Assessing the Quality of Risk Measures

[vsw id=”x_FZqIH8Db0″ source=”youtube” width=”611″ height=”344″ autoplay=”no”] After completing this reading, you should be... Read More

After completing this reading, you should be able to:

Repurchase agreements refer to short-term collateralized loan obligations. They are utilized by the big financial organizations to acquire short-term financial funding via mortgaging/pledging their assets for short-term loans or earning interests through lending money collateralized by those assets. Over the years, commercial organizations have heavily relied on repos to fund sectors with fixed income inventory. Financing an institution by using repos has the advantage of secured, short-term loan that is relatively cheap as compared to borrowing from a bank.

Repurchase agreements/repos are agreements between a lender and a borrower in which the lender purchases securities from the borrower with the condition that the securities will be bought back at a stipulated date and stipulated higher price. The securities are a form of collateral for the money borrowed.

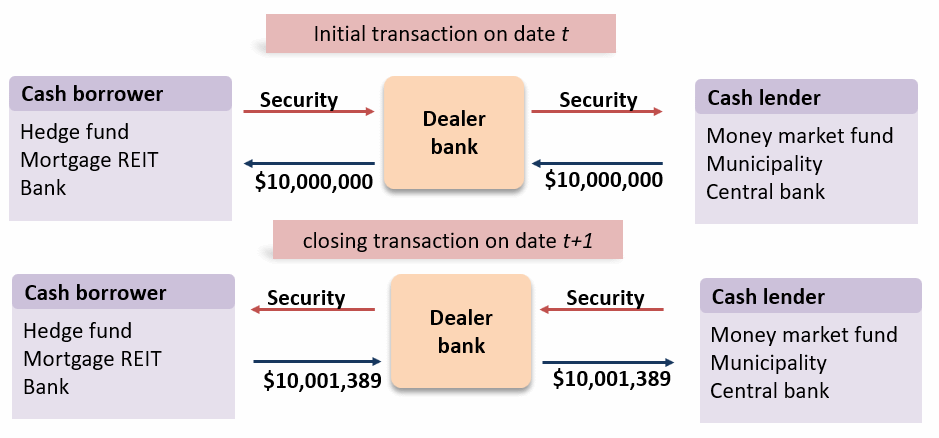

$$ \textbf{Figure 1 – Repurchase Agreement Example} $$

Note that the dealer bank might also charge a fee for intermediation.

Note that the dealer bank might also charge a fee for intermediation.

The variation between the amount loaned and repurchased price is the amount of interest paid to the lender by the borrower. This can be calculated using the following formula:

$$ \text{Dollar Interest} = \text{Principal}×\text{Repo Rate}×\cfrac {\text{Repo Term in Days}}{360 \text{ days}} $$

(Repo formulas apply a banker’s year of 360 days.)

From the above formula, we deduce that the repo rate (annual interest rate of the repo transaction) is equivalent to:

$$ \text{Repo Rate} =\cfrac {\text{Dollar Interest}}{\text{Principal}}×\cfrac {360}{(\text{Repo Terms in Days})} $$

Assuming that a counterparty 1A is selling $397 million face amount of the DBR 4’s (Deutschland Bundesrepublik, or German Government Bond with a coupon of 4%) of August 4th, 2034, to counterparty 2A scheduled for settlement on September 30th, 2018, at an invoice price of $513 million. At the same time, counterparty A1 agrees to repurchase $397 million face amount five months later, for settlements on 28th, February 2019, at a buying rate equal to the invoice price plus the interest at a repurchase agreement rate of 0.45%

Thus:

$$ $513,000,000 \left(1+0.45\% × \cfrac {151}{360} \right)=$513,968,287.50 $$

The three significant reasons for carrying out repos are:

Investing in repos is regarded as an absolute solution for investors holding cash for safekeeping or liquidity reasons. An excellent example of this situation is the money market mutual fund industry, whose main aim is to make investments in support of investors disposed to accept minimal returns for the sake of safety and liquidity.

In essence, relative to liquid non-interest-bearing and super-safe bank deposits, repurchase agreement (repo) investments consist of short-term pay rates in the absence of making huge liquidity sacrifices as well as having to incur notable default risks.

Additionally, municipalities form another significant classification of repo investors. The schedule of public expenditures has less association with the timing for tax receipts; municipalities prefer to manage cash excesses from tax receipts to ensure that money is readily available at hand to meet expenditures. Investments of tax revenue cannot be made under risky securities; however, the cash collected should not be left lying idle. Short term loans supported by collaterals, like repos, fulfill both safety and revenue considerations.

