Cross Border Investment

Investing Across Borders Investing across borders is a strategy employed by portfolio managers... Read More

Managers with the flexibility to make currency exposure risk decisions can deviate from fully hedged portfolios. This leads to strategic considerations on finding the optimal level of portfolio protection and its associated cost. Various strategies are employed to reduce hedging expenses, individually or in combination. The extent to which a strategy is used determines the portfolio’s exposure. For instance, an out-of-the-money (OTM) put option is cheaper, but the further it is from the money, the cheaper it becomes, providing less protection. Performing a cost-benefit analysis is essential to determine and maintain the optimal hedges in a portfolio.

The following strategies are commonly used for reducing the cost of hedging in a portfolio:

Over-hedging and under-hedging a portfolio refer to using hedge ratios that are either too small or too large when a manager has a directional view of the portfolio. In other words, it means using a hedge that is not perfectly aligned with the manager’s view. The manager may use a benchmark index or portfolio and adjust the hedge ratio to overcompensate or undercompensate based on their expectations for the currency’s movement.

If a currency is expected to appreciate, its exposure should be underhedged, meaning the hedge should be less than 100%.

If a currency is expected to depreciate, its exposure should be over hedged, meaning the hedge should be more than 100%.

Generally, put options become more expensive as their strike price increases. This is because the strike price acts as a floor value for the underlying asset, providing more protection at higher strike prices. To save on the call premium’s purchase price, investors may move away from purchasing in-the-money (ITM) puts and consider out-of-the-money (OTM) puts instead.

Similarly, call options can be used as a hedge for a short position, and the logic applies similarly. Out-of-the-money calls are always cheaper than in-the-money calls, making them a cost-effective choice for hedging.

Long-put options are commonly used in long-term hedging strategies, regardless of the underlying asset. Collars build upon this concept of using long puts for insurance but combine them with short, often out-of-the-money call options. The premium earned from the call option can help offset the cost of purchasing the put.

Collars provide a way to predefine the range of potential outcomes for the hedged position. The long put limits the total loss that can occur, and the short call limits the potential upside gain. In other words, collars allow investors to manage and limit the volatility in their portfolios.

A risk reversal strategy involves buying a call option and selling a put option. For instance, purchasing a 25-delta call while simultaneously writing a 25-delta put is considered a long position in a 25-delta ‘risk reversal.’

Put spreads offer an alternative to reduce the cost of hedging by selling options without involving any calls, as seen in collars. The put spread starts with a simple long put. After purchasing the put, the trader can recoup some of the initial funds by selling a further out-of-the-money put.

For instance, consider a currency with a current spot rate of 1.6550. The portfolio manager sets up the following put spread: buy a put with a strike of 1.6500 and write a put with a strike of 1.6450. The payoff on the put spread position will be as follows:

The put spread reduces the hedge cost but comes at the expense of more limited downside protection.

The Seagull Spread is a three-legged options strategy that combines elements of a Call Spread and a Put Spread with a written option. Here’s how it works:

The Seagull Spread involves two written options to help finance the protective put, making it a cost-effective choice compared to a standard Put Spread. Relative to a Put Spread, a Seagull Spread has a lower initial cost, provides the same downside protection, and limits the upside gain.

The goal of the Seagull Spread is to reduce the cost of hedging while still providing some level of protection for the underlying asset, making it a helpful strategy for managing risk in a portfolio. However, it is worth noting that the Seagull Spread is more complex than a standard Collar or Put Spread due to the involvement of multiple options trade.

