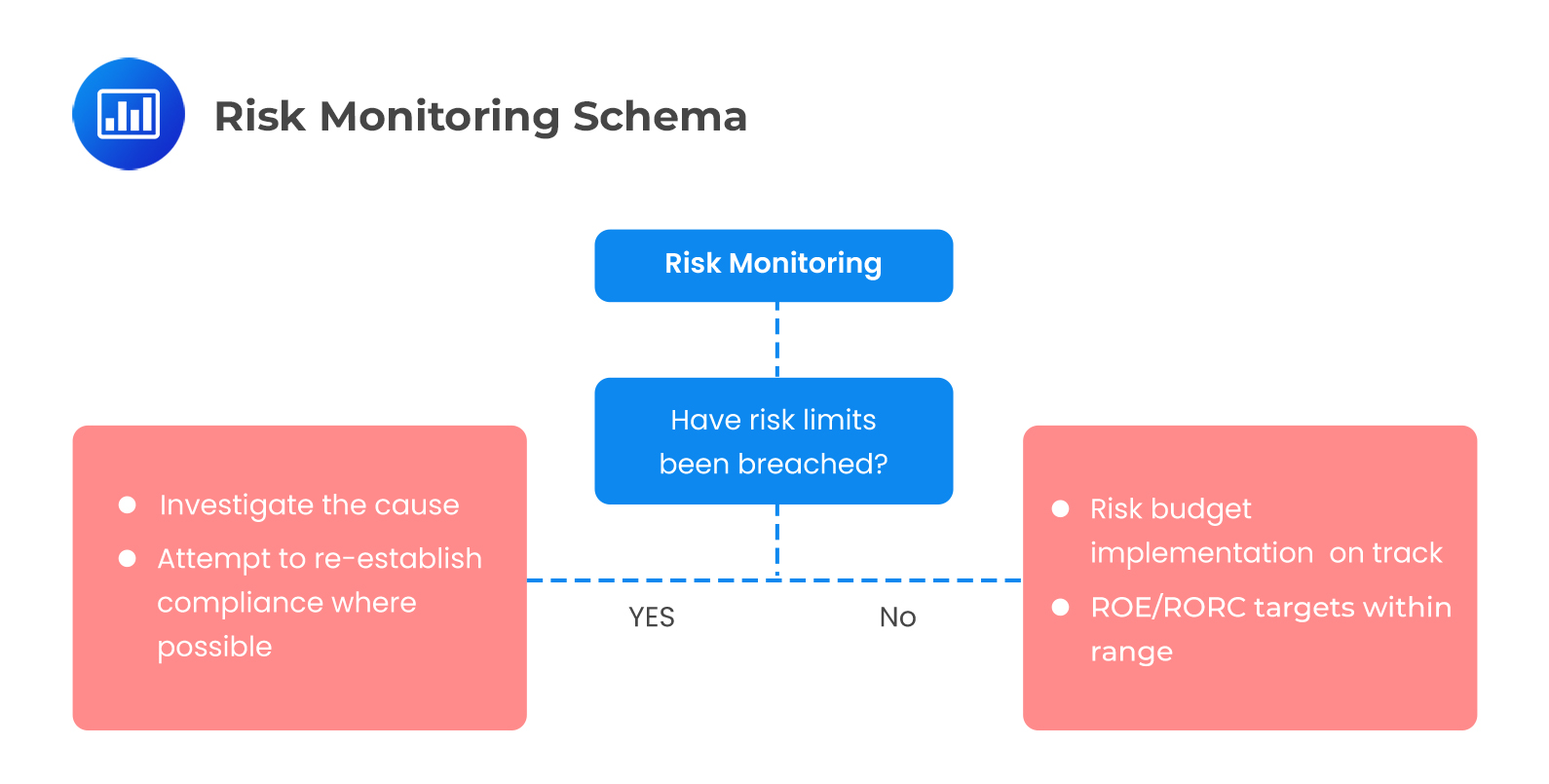

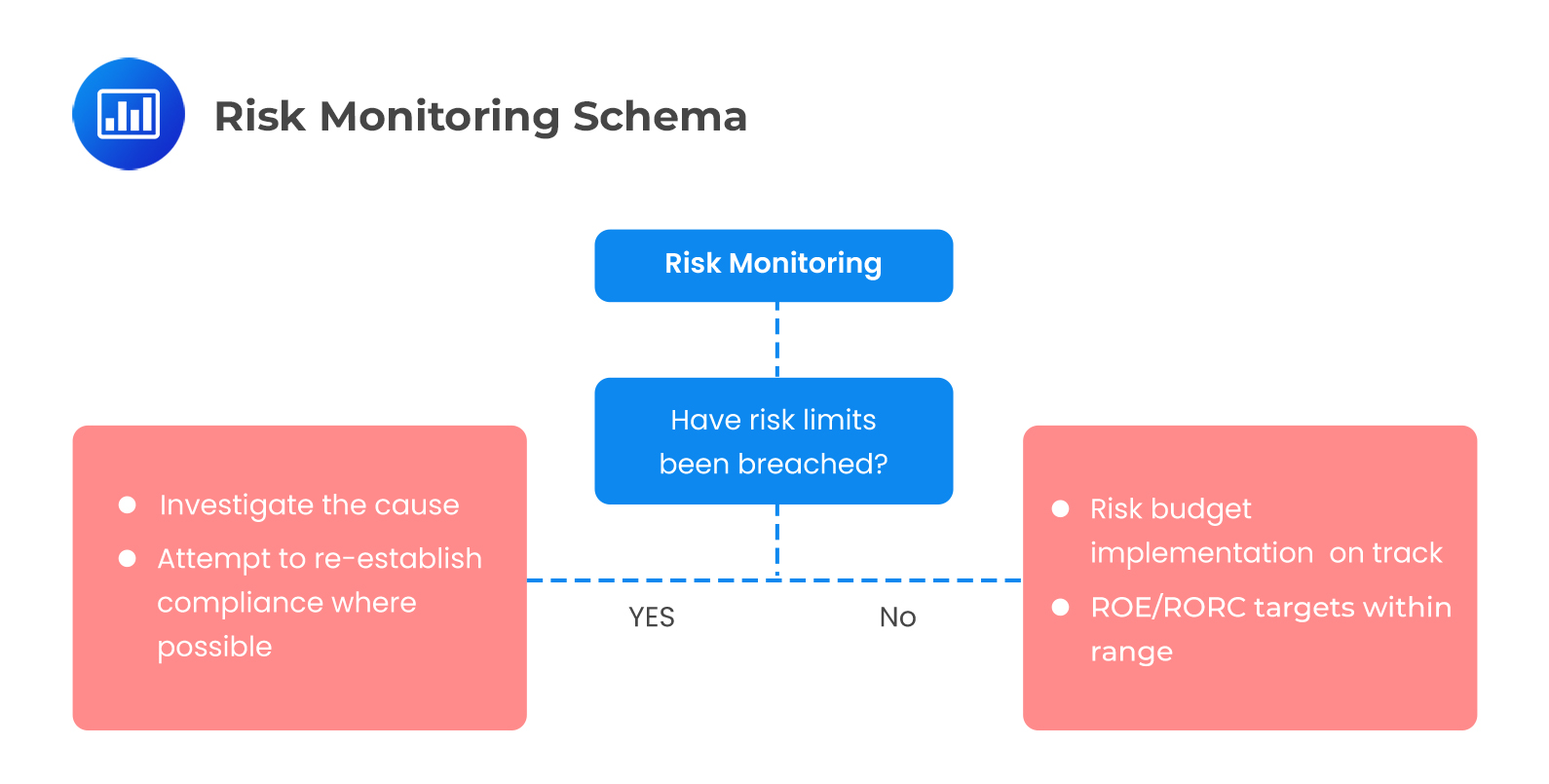

Risk Monitoring

Variance monitoring is the act of identifying unusual deviations from the expectation due to scarcity in revenue and expense dollars. Notably, variances from the risk budget hinder the ability of the investment to attain its ROE and RORC targets. Risk monitoring is important in detecting variations in the risk budget.

The Role of Risk Monitoring in the Internal Control Environment

The Role of Risk Monitoring in the Internal Control Environment

- To confirm that risk responses are implemented as planned: Variance monitoring helps to ascertain that remedies to risks are administered according to the risk plan strategies.

- To determine the effectiveness of risk responses: The timely identification of unusual behaviors in a process helps managers to tell whether the responses are effective or the need for other remedies.

- To establish the validity of the project assumptions: Regular inspection of the process enables the owners to find out the project assumptions that hold, and those which cause failures.

