The Crypto Ecosystem: Key Elements and ...

After completing this reading, you should be able to: Describe the key elements... Read More

After completing this reading, you should be able to:

The Capital Plan rule refers to a raft of regulations and policies developed by the Federal Reserve to ensure that Bank Holding Companies (BHCs) have enough capital to withstand severe stress. It forms part of a series of measures that were introduced following the 2007/2009 financial crisis aimed at restoring stability and confidence in the finance sector. By definition, a bank holding company is a corporate entity that controls one or several operating banks. There are more than 100 BHCs in the U.S., with the top 5 holding a combined asset value of well over $8 trillion.

$$ \begin{array}{l|l|c} 1 & \text{JPMORGAN CHASE & CO.} & {$2.69} \\ \hline 2 & \text{BANK OF AMERICA CORPORATION} & {$2.43} \\ \hline 3 & \text{CITIGROUP INC.} & {$1.95} \\ \hline 4 & \text{WELLS FARGO & COMPANY} & {$1.92} \\ \hline 5 & \text{GOLDMAN SACHS GROUP, INC., THE} & {$1.0} \\ \hline 6 & \text{MORGAN STANLEY} & {$0.9} \\ \hline 7 & \text{US BANCORP} & {$0.5} \\ \hline 8 & \text{TRUIST FINANCIAL CORPORATION} & {$0.47} \\ \hline 9 & \text{PNC FINANCIAL SERVICES GROUP, INC., THE} & {$0.41} \\ \hline 10 & \text{TD GROUP US HOLDINGS LLC} & {$0.41} \\ \end{array} $$

Source: Federal Financial Institutions Examination Council (2019)

Capital provides a cushion against unexpected losses and safeguards the continuity of the holding company and its constituent banks. It serves as the first line of defense against losses. A BHC could fail if its liabilities exceed its assets. That would cause massive financial turmoil and impose a burden on taxpayers and deposit insurance funds. The health of BHCs is heavily intertwined with the stability and effective functioning of the U.S. financial system.

The Federal Reserve attaches a lot of importance to BHCs’ internal capital planning processes. Besides, it is committed to regular supervision to ensure that BHCs build resilience. The Federal Reserve runs a supervisory program called the Comprehensive Capital Analysis and Review (CCAR). Under the CCAR, BHCs are required to submit an annual capital plan to the Federal Reserve Board.

Robust internal capital planning helps to ensure that BHCs have sufficient capital in a broad range of future macroeconomic and financial market environments. The attainment of this end calls for the governance of all major capital actions. Among others, these include dividend payments, share repurchase programs, and share issuance and conversion.

As per the Capital Plan Rule, all U.S.-domiciled, top-tier BHCs with total consolidated assets of $50 billion or more have to develop and maintain a capital plan supported by a robust process for assessing their capital adequacy. To realize this endeavor, the Capital Plan Rule sets out seven principles.

