Classifications and Key Concepts of Cr ...

Classification Default Model and Value-based Valuations A borrower’s default constitutes default risk. On... Read More

After completing this reading, you should be able to:

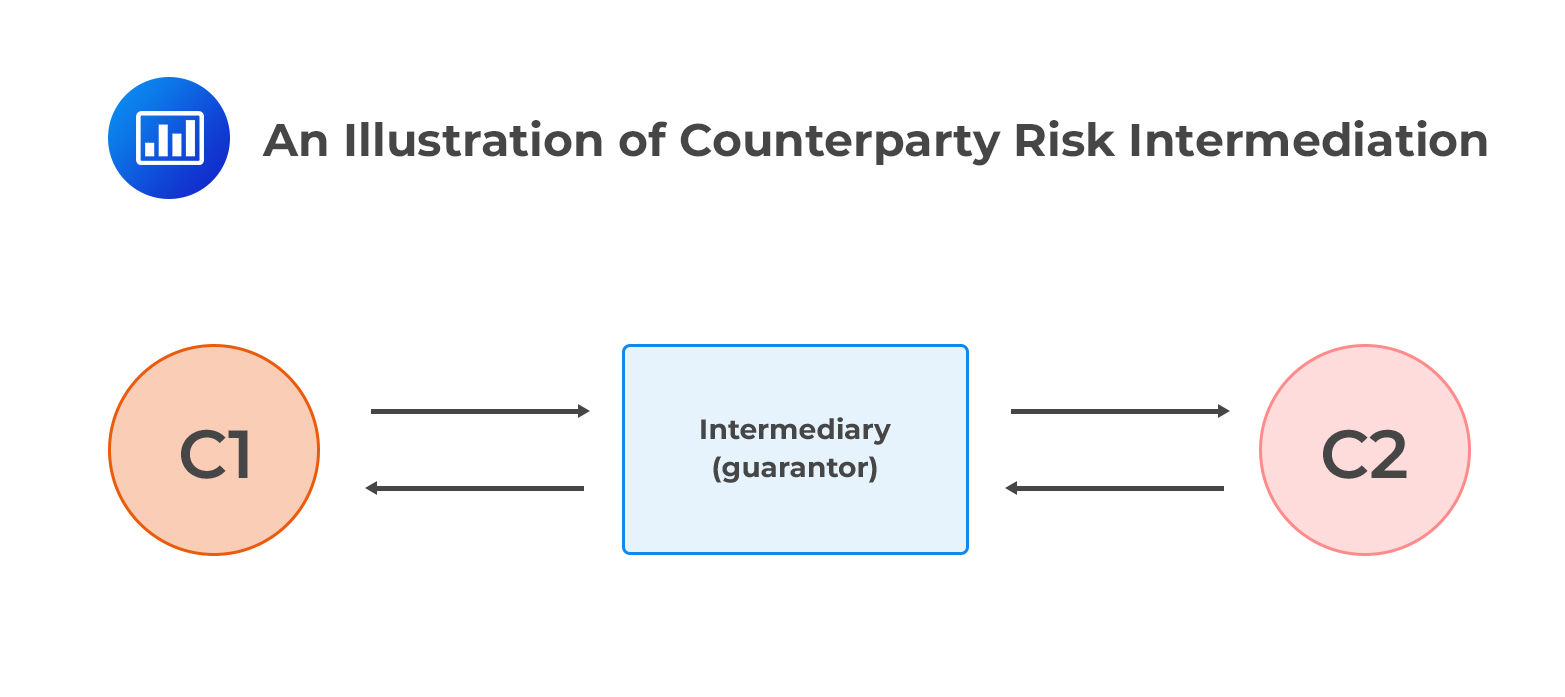

Counterparty risk is the likelihood that one of the parties involved in a transaction would default on its contractual obligation. Counterparty risk usually exists in derivative transactions and repurchase agreements.

Over the years, counterparty risk mitigation has become a key goal for trading parties around the world. Counterparty risk intermediation is the practice of using a third party to intermediate and guarantee the performance of one or both counterparties.

The most ideal form of intermediation is central clearing. In exchange-traded instruments, this is achieved because the exchange itself serves as the intermediary. In OTC derivatives markets, there are several forms of counterparty risk intermediation. We look at each form below.

The most ideal form of intermediation is central clearing. In exchange-traded instruments, this is achieved because the exchange itself serves as the intermediary. In OTC derivatives markets, there are several forms of counterparty risk intermediation. We look at each form below.