- To determine if risk exposure has changed: Approved change requests are important to check whether news risks have evolved, or the existing ones have declined due to changes in the project progressions.

- To confirm that policies and procedures happen as planned: Risk monitoring enables the management to find out if the policies and procedures are implemented as stated in the risk plan and whether they are consistent with the risk budget.

- To monitor risk triggers: It enables the management to identify the potential causes of the inherent risks so that they can make possible adjustments to control them.

Risk Consciousness

The awareness and knowledge of risks are broadening within and across organizations.

Sources of Risk Consciousness

- Lenders: Banks that offer loans to investors are concerned about where the borrowed funds are invested.

- Managers, investors, and clients have become more knowledgeable about risk management issues and thus are more aware of the need to oversee asset management activities effectively.

- Investors have become more knowledgeable about investment choices. Managers need to disclose how their products behave in adverse surroundings to boost the client’s confidence and minimize the underlying risks on return.

Afterward, several organizations formed independent risk management units (RMUs) to respond to the increased level of risk consciousness. The RMUs survey the risk exposures of portfolios and ensure the exposures are authorized and consistent with the risk budgets.

Objectives of a Risk Management Unit (RMU)

The objectives of the RMUs are as follows:

- Collection, monitoring, analyzing, and distributing data: The risk management units improve the understanding of risks and the mitigation models by distributing risk data to the organization’s managers, clients, and senior leaders.

- Developing a controllable process and structure to identify and address risk topics in the organization: RMU’s promote an organization’s risk culture and internal control environment by ensuring that best risk practices are adopted and implemented.

- Setting and implementation of risk plan and other related initiatives: RMUs help the organization develop a process and framework by which the components of risk are identified, addressed, and mitigated.

- Monitoring trends in risk: It is important to identify risk before it becomes severe. Therefore, the RMUs are helpful for monitoring changes in risk as they occur and give a timely identification of abnormal events.

- Enhancing discussions on matters relating to risk, including the unmeasurable aspects: RMUs are engaged in identifying events that are costly but have little returns, as well as the organization’s responses to such events. Precisely, they encourage the development of a platform where risk data and related issues are discussed.

- Identification, discussion, and presentation of risk topics across the organization and its clients: RMUs promote risk awareness as well as a common risk culture by identifying risk components, addressing them through discussions, and later presenting them to the relevant parties.

- Ensuring that transactions are done according to the management’s and clients’ expectations: RMUs should estimate the portfolio’s potential based on the tracking error, and ensure that the risk profile is consistent with the targets of the organization.

- Enhancing risk and performance measurements: RMUs assist in the identification and development of risk measurement and performance attribution analytical tools. Moreover, they can examine the quality of the models employed for measuring risks either by back-testing or research.

- Evaluation of portfolio managers and market environment: The RMUs develop a set of risk data through quality and credible methodologies. The risk data are analyzed and passed to the appropriate decision-makers to give conclusions.

- Promoting transparency: The RMUs offer a better understanding of the inherent risks for both the senior management and individual portfolio management by creating risk reporting and performance rating systems.

- Measuring risks: RMUs measure risks whose outcomes are used by those interested in risk management.

In conclusion, RMUs are beneficial in measuring the degree to which asset managers trade based on product objectives, management’s expectations, and the clients’ mandate. In case an abnormal risk profile is identified, RMUs report it to the relevant authorities.

Actions of the Risk Management Unit

The internal control environment of an organization is considered effective if there is a timely, meaningful, and accurate flow of information between the senior management and the entire organization. A business is effective if it can minimize loss and maximize profit. Therefore, the risk management unit gives information on whether or not the investment activities meet their expectations.

The RMUs are also important for developing systems to report risk information to the senior management, or portfolio managers on whether investment activities are in line with the targets.

Consistency of Investment Activities

Is the forecasted level of tracking error generated by the manager in line with the target? Tracking error forecasts and tracking error budgets should be compared, and standards should be set to determine the magnitude of deviation from the target, which is considered unusual.

Is risk capital allocated to the expected areas? It is not enough to know that the overall expense is consistent with the target in financial variance monitoring. Instead, each line that forms the total cost must correspond to the expectation.

Using a similar principle to risk monitoring, managers should be able to specify both overall tracking error expectations and those of their constituents. As such, the manager will be at ease in telling whether the risk incurred is consistent with the target at constituent levels and the total. It is concluded that the manager is not investing in line with the philosophy if the risk constituents are not consistent with the expectations.

