Computing FCFF and FCFE

Computing FCFF from Net Income FCFF is the cash flow available to... Read More

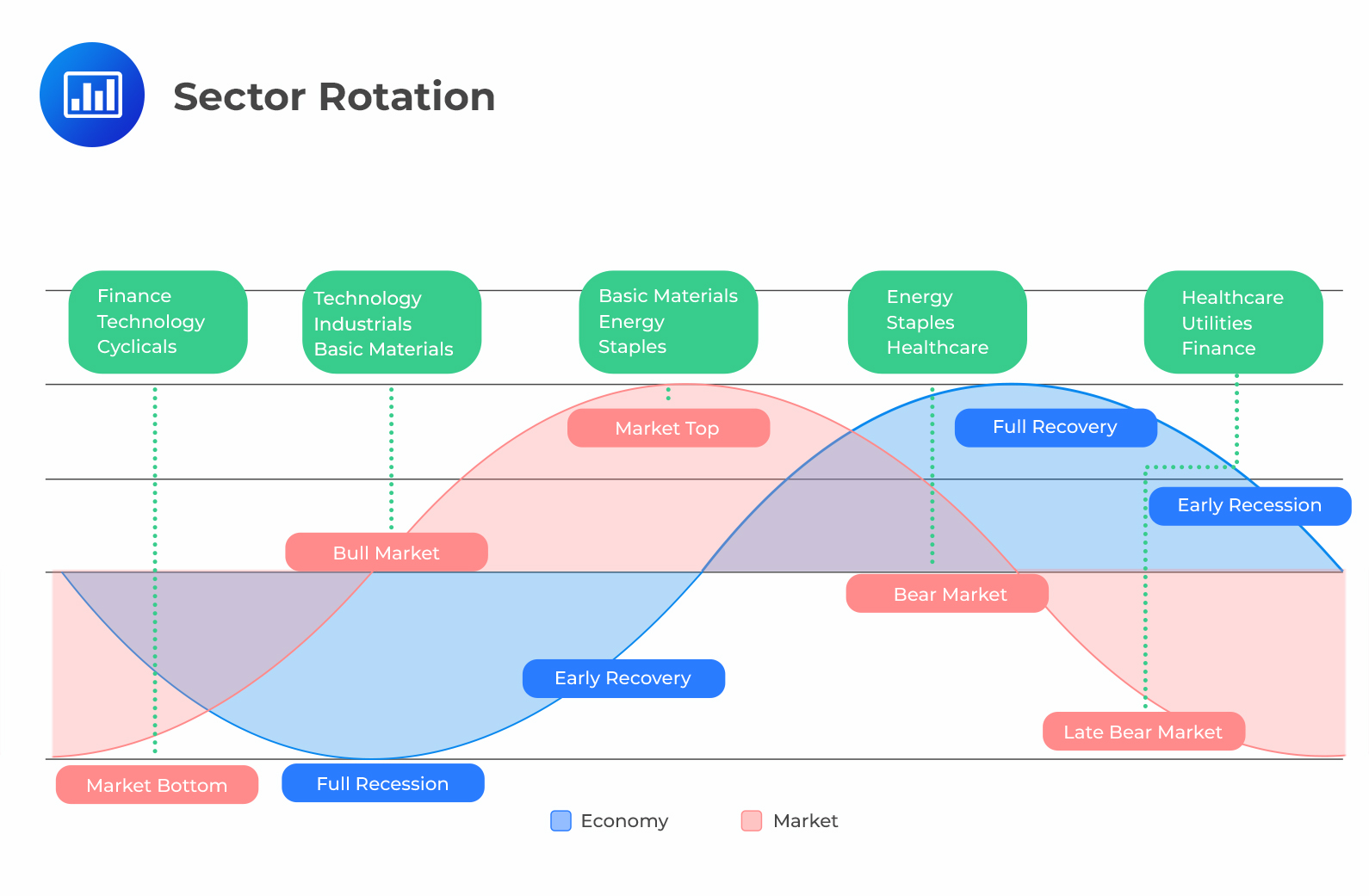

Cyclical equities are very volatile since they follow such economic cycles as recession, expansion, and peak. Growth in the economy implies a subsequent growth in cyclical stocks and vice versa. On the other hand, non-cyclical equities are issued by companies that sell basics that we keep on using even during economic downturns.

The ex-post risk premium on equity sectors is the difference between the average return on a sector and the short-term nominal risk-free rate. Ex-post simply means “after the fact.” Investors usually use historical returns as a measure of future risk to determine the riskiness of a given asset.

The ex-post risk premium on equity sectors is the difference between the average return on a sector and the short-term nominal risk-free rate. Ex-post simply means “after the fact.” Investors usually use historical returns as a measure of future risk to determine the riskiness of a given asset.

There are periods during which one sector outperforms the other.

If investors holding stocks in the underperforming sector could elect to instead hold stocks in the better performing sector before any change in performance is realized, they would generate significant returns. However, it is difficult to get the timing for these switches right in practice. Wrong timing could lead to underperformance against the broad equity market index. Nonetheless, it is valuable for investors to understand the relationship between the economy, different subsectors of financial markets, and the business cycle to improve these rotation strategies.

Question

Assume that the total annualized return generated by the consumer staple goods sector in a given country stock market was 15%; the equivalent value for the consumer discretionary goods sector was 12%. Additionally, the average annualized return that an investor could have achieved from investing in the country’s T-bills over the same period was 5%. Which of the following is most likely correct about the country’s economic sector?

- Cyclical stocks outperformed non-cyclical stocks.

- Non-cyclical stocks outperformed the cyclical stocks.

- The performance of the two sectors is identical.

Solution

The correct answer is B.

Ex-post risk premium on equity sectors is the difference between the average return on a sector and the short-term nominal risk-free rate.

The sector with a higher ex-post risk premium implies that it has outperformed the other.

Ex post risk premium on consumer staple goods = 15% − 5% = 10%.

Ex post risk premium on consumer discretionary goods = 12% − 5% = 7%.

Therefore, non-cyclical stocks (consumer staple goods) outperformed the cyclical stocks (consumer discretionary goods). This is evident because the ex-post risk premium on consumer staple goods is higher relative to that of the consumer discretionary goods.

Reading 43: Economics and Investment Markets

LOS 43 (k) Describe how economic analysis is used in sector rotation strategies.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.