Forecasting Volatility

Variance Covariance (VCV) Matrices The simplest and most commonly used method for estimating... Read More

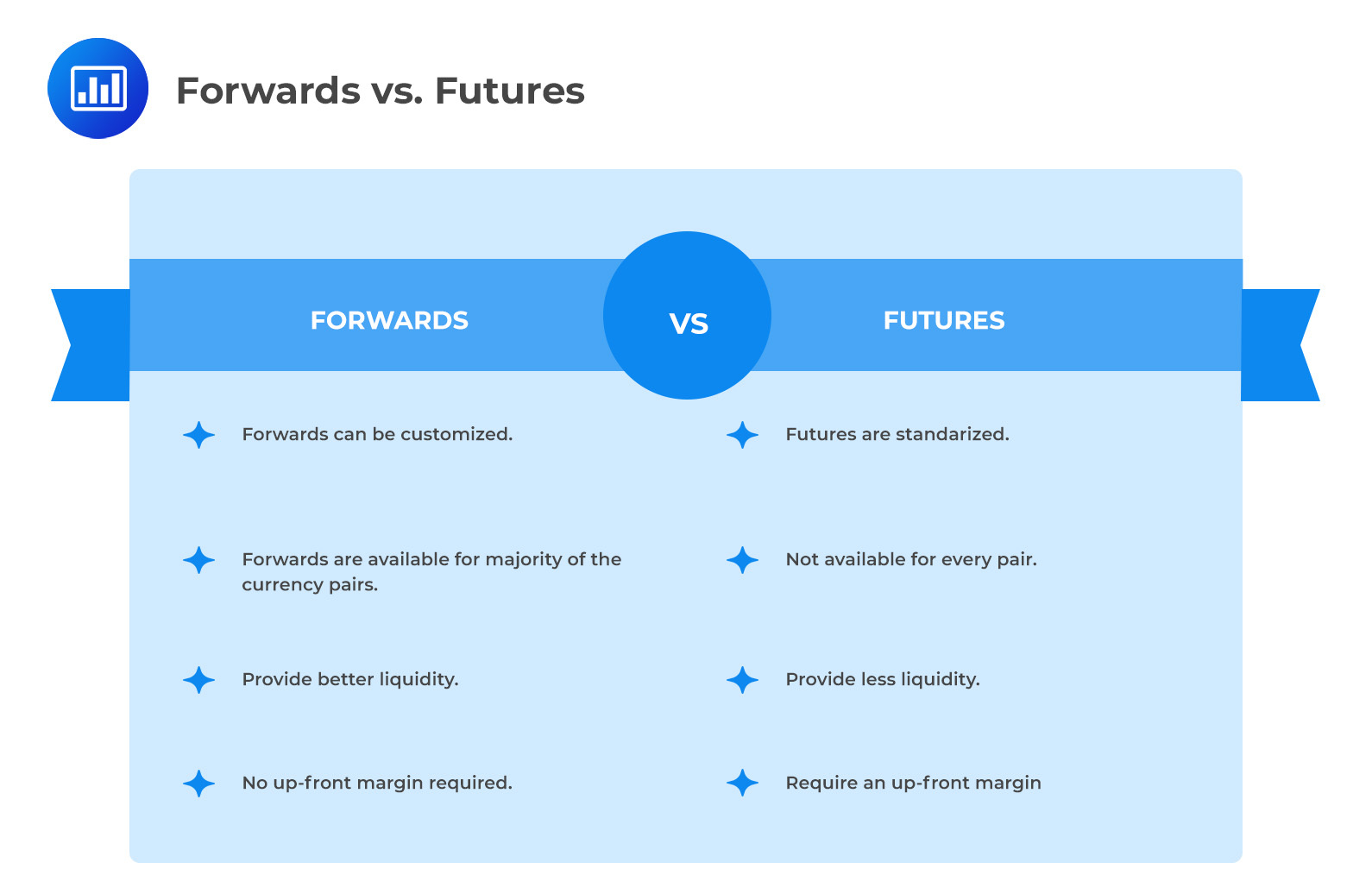

This section addresses the simplest hedging scenario: a 100% hedge ratio for a single foreign currency exposure. Both futures and forward contracts can be utilized to achieve full currency hedges, but institutional investors typically prefer forward contracts for the following reasons:

The table below offers a summary of the above points.

Using Hedge Ratios

Using Hedge RatiosHedge ratios are valuable tools for portfolio managers to measure and understand the effectiveness of hedges in a portfolio. A hedge ratio equal to the desired hedge ratio indicates a properly hedged portfolio. If the hedge remains unchanged over time, it is known as a static hedge. In this approach, the investor buys or sells the appropriate number of contracts and leaves them unchanged. On the other hand, a dynamic hedge involves a hedge ratio that may drift away from the desired ratio over time. Portfolio managers must periodically adjust the forward currency contracts’ size, number, and maturities to maintain a dynamic hedge.

It’s important to appreciate that stricter hedging comes with increased transaction costs. Managers with lower risk aversion tend to lean towards static hedges, accepting less frequent adjustments. Conversely, more risk-averse managers are willing to incur higher costs to maintain tighter control over the portfolio.

Example: Hedging

Let’s take the example of a portfolio manager based in Switzerland who manages a portfolio denominated in EUR. Initially, the manager needs to hedge EUR 10,000,000 worth of asset exposure. After one month, the asset’s value has increased to EUR 11,000,000. The manager follows a monthly hedge-rebalancing cycle to adjust the hedge position accordingly.

Question

Which of the following is least likely a reason why many institutional investors prefer forwards to futures?

- Futures contracts are standardized.

- Futures are not always available for all currency pairs.

- Future contracts lower up-front margin.

Solution

The correct answer is C:

The first two choices, A and B are why many institutional managers choose forwards over futures due to the flexibility they provide.

Option C is the least likely because futures contracts increase up-front margin requirements. The marking-to-market process they undergo can be seen as an additional cost, which institutional managers usually try to mitigate.

Reading 3: Currency Management: An Introduction

Los 3 (f) Describe how forward contracts and FX (foreign exchange) swaps are used to adjust hedge ratios