Forecasting Free Cash Flow to the Firm ...

Forecasting FCFF and FCFE There are two approaches used to forecast FCFF... Read More

Backward induction involves working backward from maturity to time 0 to determine a bond’s value at each node. It makes the following assumptions:

$$V=0.5\left[\frac{V_u+C}{1+i}+\frac{V_d+C}{1+i}\right] $$

Where:

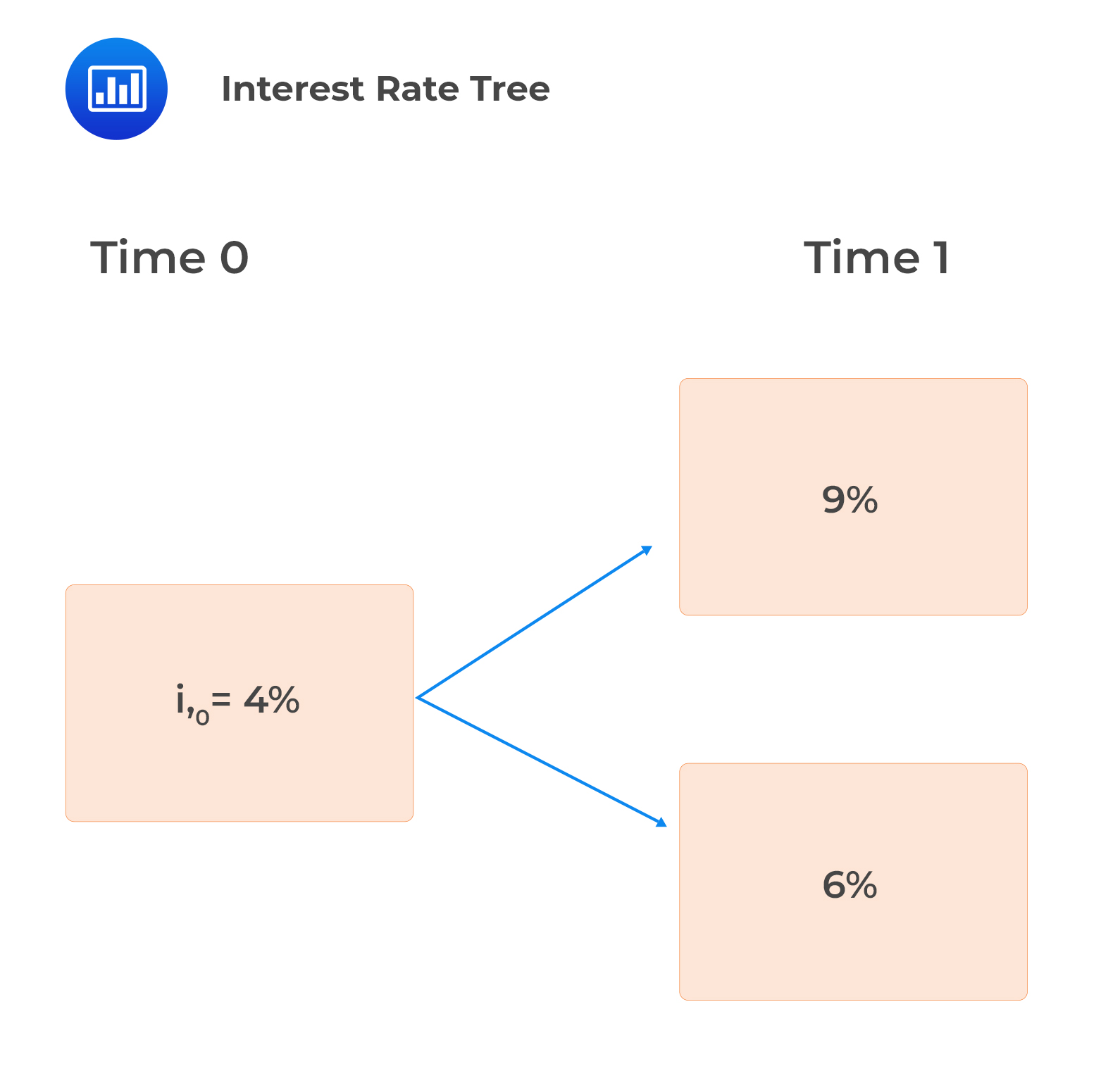

A two-year bond with no embedded options pays 8% annual coupons. Given the following interest rate tree, find the values of the bond at each node, i.e., \(V_{1,u},\) \(V_{1,d}\) and \(V_0\).