$$ \small{\begin{array}{l|c} {\text{Principle 1: Sound} \\ \text{foundational risk} \\ \text{management} } & {\text{The BHC has a sound risk-measurement and risk-} \\ \text{management infrastructure that supports the identification,} \\ \text{measurement, assessment, and control of all material risks} \\ \text{arising from its exposures and business activities} }\\ \hline {\text{Principle 2:} \\ \text{Effective loss-} \\ \text{estimation} \\ \text{methodologies} } & {\text{The BHC has effective processes for translating risk} \\ \text{measures into estimates of potential losses over a range of} \\ \text{stressful scenarios and environments and for aggregating} \\ \text{those estimated losses across the BHC.}} \\ \hline {\text{Principle 3: Solid} \\ \text{resource-estimation} \\ \text{methodologies}} & {\text{The BHC has a clear definition of available capital} \\ \text{resources and an effective process for estimating available} \\ \text{capital resources (including any projected revenues) over} \\ \text{the same range of stressful scenarios and environments used} \\ \text{for estimating losses}} \\ \hline {\text{Principle 4:} \\ \text{Sufficient capital} \\ \text{adequacy impact} \\ \text{assessment}} & {\text{The BHC has processes for bringing together estimates of} \\ \text{losses and capital resources to assess the combined impact} \\ \text{on capital adequacy in relation to the BHC’s stated goals for} \\ \text{the level and composition of capital.}} \\ \hline {\text{Principle 5:} \\ \text{Comprehensive} \\ \text{capital policy and} \\ \text{capital planning}} & {\text{The BHC has a comprehensive capital policy and robust} \\ \text{capital planning practices for establishing capital goals,} \\ \text{determining appropriate capital levels and composition of} \\ \text{capital, making decisions about capital actions, and} \\ \text{maintaining capital contingency plans.}} \\ \hline {\text{Principle 6: Robust} \\ \text{internal controls}} & {\text{The BHC has robust internal controls governing capital} \\ \text{adequacy process components, including policies and} \\ \text{procedures; change control; model validation and} \\ \text{independent review; comprehensive documentation;} \\ \text{and review by internal audit}} \\ \hline {\text{Principle 7:} \\ \text{Effective} \\ \text{governance}} & {\text{The BHC has effective board and senior management} \\ \text{oversight of the CAP, including periodic review of the} \\ \text{BHC’s risk infrastructure and loss- and resource-estimation} \\ \text{methodologies; evaluation of capital goals; assessment of} \\ \text{the appropriateness of stressful scenarios considered;} \\ \text{regular review of any limitations and uncertainties in all} \\ \text{aspects of the CAP; and approval of capital decisions}} \\ \end{array} }$$

BHCs should have a thorough risk identification framework to ensure that all risks are accounted for when assessing capital needs. The framework should look into both on and off-balance sheet positions. BHCs should closely assess the effectiveness of all hedging strategies. This is because exposures and asset values can change rapidly in a stressed market. Senior management should regularly update risk assessments, review risk exposures, and carry out stress tests to map out potential scenarios. While identifying risks, a firm should engage all senior representatives from major lines of business, corporate risk management, finance and treasury, and other business and risk functions. All the risks identified should support BHCs’ capital adequacy assessments and may be helpful in capital contingency plans as early warning indicators or contingency triggers, where appropriate. Special attention should be given to new products that could have risks outside the historical scope of the BHC’s exposures.

A BHC should have strong internal controls that help govern internal capital planning processes. BHC’s internal control framework should encompass its entire capital planning process. That includes the risk measurement systems used to produce input data, the models used to generate loss and revenue estimates, the reporting framework used to produce reports to the management and the board, and the process for making capital adequacy decisions.

There should be a regular independent review of internal controls by internal audit. The audit should include an extensive review of the full process, not just a few components. This is important so as to ensure that the process conforms to the expectations of the board and supervisors. Internal controls also include model documentation and validation, where model estimates are continually screened against actual results. For internal controls to add maximum value to the capital planning process, it is important that all audit staff have the appropriate competence and a good understanding of capital requirements.

To facilitate the governance of their capital planning process, BHCs need an internal control framework. These internal controls include the following:

BHCs’ internal control frameworks should address all aspects of the capital planning process, including the risk measurement and management techniques used to generate input data, the models and other techniques used to produce loss and profit estimates, the aggregation and reporting frameworks used to make reports for the management and the board, and the process for making capital adequacy decisions.

Internal audit is required to play a key role in evaluating internal capital planning and its various components. The audit should conduct a comprehensive review of the process frequently to ensure that the entire end-to-end process functions in line with supervisors’ and BHC’s board of directors’ expectations and in accordance with policies and procedures. Internal audits should review the way in which deficiencies are identified, tracked, and remediated. Audit staff should be competent and influential in identifying and escalating key issues. The internal audit function should also report on all capital planning processes to senior management and the board.

BHCs are required to conduct independent reviews and validation of all models used in internal capital planning, in line with existing supervisory guidance on model risk management. Validation staff should be competent and independent from model developers and business areas to ensure they produce an unbiased model review.