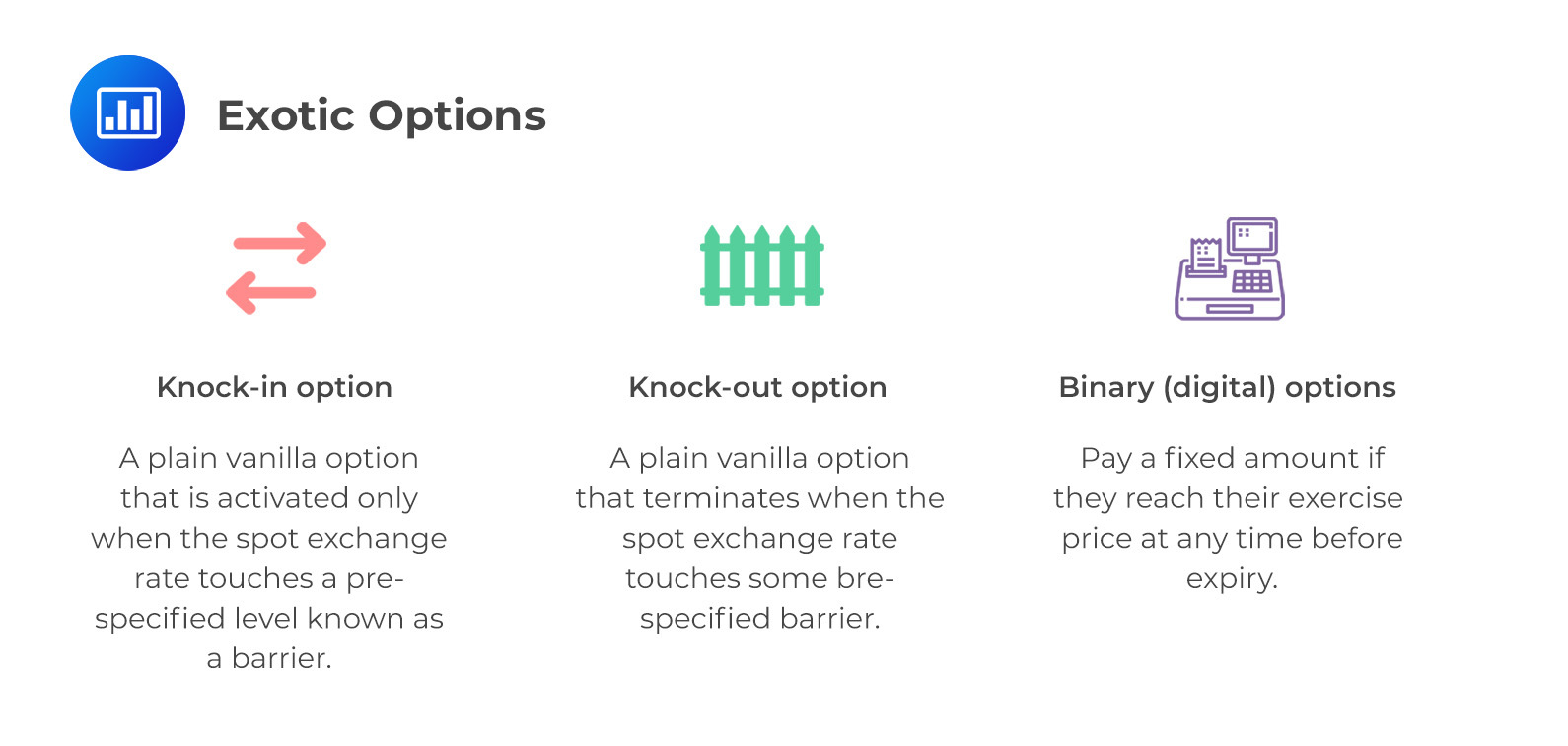

Exotic Options

Exotic OptionsIn foreign exchange markets, two standard exotic options are knock-in/knock-out and digital options. A knock-in option becomes active only when the spot exchange rate reaches a pre-determined barrier level. In contrast, a knock-out option terminates when the spot rate touches a specific barrier. Since these options have conditional activation, they are more limited and less expensive than standard vanilla options. However, the tradeoff is that they offer reduced profit potential and/or downside protection.

Digital options, also known as binary options or all-or-nothing options, pay a fixed amount if they reach their exercise level before expiration, even by a small margin. They are comparable to lottery tickets due to their “extreme payoff” characteristics. Since digital options offer substantial payoffs, their cost is higher than vanilla options with the same strike price. Their highly leveraged nature makes them sensitive to spot rate fluctuations, making them more suitable for active currency management rather than hedging strategies.

Below is a summary of the above discussion.

Knock-in/out options only exist under certain circumstances. It makes them more restrictive than plain vanilla options and hence, cheaper. The tradeoff is that the knock-in/out options provide less upside potential and/or downside protection.

Digital options have large payoffs, hence usually cost more than plain vanilla options with the same strike price.

Question

Michelle DuPartier, CFA, manages a French portfolio with significant Great British Pound (GBP) exposure. Currently, the spot rate for GBP is 1.2550. DuPartier implements the following strategy: She buys a put option with a strike price of 1.2500 and simultaneously writes a put option with a strike price of 1.2450. What is the most appropriate name for this strategy?

- Seagull spread.

- Risk reversal.

- Put spread.

Solution

The correct answer is C.

A put spread strategy involves buying a put option with a specific strike price and simultaneously selling another with a lower strike price. In this case, Michelle DuPartier has bought a put with a strike price of 1.2500 and sold a put with a strike price of 1.2450. Since this strategy includes both a long and short put, it fits the description of a put spread.

A is incorrect. A seagull spread would require an additional short short-call option, which is not present in this scenario.

B is incorrect. A risk reversal strategy combines a long put and a short call option, generally positioned near the money but still out of the money.

Reading 3: Currency Management: An Introduction

Los 3 (g) Describe trading strategies used to reduce hedging costs and modify the risk-return characteristics of a foreign-currency portfolio

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.