Investors tend to lend overnight loans since there is a premium placed on liquidity. It refers to maturity that is longer than a day. Most investors willing to give money via the repo platform for an extended period prefer taking part in the open repo; i.e., a repo that requires daily renewal until either of the parties cancels it. However, lenders who are ready to take up on some counterparty risks and liquidity with interest rate risks lend via repos terms. The term repos are available for investors and have various maturities up to several months.

The main feature of repos is the fact that they generally accept securities of the highest quality as collateral. It is because safety is a fundamental consideration for repos investors. Thus, debt from government-sponsored businesses and government securities, among others, are the most approved choices.

As noted, it is taking the highest quality assets as securities that make up the main feature in a repo. However, if a borrower defaults paying back the loan, the lender eventually incurs losses since selling the collateral might not recover the full loan amount. In that sense, haircuts are usually provided in repos agreements, in which the borrower offers security that has more worth than the loan. Furthermore, in repo agreements, there are margin calls in which the cash borrowers provide extra collateral if the value of the collateral decreases.

Financial institutions are the primary cash borrowers in repo markets. Repo markets are utilized by commercial organizations to fund their inventories in making markets. Besides, they can be used in financing the institution’s customer and proprietary positions.

An explanation for proprietary repo positions can be done by considering a relevant trading desk as a counterparty with internal aims to purchases and sell bonds. Repo for financing customer positions can be viewed in the sense that it is a customer who is the counterparty and intends to fund the buying of DBR 4s.

The repo with the client, the transaction of cash (lending), and the acquisition of the Treasury security as collateral are done through the financial institution’s counterparty trading desk. A different trading desk avails the cash and acquires the initially supplied guarantee, and thus gets connected with the other counterparty in a back-to-back repo. Essentially, in each leg of the transaction, there is a haircut charged, which heavily relies on the relevant counterparties’ creditworthiness.

A bond short by professional investors can either be a bet that the interest rates are likely to increase or partly as a bet on relative value that the price of another security increases corresponding to the cost of the security being sold short.

For instance, in a case where a hedge fund wants to sell some particular DBR 4s, the bond will be short, and thus, to make it deliverable, it gets borrowed from another place. In short, in a hedge fund’s view, a reverse repurchase will take place, which entails the reversal of securities.

Later on, the hedge fund initiates a reversal when it is ready to account for its short; that is, it is in a position to neutralize its economic exposure to the bond through purchasing the bond back. Such that, at this time, the hedge fund buys the bond and initiates unwinding of its reversal.

An example of this scenario is a case where there is a hedge fund willing to purchase the bond at market price and then have it delivered to the other counterparty who has to return the hedge fund’s money with interest. As such, in case there are lower bond returns than repo rate of interest, then a profit on hedge fund is registered against an absolute short position. The converse is also true, where the returns on the bond are higher than the repo rate of interest, a loss is registered against an absolute short position.

In that sense, it is crucial to keep in mind that, while repo investor is readily willing to accept general collaterals, there are specific bonds that are necessary for reverses, despite the repo investors willing to accept general collateral— thus accounting for special trades which refer to repo transactions that need specific bonds. These special trades are taken at special collateral rates.

Currently, broker-dealers are less reliant on repo financing than they did before the 2007-2009 crisis. There are various ways in which financial institutions can borrow funds. Some of the methods are deemed as more stable than others, meaning they can easily be managed under financial stress while others are not easily maintained.

Equity capital is known for being one with a stable source of funds since equity holder does not follow any form of schedule in regards to their payments and also, they cannot lawfully force the redemption of their shares.

On the other hand, long-term debts are less stable since the bondholders must be paid principal and interest according to bond indentures.

Also, there are short-term unsecured funding in financial stability, e.g., commercial papers. These types of funds must be paid within a range of weeks or months as they mature. An organization under critical conditions might find it hard to get financial loans elsewhere.

Funds sourced from stable sources have high expected returns according to the fund provider terms. Thus, liquidity management comes in to save institutions in balancing the costs of funding versus the risks of being found with a lack of finances, which are critical for survival.

In the vast financing choices, repo markets are relatively liquid and with low rates in repo borrowing. Also, repos have short maturities making an unstable source of funds. However, they are more stable as compared to short-term unsecured loans. Moreover, repo collateral should be able to prevent repo lenders from bolting too quickly in the onset of unfavorable news or rumors.

