Financial Crime in Times of COVID-19 � ...

After completing this reading, you should be able to: Explain the increase of... Read More

After completing this reading, you should be able to:

This chapter discusses the critical factors that underpin a bank’s liquidity risk management framework. Liquidity stress testing aims to determine the level of liquidity that should be kept for the institution to meet financial obligations under stressed conditions. A reliable liquidity stress test should project cash flows from assets, liabilities, and other off-balance sheet items for a diverse, systemic, and idiosyncratic scenario in different time horizons.

In an attempt for the banks to keep a robust stress testing framework, consider the following two factors:

The liquidity problem caused by an inadequate liquidity risk management framework is as challenging for a financial institution as the actual incapability to meet financial obligations.

We consider the main components of stress testing, which include:

A liquidity stress test aims to measure the level of liquidity the institution must maintain to ensure a continuous ability to meet financial obligations in stressed conditions. A useful liquidity framework starts with defining “liquidity” for liquidity stress testing purposes. In this context, liquidity refers to funding liquidity risk, which is the risk that the institution is unable to meet its contractual obligations without suffering unacceptable economic losses. Asset liquidity risk, which involves an institution incurring losses due to the difficulty of converting assets into cash, should further be considered as it has an impact on the level of funding created from the sale of assets.

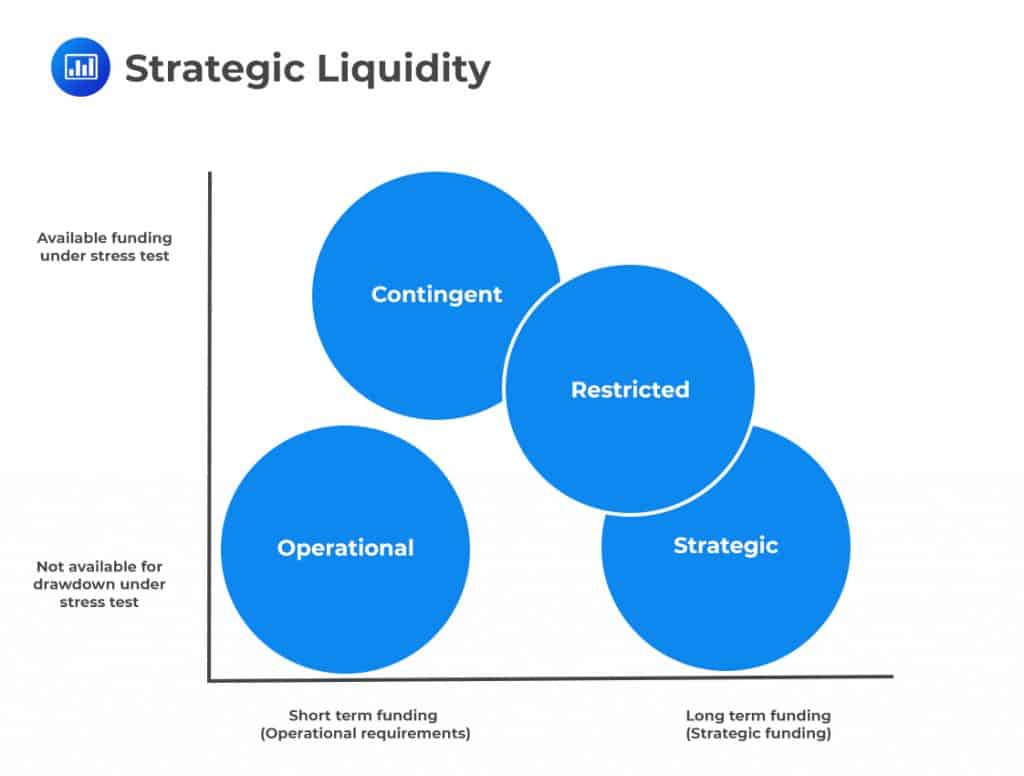

Liquidity is used for four purposes, namely operational, contingent, restricted, and strategic liquidity, as discussed below:

Operational liquidity involves the cash needed for daily funding of the business and the orderly clearing of payment transactions. There is a high level of volatility associated with operational liquidity hence necessitating an additional cushion to account for unpredictable daily settlements. During a liquidity stress test, operational liquidity is unavailable to meet financial obligations.