A special purpose vehicle is a legal entity created to fulfill narrow, specific, or temporary objectives. The goal is to establish a bankruptcy-remote entity that gives a counterparty preferential treatment as a creditor in the event of a default. Although the setup process is anchored in law, an SPV still introduces legal risk because the envisaged preferential treatment may not materialize following a default event.

SPVs typically manage assets that have been hived off the originator’s balance sheet. They are also used to finance a large project without putting an entire firm or a counterparty at risk. Some jurisdictions are very specific with regard to the ownership structure, with some stipulating that the SPV should not be owned by the originating entity. The constant goal across jurisdictions is to change bankruptcy rules and put the non-defaulting or non-solvent counterparty at the forefront of the queue when claims are being settled.

As noted above, SPVs transform counterparty risk into legal risk. Legal risk manifests in the sense that in some jurisdictions, the SPV is viewed more like a business segment of the originator such that the two are substantially the same. As such, the assets of the SPV can be consolidated with those of the business in case of a wind-up. Such a move effectively nullifies any preferential treatment of counterparties as initially envisaged during the formation of the SPV. US courts have a history of ruling in favor of consolidation, but those in the UK have been less keen to do so. Instead, they prefer to uphold the autonomy and remoteness of the SPV.

A good example of the legal risk associated with SPVs is the case of Lehman Brothers, the U.S. investment bank that went down in 2008. Lehman had inserted a “flip clause” in their collateralized debt obligation contracts with investors. The clause was meant to shield investors by directing that in case of bankruptcy, the investors’ claims would be settled in priority. At the end of bankruptcy proceedings in the U.S., the flip clause was nullified and declared “unenforceable.’ In the UK, however, the court declared that the flip clauses were indeed enforceable, effectively paving the way for SPV investors to be compensated in priority. In the end, Lehman settled most of the investors’ claims out of court.

Bottom line: Mitigating counterparty risk with any mechanism that introduces legal risk is dangerous.

In this case, the performance of a derivative counterparty is guaranteed by a third party.

Guarantees, however, do introduce the risk of double default where the original counterparty and the guarantor may default, leading to a loss.

A derivative product company is a bankruptcy-remote entity set up to specifically participate in derivative transactions. It differs from an ordinary SPV in that the originating bank injects capital eyeing a strong credit rating (usually triple-A) from credit rating agencies. To maintain its strong rating, the DPC must:

The DPC then leverages its strong rating to sell insurance to derivative counterparties, promising to make the required payments if either of the counterparties defaults. A DPC may be established with a particular type of derivative market in mind, e.g., credit derivatives.

In the run-up to the 2007/2008 financial crisis, DCPs were considered relatively safe financial vehicles that served as a testament to the continued growth of financial markets. In the aftermath of the crisis, however, DCPs were thrown into the limelight because of the ease with which they went down despite enjoying top-notch ratings. For example, Lehman Brothers had a strong A rating at the time it went down, while banks in Iceland had triple-A ratings just weeks before they were declared bankrupt. The crisis showed how dangerous it could be to rely on credit ratings as a dynamic measure of credit quality.

Bottom line: The use of DPC to convert counterparty risk into other forms of financial risk such as legal risk, market risk, and operational risk may be ineffective.

Central counterparties, also known as CCPs, protect market participants from counterparty /credit/default risk and settlement risk by guaranteeing the trade between a buyer and a seller. The use of a central counterparty (CCP) to mitigate risks associated with the default of a trading counterparty is called clearing.

CCP clearing means that a CCP becomes the legal counterparty to each trading party, providing a guarantee that it will honor the terms and conditions of the original trade even in the event that one of the parties defaults before the discharge of its obligations under the trade.

A monoline insurance company, also called “monoline,” is an insurance company that specializes in providing financial guarantees (wraps). Initially, monolines used to provide wraps to US municipal bonds. In recent years, monolines have been actively involved in the securitization market, providing cover for products such as mortgage-backed securities and collateralized debt obligations.

There exists a similarity between monoline and DPC structures in that in both, the capital requirement is dynamically related to the portfolio of assets they insure. However, monolines enjoy slightly more favorable capital requirements and their expected losses are likely to be lower because they generally wrap good quality products. This means that the amount of capital a monoline holds in comparison with the total notional insured amount is small.

Unlike DPCs, monolines are not required to post collateral against their transactions during normal business conditions. This is justified by the fact that:

The fact that monolines do not post collateral means that they can “ride the wave” in the short-term and ignore short-term volatility and illiquidity.