The process of model reviewing and validating involves:

BHCs are required to maintain an inventory of all models used in the capital planning process, including input or “feeder” models. These models produce estimates that feed into the models that generate final projections of loss, revenue, or expense. Under stressed conditions, the validity of models for estimating net income and capital should be considered since models designed for business activities already in place may not be appropriate. BHCs are also required to have a process for incorporating well-supported adjustments to model estimates when model weaknesses and uncertainties are identified.

In general, BHCs should pay more attention to model risk management, including enhancing practices around model review and validation. Nonetheless, stronger capital planning practices have been observed in some BHCs. These include:

BHCs should have comprehensive policies and procedures for the capital planning process. The policies and procedures should account for a consistent and repeatable process for all capital planning process elements and ensure transparency to third parties regarding this process. The policies should be reviewed and updated frequently, at least once per year. The management and staff should adhere to existing policies and procedures with exceptions clearly outlined.

BHCs should implement an internal control system to ensure the integrity of reported results, as well as the documentation, review, and approval of all material changes to the capital planning process and its components. All the BHCs’ capital planning process levels should be subject to such controls. Specific controls should be in place to:

BHCs should document all aspects of their capital planning process, including their risk-measurement and risk-management infrastructure, loss – and resource-estimation methodologies, the process for making capital decisions, and the effectiveness of their control and governance functions. Documentation should be accurate and clearly describe the BHCs’ practices.

A BHC’s board of directors has ultimate oversight responsibility over capital planning. Before making capital decisions, the board should ensure that it is well-informed about all material risks and exposures. It is immensely important that all board members and the board of directors have an understanding of all material risks and exposures. For that reason, the board should receive an updated risk assessment report at least quarterly. Capital adequacy information should include capital measures under current conditions as well as the potential values during stressed conditions. All scenarios brought to the board for consideration during the capital allocation process should include sufficient details on how they were arrived at, including the assumptions made. The board should also receive a formal report about mitigation strategies to address key limitations and take action when weaknesses in internal capital planning are unearthed.

Senior management is responsible for ensuring that board-approved capital controls and planning decisions are implemented satisfactorily. The management is ultimately responsible for the implementation process. Senior management should also ensure that there are effective controls around the capital planning process and that stress scenarios are sufficiently severe and cover all material risks. Proposed capital goals have sufficient analytical support and fully reflect the expectations of key stakeholders, including shareholders, lenders, counterparties, employees, and supervisors. Weaknesses in the capital planning process are evaluated for materiality. In addition, potential solutions are explored.

A capital policy refers to the principles and guidelines a BHC uses for capital planning, capital issuance, and usage and distributions. It should include internal capital goals; quantitative or qualitative guidelines for dividends and stock repurchases; strategies for addressing potential capital shortfalls; and internal governance procedures around capital policy principles and guidelines.

In addition, capital policy should discuss the following:

BHC stress scenarios must incorporate macroeconomic and financial conditions that are specifically tailored to stress a business’ idiosyncratic and key vulnerabilities. Based on a business model, these macroeconomic and financial conditions include a mix of assets and liabilities, geographic footprint, portfolio characteristics, and revenue drivers. In this sense, a BHC stress scenario that primarily focuses on a generic weakening of macroeconomic conditions fails to meet these expectations.

Those BHCs with well-developed scenario-design practices have carefully and creatively adapted BHC stress scenarios for their unique business models, highlighting key sources of risk not included in the supervisory severely adverse scenario. Furthermore, assumptions underlying BHC stress scenarios should not favor the BHC in any way.

Although recessions can have a detrimental effect on most BHCs’ business activities, some BHCs may have business models or important activities that generate vulnerabilities not accounted for by scenario analysis based on a stressed macroeconomic environment (or for which a severely depressed economy is not the primary source of vulnerability). The BHCs should include elements that address the key revenue vulnerabilities and sources of loss specific to their businesses and activities in their stress scenarios.