Restricted liquidity entails liquid assets maintained to be used mainly for specifically defined purposes. During a liquidity stress test, restricted liquidity is unavailable to meet general financial obligations; however, it applies to any assumed outflows that they support.

Contingent liquidity characterizes the liquidity available to meet general financial obligations under a stress scenario. The liquidity is in the form of the institution’s liquid asset buffer, which entails access to high-quality financial assets that are readily convertible to cash without incurring a fire sale price. The principal objective of the stress test inclines towards the contingent liquidity measurement.

Strategic liquidity involves the cash an institution holds for future business needs that may arise in the course of normal operations such as funding future acquisitions or capital, but it’s not to support the bank during times of stress.

Estimation of Contingent Liquidity via the Liquid Asset Buffer

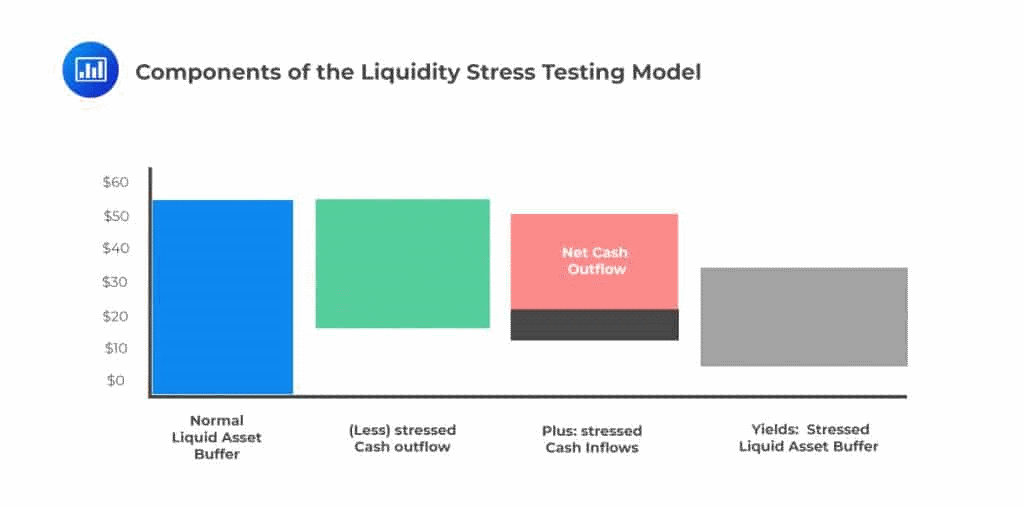

Estimation of Contingent Liquidity via the Liquid Asset BufferFor an institution to measure liquidity stress, it should target to measure the level of required contingent liquidity, which involves constructing a cash flow model that precisely and accurately measures components such as the liquid asset buffer, stressed outflows, stressed inflows, and the stressed liquid asset buffer. The following sections give a further discussion of these components.

Liquid asset buffer refers to a stock of unencumbered high-quality liquid assets usually held to protect against failure under liquidity stress. It represents the contingent liquidity that is currently available for an institution.

Before the inclusion of a security in the asset buffer, the necessary market and operational characteristics that it should meet must be explicitly defined. Further, the framework should ensure that its liquidity-generating capacity remains intact even during adverse idiosyncratic and market stress. These characteristics should include low credit and market risk, trading in an active and sizable market, ease and certainty of valuation, and low concentration of buyers and sellers.

Stressed outflows occur during stressed scenarios. They result from the need to prematurely settle non-contractual maturity obligations and the incapacity to refund contractual maturity obligations that could roll over under normal conditions. The outflows to be modeled should be explicitly defined in the framework and should belong to the categories of retail deposit outflows, derivative transaction funding, unsecured wholesale funding outflows, loss of funding on asset-backed issuances, secured funding runoff, and drawdown of credit and liquidity facilities.

Stressed inflows offset the stressed outflows but partially. They include secured funding transaction maturities, drawdowns on liquidity facilities available to the institution, and loan repayments from customers. Market conditions may reduce the level of inflows according to the assumptions employed in a given stress scenario.

