Managing And Pricing Deposit Services

After completing this reading, you should be able to: Differentiate between the various... Read More

After completing this reading, you should be able to:

In the UK, quantitative liquidity reporting is a core part of the regulatory regime. The full requirement applies to individual liquidity adequacy standards (ILAS) firms. Some smaller institutions and foreign branches are not ILAS firms. As such, the regulatory authority will agree on the format and frequency of liquidity reporting on a case-by-case basis. The following is a summary of the reporting requirements for UK standard ILAS firms:

$$ \begin{array}{l|l|l|l} \textbf{Report} & \textbf{Description} & \textbf{Frequency} & \textbf{Deadline of} \\ \text{} & \text{} & \text{} & \textbf{submission} \\ \hline \text{FSA047: Daily} & \text{Daily cash flows out} & \text{BAU: Weekly} & \text{BAU: end-of-} \\ \text{Flows} & \text{to analyses survival} & \text{firm-specific} & \text{day Monday} \\ \text{} & \text{of 3 months} & \text{and the market-} & \text{Stress: end of the } \\ \text{} & \text{} & \text{wide liquidity} & \text{day in the } \\ \text{} & \text{} & \text{stress, done} & \text{following } \\ \text{} & \text{} & \text{daily} & \text{business day} \\ \hline \text{FSA048: Enhanced} & \text{ILAS risk drivers/} & \text{BAU: Weekly} & \text{BAU: end-of-} \\ \text{mismatch report} & \text{contractual cash} & \text{firm-specific} & \text{day Monday} \\ \text{} & \text{flows across the full} & \text{and the market-} & \text{Stress: end of the} \\ \text{} & \text{maturity spectrum} & \text{wide liquidity} & \text{day the} \\ \text{} & \text{} & \text{stress, done on} & \text{following} \\ \text{} & \text{} & \text{daily} & \text{business day} \\ \hline \text{FSA050: Liquidity} & \text{Granular analysis of} & \text{Done monthly} & \text{Submitted in 15} \\ \text{Buffer qualifying} & \text{the firm’s marketable} & \text{} & \text{business days} \\ \text{securities} & \text{asset holdings} & \text{} & \text{after month-end} \\ \hline \text{FSA051: Funding} & \text{Unsecured wholesale} & \text{Done monthly} & \text{Submitted in 15} \\ \text{concentration} & \text{funds borrowings} & \text{} & \text{business days} \\ \text{} & \text{(excludes primary} & \text{} & \text{after month-end} \\ \text{} & \text{issuance), by} & \text{} & \text{} \\ \text{} & \text{counterparty class} & \text{} & \text{} \\ \hline \text{FSA052: Wholesale} & \text{Daily transaction} & \text{Done weekly} & \text{submitted in the} \\ \text{liabilities} & \text{prices and the} & \text{} & \text{end-of-day} \\ \text{} & \text{transacted level for} & \text{} & \text{Tuesday 15} \\ \text{} & \text{wholesale unsecured} & \text{} & \text{business days} \\ \text{} & \text{liabilities} & \text{} & \text{after month-end} \\ \hline \text{FSA053: Retail,} & \text{The firm’s retail and} & \text{Done quarterly} & \text{Submitted in 15} \\ \text{SME and large} & \text{corporate funding} & \text{} & \text{business days} \\ \text{enterprises} & \text{profile and the retail} & \text{} & \text{after month-end} \\ \text{corporate funding} & \text{deposits stickiness} & \text{} & \text{} \\ \hline \text{FSA054: Currency} & \text{The analysis of} & \text{Done quarterly} & \text{Submitted in 15} \\ \text{analysis} & \text{foreign exchange} & \text{} & \text{business days} \\ \text{} & \text{(FX) exposures on a} & \text{} & \text{after month-end} \\ \text{} & \text{firm’s balance sheet} & \text{} & \text{} \\ \hline \text{Off-balance sheet} & \text{Total undrawn} & \text{Done monthly} & \text{Submitted in 15} \\ \text{report} & \text{committed facilities} & \text{} & \text{business days} \\ \text{} & \text{} & \text{} & \text{after month-end} \\ \end{array} $$

How different specific types of cashflow are treated is a fundamental question in liquidity reporting. Take for example the following items:

The treatment of these cash flows may vary for regulatory purposes. For instance, callable and demand deposits are treated as one-day money for regulatory purposes. However, certain regulatory authorities allow “behavioral” modifications of retail deposits in cases where they remain relatively stable over time. For instance, in such a case, 50% of deposits can be treated as long-term funds.

The off-balance sheet items are treated as follows:

Bank liquidity models usually apply the following:

Generally, treating expected cash outflows conservatively, whether as derivative collateral or undrawn commitments, is a recommended business practice.

A bank produces several liquidity reports during its normal business course, either weekly, monthly or at any other specified duration. The format of liquidity management information (MI) is supposed to be accessible and transparent. We demonstrate a sample of reports that provide a benchmark framework for reporting in the following section.

