What are the differences between the T ...

The three CFA exam levels are progressive, and you need to pass the... Read More

The CFA Institute has diligently tracked CFA exam pass rates dating back to 1963, the year when only a single test was available for the 284 candidates to take. Of these, just 16 candidates failed, which marks the beginning of what would become a rigorous journey for aspiring finance professionals. If you’re curious about how you might have fared, you can actually take the very first CFA exam on the CFA Institute’s website. Fast forward to 2016, and the landscape had dramatically changed, with 107,591 tests failing that year.

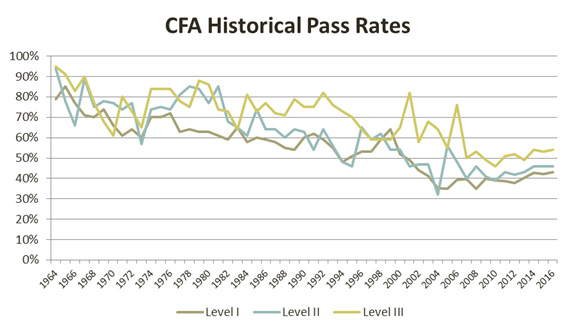

This remarkable growth in the popularity of the CFA exam correlates with a significant decline in CFA passing rates over the decades. Since the implementation of the three-test system in 1964, the CFA level 1 pass rate has shown notable fluctuations. However, since around 2008, pass rates for CFA exams across all three levels appear to have stabilized somewhat, even beginning to wander upward.

A striking trend evident from historical data is the difference in performance between the levels. Candidates sitting for Level III tend to outperform those in Level II, who in turn outperform Level I candidates. In essence, this means that the CFA level 2 pass rate is typically higher than the CFA level 1 passing score, and the CFA level 3 passing rate usually leads the pack. This pattern raises an important question: how hard is the CFA? Understanding CFA exam difficulty and the trends in CFA historical pass rates can be pivotal in strategizing your preparation.

Ultimately, these insights can shed light on what to expect and how to prepare effectively for the CFA test pass rate, helping you navigate the challenges ahead on your path to earning this prestigious credential.

Figure 1*

*All data on Level I pass rates is an aggregated pass rate for both June and December tests from 2003 to the present.

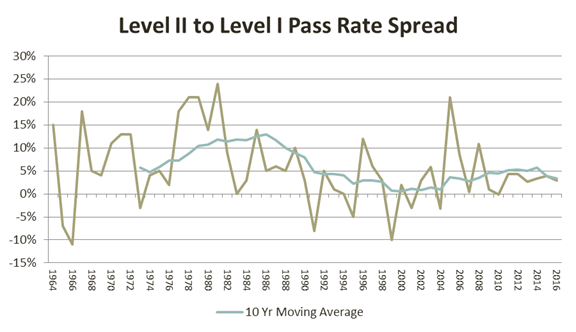

Figure 2

The chart above examines the spread between the CFA level 2 pass rate and the CFA level 1 pass rate over time, calculated as (Level II pass rate – Level I pass rate). While Figure 1 illustrates yearly fluctuations, it may not clearly depict some intriguing shifts in the CFA exam pass rates between these two levels. By 1973, Level II candidates enjoyed an average pass rate that was 6% higher than that of Level I candidates over the trailing 10 years (including 1973).

Fast forward to 1985, and this advantage ballooned to approximately 13% before experiencing a dramatic drop to 2% just ten years later. Notably, from 1983 through 2004, the difference between Level II pass rates and Level I pass rates averaged a mere 2.5%. However, over the past decade, this spread has slightly increased, stabilizing around 4-5%.

It’s logical that these spreads would compress as overall CFA pass rates declined, yet this alone doesn’t fully explain the changing pass rates for CFA exams over time. Another possibility is that many of the fluctuations might simply be statistical noise, revealing little about the underlying trends in CFA historical pass rates.

Understanding these dynamics is crucial, especially as candidates strategize their preparation for the CFA test pass rate and aim for success in their respective levels. The historical context surrounding CFA level pass rates can provide valuable insights into what candidates can expect as they embark on their CFA journey.