The current liquid asset buffer is the sum of (stressed outflows – stressed inflows) and the liquid asset buffer considering the underlying assumptions in a stress scenario.

Liquidity stress testing components can be demonstrated as shown in the following figure:

Design of the Model

Design of the ModelThe model process of liquidity stress testing begins with identifying the risk and doing event analysis to ensure that the list of scenarios captures material liquidity appropriately.

Although the consolidated stress test should be the fulcrum of any liquidity risk framework, it may be necessary to conduct stress testing on subsidiary entities within the organization. An institution should perform a separate liquidity stress test on organizational levels such as parent, service business unit, subsidiary legal entities, lines of business, and shared service centers. For less material entities or entities with manageable risk assessments, simple entity-level liquidity risk reporting might be appropriate.

An institution should consider the organizational level whereby the liquidity is commingled, and the management does liquidity control. Combining the legal entities and operating units exemplifying both of the above characteristics provides the building blocks of the enterprise-level liquidity stress test.

Sometimes liquidity may be trapped in given legal entities creating a distorted view of the consolidated liquidity position of an institution due to certain restrictions. In such scenarios, a bank should assess the effect of the restrictions on enterprise-level liquidity for both typical operating environments and stressed conditions.

The presence of liquidity transfer restrictions does not guarantee a rise in the need for an extra stress test in cases that are demonstratable to show that there is no subsidiary requirement to upstream cash to the parent. For instance, an institution may stress the consolidated entity and the holding company but fail to test individual banking subsidiaries assuming that cash movements from the parent to the subsidiary would be unrestricted.

The liquidity stress test is performed based on the currency of the tested entity using the home country currency for the consolidated test. There should be further considerations of the liquidity impact of currency conversion requirements to avoid currency mismatch for offshore subsidiaries.

Individual stress test for foreign subsidiaries is necessary for institutions that operate in several foreign jurisdictions under several regulatory oversight regimes. For instance, according to U.S. regulations, specific foreign banking organizations should conduct liquidity stress tests for intermediate holding companies and branches to address cases of foreign banks operating in the country being over-reliant on offshore funding.

For an institution to maintain adequate contingency funding through a period of extended stress, the time horizon for the stress test should be at least 12 months. Cash flow projections that run beyond twelve months are acceptable, albeit longer-term projections may be affected by forecast error according to the baseline balance sheet and statement of income budgeting time horizon. Besides, it’s not feasible for a bank to continue its operations indefinitely under stress without employing a recovery or resolution process.

A bank may decide to forecast beyond twelve months in a case where the calculation of the survival horizon depends on the stress test. The survival horizon may even extend beyond this period for banks with sufficient liquidity.

Determination of the cash flow frequency measurement is done within the overall time horizon, and the decision to estimate periodic cash flows should balance the benefits of improved precision against the reduced forecasting accuracy beyond a specific time frame. In this connection, stress models forecasting daily over a short time frame such as a month, and a weekly or monthly transition of cash flows for the remaining time horizon usually offer the best balance.

It is recommendable to do daily forecasting during the early stage of forecasting because of the relatively higher predictability of these cash flows, and also because a critical period of stress for the institution may occur during the first few days.

The liquidity stress test involves three approaches, namely historical statistical techniques, deterministic models, and Monte Carlo simulation.

Stochastic techniques that depend on observations of the historical volatility of cash flow variables, either using the historical statistical models such as CFaR or Monte Carlo simulation techniques that depend on historical observations of volatility, are less favorable in times of financial crisis.

Deterministic scenarios are the most effective tools for assessing liquidity risk since liquidity stress is an extreme “tail event.” The disadvantage of stochastic approaches is their incapability to accurately predict the management countermeasures that would occur during a liquidity crisis event.

The baseline balance sheet funding and a liquidity plan form the starting point for building a liquidity stress test. A banking organization should ensure that it enhances the structure of the baseline plan as well, ensuring that the base case is consistently structured and at the same level of detail as the stress scenarios when building its liquidity stress test framework.

Liquidity failure is a high-impact and low-frequency event by nature. However, few banks have fallen as a result of a liquidity crisis, and for that matter, there is little data reliable for building dependable and predictive models that can accurately evaluate the minimum level of liquidity that an institution should expect to remain within a confidence interval.