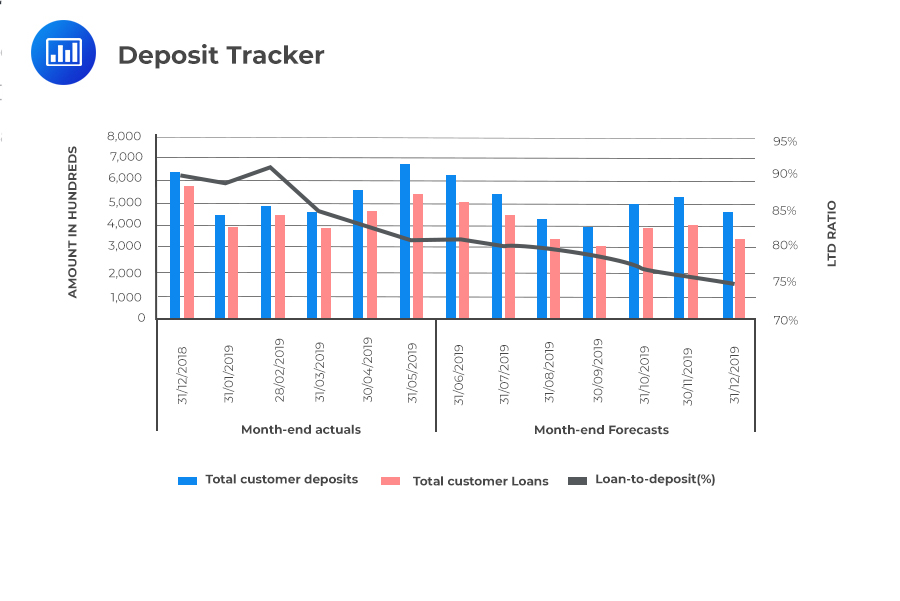

A deposit tracker report is a weekly/monthly report of the current amount of deposits as well as a forecast of deposits anticipated in the future. It provides an idea about the loan-to-deposit (LTD) ratio in the immediate short term. The information provided by the deposit tracker report include:

The following graph represents a simple example of the first part of the deposit tracker report as of 31/05/2019 for a medium commercial bank. From the report, the month-end actual is provided based on customer type, the change from the month-ends, total customer assets, and LTD ratio, and then the month-end position forecast for the whole year.

Note that forecasting in this report is based basically on objective judgment. The historical trend up to the current date may assist in making the forecast.

Note that forecasting in this report is based basically on objective judgment. The historical trend up to the current date may assist in making the forecast.

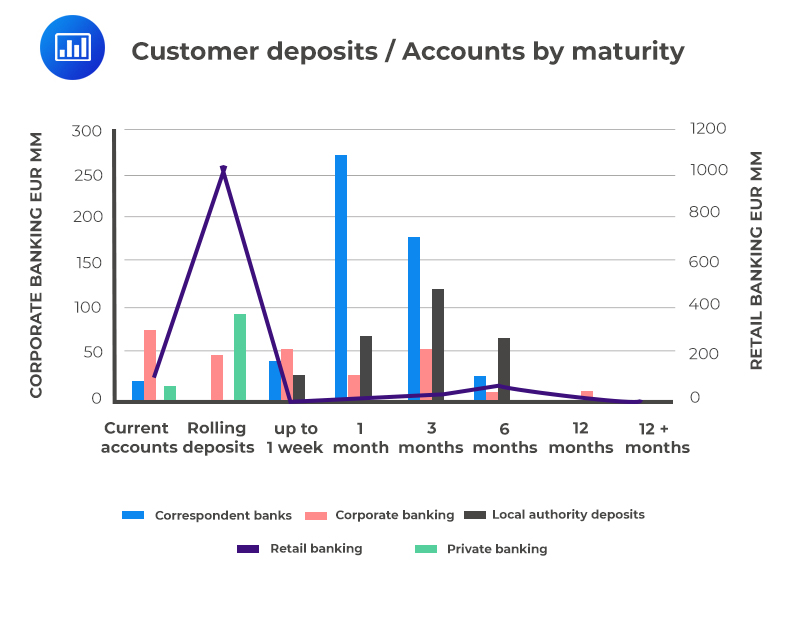

The following is a graph of the deposit tracker report that represents customer deposits by type of account and tenor. In this case, the current accounts and rolling deposits make a significant contribution to the retail bank deposits while there is little fixed-term deposit. For regulation, these funds are treated as short-term liabilities and don’t assist a bank’s regulatory liquidity metrics, which emphasize long-term funds. However, the local regulator can allow the bank to treat overnight balances as longer-term if they are demonstratable to be acting as long-term in “behavioral” terms.

The bank should undertake a marketing exercise to establish whether customers are interested in transferring their deposits into fixed-term or notice accounts. Any increase in the size of the fixed-term accounts improves the firm’s liquidity metrics.

The bank should undertake a marketing exercise to establish whether customers are interested in transferring their deposits into fixed-term or notice accounts. Any increase in the size of the fixed-term accounts improves the firm’s liquidity metrics.