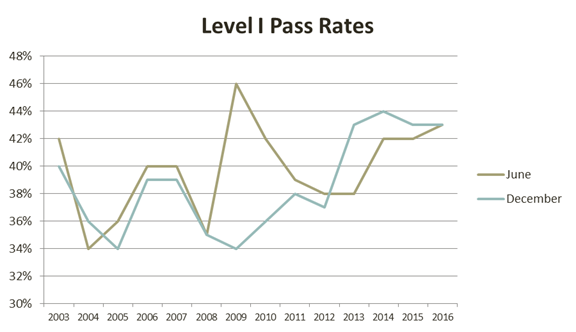

In 2003, the CFA Institute introduced a significant change by offering candidates the option to sign up for the CFA Level 1 exam in December, alongside the traditional June offering for all three levels. This adjustment sparked curiosity among candidates regarding the CFA level 1 pass rate during these two testing periods. Many candidates still hear that CFA exam pass rates in June tend to be significantly higher than those in December.

However, aside from a remarkable outperformance by June test-takers in 2009, the data does not reveal a consistent trend in the CFA Level 1 passing rate over the years. The fluctuations in CFA Level 1 pass rates between the two periods often vary without a clear pattern, which can lead to some confusion for prospective candidates.

As you navigate your preparation for the CFA exam, it’s crucial to consider these dynamics, understanding that while pass rates for CFA exams can offer some guidance, they do not define your potential for success. Ultimately, your preparation and commitment to mastering the material will play a far more critical role than the month in which you choose to take the exam.

Figure 3

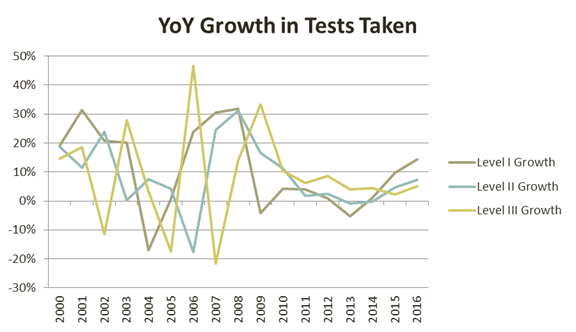

Furthermore, you may expect the introduction of a second Level I exam to boost the number of Levels I candidates, but this has not been the case either.

Figure 4

The number of CFA Level 1 tests administered in 2003 continued to grow at a similar rate as in previous years; however, this growth experienced a significant drop-off in 2004. This pattern aligns with the trend observed in CFA exam pass rates, where high growth in Level I tests typically leads to a corresponding increase in CFA Level 2 pass rates the following year, eventually impacting Level 3 pass rates two years later.

Between 2009 and 2014, the growth in Level I exams taken remained relatively flat. However, there was a noticeable uptick in the number of candidates registering for the CFA Level 1 exam in 2015 and 2016. This resurgence suggests a renewed interest in pursuing the CFA charter, which is vital for professionals seeking to enhance their credibility and career prospects in the finance industry.

Understanding these trends is essential, especially when considering how fluctuations in the number of candidates can impact the CFA passing rate. Higher registration numbers can lead to a more competitive atmosphere, influencing not just your preparation strategy but also your mindset as you approach the exam.

To provide context for the CFA exam pass rates, it’s valuable to reflect on the evolution of this rigorous examination since its humble beginnings in 1963.

In that inaugural year, the Level III examination consisted of just four questions, focusing on essential topics such as individual portfolio management, stock valuation, bond valuation, and a choice between a final question on either bonds or stocks. This foundational structure laid the groundwork for the CFA exam that candidates face today.

By 1964, ethics was introduced into all three examinations, marking a pivotal moment in the program’s history. The broad objectives of each exam mirrored those that candidates encounter today: Level I assessed the analyst’s capacity to present factual information, while Level II challenged candidates to draw insightful conclusions from this data. Specifically, Level I candidates had to demonstrate their ability to present stock and bond analyses, evaluate management, and perform essential financial calculations. Meanwhile, Level II candidates were required to project earnings and dividends, grasp capital budgeting and cost of capital concepts, value stocks, and develop both quantitative and qualitative risk assessments. Level III candidates concentrated on portfolio management, synthesizing the knowledge gained from the previous two levels.

