Portfolio Return and Variance (Calculations for CFA® and FRM® Exams)

Portfolio Expected Return Portfolio expected return is the sum of each of the individual asset’s expected return multiplied by its associated weight. Thus: $${E(R_p)}=\sum{w_ir_i}$$ Where: \(i\) = 1, 2, 3, …, n; \(w_i\) = the weight attached to asset i;…

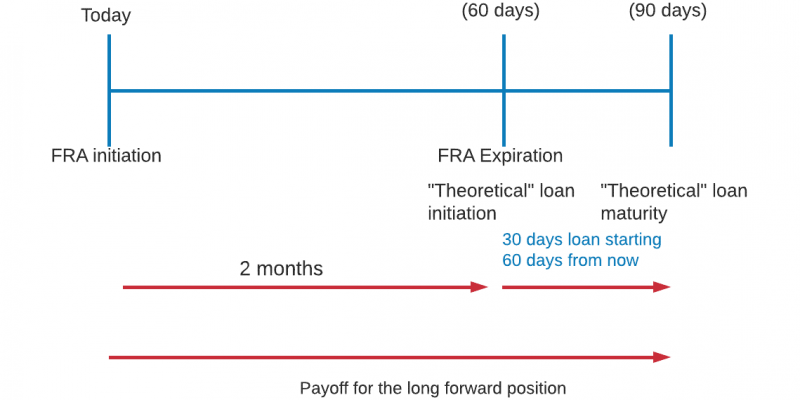

Beta and CAPM

Beta Beta is a measure of systematic risk, which refers to the risk inherent to the entire financial market. This is the risk that you cannot get rid of by diversifying across different securities. A common misconception is that Beta…

FRM Exam Preparation

The world is currently in a dark place with the ongoing rise in coronavirus cases. The adverse effects brought about by the pandemic are despicable. People and industries alike have been affected. There is an imminent risk of companies going…

Necessary Skills Needed to Pass the CFA® Exams

In this article, we are assuming that you are already enrolled in the CFA® Program, and if not, you are an aspiring CFA Program candidate. Most, if not all, CFA Program candidates wish to pass their CFA exams on their…

CFA® Exam Grading

The long wait for the release of CFA® exam scores by CFA Institute can be a period filled with a lot of uncertainty. Did you pass the exams? Did you not? Should you be saving up for the next level…