Daily liquidity report gives the bank’s liquid and marketable assets and liabilities in a straightforward spreadsheet up to 1-year maturity and beyond. It provides an end-of-day of the bank’s liquidity position for the Treasury and Finance departments. Each branch and subsidiary complete one, although a bank that has only a branch structure (and no subsidiaries) may aggregate the report.

The following table represents a simple daily liquidity report for a commercial bank showing a list of liquid securities.

$$ \textbf{Securities and CDs} $$

$$ \begin{array}{l|c|cc} \textbf{Classification marketable} & \bf{} & \textbf{Input } & \textbf{Data} \\ \textbf{} & {} & \textbf{securities} & \textbf{CDs} \\ \hline \text{Bank CDs: non-ECB eligible, liquid at} & {} & {} & {265,896} \\ \text{the maturity date} & {} & {} & {} \\ \hline \text{Bank CDs: ECB eligible, liquid same day} & {} & {} & {0} \\ \hline \text{ECB eligible securities, liquid in 1-week } & {} & {43,908} & {} \\ \text{tender} & {} & {} & {} \\ \hline \text{Non-ECB eligible securities, can be sold over} & {} & {56,876} & {} \\ \text{4 weeks} & {} & {} & {} \\ \hline \text{Government securities} & {} & {81,900} & {} \\ \hline \text{Total marketable securities and CDs} & {} & \bf{182,684} & \bf{265,896} \\ \hline \text{Non-marketable} & {} & {} & {} \\ \hline \text{Non-ECB eligible CD summary} & {} & {} & {} \\ \hline \textbf{Average remaining tenor} & \textbf{Amount} & {} & {} \\ \hline \text{2 weeks} & {34,600} & {} & {} \\ \hline \text{1 month} & {65,800} & {} & {} \\ \hline \text{2 months} & {56,890} & {} & {} \\ \hline \text{3 months} & {51,900} & {} & {} \\ \hline \text{6 months} & {61,679} & {} & {} \\ \end{array} $$

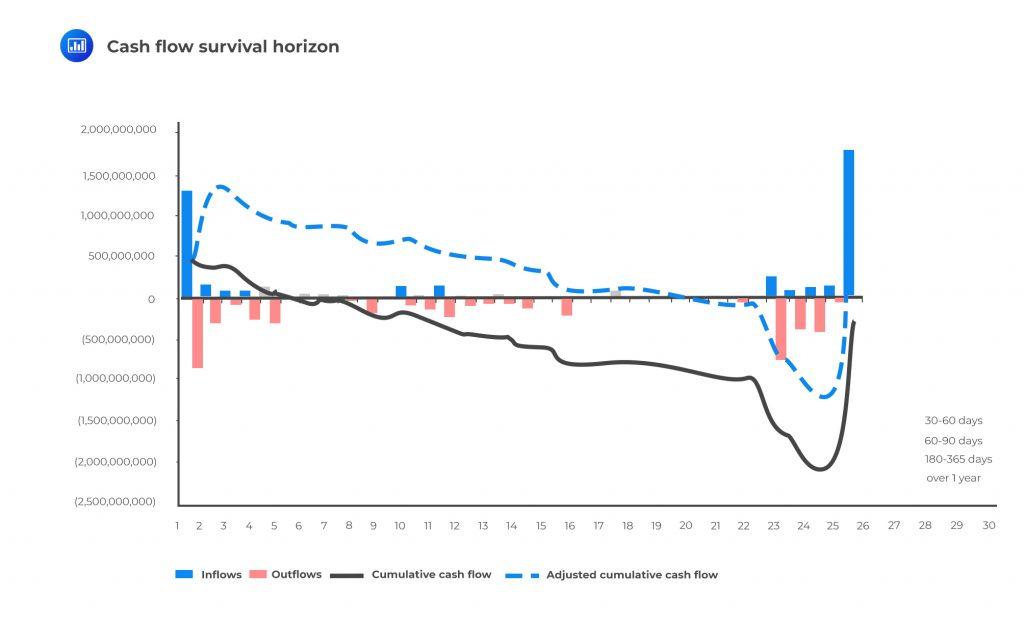

The funding maturity gap report, also called a mismatch report, reflects the maturity gap for all assets and liabilities per time bucket and with an adjustment for liquid securities. The report comprises the cumulative liquidity cash flow of the daily liquidity report. The report is also used to generate a cash flow survival horizon report.

