Market Price of CDS

The value of a CDS depends on the probability of default, i.e., the... Read More

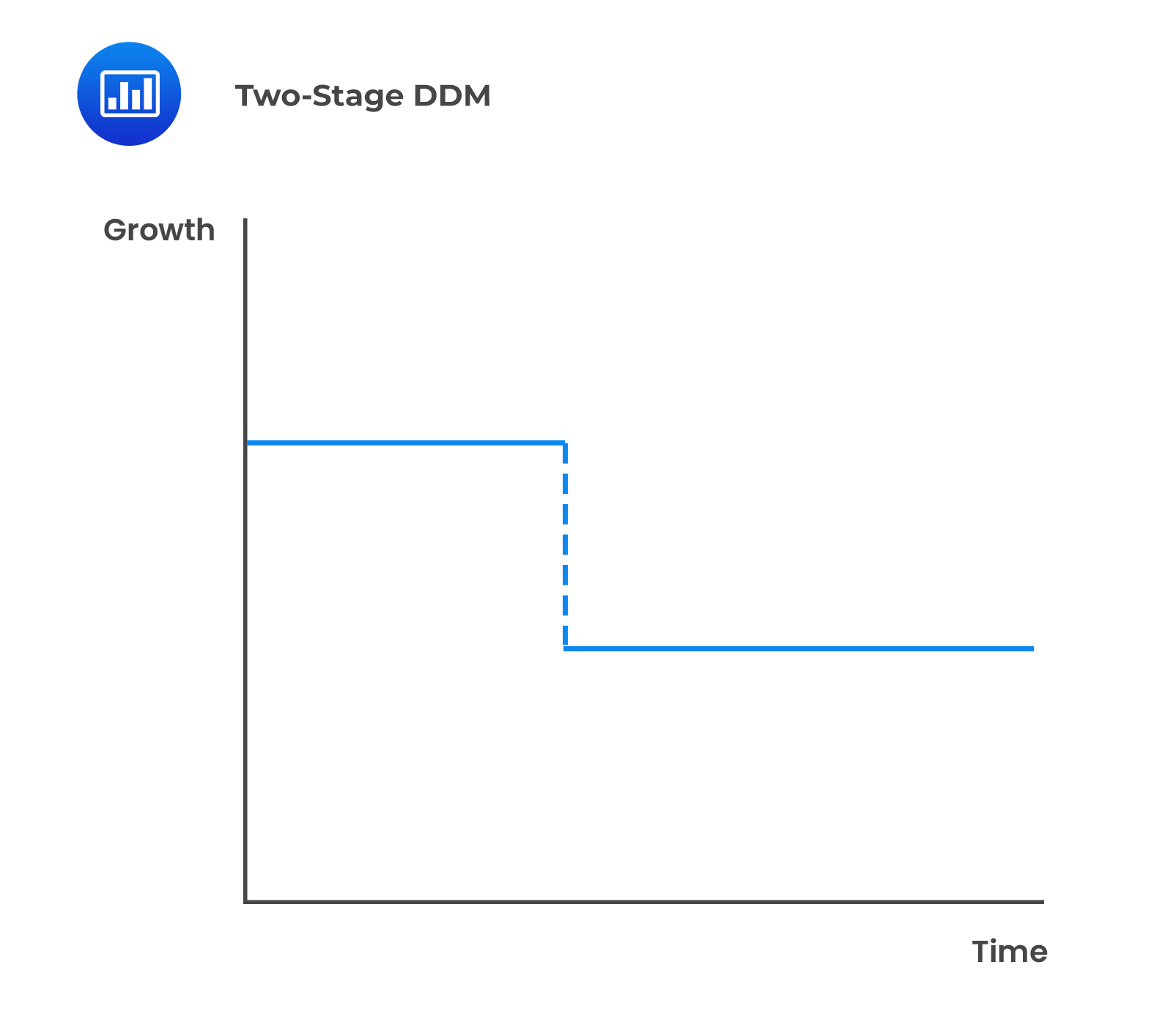

There are two approaches to the two-stage dividend discount model:

Under this model, a company’s growth is divided into two sections—one where it experiences high growth and the second where its growth is stable and sustainable. The transition from the first stage to the second is abrupt and immediate.

$$\text{V}_0= ∑_{(\text{t}=1)}^{\text{n}}\frac{\text{D}_0(1+\text{g}_{\text{S}})^\text{t}}{(1+\text{r})^\text{t}} +\frac{\text{D}_0 (1+\text{g}_{\text{S}})^\text{n}(1+\text{g}_{\text{L}})}{(1+\text{r})^\text{n}(\text{r}-\text{g}_{\text{L}})}$$

Where:

\(\text{g}_{\text{S}}=\) Short-term high growth rate.