As mentioned earlier, clearing refers to the use of a central counterparty (CCP) to mitigate risks associated with the default of a trading counterparty. Clearing implies that a CCP comes in between counterparties to guarantee performance.

OTC CCPs interpose themselves directly or indirectly between counterparties and act as a buyer to every seller and seller to every buyer. CCPs reallocate default losses using methods such as netting, collateralization, and loss mutualization. The overall goal is to reduce systemic and counterparty risks.

One advantage of CCPs is that they allow the netting of all trades executed through them. The second advantage is that CCPs also manage collateral requirements from their members to reduce the risk of movement in the value of the underlying portfolios. While these are things that are easily achievable in the bilateral market, CCPs introduce new aspects that are not present in bilateral markets. One of these is loss mutualization, where one counterparty’s losses are spread across all clearing members as opposed to being shared among a small number of counterparties, a scenario that could be financially devastating for the members involved. CCPs also facilitate orderly close-outs by auctioning the defaulter’s contractual obligations. It also enables the orderly transfer of clients’ positions from financially distressed members to other members.

The main roles of CCPs are as follows:

Some banks and most end-users of OTC derivatives access CCPs through a clearing member and will not become members themselves. That’s because to become a clearing member, a party must abide by a strict set of membership, operational, and liquidity requirements. CCPs make the failure of a counterparty less dramatic, regardless of its size, by acting as shock absorbers. Once a member defaults, the CCP moves in swiftly to terminate all financial transactions with that particular member without suffering losses. The positions of the defaulter are then auctioned to other clearing members to allow for continuity among the surviving members.

