Information and Sharpe Ratios

Information Ratio The information ratio (IR) is the proportion of the active return... Read More

The quality of financial reports can be viewed from two interrelated perspectives: reporting quality and earnings quality. Reporting quality is concerned with the information disclosed in financial reports. High-quality reporting provides decision-useful information. In other words, it includes information that is both relevant and accurate. Accurate means that the financial reports represent the actual economic situation of the company’s activities during the reporting period and its financial condition at the end of the year. Low reporting quality complicates the assessment of a company’s results, making it hard to make crucial decisions.

On the other hand, a high earnings quality reflects a satisfactory level of return on investment as well as sustainable future earnings. This implies that the company’s underlying performance was value-enhancing and that it had high reporting quality. Conversely, low-quality earnings arise either due to genuinely bad performance or because the reported information misrepresents economic reality. Therefore, high-quality earnings increase the value of a company more than low-quality earnings.

A company could have low-quality earnings while at the same time having a high reporting quality. Consider a hypothetical company whose only source of earnings is a one-off sale of its main product. Although it has low-quality earnings, it could have a high reporting quality if it computed its results correctly and provided decision-useful information. However, experiencing low-quality earnings with high-quality reporting can encourage the company’s management to misreport.

The conceptual framework for examining the quality of a company’s financial reports and locating the company’s financial reports along the quality spectrum calls for answering these two basing questions:

In this case, GAAP is used in a generic sense to refer to the generally accepted accounting principles. Examples of GAAP are IFRS, US GAAP, and other home country accounting standards. In answering the two questions, the aspects of reporting and earnings quality of financial reports can be grouped along a continuum of high to low quality.