Historical simulation can be used to assess the behavior of a portfolio during periods of stress by comparing the current and past positions. However, this method is insufficient because the observed history limits examination to only one set of outcomes.

Monte Carlo’s approach can be used to examine multiple outcomes that are probabilistically implied by one set of outcomes. If the level of tracking error is large, to portfolio must be operated at a lower risk profile.

Liquidity Duration Statistic

The liquidity profile of the portfolio changes when exposed to adverse market environments. As such, the tools for evaluating portfolio liquidity become important for stress analysis.

The liquidity duration statistic is applied at Goldman Sachs Asset Management (GSAM) to examine the implications of liquidity.

Its Use in Measuring Liquidity

The statistic is computed by first approximating the average number of days required to liquidate a portfolio, i.e., the liquidity duration.

Assume that a risk manager does not wish to exceed 15% of the daily volume in any given security holding, the liquidity duration of security i is given by:

$$ \text{LD}_{ \text{i} }=\cfrac{ { \text{Q} }_{ \text{i} }} {\left(0.15 \times { \text{V} }_{ \text{i} } \right)} $$

Where:

\({ \text{LD} }_{ \text{i} }\) is the security duration statistic for asset i.

\({ \text{Q} }_{ \text{i} }\) is the number of shares held in security i.

\({ \text{V} }_{ \text{i} }\) is the daily volume of security i.

Moreover, we can estimate the portfolio’s overall liquidity duration by weighting the liquidity duration of each security by the weight of that security in the portfolio.

Example: Computing the Liquidity Duration Statistic

Calculate the liquidity duration for a given security, assuming that a risk manager does not wish to exceed 10% of the daily volume in that security, given that there are 10,000 shares held in that security and that the daily volume is 1,000 shares.

Solution

$$ \text{LD}=\cfrac{ \text{Q} } {0.10 \times { \text{V} } }= \cfrac {10,000}{0.10 \times1,000}=100 $$

Performance Measurement Tools

Performance measurement involves comparing the portfolio manager’s actual results with the benchmarks and peer groups. Performance measurement aims to determine whether a manager can consistently outperform the market (benchmark) on a risk-adjusted basis. Moreover, it establishes whether a manager consistently outperforms their peer group on a risk-adjusted basis.

Performance measurement is considered a form of risk validation in cases where the forecasts are relevant. When computing a risk-adjusted performance measure, the returns for the relevant period and the risk incurred to achieve the returns must be known.

The following are the major performance tools and techniques:

i. The Green Zone

The green zone is used at GSAM for identifying instances of performance tracking error that is beyond normal expectations. The elements embodying the green zone include:

- Calculating normalized returns of a portfolio for the prior week, month, and year. The portfolio’s standardized returns are given by the difference between excess returns over the period and budgeted excess returns over that period, divided by the target tracking error for the time.

- Calculating the ratio of annualized tracking error to targeted tracking error for the prior twenty and sixty-day periods.

- Forming the policy decisions for (a) and (b) above, to statistically tell whether the variation from the expectation falls in the zone of reasonableness (green zone).

- Summarizing the results of the green zone analysis in a green sheet document.

ii. Attribution of Returns

Performance attribution is the most popular tool for measuring the quality of returns. Variance analysis is a form of attribution that shows how each security has contributed to the portfolio’s overall performance. This analysis is used by RMU professionals to determine whether the portfolio was going to get returns from the securities. The attribution process takes the weightings in risk factors periodically and accumulates the returns to those factors to produce a variance analysis expressed in factor terms.

Therefore, factor risk analysis and factor attribution have a meaning for managers who think in the risk factor space. Risk forecasting and attribution will be meaningful for those who think about risk based on individual securities.

iii. The Sharpe and Information Ratios

The Sharpe and information ratios are designed to provide estimates of risk-adjusted returns, where the Sharpe ratio is the proportion of returns of a portfolio above the risk-free rate relative to the portfolio deviation. On the other hand, the information ratio is the proportion of the portfolio’s excess returns relative to the portfolio’s tracking error.

Strengths of the Sharpe and Information Ratios

- They measure performance when there is competition. They do this by identifying managers who produce superior risk-adjusted excess returns among the peer group involved.

- They can be used to tell whether a manager has adequate extra returns to indemnify the assumed risk.