Modern Portfolio Theory emerged as a cornerstone of the CFA Level 2 exam and Level 3 exam, with candidates expected to master portfolio construction and asset allocation to meet client needs effectively. During the late 1960s, there was a notable shift in the demographics of the candidate pool. In 1965, only 22% of candidates were under 50 years old, but by 1969, this figure had skyrocketed to 74%. This demographic transformation signified that most candidates possessed diverse training backgrounds and varied expectations of the CFA program compared to their predecessors.

In 1969, the CFA Level 1 exam first assessed candidates on their proficiency in using computers for financial calculations. The early 1970s saw a significant overhaul of the CFA program’s Code of Ethics, and quantitative techniques along with financial analysis became dedicated subjects within the curriculum. Nancy Regan noted in The Institute of Chartered Financial Analyst: A Twenty-Five Year History that “[by] the mid-1970s, the CFA exam Candidate Program had come to be recognized as the standard of professionalism in the industry.”

When Jay Vawter took on the role of chairman of the Council of Examiners in 1978, he emphasized the necessity for candidates to not only possess factual knowledge but also to apply this knowledge in practical scenarios. This objective had always been integral to the CFA exam, but Vawter’s leadership reinforced the continuity of the three levels, ensuring that the Level III exam became increasingly focused on judgment rather than mere memorization.

Beyond structural changes, the content of the CFA exam evolved in response to a rapidly expanding body of financial knowledge. In 1980, the sections on portfolio management, economics, and fixed-income securities underwent significant revisions. William Cornish, at the conclusion of his 1979-1980 ICFA presidency, expressed skepticism that “Rip Van Winkle, C.F.A., of the Class of 1963, could awaken and pass any examination in 1980.”

As the CFA charter gained prominence within the financial industry and the role of the financial analyst expanded, the CFA exam witnessed an influx of new candidates throughout the 1980s. The sheer number of new candidates strained the ICFA’s resources consistently throughout the decade. However, the growth during the 1980s was eclipsed by the surge of exams taken in the 1990s.

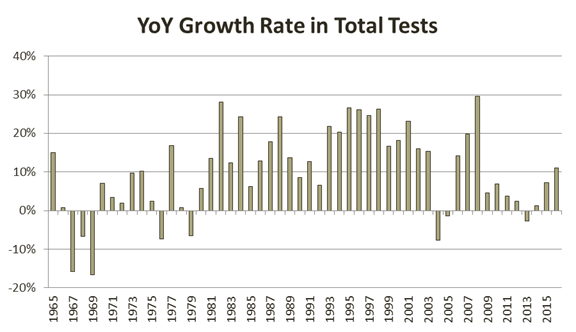

Figure 5

Throughout much of the 1990s, the total number of CFA examinations taken increased by over 20% per year. Interestingly, this rapid annual growth still did not outpace the CFA exam pass rates seen in 2008, which recorded a gain of nearly 30%. In the early 1990s, the CFA Program curriculum underwent a significant realignment, incorporating a new Body of Knowledge into Level I of the program. By 1996, the CFA Level 1 exam had transitioned entirely to a multiple-choice format, marking a pivotal shift in how candidates would approach their studies and prepare for the CFA exam.

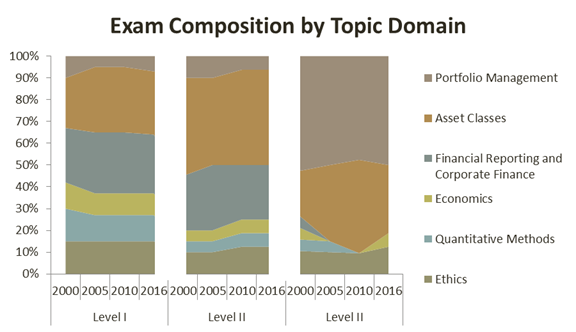

Figure 6*

*Category ranges have been adjusted to a total of 100%. Financial Reporting and Corporate Finance have been combined to compare all years. Additionally, Equity Investments, Fixed Income, Derivatives, and Alternative Investments have also been combined into “Asset Classes.”

