Standardized Measurement Approach for ...

The Basel Committee emphasizes consistency in implementing post-crisis controlling reforms. This consistency improves... Read More

After completing this reading, you should be able to:

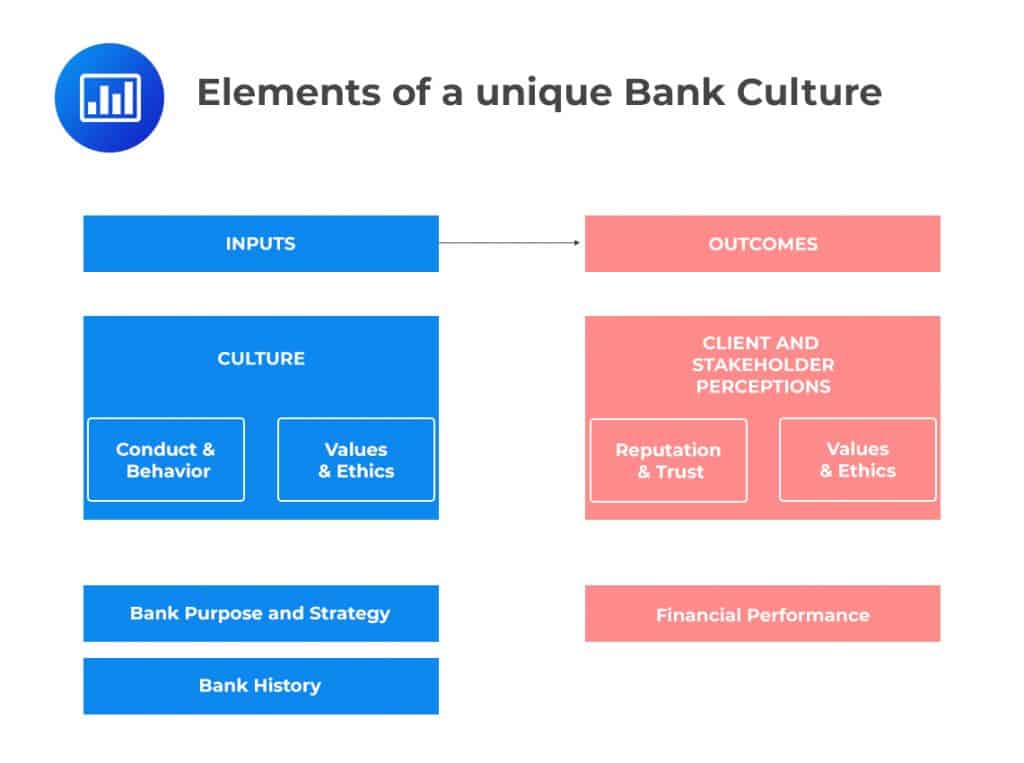

Bank management, customers, and investors have given much attention to banks’ culture and conduct over the last decade. Additionally, government, regulators, and supervisors have increased scrutiny of issues related to conduct and culture since the last financial crisis. Ultimately, banks have invested significant effort in boosting their conduct and culture. However, the banking industry still has a negative reputation. The industry, therefore, still needs to mend its trust despite all these efforts.

Challenges Banks Face Concerning Conduct and Culture

Challenges Banks Face Concerning Conduct and CultureBanks should fully embed a conduct and culture lens in everything they do as a part of their routine. As society and the competitive landscape evolves, banks cannot afford to be complacent about their trust and reputational problems. Cultural improvement is, as such, inevitable if trust is to be restored in the banking system. Here, we discuss some of the challenges that banks face in mending their negative reputation and trust issues.

Changing sources and scope of conduct issues: It is a challenge for banks to manage the changing sources and scope of conduct issues. It is equally a challenge for them to recognize that the pressure on conduct and culture is changing, and expectations are evolving. External forces, such as digitization, impose changes on banks, leading to a continuous evolution of customer expectations, and dynamic competitive pressures. Consequently, banks should recognize that the business environment is constantly evolving. Further, there is a need for them to improve their culture, reinforce the levers, and align conduct and risk management practices with everyday business. The overall aim of such moves is to restore trust in banking among all stakeholders.

A challenge of understanding the challenges of putting the customer first and balancing potential conflicts of interest: Banks need to focus on customer satisfaction as they work towards achieving more sales for increased profitability. Balancing the two is always a challenge for many financial institutions.