Due to these challenges and the highly complex, interconnected nature of liquidity behavior, the best approach in stress testing is based on developing a discrete and deterministic scenario. Additionally, banks should carefully consider their idiosyncratic material risk when designing their scenario framework.

Liquidity stress scenarios are of two types, namely historical scenarios and forward-looking (hypothetical) scenarios.

Hypothetical scenarios depend on a forward-looking view in which the financial institution experiences adverse liquidity stress. Banks develop multiple scenarios with the following characteristics:

Distinguish between systemic and idiosyncratic risk: Systemic stress such as a decrease in the market liquidity of securities may cause stress impacts. However, other stress impacts result from bank-only stress, such as a deposit run. In this case, the bank should develop scenarios for each of the cases of systemic, idiosyncratic, and for both to capture these fluctuating impacts.

Distinguish between levels of severity: For an institution to widen its view of liquidity risk and applicable limits, it should undertake graduating levels of severity, such as developing adverse and severely adverse variations of the idiosyncratic scenario.

Clearly define the scenarios: Establishing a specific and detailed description of the business and market events related to each scenario offers the basis for assumption development and links stress testing with early warning indicators in contingency funding plans. A good scenario description should include:

A bank should consider a model that is holistic in terms of capturing systematic and independent risk behavior rather than developing isolated liquidity assumptions. In this case, liquidity stress test scenarios based on the standard industry such as those needed by regulators in the Basel III Liquidity Coverage Ratio (LCR) are very prescriptive.

Together with the assumption-based hypothetical scenarios, a bank may also perform a reverse liquidity stress test to determine which conditions’ existence given the bank’s current liquidity level would cause its current business plan to fail. Developing such a reverse stress test scenario creates several problems due to the existence of many factors that could be combined to destroy the institution. Reverse stress testing is not performed collectively among financial institutions due to the challenges of identifying the associated problems. However, to enhance an understanding of the priority risks, the institution should be testing through a reverse stress test in developing traditional stress test scenarios.

Valid assumptions are crucial in liquidity stress testing as the process depends on both historical and hypothetical scenarios. There have been inadequate market and historical data to create a baseline for stress testing assumptions. However, the available segmentation frameworks that enable differentiation of assumptions across different levels of cash flow risk improve the precision of the liquidity stress test.

The Basel III Liquidity Coverage Ratio (LCR) is an essential factor an institution should consider when developing internal views of stressed liquidity behavior.

The following table gives a breakdown of crucial liquidity stress impacts:

$$\small{\begin{array}{l|l}

\textbf{Category} & \textbf{Key Liquidity Stress Impacts} \\\hline

\text{Deposit runoff} & \text{Depositors accelerate demand deposit withdrawals} \\\hline

\text{Deposit runoff} & \text{Term depositors exercise early withdrawal rights} \\\hline

\text{Loss of wholesale funding} & {\text{Inability to roll over short-term, maturing unsecured}\\ \text{ wholesale}} \\\hline

\text{Loss of wholesale funding} & {\text{Early termination of unsecured wholesale funding credit lines}\\\text{and/or early redemption of wholesale fundings}} \\\hline

\text{Loss of secured funding} & \text{Loss of willing counterparties for secured funding} \\\hline

\text{Loss of secured funding} & \begin{array}[c]{@{}l@{}}\text{Limitation of security types available for secured funding}\\\text{and/or increased collateral haircuts}\end{array} \\\hline

\text{Loss of secured funding} & {\text{Loss of access to asset-backed funding facilities due to lack of}\\\text{funding embedded options, or lack of eligible assets}}\\\hline

{\text{Reduced investment}\\ \text{portfolio liquidity}}& {\text{Increased liquidity haircuts and/or reduced valuations}\\ \text{of liquidity portfolio securities}} \\\hline

\text{Derivative cash flows} & {\text{Increased derivative margin/collateral calls due to increased}\\ \text{market volatility of underlying position}} \\\hline

\text{Derivative cash flows} & \text{Increased collateral calls due to reduction in collateral value} \\\hline \text{Ratings downgrades} & \text{Collateral or other liquidity impacts due to ratings triggers} \\\hline \text{Credit/liquidity facilities} & {\text{Accelerated drawdown of credit and liquidity facilities}\\ \text{by customers/counterparties}} \end{array}}$$

The following section discusses the considered assumptions:

Investment portfolio haircuts: The available sources of liquidity and haircut pose a critical impact on available liquidity under stress. For systematic stress scenarios, the haircut widens, just like in times of liquidity crisis. For this reason, the model should include different haircut assumptions for securities with different liquidity characteristics. It should further include anticipated haircut disparities between secured financing channels used by the institution such as Federal Home Loan Bank funding, and repo facilities.

