Capital Deepening and Technological Pr ...

Capital deepening is a condition in which an economy’s capital per worker (capital-labor... Read More

The underlying instrument in an interest rate swap is a reference interest rate. Reference rates include the Fed funds rate, Libor, and the rate on benchmark US Treasuries.

Interest rate options are, therefore, options on forward rate agreements (FRAs). An interest rate call option pays off when FRA rises above the exercise rate. The holder pays the exercise rate and receives the reference rate (usually Libor). On the other hand, the interest rate put option pays off if the FRA falls below the exercise rate. The holder pays the reference rate and receives the exercise rate.

Suppose that an interest rate call option expires in one year. The underlying interest rate is an FRA that expires in one year and is based on three-month LIBOR. This FRA is the reference rate used in the Black model.

Options on FRAs use the actual/365 convention. This is unlike FRAs, which generally apply the 30/360 convention.

The values of interest rate call and put options using Black’s Model is given by:

European call: \(c_{0}=(AP)e^{-r(t_{j-1}+t_{m})}[FRA(0,t_{j-1},t_{m})N(d_{1})-R_{K}N(d_{2})]\)

European put: \(p_{0}=(AP)e^{-r(t_{j-1}+t_{m})}[R_{K}N(-d_{2})-FRA(0,t_{j-1},t_{m})N(-d_{1})]\)

$$d_{1}=\frac{ln\bigg[\frac{FRA(0,t_{j-1},t_{m}}{R_{K}}\bigg]+\bigg(\frac{\sigma^{2}}{2}\bigg)t_{j-1}}{\sigma\sqrt{t_{j-1}}}$$

And

$$d_{2}=d_{1}-\sigma\sqrt{t_{j-1}}$$

\(FRA(0,t_{j-1},t_{m})\) is the fixed rate on an FRA at time 0 that expires at the time \(t_{j-1}\) where the underlying matures at time \(t_{j-1}+t_{m}\), with all times expressed on an annual basis.

\(R_{K}\) is the exercise rate expressed on an annual basis

\(\sigma\) is the underlying FRA interest rate volatility

\(AP\) is the accrual period in years

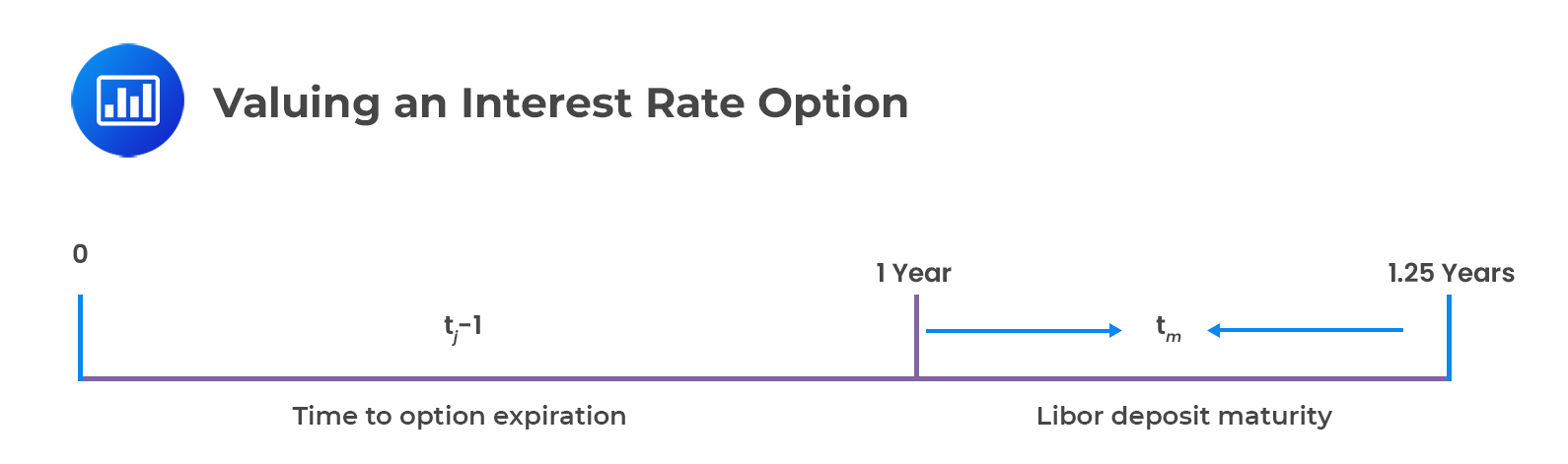

An interest rate call option expires in one year. The underlying interest rate is an FRA that expires in one year and is based on a three-month LIBOR. This FRA is the underlying rate used in the Black model.

