Basel II.5, Basel III, and Other Post- ...

In this chapter, we begin by discussing what Basel II.5 is all about.... Read More

After completing this reading, you should be able to:

Due diligence is the process of scrutinizing an investment before venturing into it. It focuses on the steps that an investor follows before entering an investment agreement. Due diligence is divided into four sections: investment process, risk management, operational environment, and business model assessment.

When performing due diligence, the investor must have a deep understanding of the investment strategy he/she selects. Moreover, he must understand the risk exposures to that strategy for him to exert energy on the ability of the manager to generate returns against potential competitors.

As part of the due diligence process, the investor must find out the previous failures of the fund as well as their solutions. Several funds fail due to:

Therefore, the investor must be keen when evaluating an investment. They should consider both successes and failures to evade some of the exposures.

The past and current due diligence processes have some contrasting sides. The vital aspects of the past due diligence process were the manager’s reputation and performance. The investors were considered lucky if they invested in a good fund; otherwise, they were unlucky. Moreover, managers were selective and would dismiss inquisitive investors.

On the other hand, as time evolved, many investment institutions came into the market. As the industry progressively developed, the accompanying frauds also increased.

Therefore, the current due diligence process consists of:

Manager evaluation is vital in finding out why and how a fund makes impressive performances or incurs losses. When assessing a manager, several questions flood the investor’s mind. The manager evaluation is organized in terms of the following.

The manager evaluation questions in this section provide information about the firm’s investment strategy and how it works. The commonly asked questions describe:

The problem under this section is to find out how the equity ownership is distributed to the portfolio management teams. The questions that arise include:

The reliability of the fund’s track record is also an important area of investigation. In this section, the commonly asked questions include:

This section seeks to ascertain the trustworthiness of the managers. In the case of established managers, it is easier to evaluate their signs of progress by using references. Their questions would include:

On the other hand, when dealing with new managers, it would be ambiguous since there are no existing references. It means that the investor will have to seek information from previous colleagues of the manager. Some of the questions for this category include:

Therefore, it is important to scrutinize the manager’s background. It is better to spend more and get a comprehensive report from the manager than to spend less and venture into a business that has had difficulties in the past.

The questions related to risk management must factor in the current due diligence process that involves evaluating the firm’s investment process and its operational and business model. The questions are categorized in terms of risk, security valuation, portfolio leverage and liquidity, investor’s exposure to tail risk, frequency of production of risk reports, and the relevance of the fund terms to the employed strategy, as discussed below.

Risk management is the process of identifying and responding to potential threats to a fund’s performance. Funds have incorporated risk management through the employment of risk managers and risk service providers to facilitate the reporting process.

Therefore, investors are obliged to investigate the inherent exposures within a strategy as well as the unique risks emerging from the manager’s side. The questions inquired here include:

Furthermore, investors must get a deeper understanding of the inputs and assumptions for risk modeling to avoid miscommunication.

When selecting a fund, the investor must pay attention to the valuation policies of a firm. The questions for this section comprise of:

Here, the investor analyzes the present and the past data in leverage to track changes, find out the sources of leverage as well as the portfolio’s liquidity. From these evaluations, the investor can locate the degree of illiquidity and leverage that can cause the strategy’s returns to diverge from the expectation.

It is worth noting that different strategies have different extents of liquidity and leverage. Therefore, the investor must adjust their expected returns from one plan to another.

To avoid exposure to unexpected risks, investors must analyze the fund’s data and check the normality. In case there is a tail risk, they should seek clarification from the manager on how the risk can be hedged.

The manager’s trustworthiness is enhanced by providing periodic reports to the investors, say, on a weekly, monthly, semi-annually, or yearly basis. The managers present regular reports which are inclusive of the major risk statistics to the investors.

Therefore, investors must ensure that they understand the information in those reports. Moreover, they should be able to compare the data and their findings with those of their peers.

Investors must find out if the terms of the fund are in line with the strategy. To do this, they can compare any fund to its peers to see if the terms make sense in terms of fees, and high-water mark, among other considerations for an investment. They should also inquire whether portfolio liquidity and the one presented to the investor match.

The fund’s operational environment comprises its internal procedures. It provides the issues that investors are likely to encounter when assessing the operating situation of the fund.

Moreover, operational due diligence ensures that there is no significant risk of loss to investors from the internal actions of the investment. Therefore, checking the adequacy of the internal control assessment, consistency of fund documents and disclosures, and the evaluation of the service providers must be performed by the investor.

Having a good plan is not enough. The fund must have qualified people and quality procedures. Therefore, investors must investigate both the qualifications of the employees and their ability to perform under any market condition. Some of the themes and questions in this area of focus include:

When performing operational due diligence, compliance is a vital part of observing. The investor must examine the various compliance practices, e.g., the restrictions related to employees, and the code of ethics, among others.