The institution should develop an orderly scoring system to rank the relative liquidity along the different segmentation dimensions and allocate specific haircuts to each security type and funding channel based on assessed liquidity risk. Developing the haircuts starts with a review of the current market conditions assuming the conditions are normal. These advance rates are compared to the experiences of the bank during the financial crisis, and if such information is unavailable, peer comparisons can provide it.

Deposit outflows: These outflows creates a substantial threat to both liquidity and the behavioral dynamic of the model. For banks with a high level of deposit funding, liquidity stress test models developed on simplistic assumptions about deposit behavior probably yields meaningless results irrespective of how accurately calibrated are other factors.

Institutions should build a set of complete deposit runoff assumptions relative to a behavioral segmentation framework capturing variations in stressed deposit behavior.

The historical behavior of a deposit portfolio at the account rather than the portfolio level should be analyzed to develop a suitable internal segmentation framework. During a hypothetical crisis, empirical analysis may yield an imperfect experiment indicative of behavior. However, the analysis suggests customer “stickiness,” offering a more rigorous foundation compared to high-level, qualitative assumptions.

Unsecured whole sell funding: During the idiosyncratic stress period, unsecured whole sell funding is hardly available. Banks need to review funding channels to differentiate them subject to overnight and term funding.

Collateral requirement: Collateral requirements increase during stress periods due to valuation impacts on existing collateral and amplified amount of collateral required due to changes in derivative positions. Assumptions for collateral call levels are developed depending on the level of required detail. Historical collateral call levels during times of stress are reviewed, selecting the most substantial liquidity requirement experienced during a historical period.

Other contingent liabilities: The developed model should address every material source of contingent liquidity outflow, such as drawdowns of customer credit lines, letters of credit, trade financing arrangements, liquidity facilities, securitization facility runoff, and other contractual arrangements. The institution should review the contingent liabilities’ behavior during the financial crisis, and if no available data from the past crisis, conservative assumptions can be employed. Note that the model should also incorporate non-contractual agreements.

Business dial back: All feasible assumptions about the institution’s capacity to reduce liquidity-draining business activities like new loan origination should be incorporated into the model. In the development of these assumptions, the business management should discuss the appropriate reduced funding activity that can occur without substantial reputational problems.

The output of a stress testing model is very substantial in assessing tactical and structural liquidity based on internally established limits and regulatory expectations. Furthermore, the liquidity risk escalation process of an institution depends on model output. The bank should develop its liquidity limit structure, and notably the contingency funding plan based on the results of the liquidity stress test. The output of a stress testing model is as below:

The following are the four key assumptions:

The amount of available liquidity concerning net cash outflows under every scenario is the key output of a stress testing model. This metric structure varies depending on the institution; some differentiate between tactical and structural liquidity while measuring the results of the liquidity stress test. For instance, the Basel III Liquidity Coverage Ratio (LCR) provides a thirty-day view of available liquidity under stress.

An institution should gauge the potential liquidity profile of the bank during the stress horizon. The leading indicators of liquidity risk comprise of prospective existing liquidity, ratios indicating wholesale funding dependence, and metrics indicating possible overconcentration in given funding channels.

A balance sheet should be thoroughly measured, gauging the economic impact of the investment portfolio. An institution may gauge the tradeoff between low-yielding, low-haircut instruments and higher performance, less liquid instruments by computing the yield net of a regulatory/economic capital charge. In confirming whether the model captures the impact of any capital actions that are necessary for supporting liquidity over the stress period, it is necessary to track the significant capital metrics for each entity. The stress test is advisably conducted at least quarterly to assist the asset-liability management team to do a review.

