Principles for the Sound Management of ...

After completing this reading you should be able to: Describe the three “lines... Read More

After completing this reading, you should be able to:

The cryptocurrency ecosystem, with a market capitalization in the trillions of dollars and thousands of cryptocurrencies in circulation, represents a significant and complex sector of the global financial system. It was initially conceived as a decentralized financial system, contrasting with traditional finance’s reliance on central bank money and intermediaries. However, the practical evolution of this ecosystem has seen a divergence from its decentralized ideal, with centralised entities playing significant roles.

Unbacked cryptocurrencies, like Bitcoin, which emerged in 2009, are decentralized digital assets not backed by any physical commodity or government guarantee. They operate on blockchain technology, which ensures secure, transparent, and immutable recording of transactions across a network of computers. This technology underpins the decentralized nature of cryptocurrencies, where every participant maintains a copy of the ledger.

Transactions in unbacked cryptocurrencies are validated by decentralized validators and recorded on a public ledger. Each transaction is broadcast to the network and, upon validation, added to the blockchain. Validators, sometimes referred to as miners, compete to verify transactions and are compensated in cryptocurrency fees. This mechanism ensures that all transactions are consistent with the history of transfers on the blockchain, maintaining the integrity of the cryptocurrency.

Despite the decentralized nature of unbacked cryptocurrencies, centralized entities like exchanges (e.g., Binance, Coinbase) have increasingly played a pivotal role in the ecosystem. These platforms facilitate the conversion between cryptocurrencies and fiat money, thus influencing the prices and accessibility of cryptocurrencies.

Stablecoins are digital currencies designed to maintain a stable value relative to a specific asset, typically the US dollar. They aim to provide the benefits of cryptocurrencies, such as fast and secure transactions, while avoiding the high volatility often associated with unbacked cryptocurrencies. Stablecoins serve as a critical medium of exchange within the crypto ecosystem, particularly in decentralized finance (DeFi).

Stablecoins are primarily of two types: asset-backed and algorithmic.

Asset-backed stablecoins and algorithmic stablecoins represent two distinct approaches to achieving price stability in the cryptocurrency market. Asset-backed stablecoins, like Tether (USDT) or USD Coin (USDC), are directly backed by tangible assets such as fiat currencies or commodities. For instance, each USDT is theoretically backed by an equivalent amount of US dollars held in reserve, providing a tangible guarantee of its value. On the other hand, algorithmic stablecoins, such as TerraUSD (before its collapse) or Ampleforth, rely on algorithms and smart contracts to maintain their peg to a fiat currency, typically without any physical backing. These algorithms automatically adjust the coin’s supply in response to changes in demand, aiming to stabilize its price. While asset-backed stablecoins derive their stability from external, tangible assets, algorithmic stablecoins depend on the efficiency and reliability of their underlying algorithms, often leading to greater complexity and potential risks in maintaining their peg.

Smart Contracts

Introduced with platforms like Ethereum, smart contracts are self-executing contracts with the terms of the agreement directly written into code. They can automate market functions and reduce the need for intermediaries. Smart contracts are a crucial component of the programmability feature of modern blockchains, allowing the development of various applications directly on the blockchain.

DeFi Services

Decentralized Finance (DeFi) is an ecosystem offering traditional financial services on the blockchain. It aims for greater transparency and lower costs by eliminating intermediaries. DeFi utilizes smart contracts to provide services like lending, borrowing, and trading. Users interact with these services through decentralized applications (dApps), which offer graphical interfaces for easier access.

Role of Stablecoins in DeFi

Stablecoins are integral to DeFi, providing liquidity and facilitating transactions. They enable the trading of crypto assets in decentralized exchanges without needing to revert to fiat currency, thus reducing transaction costs. In DeFi platforms, stablecoins are commonly used for lending and borrowing activities, often serving as collateral for loans in other cryptoassets.

The crypto ecosystem, lauded for its innovative approach to finance and decentralization, is not without its inherent structural flaws. Understanding these flaws is crucial for anyone engaged in the field, whether as an investor, developer, regulator, or enthusiast. These inherent weaknesses not only affect the functionality and efficiency of the crypto systems but also raise significant concerns regarding security, stability, and trust.