Tackling the industry-wide issue of “rolling bad apples”: Individuals with poor conduct records have the freedom to move from one bank to another. This is because there is a legal prohibition that limits a bank from publicizing reasons for one’s dismissal, and therefore, bad players in the industry are able to move from one bank to answer.

It is a challenge reconciling the appropriate form and level of public disclosures on culture and conduct: There are concerns about money laundering. In addition, there are concerns over customer profiling. Banks spend lots of resources conducting research. Most of the time, they research on the same individual or organizations that had already been researched on by a different bank. An excellent solution to prevent double work would be creating a utility for sharing information. However, legal roadblocks and privacy concerns are standing on their way.

To mend trust and reputational issues and fulfill the role of banks in society, bank culture and conduct play a crucial role. The following are some of the points that give a bank the impetus to improve its conduct and culture.

To build trust and reputation after the global crisis: After the 2008-2009 global financial crisis (GFC), there was a rapid decline in the reputation of trust in the banking industry. Improving bank culture and conduct was inevitable and a priority from the perspective of bank managers, supervisors, customers, investors, and government regulators. The industry suffered penalties of US$350-US$470 billion in fines and settlement charges for matters related to poor conduct. Reports of misconduct had a shock effect that eventually brought down the reputation of the entire banking sector. The restoration of good conduct and culture is required to ultimately regain public trust.

Continuing low trust levels and negative reputation: Despite the industry putting a lot of effort into conduct and culture, they are still hurt by bad reputation. There is a need, therefore, to rebuild banks’ reputation and regain public trust. This calls for improvement in their conduct and culture. The trust levels remain low, relative to other industries, and have not yet reverted to the pre-crisis levels.

Competition from alternative service providers: There is competition from new firms ready to provide banking services, for example, fintech start-ups, technology firms, retailers, and telecom companies. Banks have no choice but to try and regain trust. To survive, they require a great improvement in conduct and culture. There is also the concern of the acquisition and retention of talents, which widely depends on a proper culture and conduct.

To stabilize the broader financial system: Banks will be better at fulfilling their role in society, and conclusively contribute to the stability of the financial system if they practice good culture and sound conduct. Banking services are considered a public good, and failure of this particular function affects not only the shareholders but also the entire economy. Banks are executing the needed policy changes and processes to improve culture and conduct to mitigate incidents of potential misconduct. However, culture and conduct have to be fully integrated into how banks do business.

Possibility of a build-up of culture and conduct fatigue: Chances are high that progress related to culture and conduct can be initiated and then either abandoned or forgotten. However, good culture and conduct should be internalized as a way of doing business. Additionally, it should not be segregated from other business activities. Sustainable cultural changes should insist on improving leadership capabilities. This calls for the inclusion of management skills rather than purely building up financial awareness. Moreover, substantial management skills are required to develop an atmosphere that is psychologically safe and empowers employees to work genuinely at the bank.

Move towards a refined and effective management style: In the past, the banking industry managed businesses and people by the use of quantitative metrics such as the volume of sales and profits. This, however, has not posed any challenges worth assessing. Driving sustainable cultural change in banks requires leadership skills that were not a point of focus in the past. There is a need to adopt a new focus point, such as psychological safety, which requires greater management skills. Most banks that did not consider it important to improve management and leadership capabilities are now forced to invest in the same to catch up with the lost time. There is, therefore, a need to improve the culture to catch up with the evolutions.

In this section, we discuss crucial suggestions for boosting conduct and culture for banks to challenge their cultural foundation.

Adjusting hiring processes: Bank leaders should consider how culture is integrated into the recruiting and hiring processes and how new employees are assimilated into the culture. Firms should always consider cultural fit during the recruitment process. The CEO is not an exception. The board needs to hire a CEO who fits in the culture of the bank. Since the board should outlast individual CEOs, they can transmit the culture to a new CEO to ensure that the bank survives transitions.

Improving training and communication: Some companies have started culture change initiatives by incorporating training and awareness programs. These programs lay emphasis on the importance of coordinated and consistent reinforcement of culture over time. Senior executives are experimenting with new forms of continuous communication with a broader audience. Examples of such initiatives include starting a blog on which examples of acceptable and unacceptable behaviors can be shared. As a follow-up to their interaction with such content, people can be recognized for positive behaviors. In addition, internal audit is tuned to assess culture as an informal part of their work and are therefore equipped to shift to more formal assessments.

