Binomial Option Valuation Model

Contingent Claims A contingent claim is a derivative contract that gives the owner... Read More

The following steps should be followed when calibrating binomial interest rate trees to match a particular term structure:

When constructing an interest rate tree as per step 2 above, it’s important to remember that:

The following related formulas are important to remember:

$$i_{1,u}=i_{1,d}e^{2\sigma }$$

$$i_{2,uu}=i_{2,dd}e^{4\sigma }$$

$$i_{2,uu}=i_{2,du}e^{2\sigma }$$

$$i_{2,du}=i_{2,dd}e^{2\sigma }$$

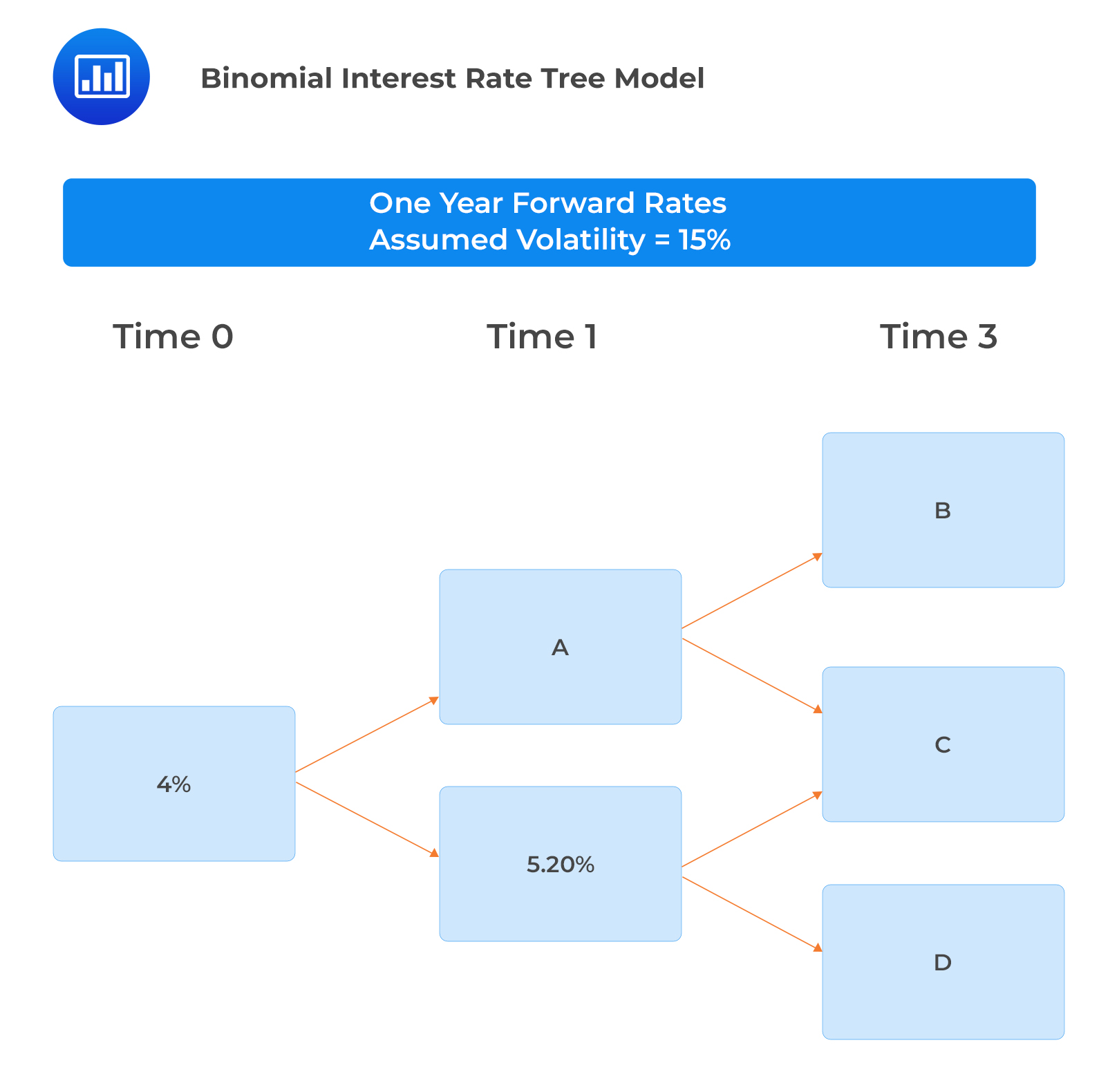

To calibrate a binomial interest rate tree, a portfolio manager collects the following information relating to the spot rate curve and forward rates:

$$ \begin{array}{c|c} \textbf{Term to Maturity} & \textbf{Spot Rate} \\ \hline 1 & 4.00\% \\ \hline 2 & 5.00\% \\ \hline 3 & 6.00\% \end{array} $$

Determine the forward rates A, B, C, and D.

Determine the forward rates A, B, C, and D.

Forward rate A

$$ \begin{align*} \text{The higher rate is determined as } i_{1u}&=i_{1d}\times e^{2\sigma} \\ &=5.20\%\times e^{2\times0.15}=7.019\% \end{align*} $$

Forward rate C

This is the middle forward rate approximated as \(f (2,1)\). Recall from the previous reading the relationship between forward and spot rates:

$$ \begin{align*} \left[1+f\left(t,T-t\right)\right]^{T-t} &=\left[\frac{\left(1+S_T\right)^T}{\left(1+S_t\right)^t}\right] \\ (1+f\left(2,1\right) &=\left[\frac{\left(1+S_3\right)^3}{\left(1+S_2\right)^2}\right] \\ f\left(2,1\right) &=\frac{{1.06}^3}{{1.05}^2}-1=8.029\% \end{align*} $$

Forward rate B

$$ \begin{align*} i_{2,uu} &=i_{2du } e^{2\sigma} \\ i_{2,uu} &=8.029\%\times e^{2\times0.15 }=10.84\% \end{align*} $$

Forward rate D

$$ \begin{align*} i_{2,dd} &=i_{2du} e^{-2\sigma} \\ i_{2,dd} &=8.029\%\times e^{-2\times0.15 }=5.95\% \end{align*} $$

It is key to note that the change in the volatility assumption affects implied forward rates. A change of volatility to a lower value makes the potential implied forward rates to collapse on the tree and vice versa.

Question

Chen Cheng, a portfolio manager at ABC Investment Bank, is training Zhang Wang, a junior investment analyst, on calibrating binomial interest rate models using Excel. Cheng starts the process by guessing a lower one-year forward rate, \(i_{1,d}\), of 3.820%. Assuming that Cheng uses a volatility assumption of 20%, the higher one-year forward rate using the lognormal model of interest rates is closest to:

- 2.56%.

- 4.67%.

- 5.70%.

Solution

The correct answer is C.

Based on the lognormal model of interest rates, the higher one-year forward rate is \((i_{1,u})=i_{1,d}e^{2\sigma}\).

$$ \begin{align*} i_{1,d} &=3.820\% \\ (i_{1,u}) &=3.820\%\times e^{2\times0.20}=5.70\% \end{align*} $$

Reading 29: The Arbitrage-Free Valuation Framework

LOS 29 (d) Describe the process of calibrating a binomial interest rate tree to match a specific term structure.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.