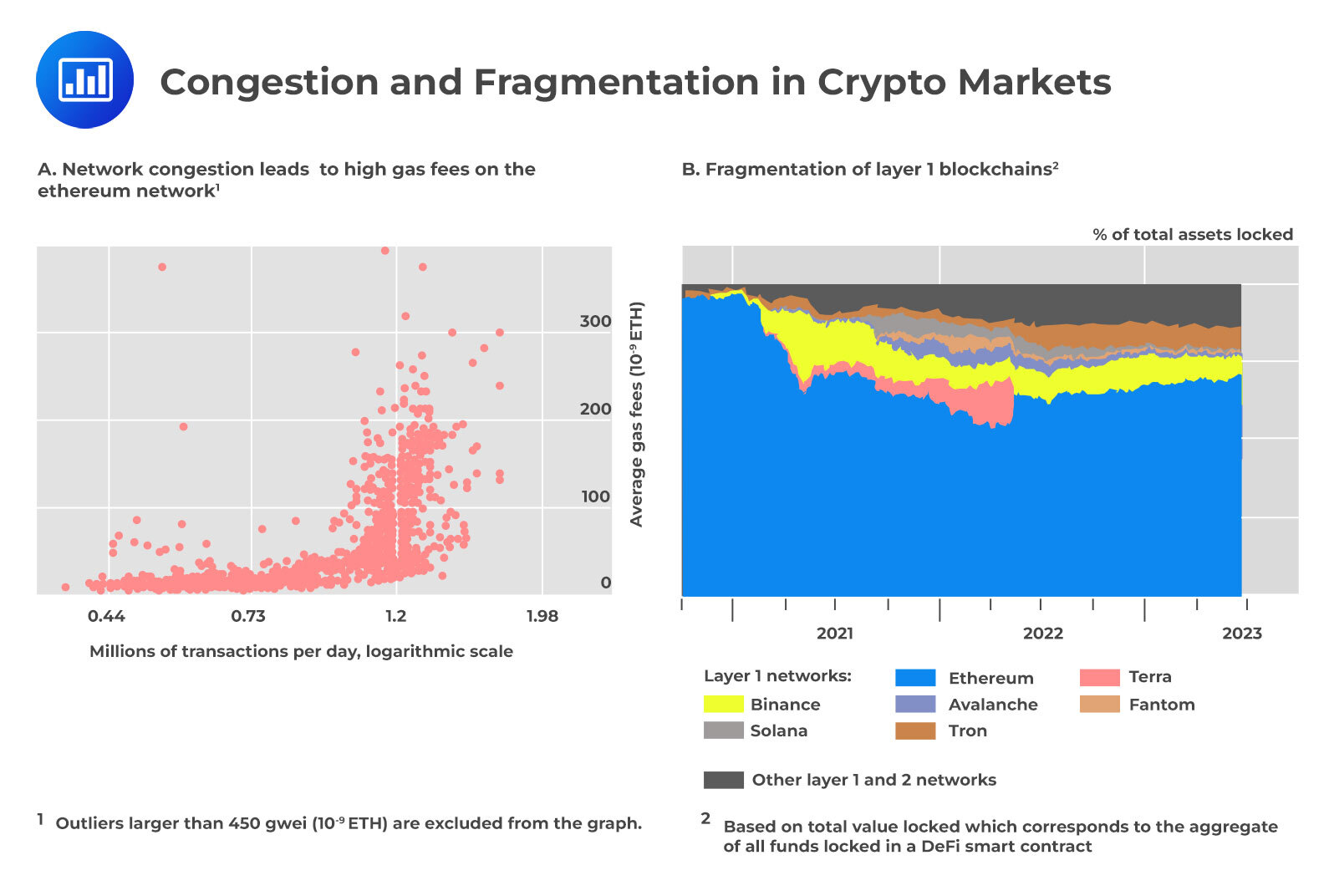

The structural flaws in the crypto ecosystem can be broadly categorized into issues related to blockchain technology itself, such as fragmentation and congestion; challenges in maintaining true decentralization due to the concentration of power and reliance on oracles; and the practical aspects of how cryptocurrencies are traded and valued, particularly the reliance on centralized exchanges. Each of these categories presents unique challenges and has far-reaching implications for the stability and reliability of the crypto world.

