Swaps

After completing this reading, you should be able to: Explain the mechanics... Read More

After completing this reading, you should be able to:

A financial asset is an asset that derives its value from a particular claim.

Assets held for the purposes of investing are referred to as investment assets. Examples of such assets include stocks and bonds issued by various financial institutions. On the other hand, assets primarily held for the purpose of consumption and not for investment or resale are referred to as non-investment or consumption assets. Examples of such assets include oil, coffee, tea, corn, e.t.c.

In this chapter, we consider three types of assets:

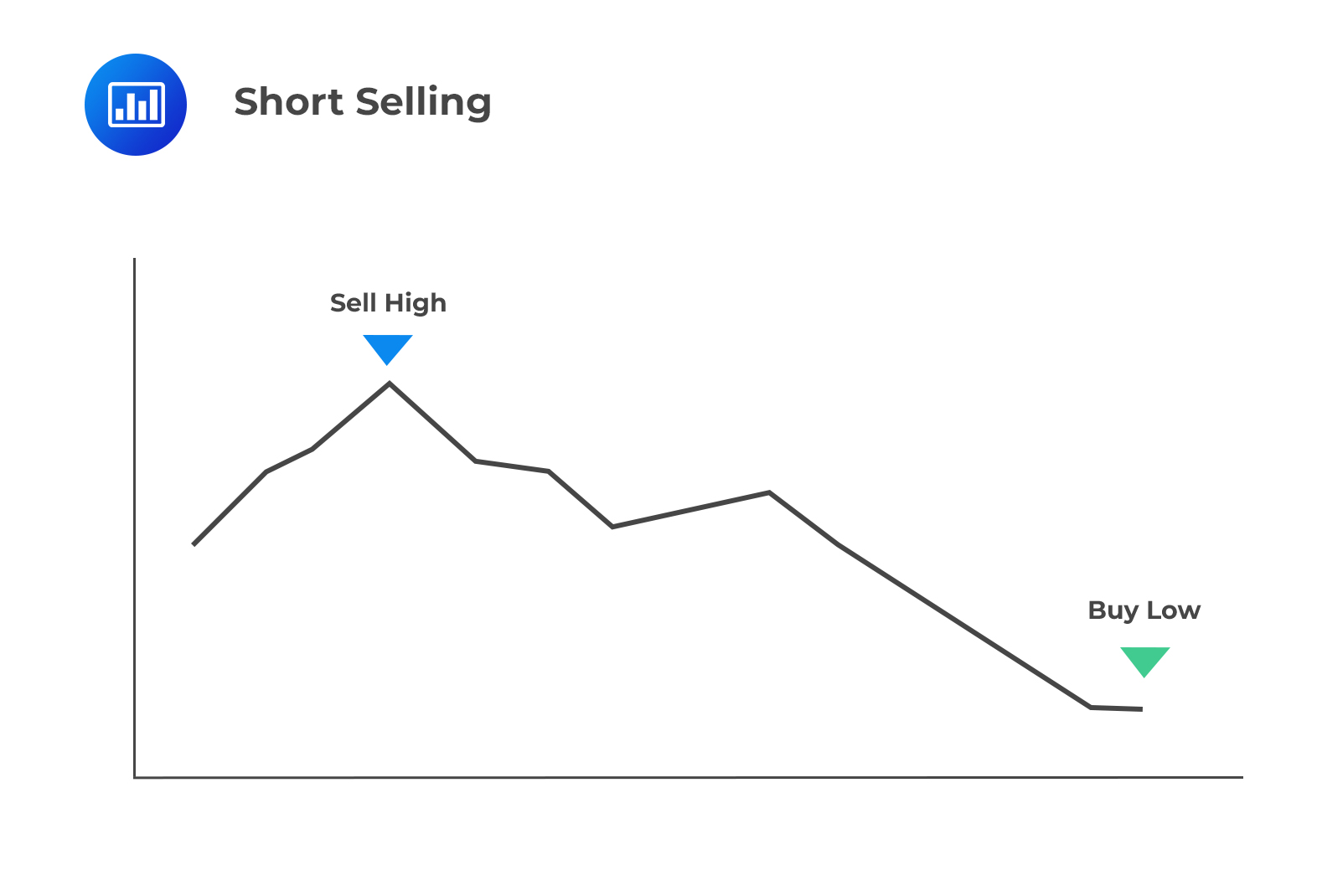

Short selling involves the sale of a security not owned by an investor. The investor sells the security but purposes to buy it later. The investor will then realize profits if the price of the security goes down and losses if the price of the security goes up.