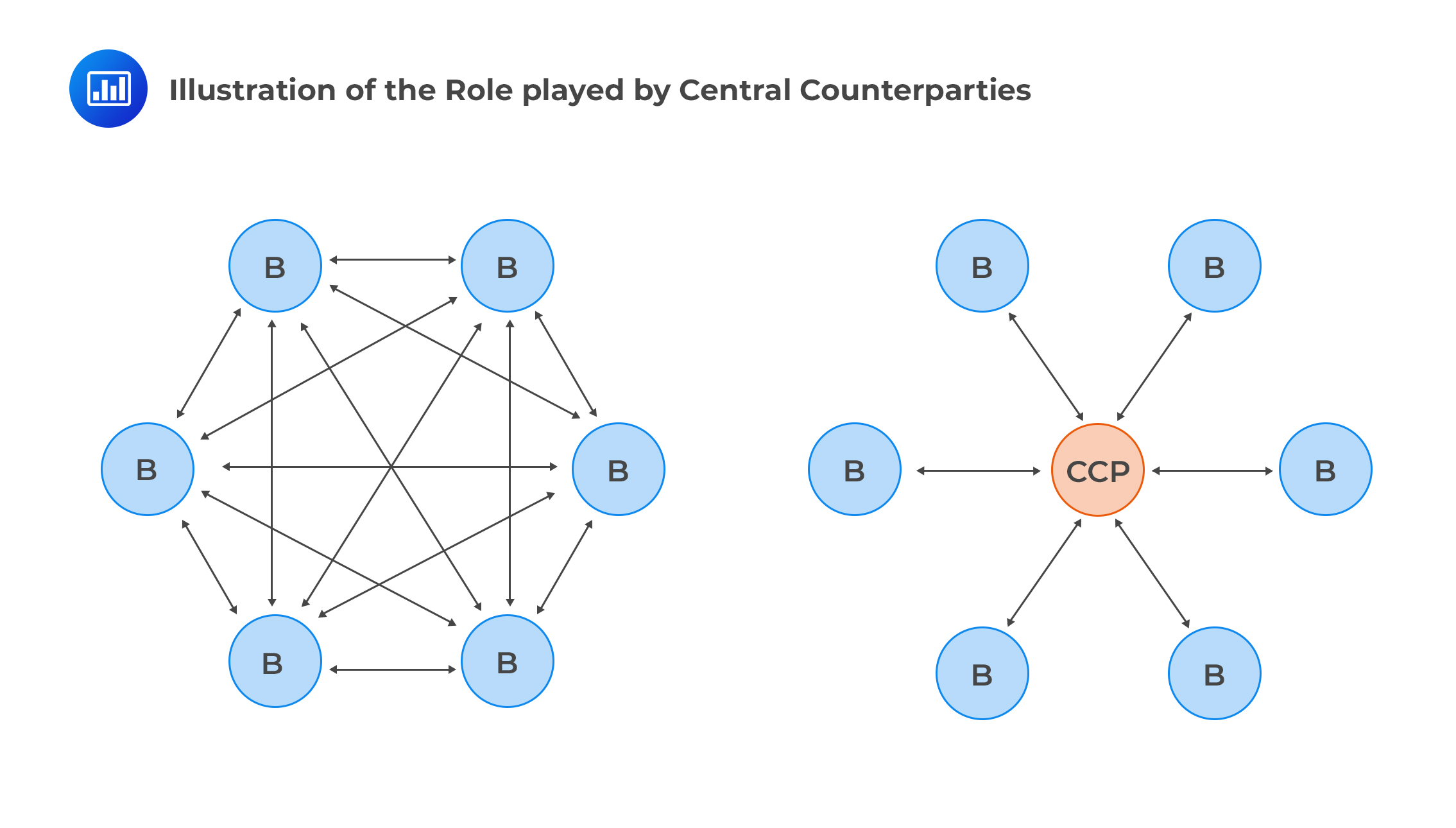

A CCP works within a set of rules and operational arrangements that are designed to allocate, manage, and decrease counterparty risks in bilateral markets. It, therefore, transforms the topology of financial markets by placing itself between buyers and sellers.

The following view, although a bit simplistic, helps to show the role CCPs play in trading. Each of the six entities denoted B represents a dealer bank. In contrast, the left side of the image shows the labyrinth of contracts in bilateral markets.

Clearly, CCPs reduce the interconnectedness within financial markets, reducing the effect of the insolvency of a party. Moreover, CCPs uphold transparency on the positions of the dealers. On the downside, CCPs, really, are not immune to financial distress, and the collapse of a single CCP can be disastrous.

Clearly, CCPs reduce the interconnectedness within financial markets, reducing the effect of the insolvency of a party. Moreover, CCPs uphold transparency on the positions of the dealers. On the downside, CCPs, really, are not immune to financial distress, and the collapse of a single CCP can be disastrous.

Going by the illustrations above, it would appear that the CCP landscape is simple. However, the true CCP landscape is much more complicated. But why?

Given the central role central counterparties play in financial markets, it would be dangerous to operate without risk mitigation strategies. One risk management strategy CCPs employ is that they require counterparties to post collateral. This enables them to cover the market risk of the trades they clear. CCPs also require parties to provide a variation margin as well as an initial margin. The variation margin addresses the net change in the market value of the members’ positions while the initial margin is an additional amount to cover the worst-case close-outs when clearing a member defaults.

In case a CCP member defaults, the CCP quickly halts all financial relations with that particular counterparty without suffering any losses. The positions of the member that has defaulted are taken up by other clearing members. This is usually actualized by auctioning the positions of the defaulting counterparty to other members by sub-portfolio, such as interest swaps. In most cases, members are more than willing to participate in the auction, given that they can realize a favorable workout of default with no negative consequences.

In cases where the initial margin and the contribution from the default fund prove insufficient and/or the auction fails, the CCP has other financial resources to address the losses. A “loss waterfall” describes diverse ways in which the resources will be utilized. It describes the methods that can be employed in the neutralization of the default of one or more CCP members:

Once a member has defaulted, the first to take effect is the “defaulter pays’ approach. In this instance, the defaulting member’s initial margin and default fund contribution are seized immediately and used to settle the loss. The two forms of collateral are posted in cash and specifically in the currency in which the contracts are dominated. The goal is to avoid liquidity risk and ensure that the process takes the shortest time possible.

In an ideal world, the “defaulter pays” approach would be designed to work to perfection, with every clearing member required to contribute all the necessary funds to pay for their own potential default. In practice, this requirement is not enforced because the financial implications would be too high for members. As such, the initial margin and default fund contribution are set at a level that ensures that there’s enough to cover losses to a high level of confidence, say, 99% of all simulated default scenarios.

The worst-case scenario occurs when the members’ default fund and the initial margin have been depleted. If this happens, the CCP turns to its own equity and contributes an amount that ensures there’s enough left to run the CCP’s day-to-day operations, or rather continue functioning normally.

If the loss still persists after the CCP has given away a portion of its equity, the concept of loss mutualization sets in. First to be seized are members’ contributions to the default fund. If the loss manages to blast through the default fund, the next phase, a right of assessment, kicks in. In this phase, the CCP requests members to part with more money, usually up to a limit specified in advance. In most cases, the “rights of assessment” kicks in if a significant fraction of the default fund (e.g. 25%) is used.