\(\text{g}_{\text{L}}=\) Long-term sustainable growth rate.

\(\text{r}=\) Required rate of return.

\(\text{n}=\) Length of the extraordinary growth rate.

ABC’s current dividend of $0.50 is expected to grow by 8% per year for the next 3 years. Thereafter, the dividend growth rate will decline to 5% and remain at that level indefinitely. Using a required rate of return of 13%, its share price value would be calculated as:

$$\begin{align*}\text{V}_0&= ∑_{(\text{t}=1)}^{\text{n}}\frac{\text{D}_0(1+\text{g}_{\text{S}})^\text{t}}{(1+\text{r})^\text{t}} +\frac{\text{D}_0 (1+\text{g}_{\text{S}})^\text{n}(1+\text{g}_{\text{L}})}{(1+\text{r})^\text{n}(\text{r}-\text{g}_{\text{L}})}\\ \\ \text{D}_{1}&=$0.50\times1.08=$0.54\\ \text{D}_{2}&=$0.54\times1.08=$0.583\\ \text{D}_{3}&=$0.583\times1.08=$0.630\\ \text{D}_{4}&=$0.630\times1.05=$0.662\\\text{V}_{3}&=\frac{0.662}{13\%-5\%}=$8.275\\ \\ \text{V}_{0}&=\frac{0.54}{1.13}+\frac{0.583}{(1.13)^{3}}+\frac{0.63+8.275}{(1.13)^{3}}=7.10\end{align*}$$

A company may experience supernormal growth for a few periods, after which the growth rate falls to a sustainable level. This may be due to patents, a first-mover advantage, or a factor that gives the company an edge. Subsequently, the growth rate will fall to a sustainable level. As such, a different discount rate may be used for the high-growth stage and the sustainable mature stage to reflect the different levels of risks involved.

A limitation to the general two-stage model is that the transition between the initial supernormal growth period and the sustainable mature growth rate is abrupt and immediate.

Valuing a Non-Dividend Paying Company

Valuing a Non-Dividend Paying CompanyA company that is not currently paying any dividends but will begin paying dividends in the future may still be valued using the dividend discount model. To value such a company, an analyst can use a multistage DDM, where the first section’s value equals zero.

On the other hand, suppose a company has no intentions of paying dividends, or it is difficult to predict the timing of dividends. In that case, an analyst can use the free cash flow or residual income model to value the company.