The crypto ecosystem, particularly in its decentralized form, faces inherent limitations due to the structure of permissionless blockchains. These limitations lead to system fragmentation and congestion, resulting in high transaction fees. This fragmentation is not a result of technological constraints but rather arises from the incentive structures governing the validators on the blockchain. These validators, operating in a pseudo-anonymous environment, must be motivated by high monetary rewards to ensure honest reporting and maintain the system’s decentralized consensus.

Fragmentation is further exacerbated by the blockchain capacity problem, a manifestation of the scalability trilemma. Permissionless blockchains can only achieve two out of the three desirable properties: security, decentralization, and scalability. Ensuring security and decentralization through incentives results in congestion, limiting scalability. This incompatibility impairs the ability of blockchains to function efficiently as payment systems or as a form of money. Newer blockchains aiming for higher transaction limits often compromise security, leading to further fragmentation.

Fragmentation is further exacerbated by the blockchain capacity problem, a manifestation of the scalability trilemma. Permissionless blockchains can only achieve two out of the three desirable properties: security, decentralization, and scalability. Ensuring security and decentralization through incentives results in congestion, limiting scalability. This incompatibility impairs the ability of blockchains to function efficiently as payment systems or as a form of money. Newer blockchains aiming for higher transaction limits often compromise security, leading to further fragmentation.

Fiat-backed stablecoins, which represent the predominant type of stablecoin, rely heavily on the credibility of central bank-issued currencies for their stability. The concept of a unit of account, essential for any monetary system, is typically provided by central banks in traditional finance. It allows for a common measure of economic value, facilitating financial transactions. In the crypto universe, where there is no central bank, stablecoins attempt to fill this role by tying their value to fiat currencies like the dollar, whose value is underpinned by a central bank. This reliance on fiat currencies is an indication of the crypto ecosystem’s inherent need for a stable, nominal anchor.

However, stablecoins face several critical issues that undermine their stability claims. One major issue is the conflict of interest for issuers, who are often incentivized to invest in riskier assets. The effectiveness of stablecoins in maintaining their stability is thus highly dependent on the quality and transparency of their reserve assets, which is frequently inadequate. Additionally, stablecoins do not benefit from the regulatory safeguards and credibility associated with bank deposits or e-money, nor do they have the backing of a central bank to defend their peg.

Moreover, since stablecoins are transferable liabilities and their transactions do not settle on a central bank’s balance sheet, they can experience fluctuations in their exchange rates, deviating from their intended parity with the pegged fiat currency. This fluctuation further complicates their role as a stable unit of account within the crypto ecosystem.

Contrary to the claims of decentralization made by crypto proponents, there is often a concentration of decision-making power in the ecosystem. This concentration partly arises from congestion effects and is evident in newer proof-of-stake blockchains, where validators posting coins as collateral end up centralizing power. Such operational structures lead to a concentration of power and coins among a few validators.

Centralization also stems from the inherent “contract incompleteness” or “algorithm incompleteness” in DeFi platforms, necessitating a certain degree of central governance. This results in governance tokens being largely held by insiders (platform developers and early investors), who exert significant influence over decision-making.

The oracle problem in decentralized finance (DeFi) arises from the need to integrate real-world data into blockchain systems. DeFi applications, while inherently relying on decentralized consensus for trust, often require external data to execute smart contracts. This data is sourced and processed by oracles, third-party services that transmit information to the blockchain. The reliance on oracles introduces a significant challenge to the decentralized nature of these systems.

The crypto ecosystem’s reliance on centralized exchanges (CEXs) presents a significant structural flaw, contradicting the decentralized ethos often championed in the blockchain space. CEXs, unlike decentralized exchanges (DEXs), maintain off-chain records of orders and transactions, similar to traditional financial exchanges. This reliance on CEXs for trading activities introduces several critical issues:

Self-Referential Ecosystem

The crypto market primarily focuses on the trading and exchange of cryptocurrencies and stablecoins within its own ecosystem. This insular nature means that, unlike traditional investments, it often does not directly finance or influence real-world economic activities. For instance, buying Bitcoin or Ethereum typically does not translate into capital investment in industries or businesses outside of the crypto space. This characteristic limits its economic impact and contribution to broader financial markets.