Furthermore, the investors must inspect and evaluate the written procedures of the fund as well as the documents outlining them.

Fund managers have a habit of making changes to documents without consulting the law firm that made them. Therefore, the investors must seek clarifications and affirmation from the law firm featured in the papers.

The investors must also check the consistency of the information disclosed; that is, the information in the various documents must be related. They must also review the terms involving fees, liquidity level, the notice period for redemptions, and the manager’s ability to stop redemptions.

Furthermore, investors must be keen on disclosures. Some managers can make insufficient disclosures, while others can make too many irrelevant risk disclosures. They should also pay attention to registration and compliance language.

After the investor’s discussion with the manager, it is important to review the document to ensure that whatever the manager disclosed is in line with what is documented. They should also check the managers’ authority over the fund in terms of risk exposures, restrictions on leverage, manager’s indemnification, and the extent of their power to amend the fund’s documents.

Another important consideration for investors is the financial statements of the fund. The investor needs to evaluate the income statements and the balance sheets of the previous fiscal years to ascertain their meaningfulness to the strategy. The leverage and the sizes of losses must be compared for past years to be able to gauge the fund’s abilities.

It is also necessary for investors to observe the changes in capital accounts of those who run the fund. They can seek clarification from either the manager or the auditor. They must also check the frequency of equity withdrawals.

The investors must access all the services provided by the fund. The present-day investors can interview service providers to find out their roles in the various sectors of the fund. To ensure that the fund’s service providers are periodically checked, the investors can obtain internal control letters as well as audited financial statements.

Unlike in the past, the success of many investments has been compromised by various obstructions in the process. No single investor wishes to pursue a failing venture. Therefore, liquidation rather than closure is necessary for a failing fund. Most successful managers take the business model risk with the seriousness it deserves. Almost all businesses that flourish have a risk model.

The continuously increasing demands for investors require a business model that can stand any performance scenario. Business risks are always escalated by overreliance on performance fees. Therefore, an investor must evaluate the ability of the manager to predict revenues and control costs.