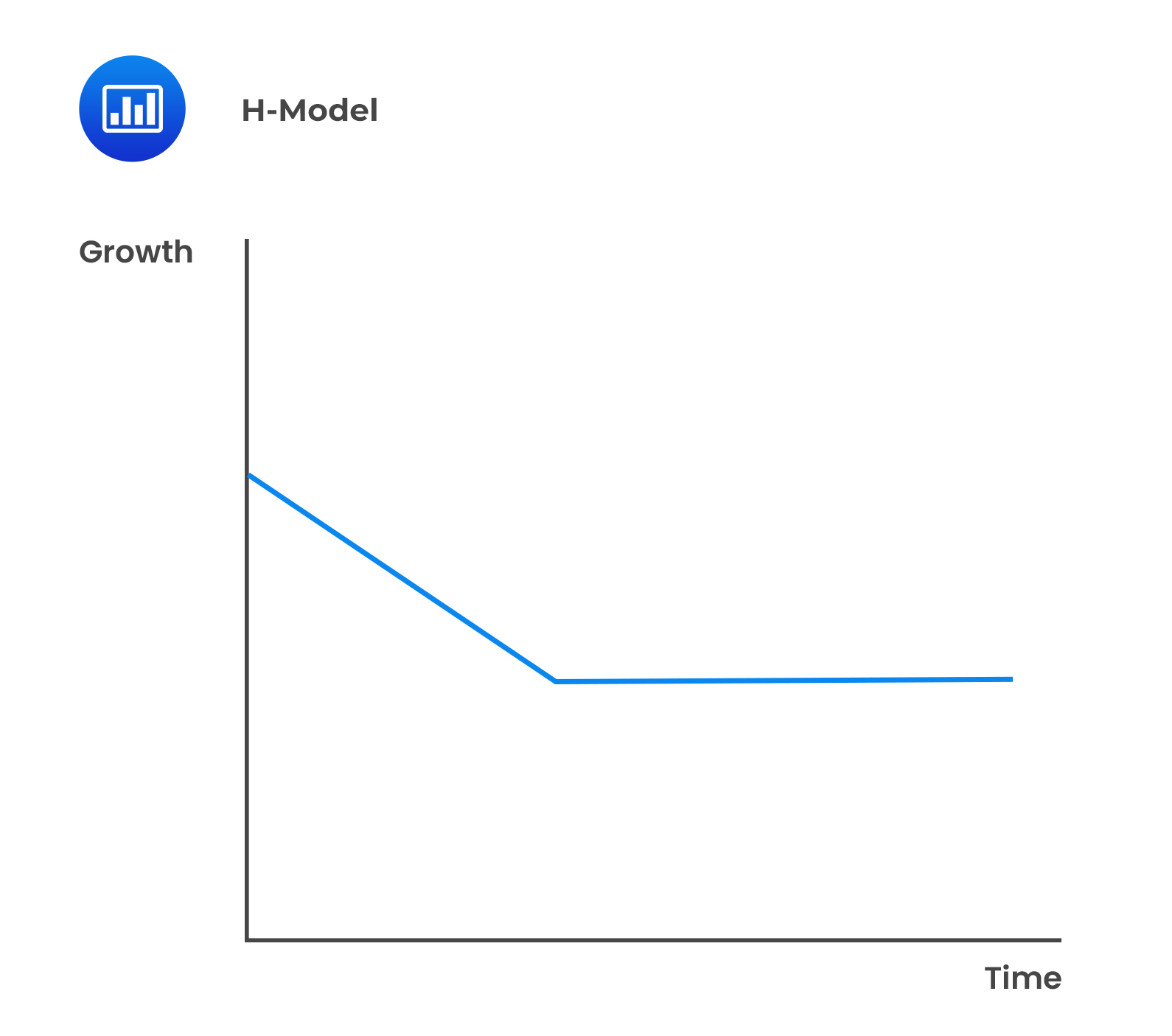

Under this model, there are two distinct stages but the transition from the high growth section to the mature stage is smooth and linear.

The value of a share using the H-model is:

The value of a share using the H-model is:

$$\text{V}_0= \frac{\text{D}_0 (1+\text{g}_{\text{L}} )+\text{D}_0\text{H}(\text{g}_{\text{S}}-\text{g}_{\text{L}})}{\text{r}-\text{g}_{\text{L}}}$$

Where:

\(\text{V}_{0}=\) Value per share at \(t = 0\).

\(\text{D}_{0}=\) Current dividends.

\(\text{r}=\) Required rate of return on equity.

\(\text{H} =\) Half-life in years of the high-growth period.

\(\text{g}_{\text{S}}=\) Initial short term dividend growth rate.

\(\text{g}_{\text{L}}=\) Normal long-term dividend growth rate after the high growth period.

XYZ’s current dividend of $0.80. The current growth of 8% per year is expected to linearly decline to 5% over the next 10 years and after that remain at that level indefinitely. Using a required rate of return of 13%, its share value would be calculated as:

$$\begin{align*}\text{V}_0&= \frac{\text{D}_0 (1+\text{g}_{\text{L}} )+\text{D}_0\text{H}(\text{g}_{\text{S}}-\text{g}_{\text{L}})}{\text{r}-\text{g}_{\text{L}}}\\ \\ &=\frac{0.80(1.05)+0.80(5)(0.03)}{0.08}\\ \\ &=12.0\end{align*}$$

If the normal growth were to commence immediately, the value of the stock would equal \(\frac{D_{0}(1+g_{L})}{r-g_{L}}=\frac{$0.80(1+0.05)}{0.13-0.05}=$10.50\). The extraordinary growth adds $1.50 to the share’s value.