The recession incorporated in the BHC stress scenario and any additional elements meant to address specific businesses or activities, such as a significant reduction in capital ratios compared with baseline projections, would lead to considerable stress for an organization. Nevertheless, a BHC stress scenario that results in lower capital ratios than those under the adverse supervisory scenario is not, in and of itself, a safe harbor. The stress scenario included in a BHC’s capital plan should place significant strain on revenue generation and loss absorption according to its unique risks and vulnerabilities.

BHCs should include enough variables in their stress scenario to address all material risks related to their exposures and business activities. BHCs must establish a consistent process for selecting the final set of variables and explain the rationale behind their selection.

BHCs with well-developed scenario-design practices produced scenarios where the link between the variables included in the scenario and potential sources of risk was transparent and straightforward. Clear narratives enhanced further transparency. On the other hand, BHCs with weaker scenario design practices produced stress scenarios that excluded important variables in BHC’s risk profile and idiosyncratic vulnerabilities.

Scenarios should be accompanied by clear narratives explaining how the scenarios address vulnerabilities and risks facing the BHCs. BHCs with stronger scenario design practices provided narratives describing the relationship between scenario variables and risks faced by the BHC’s business lines. Further, the narratives illuminated how the variables corresponded to the internal risk-management model of the BHC. On the other hand, weaker practices provided narratives that did not address such issues.

Scenario analyses should yield estimates of losses, revenues, and expenses. BHCs should have stress testing methodologies that generate credible estimates that are consistent with assumed scenario conditions. In addition, estimates should be anchored upon empirical evidence, and the estimation process should be transparent and verifiable.

Although estimates should be derived from internal data, it is important to consider using external data occasionally so as to make estimation models more robust. The quantitative approaches used to estimate losses, revenues, and expenses depend on the type of portfolio, the granularity, and the length of available time series of data, as well as the materiality of a given portfolio or activity.

The Federal Reserve allows BHCs to use a range of quantitative approaches to estimate losses, revenues, and expenses. The choice of the approach used depends on the type of portfolio or activity for which the approach is used, the granularity and length of available time series of data, and the materiality of a given portfolio or activity. The Federal Reserve stops short of directing BHCs to use a specific estimation method. However, each BHC is expected to estimate its losses, revenues, and expenses at sufficient granularity to make it possible to identify the key risk drivers.

Estimation for portfolios or business lines that are sensitive to different risk drivers or sensitive to risk drivers, estimates of losses, revenues, or expenses, should be done separately. Judgment and adjustments may be made to model estimates to account for risks that are not well captured in the model.

Guidelines by the Federal Reserve require BHCs to clearly document their key methodologies and assumptions that have been used to estimate losses, revenues, and expenses. Documentation should clearly break down all the inputs and outputs, both qualitative and quantitative.

To estimate credit losses, BHCs can use either an economic loss approach (i.e., expected losses) or an accounting-based loss approach (i.e., charge-off and recovery). Under the expected loss approach, BHCs should come up with the probability of default (PD), loss-given default (LGD), or exposure at default (EAD) and then analyze the determinants of each component. Under the accounting-based loss approach, BHCs should include variables that represent the risk characteristics of the portfolio. They should then estimate the statistical relationship between charge-off rates and macroeconomic variables.

Most BHCs determine operational risk by estimating the correlation between operational risk and macroeconomic factors. If a statistically significant relationship between operational risk and macro factors is not discovered, alternative estimation methods are employed. That includes using historical data about the BHC’s own experiences to model possible scenarios and leveraging input from management.