Retail Investor Vulnerability

Retail investors are particularly susceptible to the allure of the crypto market, often drawn in by the potential for rapid and significant returns. This is fueled by media hype and the meteoric rise of certain cryptocurrencies. However, the reality is more sobering, with a significant number of investors, especially in retail segments, experiencing losses. This can be attributed to factors like market manipulation, sudden regulatory changes, or the inherent volatility of crypto assets.

A telling example is the surge in Bitcoin’s price in late 2017, followed by a steep decline in 2018, which led to substantial losses for many late investors who bought at peak prices.

Impact of Major Crypto Events

The crypto market is known for its high volatility, which was starkly demonstrated by events such as the collapse of TerraUSD (a stablecoin) and the FTX exchange in 2022. These events caused significant market disruptions, with smaller investors often bearing the brunt of the impact. In contrast, larger investors and entities were sometimes able to navigate these turbulent periods more effectively, occasionally at the expense of smaller market participants.

During the FTX collapse, while many small investors faced substantial losses, larger entities were able to maneuver their assets, often reallocating to perceived safer assets like asset-backed stablecoins, thereby minimizing their losses or even profiting from the volatility.

High Risks with Crypto Firms

A notable risk in the crypto space stems from the lack of established control mechanisms within many crypto firms. This absence of regulatory oversight and internal controls can lead to situations where investor funds are highly vulnerable, especially in cases of financial distress or bankruptcy.

A prime example is the collapse of FTX, one of the largest crypto exchanges, which declared bankruptcy and revealed it owed over $3 billion to unsecured creditors, predominantly its users. This case highlighted not just the risk of investment in cryptocurrencies themselves but also the operational risks associated with crypto firms. The FTX incident is a cautionary tale about the potential consequences of inadequate corporate governance and financial oversight in the crypto industry.

Pseudo-Anonymity and Oversight Gaps

Crypto’s inherent pseudo-anonymity significantly complicates regulatory and law enforcement efforts. This characteristic of cryptocurrencies, coupled with the general lack of oversight, makes them potentially attractive for illicit activities such as money laundering, financing of terrorism, and tax evasion. The anonymous nature of transactions can obscure the identities of those involved, making it challenging for authorities to track and trace activities that might be illegal or harmful.

An illustrative case of this risk is the use of Bitcoin in darknet marketplaces, where anonymity and the lack of traceability of transactions have facilitated illegal trade, including the sale of drugs and other illicit goods.

Challenges in Tracking and Tracing

For regulators and law enforcement agencies, the decentralized and borderless nature of cryptocurrencies presents significant hurdles. Traditional financial monitoring and investigative tools are often less effective in the crypto context, as these tools are typically designed for a centralized financial system with identifiable parties.

The Silk Road marketplace, which operated on the dark web and used Bitcoin as its primary currency, highlighted the difficulties faced by law enforcement in tracking and tracing illegal transactions. It took an extensive, coordinated effort by multiple agencies to shut down the marketplace and trace the transactions back to their source.

To mitigate these risks, there is a pressing need for improved governance measures, including robust AML and CFT frameworks. Effective governance can ensure that market participants operate transparently and accountably, promoting the integrity of the financial system. The FATF has been instrumental in developing guidance on registration and licensing requirements for crypto service providers. These guidelines aim to enhance oversight and bring crypto transactions into a more regulated and monitored space, similar to traditional financial transactions. A key aspect of addressing these risks involves implementing FATF’s recommendations, which include identifying and verifying customer identities, maintaining records of transactions, and reporting suspicious activities. This is crucial for enabling authorities to monitor potentially illicit activities effectively.

To date, the interplay between cryptocurrency and traditional finance has been relatively limited. The primary use of crypto remains within the realm of speculation and investment rather than as a mainstream medium of exchange or a staple in traditional financial portfolios.

Despite its speculative nature, there’s a growing interest in cryptocurrency from institutional investors and households. This burgeoning interest hints at potential future integrations between crypto and traditional financial systems. Such integration could take various forms, including direct investment in cryptocurrencies, incorporation of blockchain technologies, or development of new financial products based on crypto assets.

As banks increase their involvement in the crypto space, they may expand their services to include credit provisions to entities with crypto exposures and custody services for crypto assets. This expansion, however, brings additional risks, including credit risk from borrowers with volatile crypto assets and operational risks in safeguarding digital assets.