The stress test’s purpose is to effectively oversee the process to ensure the liquidity risk profile satisfies the bank’s risk appetite and capacity. Governance and control roles include:

This committee, together with the management risk committee and executive management, is responsible for liquidity stress testing. The functions of the committee include:

The Treasury is responsible for the following activities:

Risk management is accountable for providing independent oversight of liquidity stress testing together with other programs relative to components of the liquidity risk management program. The risk management is accountable for:

Internal audit undertakes the liquidity stress testing framework periodical review, procedures, and controls to keep compliance with policy, regulatory, and control requirements.

The committee provides independent validation and control over the management governance of the liquidity stress testing model concerning the institution’s model risk management policy.

The liquidity stress test aims to get the appropriate level of liquidity buffer. In maximizing the efficiency of the liquidity portfolio, the composition of the liquidity buffer is designed based on the liquidity stress test.

Higher yielding instruments usually have less favorable liquidity components and increase investment portfolio duration. A maximization in either the yield or period of the portfolio would be suboptimal for the institution’s return on asset performance as a whole.

A yield maximizing portfolio is ineffective due to the extra balance level needed to offset stress test haircuts and the disparity between the portfolio’s inflows and the stress test outflows. Additionally, maximizing the liquidity profile of the portfolio instead of the yield may be likewise ineffective.

There exists a similar trade-off for incorporating the capital impact of various portfolio alternatives depending on the institution’s economic and regulatory capital framework. The maximization of the investment allocation of liquidity and capital may be suboptimal due to the extra regulatory and possibly economic capital requirements related to the instruments. Banks in which additional asset amount leads to an extra equity capital necessity under leverage ratio limits experience challenges due to the new haircut required for higher-risk instruments. Linking liquidity versus capital necessitates a funds transfer pricing (FTP) framework to accurately incorporates the stressed liquidity profile of diverse business segments across the enterprise.

The impact of different funding sources with varying liquidity characteristics is one of the vital information provided by liquidity stress testing. Since the financial crisis, attempts are made to provide financial institutions with an incentive to promote reliable funding sources like retail branch deposits rather than money from wholesale sources. The Treasury should establish a target funding profile by modeling the liquidity impacts of the available alternatives.

For instance, linking the liquidity profile of commercial deposits to treasury management services bolsters the business’ case investment in the desired industry segments characterized by more intensive working capital requirements. Establishing such a link needs a funds transfer pricing (FTP) framework to incorporate the stressed liquidity profile of different business segments across the enterprise appropriately.

An institution should keep an information technology system that automatically collects, aggregates, captures market data, generates reports, and does data analytics. Developing such an infrastructure for liquidity stress data is a challenge to complex financial institutions as it requires substantial amendments to the existing data warehouse capabilities built from the general ledger and transactional customer data. The following conditions are vital for consideration in establishing a sustainable infrastructure:

A data management model development is necessary to ensure that the required liquidity position data are captured automatically. The specific architecture used by an institution could include the use of standardized templates or data hub structures. For the automated development of model inputs, there is an association between the necessary liquidity characteristics and each position data which should conform to the institution’s granularity.

The development of an automated position capture should start with generating regulatory reports such as the Basel III Liquidity Coverage Ratio (LCR) with less manual intervention.

A good model should capture all necessary features and functions required in any robust analysis tool. Such features include the capacity to perform sensitivity analysis on stress test assumptions, the capacity to save scenarios, and the capacity to produce different legal entity views. The model should further include analytic functionality that measures the economic capital impact of different liquidity portfolio allocations.

Monitoring of significant risk indicators and performance drivers on a predetermined basis should be done, distributing the results to risk managers. In this connection, liquidity stress test outcomes may be included in a current risk dashboard or distributed separately.

Liquidity stress testing is integrated with other related risk frameworks like asset-liability management (for interest rate risk), recovery and resolution planning, and capital stress testing. The model may be using a related assumption framework about the balance sheet behavior of given accounts, which, when developed independently, may lead to an overall risk management framework. Banks should consider correlations between risk types that may create a systemic or idiosyncratic stress scenario.

Theoretically, an institution should keep a complete risk model that gauges the impact on liquidity, capital, and balance sheet structure based on a standard set of scenarios. Practically, this strategy may be challenging since it’s complicated and needs an institution to develop exceptional stress scenarios for each risk type.