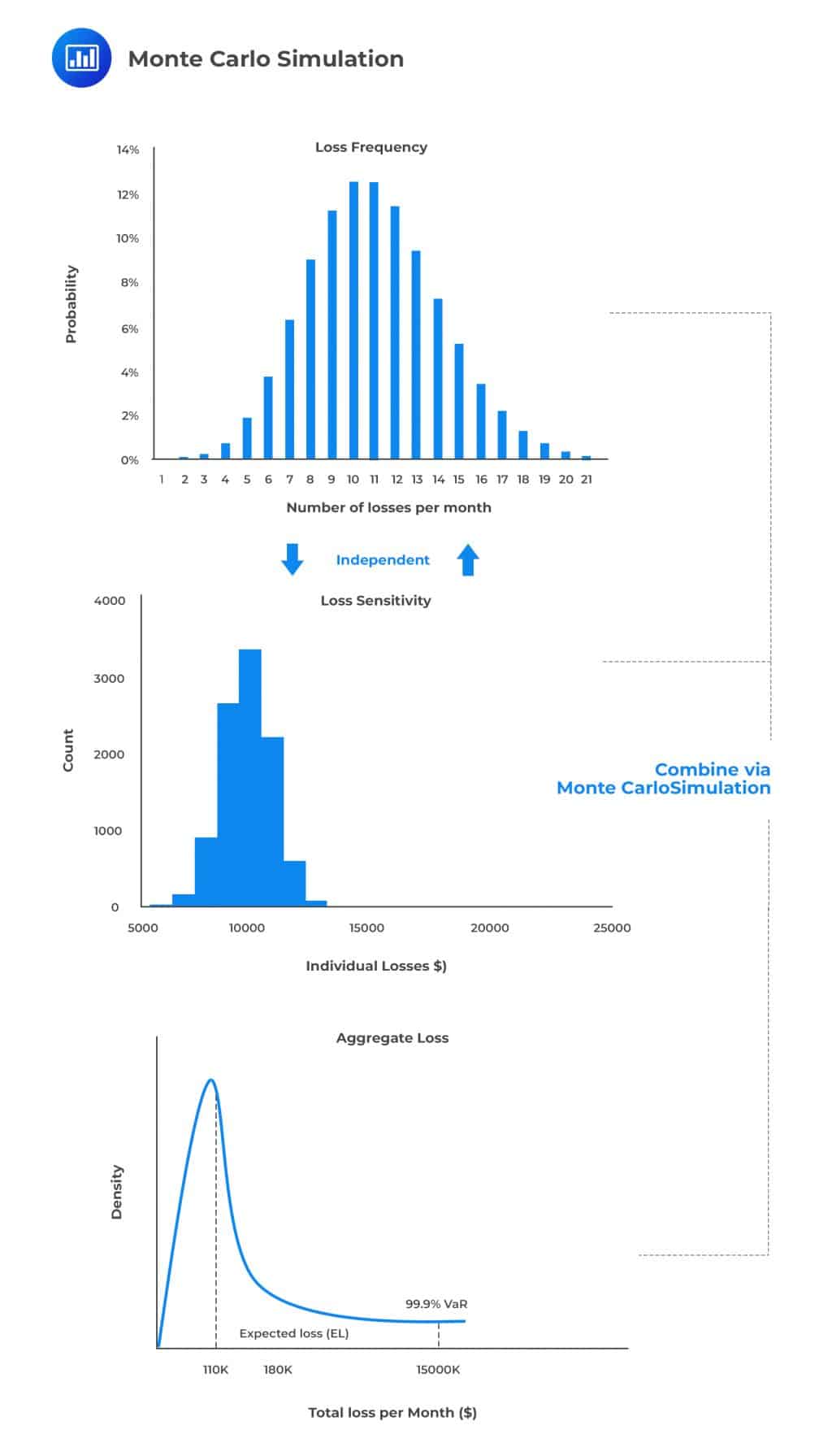

The value at risk arising from operational events can be estimated using a modified loss distribution approach (LDA). The LDA involves estimating probability distributions for the frequency and severity of operational loss events for each defined unit of measure, whether it is a business line, an event type, or some combination of the two. Using Monte Carlo simulation, the estimated frequency and severity distributions are then combined to estimate the probability distribution for annual operational risk losses.