Short sales are transacted through a broker. The short seller must deposit some collateral to guarantee the eventual return of the security to the owner. In addition, the short seller is required to pay all accrued dividends, if any, to the lender. Thus, the net profit is equal to:

Short sales are transacted through a broker. The short seller must deposit some collateral to guarantee the eventual return of the security to the owner. In addition, the short seller is required to pay all accrued dividends, if any, to the lender. Thus, the net profit is equal to:

$$ \text{Net profit}=\text{Sale price}–\text{Borrowing price}–\text{Dividend paid} $$

For example, if a trader shorts a stock today at $100, a dividend of $4 is paid next month, and the trader closes the short position the following month at $90, the net profit will be $100 – $90 – $4 = $6. His return would normally have been \(\frac {$10}{$100} = 10\%\), but the dividend that he had to pay to the long position decreased his return to only \(\frac {($10 – $4)}{100} = 6\%.\)

Ignoring brokerage costs and assuming no borrowing fee, the cash flows obtained from a long position should mirror the cash flows from a short position, i.e., a profit of $200 to a short position trader should mean a loss of $200 to a long position trader.

This reading examines the relationship between spot and forward prices of assets that provide no income, provide a known income amount, and provide an income that is a percentage of the asset.

These assets include treasury bills, stocks that do not provide dividends, and zero-coupon bonds.

Consider a financial asset that costs $50 as of now. The borrowing/lending rate of a financial institute is 5% per year. How can a trader maximize profits if the one-year forward price is:

To make a profit, a trader will have to buy the asset today at USD 50 and then sell it a year later at USD 70.

For that one year, the cost of funding the asset will equal to \((0.05 × \text{USD } 50)=\text{USD } 2.50\)

The profit made will therefore be equal to \(\text{USD } 70-\text{USD }50-\text{USD }2.50=\text{USD } 17.50\)

A forward price greater than USD 52.50 (spot price of the asset today plus the cost of funding the asset in one year) guarantees the trader a profit with zero risks.

To make a profit, a trader will have to sell the asset (at USD 50) and enter into a contract to buy it back a year later (at USD 40).

The trader will thus make an initial profit of $10. Buying back the asset generates USD 50 that can be invested at the 5% risk-free interest rate to earn an additional profit of \((0.05 × \text{ USD } 50=\text{ USD } 2.50 )\). This gives a total profit of \(\text{ USD} (10.00+2.50) = \text{USD } 12.50\).

For profits to be realized, the forward price must be lower than USD 52.50

Assuming that there are no arbitrage opportunities, the forward price should, therefore, be equal to USD 52.50.

Suppose that the borrowing and lending rates of a bank are 5.1% and 5.0%, respectively. In a no-arbitrage situation, the first case scenario gives a forward price less than 52.55 \((\text{USD } 50×(1+0.051)^1)\).

The second case scenario remains unchanged since the lending rate is similar to the interest rate used above. This implies that the forward price should lie between USD 52.55 and USD 52.50.

Financial assets that pay a known income may either be bonds that have a known coupon rate or stocks whose dividends are known in advance.

Refer to example 1 above and assume that the assets will provide cash flows of $5 every six months. Assume also that the annually compounded 6 month and one-year interest rates are 4% and 5%, respectively

The trader buys the asset and purposes to sell it later. After six months, the trader gets $5. The present value of $5 is $4.903. The trader can borrow the present value amount of the loan to be repaid in 6 months-time using the cash flow received at the 6th month.

The remaining \(\text{USD}(50-4.903)=\text{USD } 45.097\) can then be borrowed at the rate of 5% per year. The total amount required to pay off the loan will then be \(\text{USD } 45.097 × 1.05=\text{USD } 47.35185\) giving the trader a profit of \(\text{ USD } 70-\text{USD } 47.35185=\text{USD } 22.64815.\)

For profits to be realized, the forward price should, therefore, be greater than USD 47.35185.

