Expectations and Market Valuation

The return on any asset is determined by the expectation of future discount... Read More

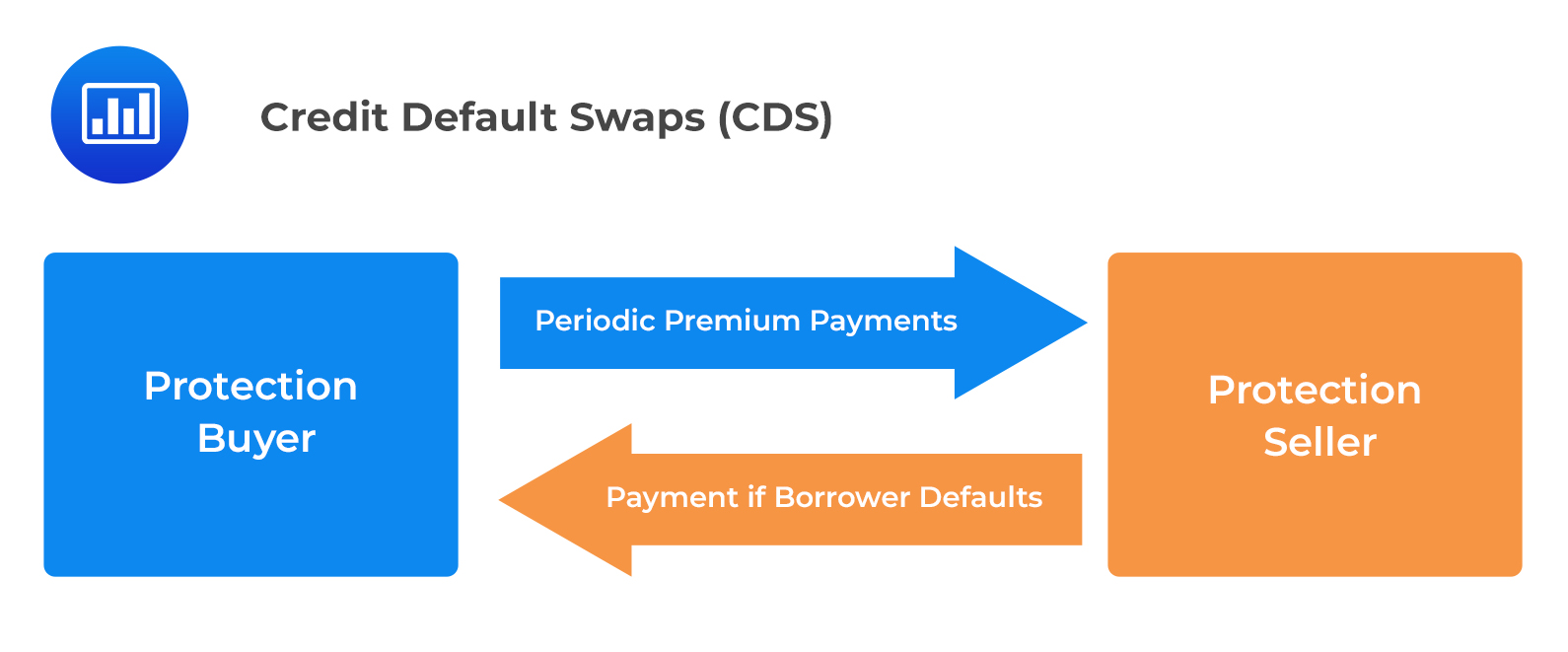

A credit derivative is an agreement between two parties, a credit protection buyer and a credit protection seller. The protection seller provides protection to the buyer against a particular credit loss. Among the various types of credit derivatives, credit default swaps (CDS) are the most prominent.

A credit default swap is an agreement between the buyer and seller to exchange the borrower’s credit risk. It can be thought of as insurance against credit risk.

The CDS buyer buys protection by making periodic payments to the seller until the end of the CDS life, or a credit event occurs. Buying protection has a similar credit risk position to selling a bond short.

On the other hand, the CDS seller collects periodic payments and profits if the issuer’s credit remains stable or improves while the swap is outstanding. Selling protection has a similar credit risk position to owning a bond or loan.