The risks involved with repo funding in repo investing results in tension between lenders and borrowers. Also, issues related to regulations create some tension. In that, borrowers want an extended term of their repo borrowing through their regulators’ advice. They aim to create more time in case refinancing conditions deteriorate and allow for avenues of alternative financing through raising capital or selling a part of the corporate entities.

Before the 2007-2009 financial crisis, the borrowers financed lower-quality collaterals ranging from low-quality corporate bonds to lower-quality mortgage-backed securities. They were available at low rates as well as low haircuts in the repo market. Therefore, the collaterals were embraced by lenders who, in turn, accepted higher rates compared to the ones available during high-quality collateral lending.

At the time of the crisis, the results of the expansion of collaterals approved for repo did not turn out quite well. Especially, borrowers who failed to meet the margin calls were a real example of the expansion effect. The leading cause was as a result of decreasing the values of securities as well as numerous other borrowers.

Generally, Bear Sterns’ method of financing was through borrowing funds on an unsecured and secured basis and utilizing equity capital. In 2006, the amount of short term unsecured funding (primarily borrowed commercial paper) was decreased.

On the other hand, its secured funding average condition was increased considerably during the first half of 2007. Repos of six months and more (longer-terms) were acquired for financing the institution’s assets while creating limitations on the use of its short-term secured funding for Treasury financing.

As a result, there was instability in the fixed income repo markets, which ran roughly from 2007 to early 2008 since the loan durations had been shortened by fixed income repo. Thus, borrowers and lenders were asked to have the higher-quality collateral post to have the said loans supported.

Bear Sterns suffered an unwarranted loss of confidence from its lenders and borrowers. Market rumors concerning the company’s liquidity position might have partly been the cause of loss of confidence

The results were:

In a repo, one of the significant risks of lending money is the impending possibility of a borrower to default and insufficient collateral values to cover the amount of the loan. Overnight loans are loans lent by investors to financial institutions through the tri-party repo system in which collateral is taken as security.

Before the final week of Lehman, more than $100 billion was lent to Lehman by JPM’s tri-party. JPM, on its tri-party advances, had never taken haircuts until the start of 2008. JPMorgan took advantage of Lehman Brothers’ life and death since it was on the verge of getting bankrupt, extorting billions of dollars in assets that had important use.

JPM repeatedly demanded Lehman to increase the amount posted on collateral payments, and thus, their desperate need for cash was drained by JPM. Compared to a single tri-party investor, JPM extorted on its broker-dealer’s whole tri-party repo book on a daily book. It was later known that Lehman’s security pledges to JPM were illiquid and overstated values.

Unfortunately, Lehman’s exposure to JPM kept increasing to the point of including sectors that were unconnected to third-party repo clearing. It later emerged that some of the biggest collaterals pledged by Lehman were not only illiquid, but their valuation was reasonably impractical but was highly supported by Lehman’s credit. While all this was going on, JPM kept making major credit extensions to the already crumbling bank.

Repo trades are classified as;

In general collateral, the lender has no specification of the type of security the cash lender is willing to accept. However, there might be a specific specification on broad categories that are known as acceptable securities. For special trading, the cash lender has to initiate the repo to have a particular security.

There is daily general collateral in each repo term and each bucket of insurance. Repo investors are more suited for general trades since they can get the highest collateral rate that they are willing to agree to. In the case of special trade, traders aiming to particular short securities should have this type of repo transaction. More so, they have to decide on whether they are ready to lend money at lower rates as compared to GC to borrow securities.

On a particular date, a specific issue’s special rates are dictated by its demand for borrowing to that date in comparison to the supply availability. Thus, there is a difference between demand and supply of borrowing and lending issues to the demand and supply for purchasing and selling issues.

As such, high demand is placed on a bond that trades richly in comparison to other bonds. In short, to predict one’s bond special spread is quite a hard task.

Every three months, the United States Department of the Treasury usually auctions a new ten-year Treasury bond note at the mid-quarter refunding in February, May, August, and November. The U.S. Treasury sells bonds maturing at various times based on the three-month fixed period. A ten years OTR (on-the run) security, for instance, carries more trade significance as compared to that of thirty years. Current issues tend to be more liquid; as a result, they consist of low bid-ask spreads.

Treasuries with newly issued bonds are the right candidates for both long and short positions because they have extra liquidity. In a situation where all factors are held constant, holders of the relatively short position prefer to sell liquid treasuries, to recover them within a short period, and at preferably lower costs.