Balancing financial incentives: Banks’ incentive structures should be designed and controlled so that they sustain good customer outcomes. Incentives linked to sales should utterly be removed to enable banks to move towards this goal. Banks should revise their sales incentive structures for frontline salespeople and all layers of management. Banks have reduced their focus on sales performance, but have not yet created a sustainable culture of good conduct. One problem is that drastic changes in these incentives can potentially cause unintended consequences. Workers may take action to cover up such consequences. This could motivate them to take unethical steps, for example, not reporting a loss or shuffling losses into a different account. The main challenge is finding the balance and achieving it. It is also a challenge to adjust variable pay in this sector since competition for talent is global, and even efforts to address this issue of compensation vary by jurisdiction. The United Kingdom and European Union, for instance, are imposing caps on incentive compensation. However, this is not the case in the US and Asia, making it hard to have coherent global pay structures.

Increasing individual accountability: The right culture should encourage everyone to hold the other party to account. Many banks are incorporating new elements into employee evaluations, such as including values in the appraisal process. If one doesn’t receive a minimum score for each value, they don’t receive their bonus, or they do not advance. This is a bit extreme, but it may be the only way to bring this to the ground. Strengthening accountability is one of the most important parts of improving an organization’s culture. However, sharpened individual accountability may lead to unwanted consequences. however, the focus on accountability raises some additional concerns, including:

Expanding monitoring and measurement: An organizational culture encompasses behaviors that are difficult to assess and interpret. Data collection helps with culture assessment. However, understanding culture requires considering the bigger picture and seeing how the various pieces fit together. There are various forms of monitoring that banks should employ:

Adapting board oversight: The level of detail required to handle operational issues as well as monitor the behavior of tens or even hundreds of thousands of employees is a significant challenge to the directors of big firms. What they see or are presented with might look okay. However, they might discover later that something may be wrong. Is culture something boards are genuinely worried about? Or do they view this as just the flavor of the month from regulators? The board is responsible for the behaviors of all of the firm’s employees everywhere, and all of the time, the consequences of misconduct are now quite serious. The board has an important part to play in establishing and supporting culture change.

Regulators across the world have increased attention to conduct and risk culture.

Cultural and conduct oversight represents a departure from historical, often quantitative-based prudential supervision. Indeed, financial regulators are struggling to determine what this means in terms of the skills and capabilities of their staff and their traditional approaches, as well as their own internal cultures and practices. A consensus has not yet been reached as to whether outside organizations that focus on quantitative measures of bank health will be able, without hands-on experience, to truly assess the culture of the banks that they supervise and add value to the culture review process.

Different people have different opinions on the role of regulators in encouraging strong conduct and culture in banks. Given that culture is so unique to a particular bank, it’s difficult to imagine an external party engaging productively in a culture assessment. We have had many scandals and conduct issues that imply that there is a possibility of insiders being unaware of signs that culture is deteriorating. In such cases, an unbiased, external investigation would be beneficial.

Several regulators have taken an optimistic view of this issue and have been experimenting with alternative approaches. DNB, for instance, hired psychologists to observe and analyze bank cultures. The Singapore Monetary Authority. on the other hand, is establishing Al and data analytics capabilities.

Conduct and culture must be distinguished when determining the role supervisors should play in this area. Since conducting risk management relies on observable behaviors, supervisors may be able to assess it more clearly.

A number of markets have shifted their thinking on conduct and culture. They focus beyond individual bank efforts. Instead, they have embraced collaboration across multiple players, including sharing of tools and practices.

Examples of regulatory initiatives in this area include:

After the 2008-2009 financial crisis, the banking industry has tried to make improvements from its previous mistakes that may have contributed to the crisis. The group of thirty in their publication of 2018 noted some of the lessons learned in the journey to reform the banking sector. The following are the lessons learned:

Managing culture is not a one-off thing: Culture is not static, and therefore its management should be a continuous effort and should receive constant and permanent reinforcement. A firm must, therefore, constantly adapt to new cultures to align with the changing strategies and business conditions. The banking industry is evolving with time, creating a need for banks to ensure that their cultural efforts are responsive to potential changes in the desired outcomes.