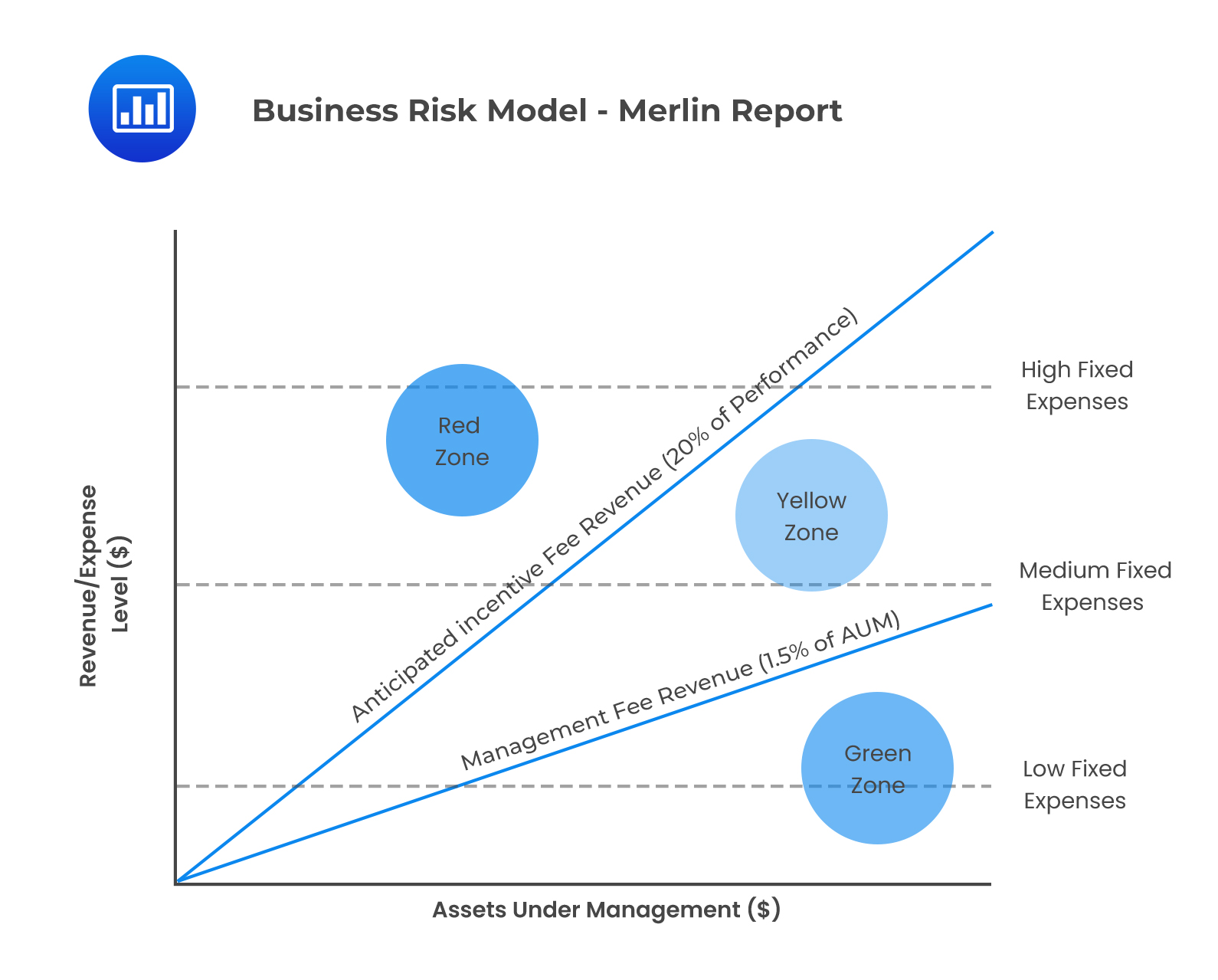

Large funds experience performance challenges if they exceed the strategy’s ability to gain. A fund can operate in the red, yellow, or green zone. In the red zone, the fund cannot sustain itself at all. In the yellow zone, minimal performance is required, and in the green zone, the fund can sustain itself in any business environment. Therefore, the investor must investigate if the fund’s model is operating in the green zone.

The following figure illustrates the basic revenue and expense scenarios for three types of hedge fund operating models analyzed in the Merlin report: red zone, yellow zone, and green zone.

Investors can also inquire about the fund’s business model risk. The questions here include the following:

Investors can also inquire about the fund’s business model risk. The questions here include the following:

Despite the preceding due diligence practices, investors can still be defrauded. Many hedge funds fail due to increased leverage as well as fraud. The following features can identify fraud risk in a fund:

A due diligence questionnaire must contain all the investor needs to know about the fund. Therefore, a diligence questionnaire is considered sufficient if it consists of the following sections.

Lastly, it is worth noting that due diligence questionnaires can either be open-ended or closed-ended, depending on the nature of the questions.

Practice Question

Martin is a seasoned risk manager at a prominent investment firm. During a quarterly review meeting with the firm’s investment committee, a discussion ensues about the historical failures of certain hedge funds that the firm had previously considered investing in. Martin recalls one fund in particular, Falcon Hedge. The fund showcased impeccable internal controls, stringent risk management protocols, and a well-structured committee decision-making process. However, they seemed overly focused on these aspects and were cautious to a fault. Over time, the fund’s returns were consistently below the benchmark, resulting in dissatisfied investors and increasing redemption requests. Falcon Hedge, despite its attention to operational risk and controls, eventually closed its doors.

Based on the situation of Falcon Hedge, which of the following reasons most likely contributed to its failure?

A. Poor investment decisions

B. Excessive leverage

C. Insufficient attention to returns

D. Extreme events

Solution

The correct answer is C.

The description of Falcon Hedge indicates they might have gone to extreme lengths to manage and reduce operational risks, possibly at the expense of generating robust returns. This aligns with the situation where a hedge fund, in trying to minimize operational risk, implements excessive controls leading to lower returns due to the accompanying expenses. This oversight, coupled with consistent underperformance, led to increased redemption requests and the eventual closure of the fund.

A is incorrect. While poor investment decisions can lead to the failure of hedge funds, the vignette specifically highlights that Falcon Hedge was overly cautious and focused heavily on internal controls and risk management, which doesn’t necessarily imply they made poor investment decisions.

B is incorrect. Excessive leverage magnifies both gains and losses. The vignette does not mention that Falcon Hedge was involved in high-leverage activities or faced amplified losses due to leverage. Instead, it suggests that the fund was overly cautious.

D is incorrect. Extreme events refer to rare or unexpected occurrences like market crashes. The vignette does not suggest that Falcon Hedge faced such an event. Their challenge seemed rooted in their operational approach rather than external market shocks.

Things to Remember

- Operational risk management is essential, but excessive focus can divert attention from primary investment objectives.

- A balanced approach between risk management and return optimization is crucial for hedge funds’ sustainability.

- Robust internal controls, while important, shouldn’t overshadow the primary objective of producing competitive returns.

- Consistent underperformance can erode investors’ confidence, leading to increased redemption requests and fund closures.

- Each risk category – be it operational, market, credit, or others – requires adequate attention. Overemphasis on one can be detrimental to the fund’s overall health.