Market Risk and Counterparty Risk

Market Risk and Counterparty RiskBHCs with sizeable trading operations may incur significant losses from the market movement and counterparty dealings, particularly under a stress scenario. Credit losses arise as a result of potential deterioration in the credit quality or outright default of a trading counterparty. Market risk losses move in risk factors such as interest rates, credit spreads, or equity, and commodity prices.

BHCs use two different techniques for estimating such potential losses – probabilistic approaches that generate a distribution of potential portfolio-level profit/loss (P/L) and deterministic approaches that generate a point estimate of portfolio-level losses under a specific stress scenario. BHCs that choose probabilistic approaches should offer evidence that justifies their choice. They have to demonstrate that such methods can yield more severe risk scenarios compared to historical scenarios. BHCs that choose deterministic approaches should demonstrate that they have considered a wide range of possible scenarios so as to adequately cover their risk exposures. All assumptions employed in either approach should clearly be spelled out.

A key part of the annual Comprehensive Capital Assessment and Review (CCAR) submissions by BHCs is their Pre-Provision Net Revenue (PPNR). Pre-Provision Net Revenue is defined as interest and non-interest income, less interest, and non-interest expense. PPNR represents a large number of items on the income statement, including interest income on loans, and interest expenses related to retail deposits.

$$ \begin{align*} \text{Pre-Provision Net Revenue (PPNR)} &= \text{Loan balances} × \text{Loan yields} + \text{Deposit balances} × \text{Deposit rates} \\ & =\text{Net interest income} + \text{Non interest income} – \text{Non interest expense} \\ \end{align*} $$

As per the Capital Plan Rule, BHCs should estimate revenue and expenses over the nine-quarter planning horizon. In line with that, BHCs should have effective processes for projecting PPNR subcomponents over a range of stressful scenarios.

When projecting PPNR, BHCs should ensure they take the impact of regulatory changes on performance and their ability to reach set targets into account. The underlying assumptions for revenues, expenses, and loss estimates should be theoretically and empirically sound. To ensure that the model yields robust results, it’s advisable to use a mix of external and internal data.

In all cases, BHCs should ensure that projections (i.e., PPNR, loss, balance sheet size, and RWA) present a coherent story within each scenario. BHCs should strive to establish a clear, comprehensible link among revenue, expenses, the balance sheet, and any applicable off-balance-sheet items. In addition, they should document all methodologies and assumptions used to generate these projections.

Balance sheet assumptions used to project net interest income should be consistent with balance sheet assumptions considered as part of loss estimation. BHCs should ensure that net interest income projections are based on methodologies that incorporate discount or premium amortization adjustments for assets not held at par value and that would materialize under a range of scenarios.

Equally important is the need to consider the various impacts of the assumed scenario conditions on their non-interest expense projections, including costs that are likely to increase during a downturn, e.g., credit collection costs. The focus should be on uncovering key determinants of individual expense items and how sensitive such determinants are to changing macro conditions and business strategies.

BHCs should have a well-defined and well-documented process of generating projections of on- and off-balance sheet items and risk-weighted assets (RWA) over a stress horizon period. It is important to consider the drivers of changes in every balance sheet item under consideration (assets and liabilities). Projections should not use favorable assumptions that do not conform to reality or near-future expectations. A good example would be large changes in an asset mix that serve to decrease the BHC’s risk weights and post-stress capital ratios but are not adequately supported by PPNR or loss estimates. RWA projections should incorporate relationships between revenues, expenses, and balance sheet items into scenario analysis.

Practice Question

Which of the following should a BHC model’s review and validation process NOT include?

A. An evaluation of the conceptual soundness.

B. Ongoing monitoring that includes verification processes and benchmarking.

C. Policies and procedures.

D. An outcomes analysis.

The correct answer is C.

The process of reviewing and validating a BHC model must have an evaluation of conceptual soundness (Option A). In addition, there should be ongoing monitoring that includes verification processes and benchmarking (Option B). Last but not least, an outcomes analysis needs to be done (Option D).

Note: There are no policies and procedures in the model review and validation processes.