OpRisk Data and Governance

After completing this reading, you should be able to: Describe the seven Basel... Read More

After completing this reading, the candidate should be able to:

In recent years, banks have taken center stage in the management of increasingly destructive criminal activities, particularly money laundering and financial terrorism. Multiple banks have been fined for their failure to identify or report suspicious transactions. The Basel Committee has responded by introducing a raft of supervisory measures aimed at:

The Core Principles for Effective Banking Supervision (2012) requires banks to:

“have adequate policies and processes, including strict customer due diligence (CDD) rules to promote high ethical and professional standards in the banking sector and prevent the bank from being used, intentionally or unintentionally, for criminal activities”.

The guidelines are as follows:

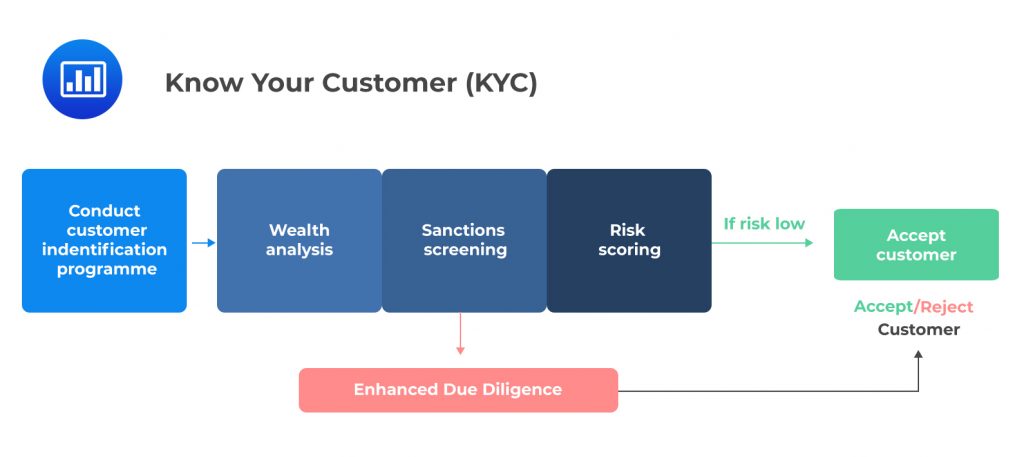

It is the responsibility of every bank to identify and evaluate money laundering (ML) and Financial terrorism (FT) risks it faces and develop commensurate defense policies. The assessment should sweep across all levels and business lines. At the core of this endeavor lies customer due diligence (CDD) – a comprehensive guide on how the bank should interact and treat its customers to ensure that all transactions meet the required level of integrity. The bank should design policies for customer acceptance, due diligence, and continuous monitoring of all transactions processed through the bank and/or its affiliates.

The board of directors plays an integral role in the identification and management of various risks, including ML and FT. As such, the board should have a clear understanding of these risks so as to be in a position to make informed decisions. In this regard, the board should regularly be furnished with the relevant risk reports.

It’s also the responsibility of the board to delegate roles and responsibilities in the most efficient and practical manner. In addition, the board should appoint a well-qualified chief AML/CFT (anti-money laundering (AMT) and Countering Financing of Terrorism) officer to oversee the entire AML/CFT function.

To properly manage the AML/CFT function, there should be three lines of defense:

Business units should be charged with identifying, assessing, and controlling the ML/FT risks inherent in their business. All the relevant personnel in direct contact with clients should be furnished with clear policies and procedures that outline their obligations and instructions in various situations.

Also part of the first line of defense is the staff recruitment process. All incoming staff should be screened and vetted accordingly.

The chief AML/CFT officer should be in charge of the continuous monitoring of all ML/FT objectives. They should be the face of all AML/CFT operations and the individual to interact with all internal and external authorities.

The office of internal audit should regularly perform an independent assessment of the AML/CFT policies and procedures and seek to find out whether such policies are being followed to the letter.

Every bank should have a monitoring system that tracks the activity of each and every account opened at the bank. The system should be designed such that it can be able to detect changes in customer transactions or flag suspicious activity.

Customer Acceptance Policy refers to the general guidelines followed by banks in allowing customers to open accounts with them.

AML/CFT in a Group-Wide Context

AML/CFT in a Group-Wide ContextIn certain situations, banks may be allowed to rely on third parties with regard to customer due diligence (CDD). In these circumstances, the third party will most likely have an already established business relationship with the customer. A bank can rely on a third party for the following aspects:

However, it is important to note that not all third parties are eligible for such reliance. In some jurisdictions, banks can only rely on CDD from fellow banks and financial institutions. In certain scenarios, the magnitude and size of transactions built upon third-party CDD may be limited.

Relevant criteria for assessing reliance include:

Practice Question

Bank Z is a mid-sized financial institution that has recently experienced a surge in suspicious transactions. The bank’s internal investigation team has been overwhelmed with the increasing volume of cases to review. Despite having policies and procedures in place for identifying, investigating, and reporting suspicious transactions, Bank Z has struggled to keep up with the workload and maintain compliance with anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations.

In response to the situation, Bank Z’s management is considering implementing changes to improve the efficiency and effectiveness of its suspicious transaction reporting process.

Which of the following measures should Bank Z prioritize to enhance its reporting of suspicious transactions?

A. Streamline the internal investigation process by reducing the number of false positives and promptly reporting genuine suspicious transactions.

B. Reallocate resources from other departments to the internal investigation team to handle the increasing volume of cases.

C. Amend the bank’s policies and procedures to lower the reporting threshold for suspicious transactions to capture more potential cases.

D. Implement an automatic system to report all suspicious transactions directly to law enforcement agencies and the Financial Intelligence Unit (FIU)

Solution

The correct answer is A.

Ongoing monitoring and review of accounts and transactions enable banks to identify suspicious activity, eliminate false positives, and report genuine suspicious transactions promptly. By focusing on streamlining the internal investigation process, Bank Z can improve the efficiency and effectiveness of its suspicious transaction reporting process, ensuring compliance with AML/CFT regulations.

Option B, reallocating resources from other departments, may provide temporary relief but does not address the root cause of the problem, which is the need for an efficient and effective investigation process. Option C, lowering the reporting threshold, could increase the workload and exacerbate the issue by generating more potential cases to investigate. Option D, implementing an automatic system without internal investigation, could compromise the quality of reports and lead to a high volume of false positives being reported to law enforcement agencies and the FIU.

Things to Remember

- Efficiency is crucial: Ongoing monitoring and a streamlined review process are vital in identifying genuine suspicious activities and ensuring compliance with AML/CFT regulations.

- Address root causes: Temporary measures, like reallocating resources, might offer short-term relief but won’t solve underlying inefficiencies in the investigation process.

- Quality over quantity: Lowering the reporting threshold without improving the review process can overwhelm teams and increase the chances of missing genuinely suspicious activities.

- Automated systems need oversight: Relying solely on automated systems can lead to high false positive rates. Internal investigations are essential to validate suspicions before escalating them.

- Regulatory compliance: Maintaining adherence to AML/CFT regulations is paramount. Institutions should prioritize solutions that ensure both efficiency and regulatory compliance.