The trader sells the asset and enters into a forward contract to buy it back at USD 40. This can be done by investing $4.903 from the proceeds of the sale at 4% per year to generate $5 that will be paid as dividends to the new owner, and the remaining amount \(\text{ USD } 50-\text{USD } 4.903=\text{USD } 45.097\) at 5% per year for one year. This gives a value of \(\text{USD } 45.097 × 1.05 = \text{USD } 47.35185\). The profit is therefore \(\text{USD } 47.35185-\text{USD }40=\text{USD } 7.35185.\)

For profits to be realized, the forward price should, therefore, be less than USD 47.35185

For profits to be generated, the forward price should be greater than USD 47.35185 for the first case scenario and less than USD 47.35185 for the second case scenario. A no-arbitrage opportunity, therefore, arises when the forward price is USD 47.35185.

Instead of providing the known income as cash, some financial assets provide the income as a percentage of the price of the asset.

Defining terms as:

\(S\) = Spot Price

\(F\) = Forward Price

\(R\) = Risk-free interest rate per year compounded annually

\(Q\) = Yield

\(T\) = Time to maturity

The general formulae for:

$$ \text F=\text S(1+\text R)^{\text T} $$

If F is greater, to realize profits, traders should buy the assets and sell them in the forward markets. The reverse is true.

$$ \text F=(\text S-I)(1+\text R)^{\text T} $$ The spot price, S can be found by making S the subject of the formula; $$\text{S}=\text{I}+\frac{\text{F}}{(1+\text{R})^{\text{T}}}$$

If F > (S − I)(1 + R)T, to realize profits, traders should buy the assets and sell them in the forward markets.

If F <(S − I)(1 + R)T , investors can make arbitrage profits by selling the assets and buying the forward contract.

$$ \text S=\cfrac {\left\{ \text F(1+\text Q)^{\text T} \right\}}{(1+\text R)^{\text T}}, \text F=\text S \left\{ \cfrac {(1+\text R)}{(1+\text Q)} \right\}^{\text T} $$

The price of a forward contract does not necessarily reflect the value of the contract. At the onset of a forward contract, the forward price is calculated as shown above. The value is, however, zero or close to zero. The value of the contract either becomes positive or negative as time passes by and is dependent on asset price changes. The agreed-upon forward price at which the asset will trade will, however, remain constant.

Define K as the forward price of an asset at the time the contract was originally entered, F as the current forward price for the contract, S as the spot price and T as the current time to maturity of the contract.

$$ \text{Value of a long forward contract} = \frac {(\text F-\text K)}{(1+\text R)^{\text T}} \text {where F}= \text S(1+\text R)^{\text T} $$

If an income with a present value of I is to be paid during the remaining life of the contract,

$$ \text{Value of a long forward contract} = \text S-\text I-\left\{ \frac {\text K}{(1+\text R)^{\text T}} \right\} $$

and

$$ \text{Value of a short forward contract} = \frac {(\text K-\text F)}{(1+\text R)^{\text T}} \text {where F} =\text S(1+\text R)^{\text T} $$

If a yield at the rate of Q is provided,

$$ \text{Value of a long forward contract} = \left\{\frac {\text S}{(1+\text Q)^{\text T}} \right\}- \left\{ \frac {\text K}{(1+\text R)^{\text T}} \right\} $$

Consider a forward contract where the stock price is USD 60, no income is provided, and that the annual rate of interest is 4%. The current forward price is $ 62.4. If, at some time back, a long forward contract was entered to purchase the stock at $ 65, what is the value of the long forward contract?

$$ \begin{align*}\text{Value of a long forward contract} &= \text S-\text I-\left\{ \frac {\text K}{(1+\text R)^{\text T}} \right\}\\&=60-0-\frac{65}{1.04} =-2.5\end{align*}$$

Unlike future contracts, which are settled on a daily basis, forward contracts are settled at maturity.

It can be shown that if interest rates are constant (or if they change in a perfectly predictable way), the theoretical no-arbitrage forward and futures prices are the same.

However, in practice, interest rates do vary unpredictably, and futures prices are therefore different from forward prices. This difference is due to the correlations between the returns from the underlying assets and interest rates.