- They can be used at the portfolio level as well as the individual sectors to identify the managers with excess risk-adjusted performances in a particular sector.

Weaknesses

- They may require data that are not available for both the manager and his/her opponents.

- When the Sharpe and information ratios are calculated based on the realized risk as opposed to the potential risk, their relevance will depend on the environment’s friendliness to the manager.

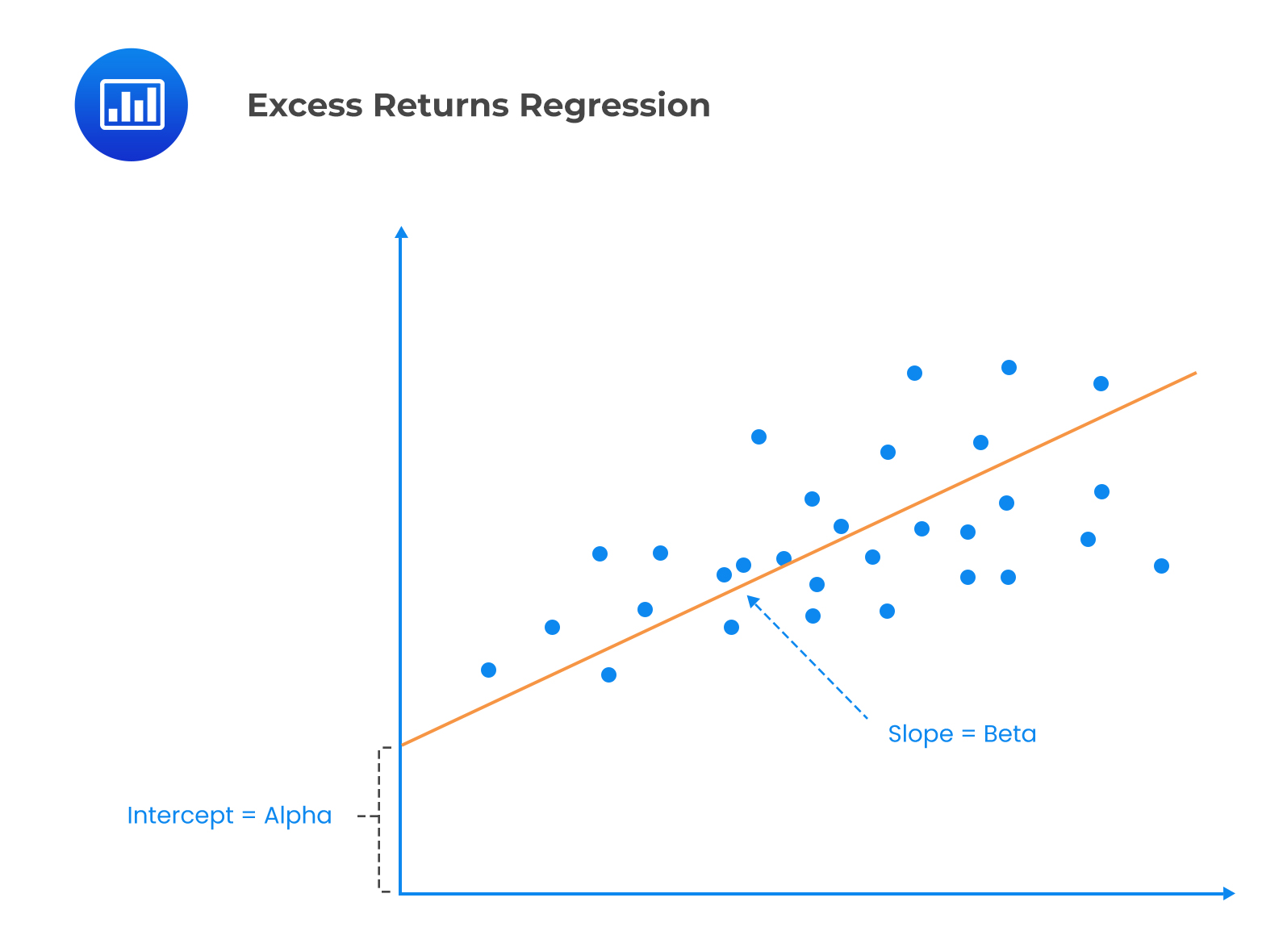

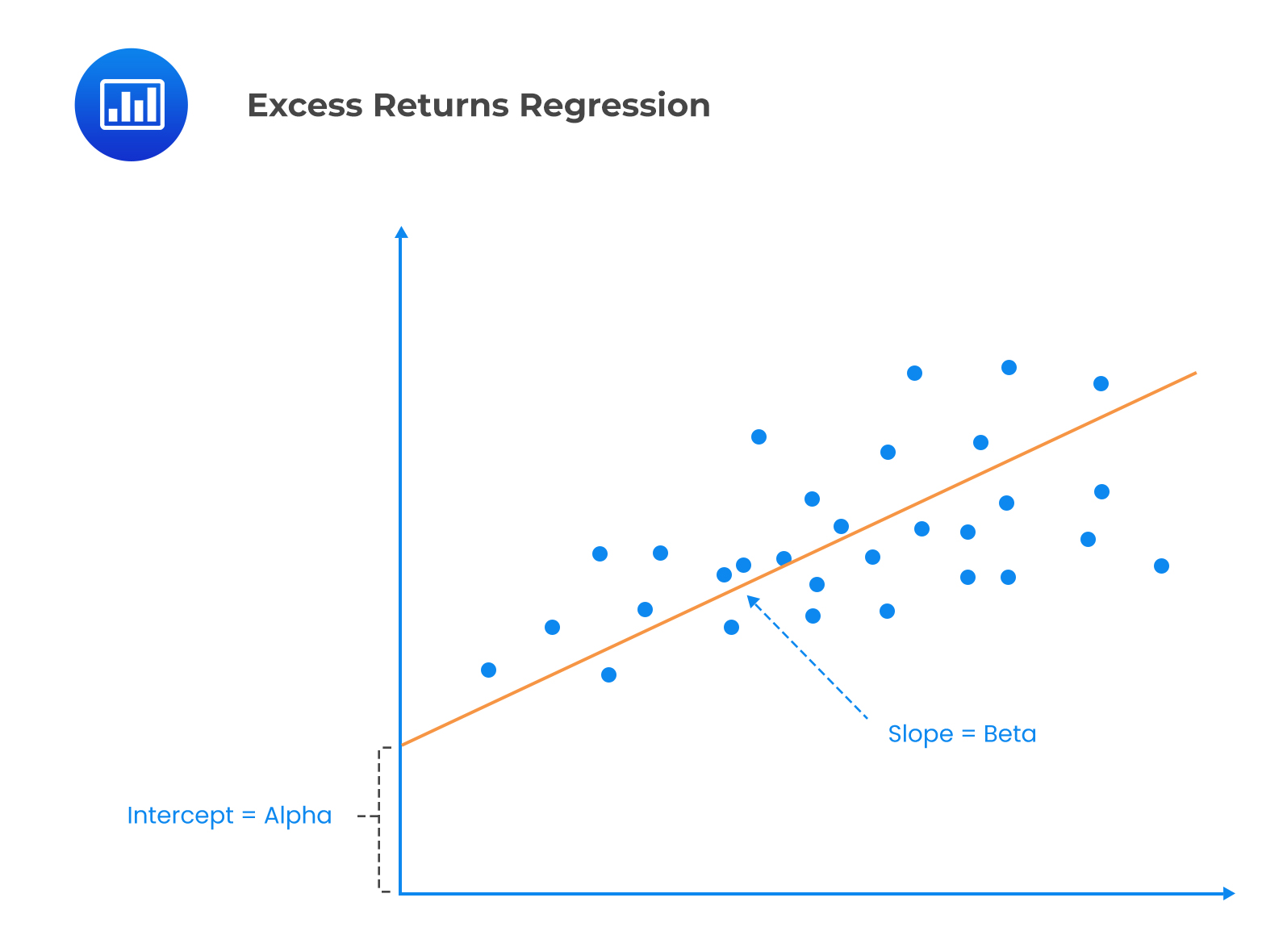

iv. Alpha versus the Benchmark

Here, the fund’s excess returns are regressed against the benchmark’s excess returns. The results of the regression include Alpha, which is an intercept, also known as skill, and Beta, which is a slope coefficient against the benchmark’s excess returns. The statistical significance of the alpha term can be tested to check whether it is positive and statistically different from zero.

Strengths

Strengths

- It gives room for opinions from the management on whether there is a skill or the excess returns occurred by chance by checking if the manager has excess returns over the benchmark.

- The managers can differentiate extra returns due to leverage from excess returns due to skill.

