How Does the CFA Institute® Grade CFA® Exams?

If you are a CFA exam candidate, you are probably concerned about how easy it is to pass your exam and how the CFA Institute grades the exams. The CFA Institute applies a unique methodology to come up with a…

Frequently Asked Questions on the CFA Level III® Exam

Congratulations on passing the first two levels of the CFA® exam. If you are a CFA level III candidate, you are familiar with the CFA exam and have more confidence in passing the exam. As you take the final exam…

Five Reasons Why You Should Pursue A CFA® Charter

Financial certifications are a great way to enhance your C.V and help you progress in your career in the financial industry. Earning a CFA® charter is a globally recognized certification for financial analysts and investment management that will give you…

A Simple Step by Step Guide to Prepare for Your CFA® Level III Exam

Congratulations on passing your CFA® level I and level II exams. While it was not easy to get here, only one level remains towards attaining your CFA charter. As you prepare for the final level of the CFA exams, here…

A Simple Step by Step Guide to Prepare for Your CFA® Level II Exam

Congratulations on passing your CFA® Level I exam. CFA students are brilliant and aim for the best, just as you are. To achieve success, you need to be focused and have an innovative study plan. As you prepare for level…

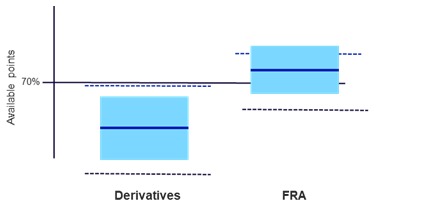

The New Format of Interpreting your CFA® Result

During December 2017 sitting, the CFA® institute changed the way they would report CFA candidate results. The institution introduced the new format because it gave candidates a wealth of information on their overall performance. In addition, the new format allows…

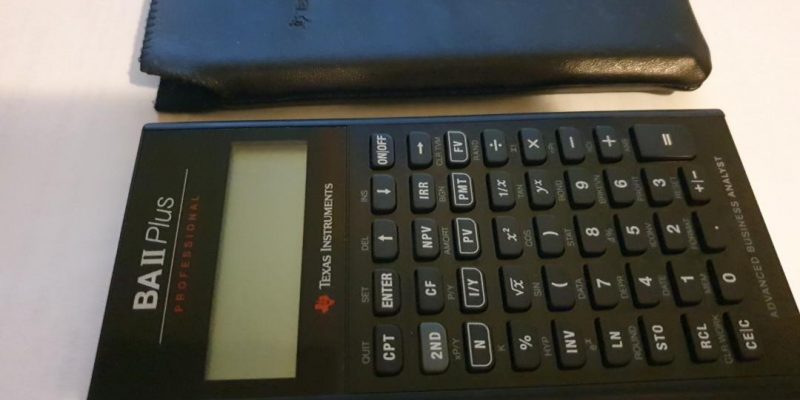

Advanced Calculator Functions using the TI BA11 Plus Calculator for the CFA® Exam

During a CFA® Exam, speed and accuracy matter, and candidates should invest their time learning how to use the TI BA11 Plus Calculator more effectively to employ its capability. This calculator is the ultimate choice for candidates sitting for CFA…

What is the Difference between the CFA® Charter and CFP Mark?

Whether you are considering a career in finance or are a professional, you have probably heard about CFA and CFP designations. If you wonder what they mean and which designation is the right fit for you, we have the answers…

A Step By Step Guide on How to Become an Equity Analyst

Equity analysts, also referred to as stock analysts, focus on stock markets and research how companies perform in the securities market. Moreover, equity analysts in corporate finance assess companies within their portfolios. Other roles of equity analysts include preparing reports…