As an example, suppose that the price of an asset is positively correlated with interest rates. If the asset price increases, there will be an immediate gain from a long futures contract. This gain can then be invested at a relatively high-interest rate because (on average) interest rates increase when the asset price increases. If the asset price decreases, there will be an immediate loss on the long futures contract. However, the funds can be financed at a low-interest rate because interest rates (on average) decline when the asset price declines. This makes the long futures contract slightly more attractive than a long forward contract, and the futures price would therefore be slightly higher than the forward price. When the correlation between the return from the underlying asset and interest rate is negative, however, this argument is reversed, and the theoretical futures price is slightly lower than the theoretical forward price.

Another disparity between futures and forward contracts comes about due to differences in delivery dates. Futures contracts have a range of delivery dates. A trader with a short position will deliver the asset as soon as possible to avoid financing costs if the interest rates charged are higher than the returns from the underlying asset. If the interests are lower, the trader will hold on to the asset as much as possible in order to maximize the income earned on the asset. Forward contracts lack a range of delivery dates.

In as much as forward prices are approximately equal to futures prices, the profits and losses realized from the contracts are not the same. A trader trading with a futures contract will have his/her profits reflected immediately since they are settled on a daily basis. On the other hand, the profits/losses of a forward contract will be shown in present value terms since forward contracts are settled at maturity.

Index arbitrage is a trading strategy that involves buying the portfolios of a stock underlying an asset in cases where the futures price is greater than the theoretical price and selling them in the futures market. In cases where the theoretical price is greater than the forward price, an investor sells the stock and enters into a long futures position.

Program trading enables a computer to send out all the required trades to an exchange as the futures contract is being traded.

The similarity between the price of a portfolio and an index presents a no-arbitrage opportunity. However, there are some cases where the index does not correspond to the value of a portfolio.

Question 1

Consider a forward contract on a stock index such as the S&P 500. Everything else being constant, which of the following statements is least accurate?

A. The forward price will fall if interest rates rise.

B. The forward price is directly linked to the level of the stock market index.

C. If the time to maturity is increased, the forward price will rise.

D. The forward price will fall if dividend payments on the underlying stocks increase.

The correct answer is A.

Increasing the level of interest rates r makes the forward contract more appealing to investors. Thus, the forward price will increase.

Question 2

The one-year U.S.dollar interest rate is 1.5%, and the one-year GBP interest rate is 2.0%. The current \(\frac {\text{USD}}{\text{GBP}}\) spot exchange rate is 0.85. Assuming annual compounding, what is the one-year \(\frac {\text{USD}}{\text{GBP}}\) forward rate.

A. 0.8825

B. 0.7575

C. 0.8520

D. 0.8542

The correct answer is D.

If we assume annual compounding, then:

$$ \text F_0=\text S_0 \cfrac {(1+\text r)}{(1+\text R)} $$

Where:

\(F_0\) = forward exchange rate

\(S_0\) = spot exchange rate

\(r\) = quoted currency interest rate

\(R\) = base currency interest rate

$$ \text F_0=0.85 \cfrac {1.02}{1.015}=0.8542 $$

Exam tip:

All prices \((\text S_0,\text F_0)\) are measured in the domestic currency. Unless directed otherwise, you’re supposed to apply the indirect quotation methodology in the exam. Under the method, an \(\frac {\text A}{\text B}\) quote has A as the base currency, and B as the quoted currency. The base currency (in this case, the U.S. dollar) is always equal to one unit (in this case, US$1), and the quoted currency (in this case, the GBP) is what that one base unit is equivalent to in the other currency. That is, 1USD=0.85GBP.

Question 3

The price of a six-month futures contract on an equity index is currently at USD 1,215. The underlying index stocks are valued at USD 1,200. The stocks also pay dividends at a rate of 3%. Given that the risk-free rate is 5%, determine the potential arbitrage profit per contract.

A. $3

B. $12

C. $15

D. $0

The correct answer is A.

The fair value of the futures contract, \(F\), is given by:

$$ F=S\times \left(\frac{ (1+r)}{(1+r^{*})} \right)^{T}$$

Where:

\(S\) = current value of the underlying

\({ r }^{ \ast }\)=rate of dividends

\(r\)=risk-free rate

\(T\)=time to maturity=\(\frac { 6 }{ 12 } \)

$$ \begin{align*}F&=S\times \left(\frac{ (1.05)}{(1.03)} \right)^{0.5}\\ &=1,211.59\end{align*}$$

Thus, the actual futures price is too high by \($3\left( =1,215–$1,212 \right) \).