In practice, the rights of assessment are capped at say, 100% of the last default fund contribution subject to a maximum of 3 defaults within a six-month period. But why are the rights capped? If these rights were unlimited, the CCP would have the “privilege” to ask for as much additional funds as needed from members, but this would create moral hazard and unlimited exposure for members who would be required to dip into their pockets at the worst possible time.

If the loss is still not exhausted after rights of assessment, the CCP is left with no choice but to dip into its remaining equity to cover the shortfall. If there’s a residual loss even after the CCP’s equity has been depleted, the CCP has two options:

If none of these options bears fruit, the CCP fails (is declared insolvent).

In practice, it is extremely difficult for a default event to result in losses that blast through all of the above buffers and actually culminate in the failure of a CCP.

In bilateral markets, the original counterparties transact directly with each other. In central clearing, the CCP acts as the counterparty to each of the original parties.

There’s considerable wiggle room in bilateral markets on matters collateral. Although applicable rules are continually being changed to standardize collateral provision, a great deal of flexibility still reigns in CCP markets, collateral requirements are standardized, almost always non-negotiable, with eligible securities clearly specified. There are strict margin rules that must be followed, e.g., daily or intra-day posting.

In bilateral markets, just about any product can be traded, as long as counterparties can come to an agreement with regard to all the relevant parameters.

In CCP markets, on the other hand, there’s a limited range of tradable products that are standardized, plain-vanilla, and liquid. This ensures that the risk profile of all contracts can be analyzed with an almost zero chance of unexpected variability. Also, it ensures that the market is sufficiently interconnected such that it is easy to replace a contract.

Anyone can participate in bilateral trades as long as they can find a counterparty who deems their creditworthiness acceptable.

CCP markets, on the other hand, are only open to clearing members, typically large and financially stable financial institutions. A clearing member can sponsor an entity and effectively clear that entity’s transactions. Only a few entities are able to use a clearing member as a conduit because the entity must be ready to provide collateral.

In bilateral markets, netting may not be allowed in the contractual agreement. When present, it is often a result of a mutual agreement between counterparties. What’s more, trades are not offset as market participants often get into trades intending to bet on specific events and do not wish to be market-neutral.

In CCP markets, the CCP naturally tries to maintain market neutrality by netting transactions.

In bilateral markets, risk mitigation is not strictly enforced. A risk-averse counterparty will tend to spread out its positions among different counterparties in order to limit exposure to a single party.

In CCP markets, there’s more focus on risk mitigation, with the CCP requiring clearing members to adhere to strict margin or default fund requirements. This creates a sense of protection for counterparties and it is not unusual to find a counterparty channeling a large percentage of its positions through a given CCP.

In bilateral markets, the close-out process can be messy, lacks clear guidelines, and disputes are fairly common. The process is entirely between two bilateral parties and can quickly spiral into a default scenario for all of a party’s positions, not just for a single transaction.

In CCP markets, close-out is a well-coordinated process marked by clear guidelines. The loss waterfall, for example, ensures that there’s a structured process of handling the default of a counterparty such that significant losses can be absorbed without subjecting any particular member to severe financial strain. Contracts can be replaced almost immediately.

In bilateral markets, counterparties incur costs in the form of counterparty risk, funding, and capital costs.

In CCP markets, the main cost comes in the form of initial margin, and capital costs are relatively lower.

Although the presence of a central counterparty goes a long way toward mitigating various risks, they do not eliminate all the risks. In addition, default fund contributions do well to avoid CCP failure, but losses still occur. For these reasons, CCPs attract some capital charges.

CCP capital requirements for qualifying CCPs (QCCPs) come in two forms:

Central clearing of OTC derivatives aims squarely at reducing counterparty risk through the risk management practices of the CCP. Particularly, this applies with respect to their collateral requirement. This implies that credit value adjustment (CVA) and associated capital charges would no longer be an issue when clearing via a CCP. However, two issues arise from the above view:

Practice Question

Which of the following are advantages of central counterparties?

A. Loss mutualization, adverse selection, and legal and operational efficiency.

B. Offsetting, liquidity, and bifurcations.

C. Legal and operational efficiency, moral hazard, and bifurcations.

D. Default management, liquidity, and loss mutualization.

The correct answer is D.

Default management, liquidity, loss mutualization, offsetting, and legal and operational efficiency are all advantages of CCPs.

Disadvantages of CCPs include moral hazard (counterparties have a limited ability to monitor each other’s credit quality), adverse selection (counterparties pass the riskier products to the CCP), bifurcations (mismatch between cleared and non-cleared trades), and procyclicality (the positive dependence with the state of the economy).