In the early 2000s, Corporate Finance emerged as a significant topic domain on its own, whereas it had previously been grouped with accounting. The accounting topic evolved during this period, transitioning to “financial statement analysis” and later “financial reporting and analysis.” At the beginning of the century, the CFA exam still grouped asset classes together into a single topic with a target weight, but by 2007, each major asset class was assigned its own target weighting. Notably, the derivatives asset class was promoted to a major category alongside equities, fixed income, and alternative investments.

Throughout the 2000s, the portfolio management topic was expanded to encompass wealth planning, reflecting the rising popularity of defined contribution plans and the concurrent decline of defined benefit plans. Consequently, financial reporting, corporate finance, and quantitative methods were eventually removed entirely from the Level III exam.

Item set questions were introduced into the Level II and Level III exams in 2000. By 2005, the Level II exam was comprised solely of item-set questions. The constructed response (essay) questions in the Level III exam have also evolved to become more specific and less open-ended. The essay questions today are certainly a far cry from the broad equity or fixed-income essay questions of the 1963 exam.

Other notable changes throughout the 2000s include the implementation of the Global Investment Performance Standards, which replaced the AIMR Performance Presentation Standards in 2005. There was also an increased focus on the International Financial Reporting Standards (IFRS), a general shift from specific accounting topics towards financial analysis, the expansion of relative valuation techniques, the introduction of fixed-income hedging methodologies, more material on various alternative investments (private equity, commodities, and hedge funds), and the addition of behavioral finance topics.

While the scope of knowledge required of CFA exam candidates has certainly increased over the years, the continuous changes to the exam’s content over more than 50 years may not fully explain the plummeting pass rates. So, is there a reason for this decline?

In explaining the decrease in pass rates from 2000 to 2015, the CFA Institute claims (in The CFA Program: Where Theory Meets Practice) that:

“Falling pass rates reflect the expansion of the candidate pool and related shifts in academic and professional experience, the steady evolution of the CBOK [Candidate Body of Knowledge] supporting the investment management profession, and candidate preparation practices.”

The CFA Institute’s perspective suggests that the falling pass rates indicate more about the candidates than the exams themselves. Certainly, the candidate pool has continued to expand, and the experience level of the average candidate has likely trended downwards (though there’s no hard data to support this assumption). There is no implication from the quote that the exam has become intentionally more difficult. Perhaps the material that candidates must know has become more complex or broader in nature, but the bar is not being set higher purely to push pass rates below a targeted level. This explanation is reasonable, as the CFA Institute’s criteria is based on what constitutes a qualified analyst rather than on how many candidates should reasonably be expected to pass each year.

Regarding the reference to candidate preparation practices, this remains uncertain. The June 2015 CFA Program Candidate Survey Report shows a slight increase in hours studied from 2010 to 2015, with non-CFA Institute preparatory materials (which have likely gained in popularity in recent decades due to the abundance of content available online) being among the most effective resources for candidates preparing for their exams. Of course, this primarily sheds light on recent history and doesn’t inform us of long-term shifts in study methodologies.

Some believe that the CFA Institute has made the exams more difficult for its own benefit. After all, more failed candidates in one year likely generate more retakes of the exam the following year. There exists an unavoidable conflict of interest in the CFA Institute’s model of both selling admission to the exams and grading them. That said, many people are involved in setting the standards for each exam every year, making it unlikely that there is a coordinated effort to keep pass rates artificially low.

Regardless of the reasons behind the past decline in pass rates, it is noteworthy that they have actually stabilized and begun to inch up over the last few years. Perhaps the slowing growth in tests taken since the Global Financial Crisis (GFC) reflects declining interest among “casual” candidates, or maybe a larger proportion of unsuccessful candidates are opting out of the program. It will be interesting to continue monitoring the pass rates going forward, and hopefully gain some more data-backed insight that currently seems to be lacking.

1. What is the CFA Level 1 Pass Rate?

The CFA Level 1 pass rate is an important metric for candidates to understand. It represents the percentage of candidates who successfully pass the first exam in the CFA Program. Recently, pass rates have trended lower, reflecting the increasing diversity of candidates and their preparation levels. Why is this significant? It provides insight into the difficulty of the exam and the preparation required to succeed.