- Alpha, Beta, and tests of significance can be easily obtained in calculations.

- iv. The beta statistic shows if elements of the manager’s returns are derived from being underweight or overweight, the market, that is, if the Beta is not equal to 1.

Weakness

- The insufficiency of data points to make conclusions about the statistical significance of Alpha is the limitation of this tool.

v. Alpha versus the Peer Group

This tool is used to find out if the manager shows skill over what is in the peer group. Here, the manager’s excess returns are regressed against the excess returns of the manager’s peer group.

A peer group is the manager’s opponent in his strategy, and the peer group’s return is the capital-weighted average return of all managers trading similar strategies.

The outputs of the regression of this tool include Alpha and Beta. Alpha is the intercept, also known as skill. It represents the manager’s excess returns against the peer group. On the other hand, Beta is the slope coefficient against the excess returns of the peer group. It measures the degree to which a manager uses greater or lesser amounts of leverage, compared to his peer groups.

Strengths

- It gives room for opinions from the management on whether there is the skill or the excess returns occurred by chance, by testing if the manager has excess returns over the peer group.

- Managers can differentiate excess returns due to leverage from excess returns due to skill.

- The Alpha, Beta, and significance tests are easily obtained in calculations.

Weaknesses

- Insufficiency of data points to conclude the statistical significance of Alpha and Beta.

- Peer group returns may be biased

- There exists a wide divergence in the amount of money under management among peers.

Objectives of Performance Measurement

As highlighted in the previous section, the objectives of performance measurement include:

- To investigate the consistency of excess risk-adjusted performance generated by a manager given a benchmark.

- To establish the superiority of risk-adjusted performance generated by a manager given the peer group.

- To determine the sufficiency of the returns to compensate for the assumed risk in terms of cost.

- To identify the managers who generate high-quality excess risk-adjusted returns.

Practice Question

At Stellar Asset Management, a firm that recently expanded its operations globally, the senior risk management team is in the process of revising its risk management framework. They aim to align it more closely with the challenges and intricacies of the international market. As part of this process, they’re revisiting the foundational pillars: risk planning, risk allocation, and risk oversight. During their meeting, they emphasize the importance of creating a detailed and comprehensive risk plan.

Given the scenario above, which of the following statements accurately reflects best practices in risk management?

A. Within a risk plan, integrating qualitative scenario analyses can effectively highlight potential weak points that might undermine its successful execution.

B. Although a risk plan can outline volatility objectives, it shouldn’t weave in the ramifications of crucial organizational ties on these objectives.

C. Exceptional and infrequent events ought to be excluded from a risk plan and reserved exclusively for its overarching operational strategy.

D. A risk plan must precisely gauge return on equity by solely assessing the return on risk assets for each specific segment in isolation.

Solution

The correct answer is A.

Incorporating qualitative scenario analyses in a risk plan provides a robust framework to proactively detect and address potential vulnerabilities. These analyses serve to simulate a spectrum of scenarios, especially challenging ones, to understand their potential repercussions on the firm’s risk position, ensuring better preparedness.

B is incorrect. An effective risk plan not only sets forth volatility objectives but also takes into account the potential impact of vital organizational ties on these objectives. Recognizing and accounting for these relationships is fundamental to formulating a risk plan that is both holistic and aligned with the organizational ecosystem.

C is incorrect. Exceptional events, regardless of their frequency, are integral to a risk plan. Their inclusion ensures that the firm is equipped with strategies and contingency measures to navigate the challenges that such events can introduce, underscoring the proactive essence of risk management.

D is incorrect. When developing a risk plan, it’s pivotal to adopt an integrated view on risk allocations when determining return on equity. Analyzing each segment in isolation might overlook the intricacies and interdependencies between different risk assets, leading to a potentially skewed risk assessment.

Things to Remember

- Incorporating qualitative scenario analyses in a risk plan helps in proactively identifying and addressing potential vulnerabilities.

- Scenario analyses simulate diverse situations, enhancing preparedness by understanding potential impacts on a firm’s risk position.

- An effective risk plan should consider the influence of vital organizational ties on volatility objectives.

- Understanding and accounting for these relationships ensures a risk plan that’s comprehensive and in harmony with the organizational ecosystem.

The Role of Risk Monitoring in the Internal Control Environment

The Role of Risk Monitoring in the Internal Control Environment Strengths

Strengths