The increasing interconnection between crypto and traditional finance sectors could have systemic implications. If major financial institutions allocate significant portions of their portfolios to crypto, it could lead to greater transmission of crypto market volatility into the broader financial system. This could be particularly concerning during periods of market stress or crypto market crashes.

Another avenue of interconnection is the tokenization of real-world assets, like stocks or real estate, into crypto tokens. This process could lead to a deeper intertwining of crypto with traditional finance, as it allows traditional assets to be traded and managed within the crypto ecosystem. If this trend of tokenization grows, it could elevate the systemic importance of the crypto ecosystem, creating new channels through which shocks in the crypto market could impact the broader financial system.

Strengthening regulatory frameworks

Implementing clear and comprehensive regulatory frameworks for cryptocurrencies is crucial for mitigating risks. These regulations should comprehensively address issues such as market manipulation, fraud, and consumer protection. Given the global nature of cryptocurrencies, international cooperation is vital to establish and enforce consistent standards. This includes collaboration on anti-money laundering (AML) and combating the financing of terrorism (CFT) practices, tax regulations, and the monitoring of cross-border transactions.

Enhancing transparency and reporting standards

Mandatory disclosure requirements for crypto firms can significantly enhance transparency, enabling investors to make informed decisions and reducing risks of fraud and “rug pulls”. Regular audits and compliance checks of crypto exchanges and wallet providers can ensure adherence to regulatory standards and help identify potential risks early.

Establishing clear governance protocols in DeFi

Developing clear governance standards for decentralized autonomous organizations (DAOs) is essential to mitigate risks associated with centralization and decision-making in DeFi platforms. Encouraging or mandating thorough auditing and certification of smart contracts before deployment can reduce the risks of coding errors and vulnerabilities.

Integrating anti-money laundering and counter-terrorism financing measures

Strengthening AML and CFT measures specifically for crypto transactions is crucial in combating illicit activities. This includes enhanced due diligence, transaction monitoring, and the reporting of suspicious activities.

Risk management and consumer protection

Requiring crypto firms to clearly disclose risks and educating consumers about the volatile nature of crypto investments are key for consumer protection. Developing insurance schemes for crypto assets and establishing safeguard mechanisms, such as a fund to protect investors from losses due to operational failures or fraud, can provide additional security.

Monitoring and managing interconnections with traditional finance

Implementing prudential standards for banks’ exposure to crypto assets, as endorsed by regulatory bodies like the Basel Committee on Banking Supervision, can manage the risks arising from banks’ involvement in the crypto sector. Regulating and monitoring the tokenization of real-world assets can prevent undue risk transfer between the crypto market and traditional financial systems.

Encouraging technological innovation and responsible growth

Supporting technological innovations in blockchain and crypto can lead to safer and more efficient market practices. Creating an environment where innovation is balanced with robust risk management practices can foster responsible growth in the sector.

Practice Question

How does the concentration of governance tokens among platform developers and early investors affect the crypto ecosystem?

- It guarantees a democratic and equitable distribution of decision-making power among all users of the platform.

- It leads to a fair and transparent voting mechanism on all governance-related issues.

- It results in a centralized control of decision-making, potentially prioritizing the interests of a select few over the wider user base.

- It ensures that all users, regardless of their investment in the platform, have equal influence on its future development.

The correct answer is C.

Concentrating governance tokens among platform developers and early investors is a structural flaw in the crypto ecosystem because it centralizes decision-making power. This concentration can lead to governance decisions that prioritize the interests of these few token holders, possibly at the expense of the broader community’s needs or the platform’s long-term health. Such centralization in governance contradicts the decentralized ethos that many blockchain platforms aim to uphold and can undermine the trust and participatory nature that are fundamental to decentralized systems.

A is incorrect because the concentration of governance tokens among a few individuals does not ensure democratic or equitable distribution of decision-making power. Instead, it centralizes power among a small group.

B is incorrect as this concentration of governance tokens does not inherently lead to fairness and transparency in voting mechanisms. The control exerted by a few token holders can skew governance towards less transparent and unfair practices.

D is incorrect because the concentration of governance tokens among a select group means that not all users have equal influence. Users with fewer or no tokens may have little to no say in the platform’s development and governance decisions.