Solution

Solution

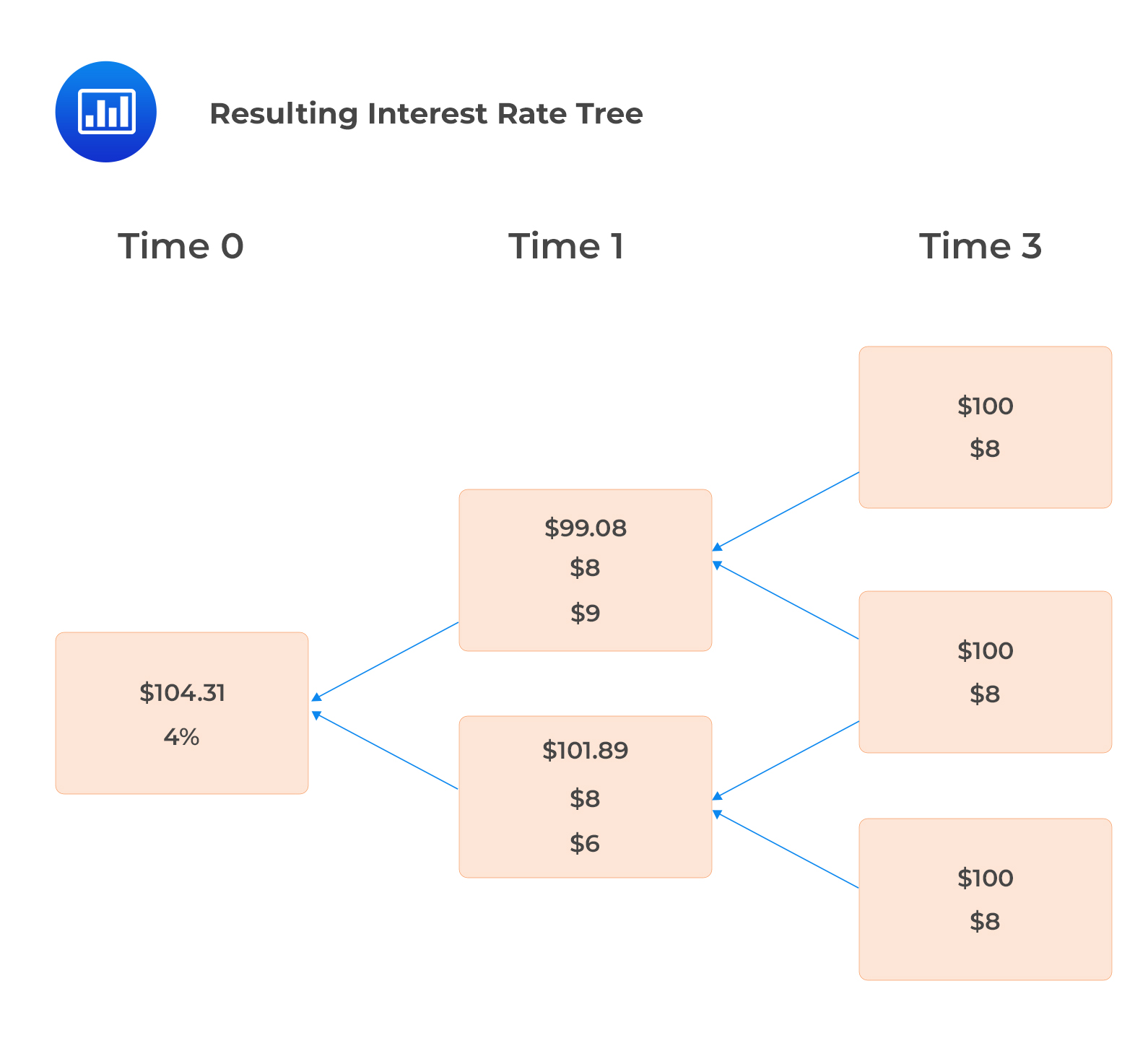

$$ \begin{align*} V_{1,u} &=0.5\times\left[\frac{100+8}{1.09}+\frac{100+8}{1.09}\right]=$99.08 \\ V_{1,d}& =0.5\times\left[\frac{100+8}{1.06}+\frac{100+8}{1.06}\right]=$101.89 \text{ and}\\ V_0 &=0.5\times\left[\frac{99.08+8}{1.04}+\frac{101.89+8}{1.04}\right]=$104.31 \end{align*} $$

The resulting interest rate tree is as shown below:

Question

Exhibit 1 is a binomial interest rate tree related to a bond with annual coupons of 4% with a face value of $100 that matures in three years.

Based on Exhibit 1, the price of the bond is closest to:

- $101.90.

- $103.87.

- $105.51.

Solution

The correct answer is C.

$$ V=0.5\left[\frac{V_u+C}{1+i}+\frac{V_d+C}{1+i}\right] $$

The cash flow at Time 3 is 104, the redemption of par value ($100) plus the final coupon payment ($4)

Node values for time two are determined as follows:

$$ \begin{align*} & \text{Upper node: }\frac{104}{1.03}=100.97 \\ & \text{Middle node: }\frac{104}{1.02}= 101.96 \\ & \text{Lower node: }\frac{104}{1.01}= 102.97 \end{align*} $$

Time 1

$$ \begin{align*} & \text{Upper node: } 0.5\times\left(\frac{100.97+4}{1.035}+\frac{101.96+4}{1.035}\right)= 101.90 \\ & \text{Lower node: } 0.5\times\left(\frac{101.96+4}{1.025}+\frac{102.97+4}{1.025}\right)= 103.87 \end{align*} $$

Time 0

$$ \text{Node value: } 0.5\times\left(\frac{101.90+4}{1.013}+\frac{103.87+4}{1.013}\right)= 105.51 $$

Therefore, the price of the bond is $105.51.

This can be shown in the interest rate tree framework.

Reading 29: The Arbitrage-Free Valuation Framework

LOS 29 (e) Describe the backward induction valuation methodology and calculate the value of a fixed-income instrument given its cash flow at each node.