Active Currency Trading Strategies

This section will explore tactical decisions a portfolio manager can make regarding currency... Read More

Convergence refers to a situation where countries with low per capita incomes grow faster than countries with high per capita incomes. Consequently, with time, the per capita income for developing countries converges with that of developed countries.

The neoclassical growth theory forecasts unconditional and conditional convergence. The endogenous growth model, however, does not predict any occurrence of convergence.

Absolute Convergence

The Absolute convergence implies that the developing countries, despite their unique features, will grow and eventually attain the developed countries’ per capita income. Since the neoclassical model assumes that all countries have the same level of technology, the per capita income in all countries should grow at the same rate. However, neoclassical growth theory means that the per capita income level will be equal in all countries, given the prevailing characteristics (does not insinuate the absolute convergence).

Conditional Convergence

Conditional convergence is where the convergence is dependent on countries that have equal saving rates, population growth rates, and production functions. If these conditions hold, the neoclassical growth theory will imply convergence to the same per capita output and steady-state growth rate.

Club Convergence

Club convergence implies a group (club) of only rich and middle-income countries whose income converges to that of the wealthiest country in the world. Therefore, member countries of the club with low per capita income will grow faster than the non-members. Emerging countries will only join the club if they execute necessary institutional changes. If the new members fail to implement these changes, they will fall into a non-convergence gap.

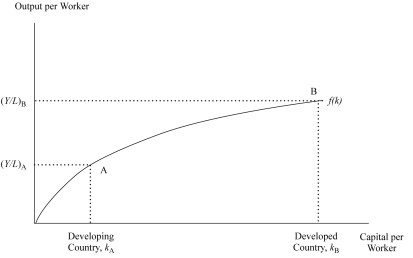

Capital deepening and accumulation: Developed countries are almost at the flattened point of the production function (point B). This implies that more capital injection will not impact output much. On the other hand, developing countries operate at the lowest point of the production function(point A), as seen in the graph below. Therefore, any capital injection will have a positive impact on the output.

Question 1

A developing country is concerned about its illiteracy and the low standard of living. The government appoints a committee to benchmark an advanced country and develop strategies to increase the country’s output.

Which of the following plans considered by the committee will most likely delay convergence with the advanced (developed) country?

- Creation of policies that encourage the return of highly educated citizens.

- Enforcing high tariffs on imports to protect the growing local industries.

- Use of external debt to improve transport and manufacturing infrastructure.

Solution

The correct answer is B.

Enforcing high tariffs on imports to protect the growing local industries will discourage growth, and thus it is not supportive of convergence with developed economies.

Question 2

An economic researcher asserts that “many countries with the same population growth rate, savings rate, and production function will eventually have growth rates that converge over time.” The convergence the researcher has described is most likely to be:

- Conditional convergence.

- Absolute convergence.

- Club convergence.

Solution

The correct answer is A.

Conditional convergence depends on countries with the same saving rate, population growth rate, and production function. If this condition holds, then the neoclassical model implies convergence to the same per capita output and steady-state growth rate.

Reading 9: Economic Growth

LOS 9 (j) Explain and evaluate convergence hypotheses.