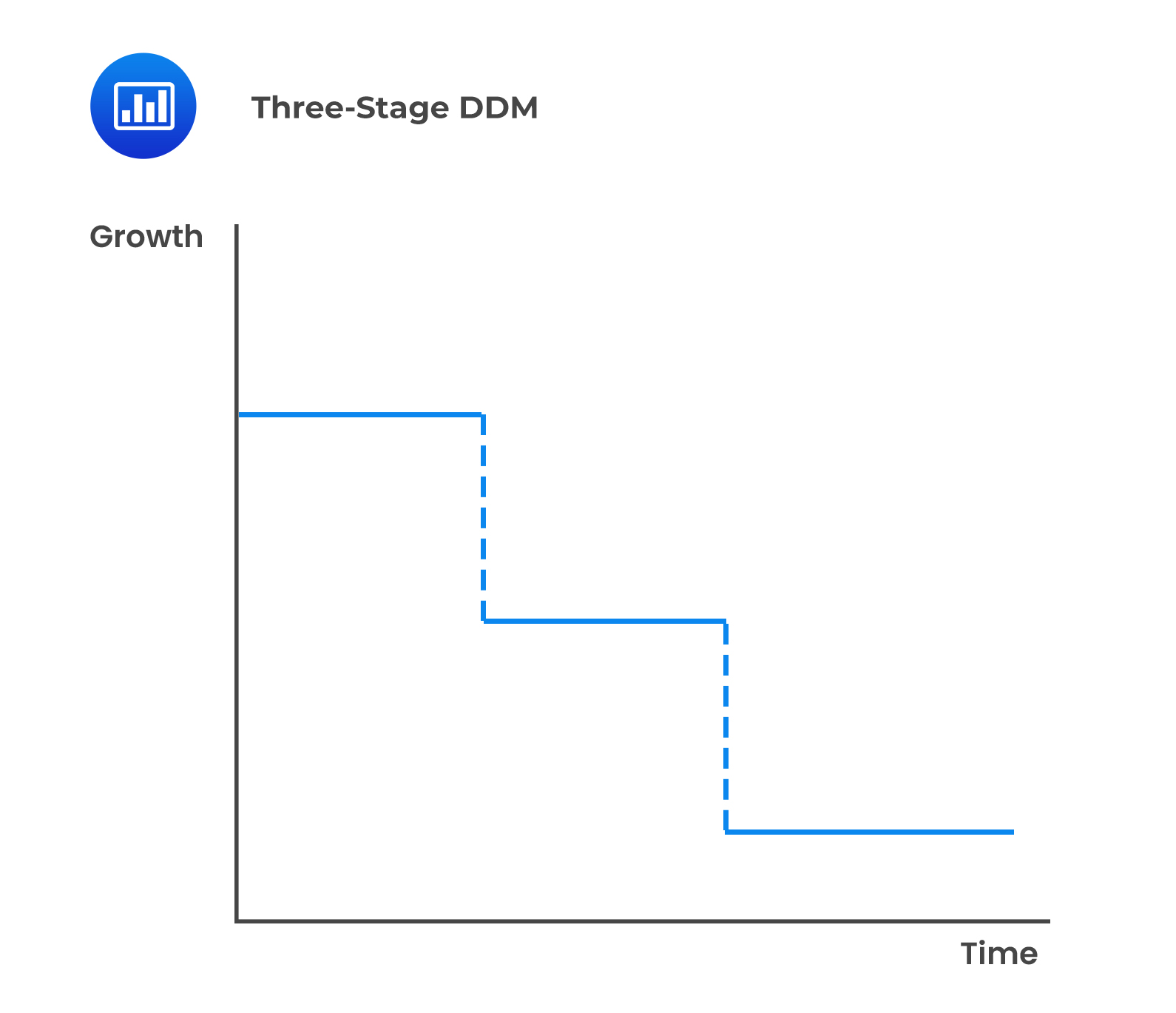

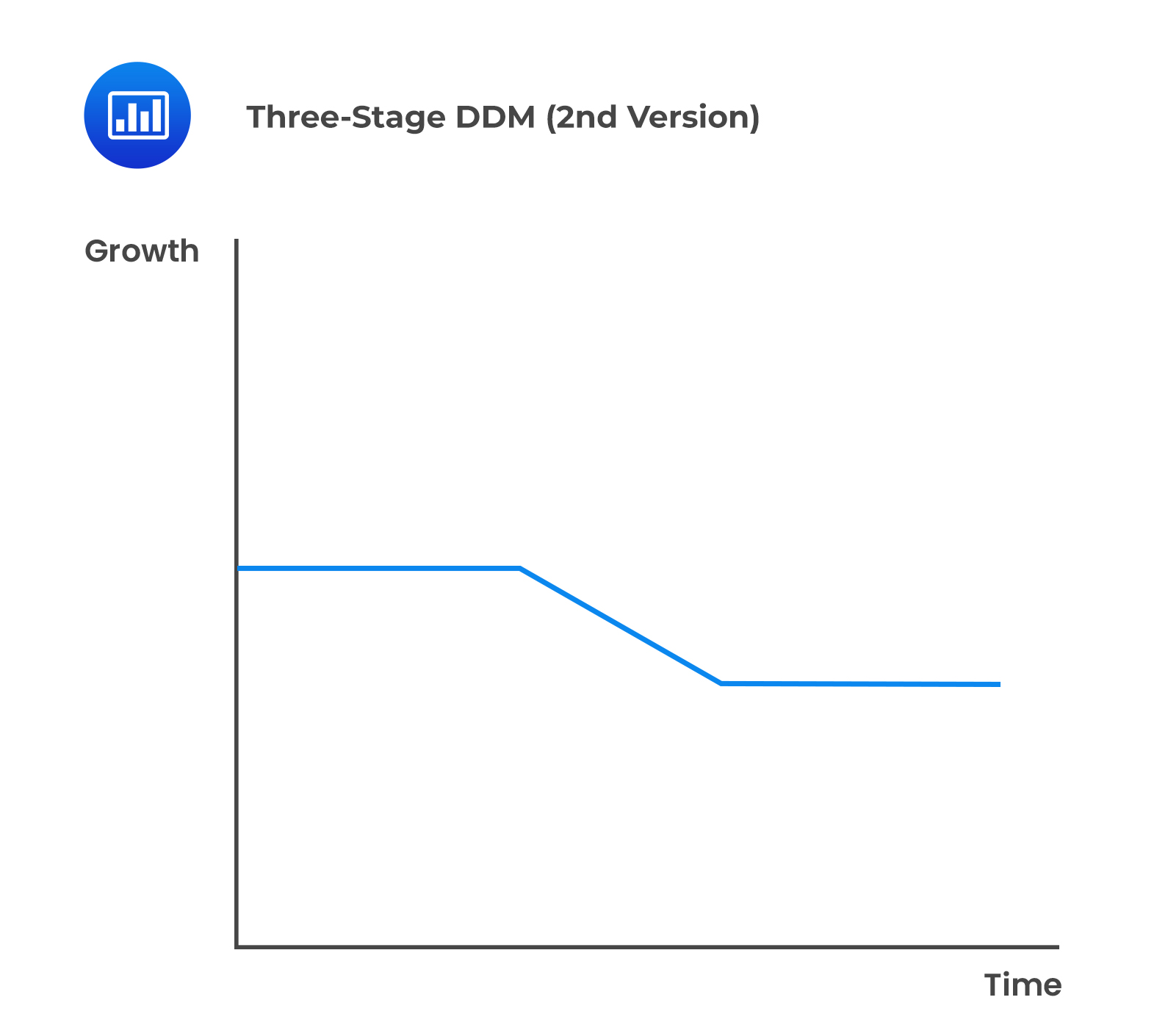

There are two approaches to the three-stage dividend discount model differentiated by the modeling of the second stage:

Company A recently paid a dividend of $2.00, and it is expected to grow at 14% for the next two years, 12% for the following three years, and 6% thereafter. Therefore, using the three-stage dividend discounted and assuming a required rate of return is 11%, the value of the stock can be estimated as:

$$\begin{align*}\text{D}_1&=\$2×1.14=\$2.28\\ \text{D}_2&=\$2.28×1.14=\$2.60\\ \text{D}_3&=\$2.60×1.12=\$2.91\\ \text{D}_4&=\$2.91×1.12=\$3.26\\ \text{D}_5&=\$3.26×1.12=\$3.65\end{align*}$$

Value of the constant growth dividends:

$$\begin{align*}\text{V}_{5}&=\frac{3.65\times1.06}{11\%-6\%}=77.40\\ \\ \text{V}_0&= \frac{2.28}{(1.11)^1} +\frac{2.60}{(1.11)^2} +\frac{2.91}{(1.11)^3} +\frac{3.26}{(1.11)^4} +\frac{3.63+77.40}{(1.11)^5}\\&=56.52\end{align*}$$

The PV of the terminal value constitutes an overwhelming portion of the total value of the stock, i.e., \(\bigg(81.25\%=\frac{$45.92}{$56.52}\bigg)\).

Question

A company just paid a dividend of $1.50. The dividend is projected to grow at 8% in the next period and linearly decline over the following 6 years to 4% and thereafter remain at that level indefinitely. Using a required rate of return of 10%, the value of the share is closest to:

- $25.

- $36.

- $29.

Solution

The correct answer is C.

$$\begin{align*}\text{V}_0&= \frac{\text{D}_0 (1+\text{g}_{\text{L}} )+\text{D}_0\text{H}(\text{g}_{\text{S}}-\text{g}_{\text{L}})}{\text{r}-\text{g}_{\text{L}}}\\ \\&=\frac{150(1.04)+1.50(3)(0.04)}{0.10-0.04}\\ \\&=29\end{align*}$$

Reading 23: Discounted Dividend Valuation

LOS 23 (l) Calculate and interpret the value of common shares using the two-stage DDM, the H-model, and the three-stage DDM.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.