2. How Have CFA Pass Rates Changed Over the Years?

Looking at CFA historical pass rates, how have they evolved? CFA pass rates by year have seen significant changes, particularly for Level 1, where pass rates have declined as the exam has become more widely accessible. Meanwhile, Level 2 and 3 pass rates have remained relatively steady. Analyzing these trends helps candidates understand how the exam’s difficulty and candidate preparation have shifted over time.

3. What Do Current CFA Pass Rates Mean for Future Candidates?

How should candidates interpret the CFA exam pass rates? The CFA passing rate provides valuable insights into the exam’s complexity and the preparation strategies required. For instance, while the pass rate for CFA Level 1 is often lower, candidates who pass tend to perform better in subsequent levels, suggesting that focused preparation becomes even more crucial.

4. How Do the CFA Level 2 and Level 3 Pass Rates Compare to Level 1?

What are the differences between the CFA Level 2 pass rate and CFA Level 3 pass rate compared to Level 1? The CFA Level 2 passing rate and CFA Level 3 passing rate are generally higher than that of Level 1. This is partly because candidates at these levels are more experienced and focused, but it also reflects the increasing complexity of the exams, requiring different preparation strategies.

5. Why is the CFA Exam So Difficult?

How hard is the CFA exam, and what makes it so challenging? The CFA exam difficulty stems from the extensive curriculum and the demanding exam format. Each level builds upon the previous one, with Level 2 being particularly complex and Level 3 focusing heavily on practical applications. Candidates need to have a strong grasp of the material and excellent time management skills to overcome these challenges.

6. How Can I Improve My Chances of Passing the CFA Exam?

What can candidates do to boost their scores despite the challenging CFA level pass rates? Understanding the pass rate for CFA Level 1 can help set realistic goals. To achieve the CFA Level 1 passing score, candidates should develop a robust study plan, regularly take mock exams, and use both CFA Institute materials and third-party resources to solidify their knowledge and exam strategies.

7. How Do CFA Pass Rates Vary by Country?

Does the CFA Level 1 pass rate by country differ significantly? Yes, pass rates can vary depending on candidates’ geographical locations. Factors like educational background, access to study materials, and professional experience can influence performance. Candidates from countries with strong financial sectors tend to perform better due to greater familiarity with the exam’s content and structure.

8. How Do CFA Pass Rates Impact the Finance Industry?

What effect does the fluctuating CFA pass rate have on the finance industry? Employers place a high value on the CFA designation because of its rigorous standards. Despite the low CFA Level 1 passing score, the exam’s difficulty ensures that only well-prepared professionals earn the charter, maintaining the prestige of the CFA designation and its relevance in the finance industry.

9. What Score Do You Need to Pass the CFA Level 1?

The exact CFA pass rate Level 1 score is not publicly disclosed by the CFA Institute. However, it’s generally understood that candidates need to achieve approximately 70% or higher to increase their chances of passing. While this isn’t an official figure, it’s a helpful benchmark for those preparing for the exam. Given the historically low pass rate CFA Level 1, it’s crucial for candidates to aim high during their studies to secure a passing score.

10. What Happens When You Fail CFA Level 1?

If you fail CFA Level 1, you have the option to retake the exam during the next available testing window. The CFA pass rates by year show that many candidates take the exam more than once before passing. Failing provides an opportunity to re-strategize, review weak areas, and improve preparation methods. Given the low pass rate for CFA, it’s important to remain persistent and make the necessary adjustments to your study plan for future success.

11. How Difficult is CFA Level 1?

How difficult is CFA Level 1 compared to other exams? The challenge of CFA Level 1 lies in the vast amount of material covered and the complexity of the concepts. It’s often said that the breadth of knowledge required makes it tough for candidates to master every topic. This, combined with the lower pass rate CFA Level 1, reflects the exam’s demanding nature, particularly for candidates without a strong background in finance or accounting.

12. What is the Most Difficult Topic in CFA Level 1?

For many candidates, Financial Reporting and Analysis (FRA) is considered the most difficult subject in CFA Level 1. The sheer volume of content and the technical details involved in analyzing financial statements make this topic particularly challenging. Given the historically low pass rate CFA Level 1, mastering FRA is essential for improving your chances of passing. Focusing on high-weighted subjects like FRA can significantly impact your overall performance.

The three CFA exam levels are progressive, and you need to pass the... Read More

CFA exams are written twice annually in June and in December. It is,... Read More