The following figure shows a graphical representation of cash flow survival horizon:

Funding Concentration Report

Funding Concentration ReportThis report is crucial management information (MI) for senior Treasury and relationship managers. Funding diversity, a fundamental principle in liquidity management, requires financial institutions to avoid overreliance on one source of funds such as intraday group funds. A funding concentration report is as illustrated below:

$$ \textbf{Large Depositor Concentration Report Summary} $$

$$ \textbf{Group Treasury Large Depositors by Country as} \\ \textbf{a Percentage of Total Funding} $$

$$ \begin{array}{l|c|c|c} \textbf{Country} & \textbf{Total large deposits} & \textbf{% of external country} & \textbf{% of external group} \\ \textbf{} & \textbf{‘000s} & \textbf{funding} & \textbf{funding} \\ \hline \text{F} & {5,600,000} & {10\%} & {7.20\%} \\ \hline \text{G} & {6,890,450} & {43.67\%} & {4.30\%} \\ \hline \text{H} & {7,567,890} & {21.00\%} & {3.89\%} \\ \hline \text{I} & {5,890,500} & {12.54\%} & {2.80\%} \\ \hline \text{J} & {3,783,900} & {3.89\%} & {4.78\%} \\ \hline \text{K} & {4,783,870} & {23.84\%} & {2.63\%} \\ \hline \text{Total} & {34,516,610} & {} & {25.6\%} \\ \end{array} $$

The above table represents an example of a hypothetical large depositor concentration report for a banking group. In this case, “large” is defined as someone that deposits USD 50 million or more; however, a bank may define it in the percentage of total liability terms rather than absolute amounts. Generally speaking, a deposit of 5% of total liabilities should be treated as large by ALCO.

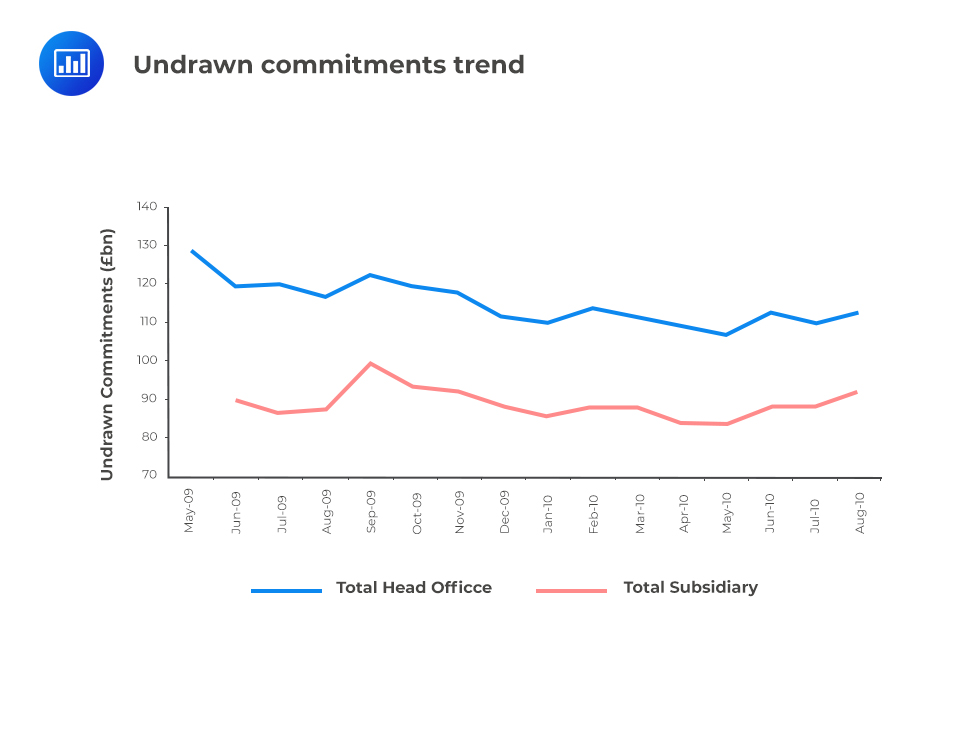

Off-balance sheet items such as liquidity lines, letters of credit, revolving credit facilities, and guarantees are potential stress points for a bank’s funding. Unutilized liquidity and funding lines are expected to be drawn down in a stress scenario since customers experience their own funding challenges. The presence of undrawn commitments may cause funding shortages at wrong times; hence liquidity metrics must include undrawn commitments.

The following figure shows an undrawn commitment report, showing the trend over time:

Liability Profile

Liability ProfileThe liability profile is a simple breakdown of the share of each type of liability at the bank. The liabilities of a bank comprise the following categories:

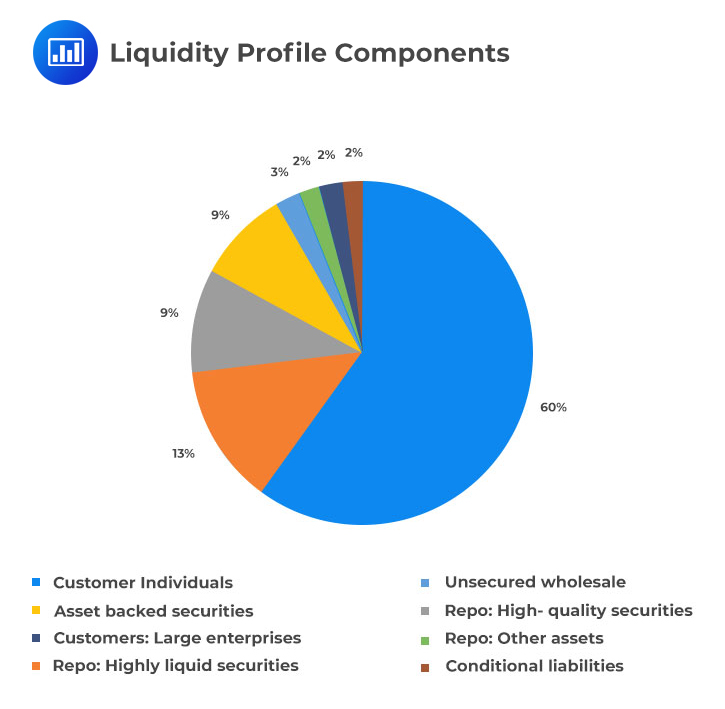

The share of each of the components is shown in the following pie chart:

Other types of funding sources by product type that may be included in the liquidity profile include covered bonds, client-free cash, structured deposit products, unsecured credit institution, unsecured government and central banks, net derivative margin, and primary issuance.

Other types of funding sources by product type that may be included in the liquidity profile include covered bonds, client-free cash, structured deposit products, unsecured credit institution, unsecured government and central banks, net derivative margin, and primary issuance.

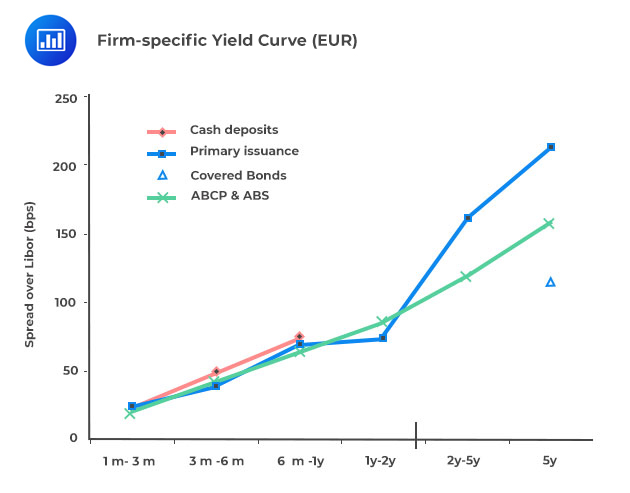

Together with liquidity cash flow metrics, the liquidity position of an institution can be gleaned by banks funding costs and the components of its funding by product. The regulatory authority usually obtains early warnings of a given bank experiencing funding stress through the funding yield curve. If the curve rises significantly beyond the curves for its peers, it indicates funding stress. For individual bank senior management, an idea of a peer group average can be obtained from the regulator. A comparison to one’s own funding level is a worthwhile exercise and should be undertaken on at least a quarterly basis.

A yield curve for a hypothetical bank may look like this:

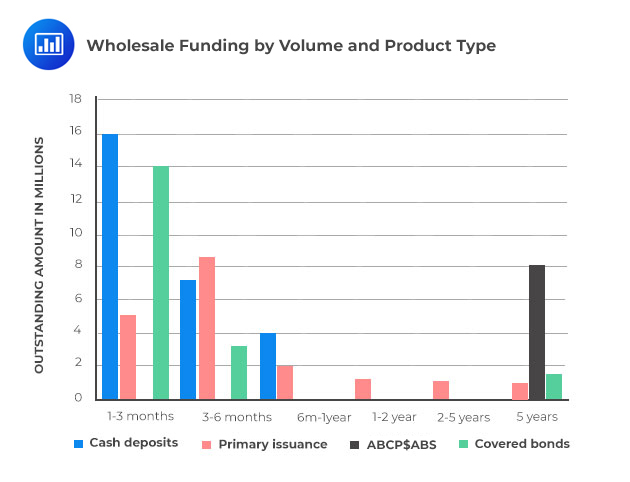

The following graph represents the breakdown of the same bank’s wholesale funding by volume and product type.

The following graph represents the breakdown of the same bank’s wholesale funding by volume and product type.

