Extensions of VaR

Conditional Value at Risk (CVaR) Rockafellar and Uryasev introduced conditional value-at-risk (CVaR) in... Read More

A credit event is an event that triggers the default of a bond. The CDS seller must purchase the defaulted bonds at their face value from the CDS buyer in case of a credit event.

The International Swaps and Derivatives Association (ISDA) is the unofficial governing body of the CDS market. The ISDA outlines the following types of credit events:

Bankruptcy is a legal procedure that forces creditors to defer their claims. This can happen when the reference entity becomes insolvent or is unable to fulfill its debt obligations.

The reference entity fails to meet one or more payment obligations (principal or interest) after applying any applicable grace period without filing for formal bankruptcy.

This involves altering the terms of the obligation involuntarily to make the new terms less attractive to the debt holder. These events may include:

This involves disputing the validity of the contract or imposing a temporary suspension of activity on the reference entity.

In a credit event, both the buyer and seller of the CDS have the right, but not the obligation to settle. CDS settlement can be done in the form of a physical or cash delivery.

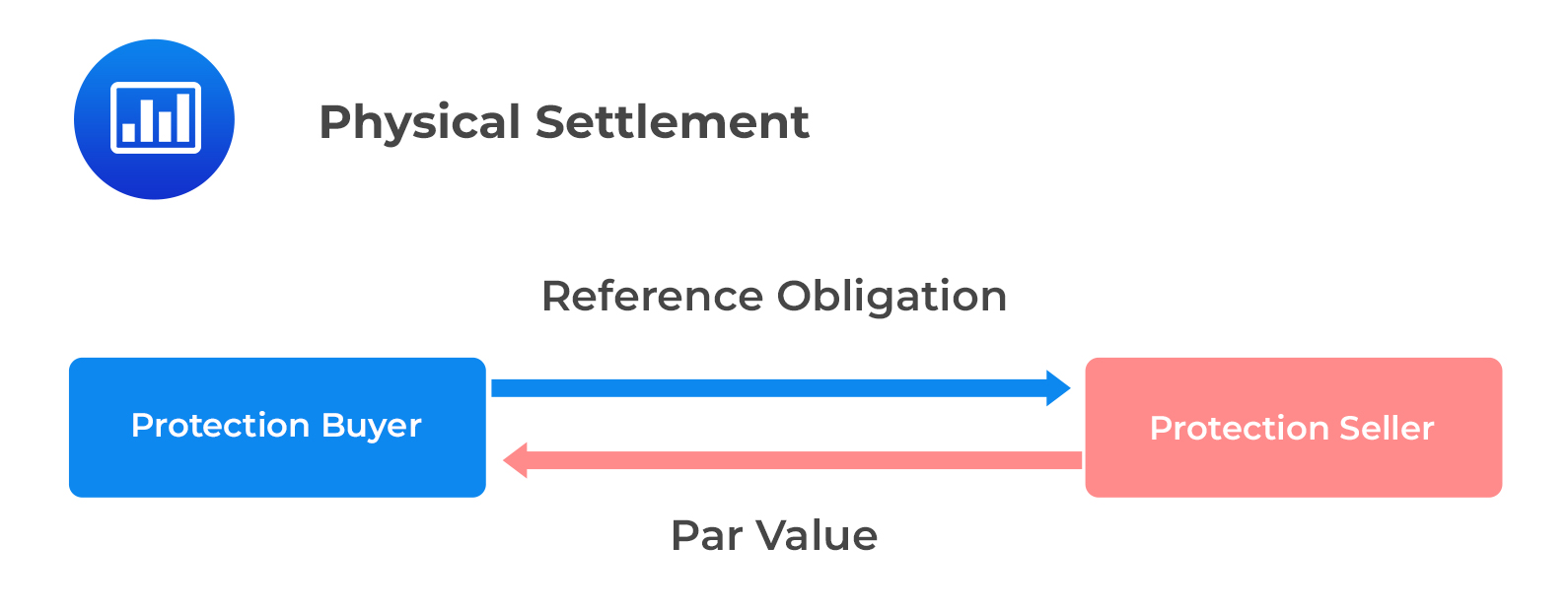

Physical settlement involves the actual delivery of the debt instrument in exchange for a payment by the credit protection seller of the notional amount of the contract. This mode of settlement is uncommon.

Cash Settlement

Cash SettlementCash delivery is the most common settlement method for CDS contracts. Here, the credit protection seller pays cash to the credit protection buyer following a credit event.

The recovery rate is the proportion of the defaulted amount that can be recovered through bankruptcy proceedings or some other settlement form. The payout ratio, which is the complement of the recovery rate, is the estimate of the expected credit loss.

The recovery rate is the proportion of the defaulted amount that can be recovered through bankruptcy proceedings or some other settlement form. The payout ratio, which is the complement of the recovery rate, is the estimate of the expected credit loss.

$$ \text{Payout ratio}=1-\text{Recovery rate} $$

The rest of the settlement amount is determined by an auction involving major banks and dealers to choose the cheapest-to-deliver defaulted debt.

The payout amount is the product of the payout ratio and the notional amount.

$$ \text{Payout amount}=\text{Payout ratio} \times \text{Notional amount} $$

Question

A company with two subordinated unsecured senior debts outstanding has filed for bankruptcy, triggering CDS contracts. Bond A is trading at 30% of par, and Bond B is trading at 40% of par. The recovery rate for both CDS contracts is closest to:

- 30%.

- 40%.

- 50%.

Solution

The correct answer is A.

The recovery rate is 30% for both CDS contracts since Bond A is the cheapest- to-deliver obligation.

Reading 32: Credit Default Swaps

LOS 32 (b) Describe credit events and settlement protocols with respect to CDS.