The above information is illustrated below;

The value of a European call option can then be calculated using the formula:

The value of a European call option can then be calculated using the formula:

European call: \(C_{0}=(AP)e^{-r(1.25)}[FRA(0,1,0.25)N(d_{1}-R_{K}N(d_{1})]\)

Where FRA (0,1,0.25) is the FRA rate at time 0 that expires in time one and is based on 0.25-year Libor

Notice the following from the interest rate option valuation model:

A swap option (swap option) is an option on a swap that gives the owner the right but not the obligation to enter an interest rate swap at a predetermined swap rate (exercise rate).

A payer swaption is a swaption to pay fixed, receive floating, while a receiver swaption is a swaption to receive fixed, pay floating. The buyer of a payer swaption option gains when the fixed-rate goes up before the swaption expires. On the other hand, a receiver swaption has a positive value if the market swap fixed-rate at expiration is less than the exercise rate. When exercised, the buyer of a payer swap option can enter into a pay-fixed, receive floating swap at the predetermined swap rate, \(R_{K}\).

The payer swaption buyer may immediately enter an offsetting at-the market receive fixed and pay floating swaption at a higher (current) fixed swap rate. The floating legs cancel out. The investor is now left with an annuity of the difference between the current fixed swap rate and the lower swaption exercise rate.

The present value of this annuity is given by:

$$\text{Present value of an annuity (PVA)}=\sum_{j=1}^{n}PV_{0},t_{j}(1)$$

The values of a payer and receiver swaptions are determined as follows:

$$PAY_{SWN}=(AP)PVA[R_{FIX}N(d_{1})-R_{K}N(d_{2})]$$

$$REC_{SWN}=(AP)PVA[R_{K}N(-d_{2})-R_{FIX}N(-d_{1})]$$

Where:

$$d_{1}=\frac{ln\bigg(\frac{R_{FIX}}{R_{K}}\bigg)+\frac{\sigma^{2}}{2}T}{\sigma\sqrt{T}}$$

And

$$d_{2}=d_{1}-\sigma\sqrt{T}$$

\(R_{FIX}\) is the fixed swap rate starting when the swaption expires

\(T\) is the swaption expiration quoted on an annual basis

\(R_{K}\) is the exercise rate starting at time T (annual basis)

AP is the accrual period. If the swap is settled quarterly, \(AP=\frac{90}{360}\)

\(\sigma\) is the volatility of the forward swap rate

The swaption valuation model has the following features that make it different from the standard Black model:

Consider a European payer swaption that expires in one year. The underlying is a five-year swap with a fixed rate of 6% that makes annual payments. At the swaption expiry in one year, the fixed rate of a five-year annual pay swap is 7%.

\(R_{K}\), the exercise rate, \(6\%\)

\(R_{FIX}\), the fixed swap rate starting when the swaption expires, \(=7\%\)

The buyer of the payer swaption can benefit by entering a five-year swap at a fixed rate of 6% even though the market rate is higher, at 7%. The buyer is now left with an annuity of the difference between the current fixed swap rate (7%) and the lower swaption exercise rate (6%).

Question

A payer swaption is most likely interpreted as:

- The difference between bond component and swap component

- The difference between the swap component and bond component

- The sum of the swap component and bond component

Solution

The correct answer is B:

The formula for the payer swaption value is:

$$PAY_{SWN}=(AP)PVA[R_{FIX}N(d_{1})-R_{K}N(d_{2})]$$

Where \((AP)PVA(R_{FIX})N(d_{1}))\) is the swap component and \((AP)PVA(R_{K})N(d_{2})\) is the bond component. Thus, the payer swaption model value is the swap component minus the bond component.

The following formula gives the receiver swaption model value:

$$REC_{SWN}=(AP)PVA[R_{K}N(-d_{2})-R_{FIX}N(-d_{1})]$$

Where:

\((AP)PVA(R_{FIX})N(-d_{1})\) is the swap component and \((AP)PVA(R_{K})N(-d_{2}\) is the bond component.

This, the receiver swaption model value is the bond component minus the swap component.

Reading 38: Valuation of Contingent Claims

LOS 38 (j) describe how the Black model is used to value European interest rate options and European swaptions;