Summary and Qualitative Reports

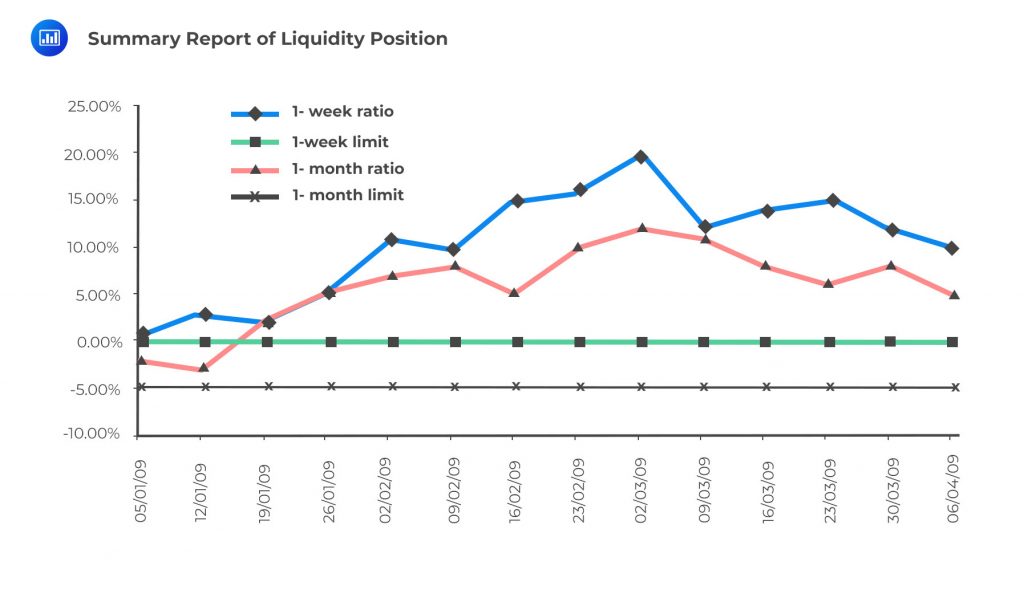

Summary and Qualitative ReportsSenior management liquidity report management information is presented as a one-page summary of the vital metrics of liquidity. These reports are kept on one side of A4 to increase their chances of being noticed and read by the senior management. The following is an example of a hypothetical monthly liquidity snapshot for senior management.

$$ \begin{array}{l|c|c|c|c|c|c|c|c|c} \textbf{} & \textbf{1} &\textbf{2} &\textbf{1} &\textbf{2} &\textbf{1} &\textbf{2} &\textbf{3} &\textbf{6} &\textbf{1} \\ \textbf{} & \textbf{Day} &\textbf{Day} &\textbf{Week} &\textbf{Week} &\textbf{Month} &\textbf{Months} &\textbf{Months} &\textbf{Months} &\textbf{Year} \\ \hline \text{Cumulative Net} & {180} & {180}& {(1,160)}& {(1,160)}& {(1,080)}& {(1,308)}& {(1,050)}& {(750)}& {(750)} \\ \text{Cash Balance} & {} & {}& {}& {}& {}& {}& {}& {}& {} \\ \hline \text{Other Forecast} & {} & {}& {}& {}& {}& {}& {}& {}& {} \\ \text{Inflows} & {} & {}& {}& {}& {}& {}& {}& {}& {} \\ \hline \text{Other Forecast} & {} & {}& {}& {}& {}& {}& {}& {}& {} \\ \text{Outflows} & {} & {}& {}& {}& {}& {}& {}& {}& {} \\ \hline \text{Cumulative Cash} & {180} & {180}& {(1,160)}& {(1,160)}& {(1,080)}& {(1,308)}& {(1,050)}& {(750)}& {(750)} \\ \text{Gap} & {} & {}& {}& {}& {}& {}& {}& {}& {} \\ \hline \text{Counterbalancing} & {280} & {280}& {735}& {740}& {848}& {848}& {1,338}& {1,338}& {1,338} \\ \text{Capacity} & {} & {}& {}& {}& {}& {}& {}& {}& {} \\ \hline \text{Liquidity Gap} & {460} & {460}& {(425)}& {(420)}& {(232)}& {(460)}& {288}& {588}& {588} \\ \hline \text{Limit} & {} & {}& {}& {}& {}& {}& {}& {}& {} \\ \hline \text{Variance} & {460} & {460}& {(425)}& {(420)}& {(232)}& {(460)}& {288}& {588}& {588} \\ \end{array} $$

$$ \text{* Cash gap turns negative between 2-day and 1-week} \\ \text{* Liquidity gap turns negative between 2-day and 1-week } $$

$$ \begin{array}{l|c|c|c} \text{} & \textbf{Current} & \textbf{Previous} & \textbf{Change} \\ \text{} & \textbf{month} & \textbf{month} & \text{} \\ \hline \text{Liquidity Risk Factor} & {20.2} & {23.1} & \text{Decrease} \\ \hline \text{Loan-To-Deposit Ratio} & {86\%} & {84\%} & \text{Increase} \\ \hline \text{Net Inter-Group Lending} & {-1,220} & {-1,550} & \text{Increase} \\ \end{array} $$

$$ \begin{array}{l|c|c|c} \text{} & \textbf{Current} & \textbf{Previous} & \textbf{Change} \\ \text{} & \textbf{month} & \textbf{month} & \text{} \\ \hline \text{Liquidity Risk Factor} & {20.2} & {23.1} & \text{Decrease} \\ \hline \text{Loan-To-Deposit Ratio} & {86\%} & {84\%} & \text{Increase} \\ \hline \text{Net Inter-Group Lending} & {-1,220} & {-1,550} & \text{Increase} \\ \end{array} $$

From the above report, it is notable that the cash gap becomes negative between the first and second week, while the liquidity gap turns negative between the first and second day.