To link liquidity stress testing and capital stress testing requires an institution to incorporate any essential capital infusions of subsidiary entities. For every liquidity stress test scenario, the institution should develop capital impact assumptions based on the general market and idiosyncratic conditions that occur under the scenario. The extent of detail for developing these assumptions differ from a high-level capital infusion assumption to complete credit loss and pre-provision net revenue modeling for victim subsidiaries.

Additionally, the capital stress testing framework should comprise of a liquidity stress evaluation aimed at gauging the impact of any required liquidity impacts on capital adequacy. Finally, a liquidity impact analysis should be done to establish if extra capital impacts may arise through investment portfolios and necessary funding actions that would raise additional worsening in capital adequacy.

Interest rate risk models are made to gauge the interest expense and economic value of equity impacts of adverse changes in interest rates. Liquidity impact analysis is not run concomitantly stress testing for interest rate risk as done for capital stress testing. However, we employ a consistent behavioral framework in both the interest rate and liquidity stress testing models. For instance, in an event where the liquidity stress test model assumes that there is no runoff in given operational deposits, the interest rate risk model has to segment these deposits and treat them as non-operational deposits.

In the liquid stress model, consideration of interest rate impacts is essential. The combination of the liquidity stress test scenario framework, liquidity risk dashboards, and liquidity risk early warning indicators should comprise the likelihood of an interest rate shock and its possible impact on general liabilities.

Fund transfer pricing is an essential tool for driving business decision-making, despite that it’s not a risk model. The purpose of the FTP framework is to price liquidity appropriately, irrespective of whether provided for lending by the treasury center or credited to liability-generating activities. This framework should leverage and be consistent with the contingent liquidity necessities for assets and liabilities measured by the liquidity stress test model. All costs of carrying a buffer should pass through the FTP framework.

Question

Cascade Finance, a global bank, is preparing for a strategic review session to better align its operational framework with global standards. As part of this process, the bank is evaluating various types of liquidity to ensure that they are optimally managed. During the meeting, the bank’s CFO presents a hypothetical scenario to the team:

“In a situation where our bank faces an unexpected, significant financial outflow due to an unforeseen event like a major lawsuit settlement, which type of liquidity would be most directly affected and would be of utmost concern?”

A. Operational liquidity

B. Funding liquidity

C. Strategic liquidity

D. Contingent liquidity

Solution

The correct answer is D.

Contingent liquidity pertains to the ability of a bank to handle unforeseen or sudden financial outflows or events. Major lawsuit settlements are exactly the kind of unforeseen events that would test a bank’s contingent liquidity. In such situations, a bank would need to draw from its contingent liquidity reserves or obtain external funds quickly to meet its obligations.

A is incorrect: Operational liquidity is the ability of the bank to manage its day-to-day operational needs and is concerned with the efficient management of payments and settlements. While it ensures smooth daily operations, it is not specifically designed to handle large, unexpected financial outflows.

B is incorrect: Funding liquidity is related to a bank’s ability to fund the assets on its balance sheet and to meet its obligations as they come due. Although a significant financial outflow would affect funding liquidity, the direct concern in the presented scenario is not about the bank’s ongoing ability to fund assets, but about its ability to deal with a sudden, unexpected liability.

C is incorrect. Strategic liquidity refers to the bank’s ability to finance its long-term investment activities. While it is essential for the bank’s growth strategy and long-term health, it is not directly affected by sudden, unexpected financial outflows due to events like lawsuit settlements.

Things to Remember

- Contingent liquidity is crucial for unexpected events that might lead to significant financial outflows, requiring banks to have safeguards in place.

- This type of liquidity involves both reserves and quick access to external funds to navigate unforeseen financial crises.

- Proper management of contingent liquidity aids banks in maintaining confidence among stakeholders during times of sudden financial strain.

- It is essential for banks to periodically test their contingent liquidity through stress testing and scenario analysis to ensure preparedness for a variety of potential crises.

- Differentiating between various types of liquidity helps banks in targeted risk management and ensuring overall financial health.

Prepare for FRM Part II by analyzing liquidity stress scenarios, funding risks, and enterprise liquidity management strategies.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.