Leadership always matters: Conduct and culture must be embedded from the board to senior management and through middle management down to the teller and through all business units and geographic locations. The board should be aware of as well as involved in defining and guiding the culture. The role of the board is to define the purpose of the organization and ensure strategy, communications, policies, processes, and practices are all aligned with the desired culture. Senior leaders need to involve middle management to reinforce further firm values and intended behaviors in their respective areas of oversight.

The scope of conduct management is changing from misconduct to conduct risk management: Misconduct should be defined more broadly to entail more than just misbehavior by an employee’s desire for personal gain. It should cover intent, negligence, failure of judgment, all stakeholders, and harm to customers and colleagues, among others. Banks should also focus on improving and promoting good conduct as they consider reducing misconduct.

Management of culture requires a multipronged approach and the simultaneous alignment of multiple cultural levers: Culture is not empirically good or bad, but should be right for a bank based on its values, strategy, and business model. The different levers of culture should be aligned with the desired outcomes. Cultural levers include structural elements such as policies, organization, processes, and technology, as well as intangibles such as tone from the top, beliefs, and perceptions. A bank’s various cultural elements are a true reflection of its values and priorities.

A more diverse set of views and voices in senior management will lead to sustainable outcomes for all stakeholders: Diverse thinking, problem-solving, and leadership styles will help organizations achieve better results through greater questioning, challenge, creativity, and innovation. Diversity in leadership teams can also be helpful since it makes employees feel safer in raising concerns and escalating issues. Most institutions have recently put more focus and importance on hiring, retaining, and empowering diverse employees. Gender disparity in pay is gaining attention as an emerging issue in the banking industry.

This disparity can partially be attributed to issues with equal pay for equal work as women hold fewer senior/highly paid positions than men. These imbalances can create cultural issues such as bullying, and harassment, among others, that can negatively impact clients.

Cultural norms and beliefs cannot be explicitly measured. However, the behaviors and outcomes that culture drives can and should be measured: The banking industry has not yet come up with metrics or their measurements. Measuring culture is thus very challenging even though it is necessary. A set of indicators is necessary to show when employees are in line with the firm’s strategy, core principles, and even goals. There should be objective and meaningful metrics through which the management can observe employees’ behaviors. Having this in place will ensure that a healthy culture is maintained and conduct issues are detected before they become problematic. Culture is not constant as it evolves and is influenced by various factors, including company strategy, acquisitions, evolving customer needs, or technological advancements, among others. The more mature banks, in terms of culture and conduct reporting, provide the following lessons on metrics:

Deriving metrics from company values is a multistep process: Deriving metrics from company values requires organizations to answer some challenging questions about values, identifying stakeholders, and outcomes for each. The information obtained should then be used to communicate desired behaviors and translated into observable metrics. Banks need to start on a data exploration and analysis effort to ensure that the data needed for the desired metrics are available or can be readily collected. Several tools, including internal surveys, audits, and customer assessments, are particularly useful in gathering data for given metrics.

Restoration of trust will benefit the industry as a whole: The restoration of trust will benefit the whole banking sector. Therefore, industry-wide dialogue and best practices sharing are essential elements in achieving a healthier banking sector. The banking industry should consider mechanisms of collaboration to develop cross-industry comparisons of their progress in culture and conduct. This collaboration and comparison will help provide banks with a view into their culture relative to those of peers. Further, such benchmarking results can provide banks with an objective basis for introspection and constructive challenge, guarding against overconfidence in their approaches.

Practice Question

Staff development can be used to strengthen corporate culture. Which one of the following is a way in which a bank can develop its staff to encourage a strong culture?

A. Hiring a new CEO.

B. Changing the hiring and promotion processes.

C. Increasing salaries for the highest-performing employees.

D. All of the above.

The correct answer is B.

Banks are increasingly applying conduct screens to promotion and external hiring decisions. Some banks have stepped up their hiring practices to better assess recruits’ alignment with the organization’s conduct and culture. They, for example, do this by including conduct interview questions, ethical screening, and several forms of personality assessments. This will encourage a healthy culture.

A is incorrect: Hiring a new CEO without putting how the new CEO would be assimilated into the organization’s culture into consideration does not encourage a strong culture.

C is incorrect: Increasing workers’ pay does not strengthen a firm’s culture.

D is incorrect.