A qualitative monthly report should be prepared and sent to the head office group treasury for the banking groups operating across country jurisdictions or multiple subsidiaries for a better understanding of the liquidity position in the respective countries.

A group treasury qualitative reporting provides a report on liquidity highlights through templates for subsidiaries and branches. Summarizing the main liquidity changes for the previous month, usually produced weekly at specific dates. The points considered in regular liquidity qualitative reporting are the following:

The report should explain:

As discussed in the previous chapter, the main objective of liquidity stress testing is to gauge the level of funding difficulties a bank may experience in times of idiosyncratic or market stress. The stress test output reports are, therefore, significant in providing the senior management with an understanding of a bank’s liquidity position to take mitigation actions when necessary.

The cashflow survival report is the primary output of a stress test process. This is followed by a stressed cumulative cash flow forecast considering the immediate sale or repo of marketable securities. The standard FSA-specified stresses that can be applied include wholesale funding, retail liquidity, intra-day liquidity (3- and 5-day stresses), cross-currency liquidity, intra-group liquidity, off-balance sheet liquidity, market-able assets, non-marketable assets, and funding concentration.

A line-by-line stress test result report is produced every quarter as a requirement by the regulators. The following stress test report shows the results of individual shocks on the liquidity ratio, and the probability of each result occurring. The following categories are included:

This report would be produced as part of routine stress testing, undertaken either by Treasury or risk management.

$$\small{\begin{array}{l|l|l|l|l|l|l} \text{Stress-}\\ \text{ test}\\ \text{combined } \\ \text{shocks}& {} & {} & {\textbf{Sight-} \\ \textbf{8 Day}} & {\textbf{Sight-} \\ \textbf{1 Month}} & \textbf{Probability} & \textbf{Impact} \\ \textbf{} & {} & {} & {\textbf{} \\ \textbf{}} & {\textbf{} \\ \textbf{ }} & \textbf{ } & \textbf{ } \\ \hline{ \text{Stress} }\\ \text{ test} \\ \text{ individual} \\ \text{ shocks}& \text{light} & {\text{A rating category} \\ \text{of 1 notch downgrade}} & {8\%} & {1\%} & {45\%} & {20} \\ \text{} & \text{moderate} & {\text{A rating category} \\ \text{of 2 notch downgrade} } & {2\%} & {0.25\%} & {22\%} & {30} \\ \ \text{} & \text{severe} & {\text{A rating category } \\ \text{of 3 notch downgrade}} &{-15\%} & {-20\%} & {2\%} & {80} \\ \hline {\text{Market to } }\\ \text{market}& \text{light} & \text{} & {8\%} & {1\%} & {50\%} & {45}\\ \text{reduction}\\ \text{in asset} & \text{moderate} & {} & {2\%} & {0.25\%} & {22\%} & {55} \\ \text{value} & \text{severe} & {} & {-15\%} &{-20\%} & {3\%} &{88}\\ \hline \text{Asset }\\ \text{increased}\\ \text{haircut} & \text{light} & {} & {8\%} & {1\%} & {55\%} & {30} \\ {} & \text{moderate} & {} & {2\%} & {0.25\%} & {30\%} & {37}\\ \text{} & \text{severe} & {\text{Treat all marketable} \\ \text{securities as illiquid} } & {-15\%} & {-20\%} & {8\%} & {45} \\ \hline \text{Absence}\\ \text{of repo}\\ \text{ facilities} & \text{light} & {\text{Reduction of customer } \\ \text{deposits by 5%, replace} \\ \text{with o/night funding} } & {8\%} & {1\%} & {45\%} & {30} \\ {} & \text{moderate} & {\text{Reduction of customer} \\ \text{deposits by 10%,}\\ \text{replace} \\ \text{with o/night funding} } & {2\%} & {0.25\%} & {29\%} & {70} \\ {} & \text{severe} & { \text{Reduction of customer } \\ \text{deposits by 15%,}\\ \text{replace} \\ \text{with o/night funding} } & {-15\%} & {-20\%} & {3\%} & {120} \\ \hline \text{Intragroup }\\ \text{deposit}\\ \text{withdrawal} & \text{light} & {\text{Reduction in net group} \\ \text{liability to EUR500 mm,} \\ \text{withdrawals to replace } \\ \text{funding} } & {8\%} & {2\%} & {43\%} & {35} \\ \text{} & \text{moderate} & {\text{Reduction in net group} \\ \text{liability to EUR250 mm,} \\ \text{replace with overnight} \\ \text{funding} } & {2\%} & {0.25\%} & {22\%} & {45} \\ \text{} & \text{severe} & {\text{Reduction in net group } \\ \text{liability to nil, replace} \\ \text{with overnight funding} } & {-15\%} & {-20\%} & {10\%} & {90} \\ \hline {\text{Interbank } } \\ \text{deposit}\\ \text{withdrawals}& \text{light} & {\text{Reduction in deposits from} \\ {“ \text{relationship banks}”} \\ \text{(correspondent banks) by} \\ \text{5%, other inter-bank} \\ \text{deposits by 25%, replace} \\ {\text{with o/night funding} }} & {8\%} & {1\%} & {50\%} & {33} \\ \text{} & \text{moderate} & {\text{Reduction in deposits}\\ \text{from} \\ \text{“relationship banks”} \\ \text{(correspondent banks) by} \\ \text{25%, other inter-bank} \\ \text{deposits}\\ \text{by 50%, replace} \\ {\text{with o/night funding} }} & {2\%} & {0.25\%} & {22\%} & {50} \\ \text{} & \text{severe} & {\text{Reduction in deposits}\\ \text{from} \\ \text{“relationship banks”} \\ \text{(correspondent banks) by} \\ \text{50%, other inter-bank} \\ \text{deposits by 100%, replace} \\ \text{with o/night funding} } & {-15\%} & {-20\%} & {4\%} & {75} \\ \hline \text{Changes}\\ \text{in FX}\\ \text{rates} & \text{light} & {\text{Stresses the GBP and} \\ \text{USD FX rates by 15%}} & {8\%} & {1\%} & {45\%} & {20} \\ \text{} & \text{moderate} & {\text{Stresses the GBP and} \\ \text{USD FX rates by 15%}} & {2\%} & {0.25\%} & {26\%} & {35} \\ \text{} & \text{severe} & {\text{Stresses the GBP and} \\ \text{USD FX rates by 25%}} & {-15\%} & {-20\%} & {2\%} & {65} \\ \hline \text{FX swap}\\ \text{market}\\ \text{withdrawals} & \text{light} & {\text{Withdrawal of less} \\ \text{liquid swap markets} } & {8\%} & {1\%} & {43\%} & {35} \\ \text{} & \text{moderate} & {\text{Withdraws of swap markets} \\ \text{ (excl. USD, EUR, GBR} } & {2\%} & {1\%} & {30\%} & {60} \\ \text{} & \text{severe} & {\text{Withdrawal of all swap} \\ \text{markets} } & {-15\%} & {-20\%} & {5\%} & {75} \\ \hline \text{Stress}\\ \text{test-}\\ \text{combined}\\ \text{shocks} & {} & {} & {\text{Sight-} \\ \text{8 day}} & {\text{Sight-} \\ \text{1 Month}} & \text{Probability} & \text{Impact} \\ \hline \text{Slow-}\\ \text{burn}\\ \text{liquidity}\\ \text{crunch} & {} & {\text{Balance sheet shocks} \\ \text{description in details}} & {-32\%} & {-38\%} & {2\%} & {110} \\ \hline \text{Severe}\\ \text{reputational}\\ \text{damage} & {} & {\text{Balance sheet shocks} \\ \text{description in details}} & {-38\%} & {-54\%} & {0.25\%} & {180} \\ \end{array}}$$