Types of CDS

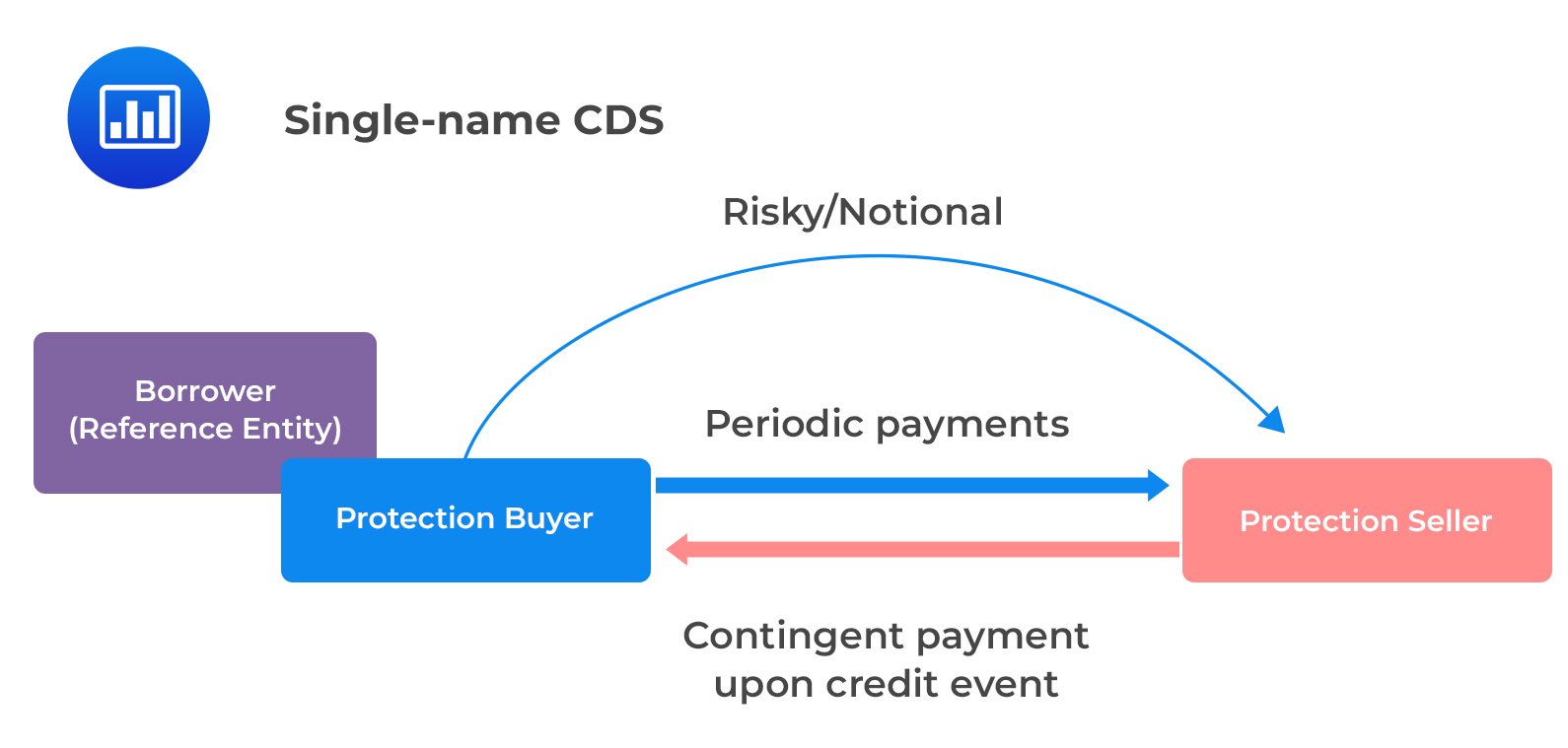

Types of CDSA single-name CDS is a contract that covers debt security issued by one specific borrower. The borrower is known as the reference entity. A reference obligation is the specific fixed income security issued by the borrower that is the designated instrument being covered.

The CDS is paid in the event of:

The CDS amount paid depends on the market value of the cheapest-to-deliver bond with the same seniority as the reference obligation. The following diagram illustrates a single-name CDS.

Example: Single-Name CDS

Example: Single-Name CDSXYZ Inc. has the following debt issues trading in the market.

Suppose the company restructures its debt (credit event occurs). In that case, the cheapest-to-deliver obligation for a senior CDS contract among the above issues will be a two-and-a-half-year senior unsecured debt trading at 20% of par. This is because it is the lowest-priced debt issue and hence the cheapest to deliver.

Bond A is subordinated and thus, does not qualify for coverage under the senior CDS.

An index CDS involves several reference entities. Each entity has equal protection, and the total notional principal is the sum of the protection on all the reference entities.

The credit correlation influences the value of an index CDS. The higher the default correlation between multiple issuers making up the index, the higher the spread, and thus the more costly the protection will be and vice versa.

An index CDS allows investors to take positions on the credit risk of a group of borrowers.

A tranche CDS involves a combination of reference entities. However, it limits losses to prespecified levels.

The following parameters uniquely define a CDS:

The difference between the standardized coupon rate and the credit spread is paid upfront by one party. This is known as the upfront premium that accounts for the difference between the present value of the credit spread and the standard rate.

Question

The party which is long the reference entity’s credit is most likely the:

- Credit protection buyer.

- Credit protection seller.

- Borrower.

Solution

The correct answer is B.

The credit protection seller is long the reference entity’s credit since they are bullish on the borrower’s financial condition.

A is incorrect. The credit protection buyer is said to be short the reference entity’s credit since they are bearish on the financial condition of the borrower

C is incorrect. The borrower is the reference entity. This is the company for which credit protection is bought.

Reading 32: Credit Default Swaps

LOS 32 (a) Describe credit default swaps (CDS), single-name and index CDS, and the parameters that define a given CDS product.