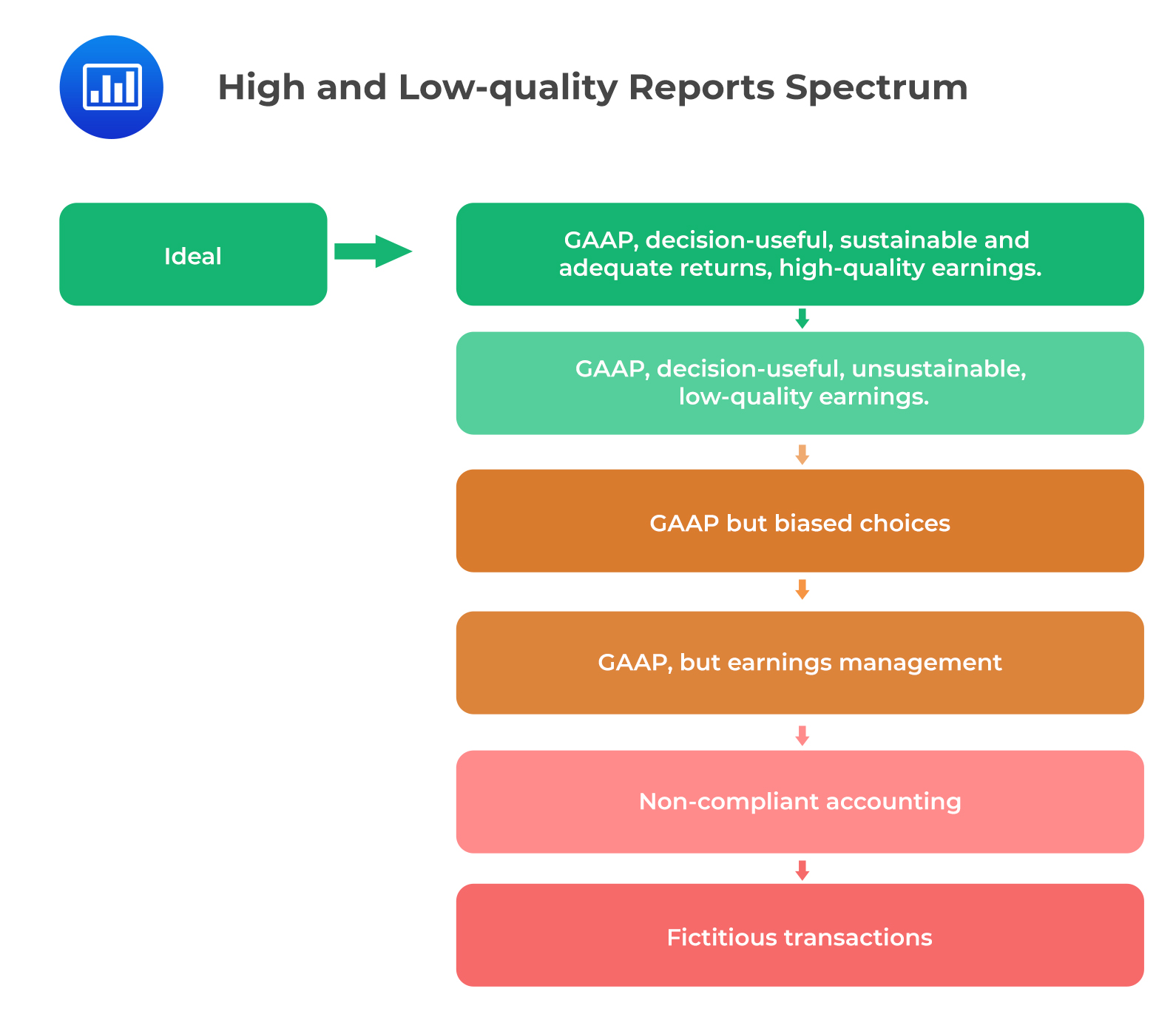

The chart below shows a spectrum that provides a basis for assessing high versus low-quality reports spectrum.

From the above spectrum, any deviation from the highest point can be examined in terms of the two-conceptual question frameworks. For example, a company that provides GAAP-compliant, decision-useful information about low-quality earnings would appear lower on the quality spectrum. The same also applies to companies that are GAAP complaints but have biased choices.

From the above spectrum, any deviation from the highest point can be examined in terms of the two-conceptual question frameworks. For example, a company that provides GAAP-compliant, decision-useful information about low-quality earnings would appear lower on the quality spectrum. The same also applies to companies that are GAAP complaints but have biased choices.

Biased choices provide information that does not accurately represent the company’s economic situation. Consequently, it hinders an investor’s ability to generate accurate forecasts of the future performance of the company. Biased accounting can be seen as “aggressive” if they increase the company’s reported performance and financial position in the current period. They can be deemed as “conservative” if they postpone current earnings to the future. Another type of bias is ‘earnings management’ such as earnings “smoothing,” which means understating earnings volatility relative to the volatility if earnings are represented accurately.

Question

Jose Luis is an equity analyst and wants to analyze the financial statements of Prisma Capital, an investment company in Mexico. Luis first focuses on financial reporting quality by using a conceptual framework that addresses the reporting and earnings quality. Luis deduces that the financial reporting quality spectrum for Prisma Capital is as follows:

Statement 1: Prisma Capital’s financial statements adhere to generally accepted accounting principles (GAAP).

Statement 2: Prisma Capital understates earnings during periods when the company is performing well and overstates earnings during periods of low performance.

Based on Luis conclusions, Prisma Capital’s financial statements can be most likely categorized as:

A. GAAP compliant and decision-useful, with sustainable and adequate returns.

B. GAAP compliant, decision-useful, unsustainable, and satisfactory returns but low-quality earnings.

C. GAAP compliant, but with earnings management.

Solution

The correct answer is C.

Prima Capital earnings are biased. It exhibits earnings “smoothing,” a form of earnings management bias because the company understates earnings during high-performance periods and overstates earnings during low-performance periods.

A and C are incorrect. Biased choices provide information that does not accurately represent the company’s economic situation. Consequently, it hinders an investor’s ability to generate accurate forecasts of the future performance of the company.

Reading 15:Evaluating Quality of Financial Reports

LOS 15 (a) Demonstrate the use of a conceptual framework for assessing the quality of a company’s financial reports.