Practice Question

A senior risk analyst at RavenBank, a multinational banking institution, is leading a training session for new hires. To test their understanding of liquidity risk reporting, she presents them with multiple reports which are considered benchmarks for banks operating in various jurisdictions. While some of these reports are critical for UK banks, their principles are transferable across borders.

She then poses a question: “Imagine you are assigned to monitor and assess the concentration risk stemming from reliance on a few significant fund providers. Which liquidity risk report would be the most direct source of this information?”

A. Funding maturity gap (mismatch) report

B. Undrawn commitment report

C. Funding concentration report

D. Deposit tracker report

Solution

The correct answer is C.

The Funding concentration report is specifically designed to provide information about the concentration of a bank’s funding sources. It would indicate how reliant the bank is on a few significant fund providers and the associated concentration risk. Monitoring this report would allow the bank to understand and mitigate the risks of over-reliance on particular fund providers.

A is incorrect: The Funding maturity gap (mismatch) report provides information on the mismatches between a bank’s assets and liabilities over different maturity horizons. While it helps in understanding the bank’s liquidity over various timeframes, it does not give direct information about the concentration of fund providers.

B is incorrect: The Undrawn commitment report details the bank’s potential future cash outflows that arise from commitments it has made but not yet disbursed. It focuses on potential future liquidity needs, not on the sources of current funding.

D is incorrect: The Deposit tracker report tracks the deposits at the bank, giving a breakdown of the type, amount, and origin of the deposits. While it offers insight into a bank’s liabilities side and the behavior of depositors, it does not specifically focus on the concentration of funding sources or significant fund providers.

Things to Remember

- Funding concentration reports are pivotal for banks to identify and manage over-dependence on limited sources of funds.

- High funding concentration can lead to vulnerabilities, especially if one or more primary fund providers alter their funding patterns or face their own financial crises.

- Regularly monitoring and diversifying funding sources can mitigate potential liquidity crunch situations and reinforce the bank’s stability.

- Comprehensive risk management incorporates a deep understanding of various liquidity reports, with each serving a distinct purpose in identifying and mitigating potential risks.

- In a global banking context, the principles of liquidity risk reporting can be transferred across borders, making them essential knowledge for risk analysts worldwide.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.