In case there is a sacrifice to be made on liquidity through lending the bond in a repo market, traders and investors in long OTR should be granted compensation as a result of liquidity. Also, investors and traders having the will to short OTR securities should show interest to pay for the liquidity of the said bonds when acquiring them in the repo market.

The auction cycle is also essential in ascertaining bonds that trade special as well as how particular individuals purchase throughout the auction cycle. It has been observed that special trades are quite unstable as they are based on day-to-day trading which reflects the supply and demand for special collateral. Although the OTR special spread cycle is irregular, it is prevalent for trades to be small after auctions and reach peak levels before auctions.

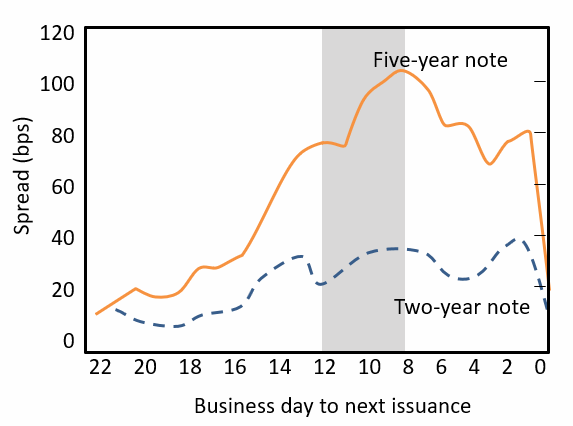

$$ \textbf{Figure 2 – Spread relative to Time until the Next Auction} $$

There is a significant similarity between the cases of a five-year OTR and two-year OTR. It suggests that similar patterns are registered for shorter maturity OTRs; however, the spread’s tendency is not so broad. The reason behind such is explained by the fact that short-maturity Treasuries are issued more frequently. Thus, it bars any particular issues from being the significant liquid or short with most favors.

There is a significant similarity between the cases of a five-year OTR and two-year OTR. It suggests that similar patterns are registered for shorter maturity OTRs; however, the spread’s tendency is not so broad. The reason behind such is explained by the fact that short-maturity Treasuries are issued more frequently. Thus, it bars any particular issues from being the significant liquid or short with most favors.

Recently, penalties were introduced as a punishment for defaulting on delivering a bond bought. The implication was that, before the sanctions, the special rate was maintained above 0%.

If a trader shorts a ten-year OTR but defaults to deliver upon an agreement, such a trader has to lose that day’s money plus the interest on the same money.

In case a trader borrows a bond overnight at a 0% rate in the repo market, to make a delivery, the profitability of the borrow to the trader is the same as a loss. The reason being, there is no interest in selling a bond in such a scenario. Before, the bond could not be borrowed by any traders since special rates were 0% or less. Thus, to have the bond eligible for borrowing, the special rates should at all times be more than 0% but not exceeding the general collateral rates.

The introduction of the penalty for failure to deliver formed a penalty rate as the new upper limit for special spreads only, excluding the general collateral rates.

OTR bonds usually trade at a premium due to their liquidity advantage. Thus, special spreads need to be translated into yield premiums or price. The bond’s financing value refers to the amount of lending a bond in a repo, borrowing loans at its special rate, and having the cash invested at the higher general collateral.

The assumption made in this case is how the trading of the special bond will be, and the period it will take. The market view should also be inline, as expressed in the term structure of the special spreads.

In calculating the financing advantage of a special trading bond in a repo transaction, we will consider the example below:

Given that lending cash value of $156.89 has a spread of 0.789% for 221 days, calculate the financial advantage of the special bond;

$$ $156.89×\cfrac {221 \text{ days} ×0.789\%}{360 \text{ days}}=$0.75991 \cong $0.76 $$

This implies that 76 cents per $156.89 market value of the bond.

Practice Question

Suppose that DBR 4s with a face value of $100 million are to be sold by a counterparty to another counterparty for settlement at the price of $109 million. The counterparty selling the DBR 4s decides to buy back the $100 million face amount some 101 days later for settlement at a buying price equal to that of the invoice price with a repo rate of 0.26%.

At what price can the counterparty repurchase the bond?

A. $109.08 million

B. $100.07 million

C. $126.26 million

D. $109.78 million

The correct answer is A.

The repurchase price is:

$$ $109,000,000\left( 1+\frac { 0.0026\times 101 }{ 360 } \right) =$109,079,509 $$

$$ \approx $109.08 \text{ million} $$

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.