Credit Risks and Credit Derivatives

After completing this reading, you should be able to: Use the Merton model... Read More

After completing this reading, you should be able to:

Credit transfer refers to mechanisms used by banks to transfer and disperse credit exposures to third parties. This happens mainly through novel credit instruments such as credit default swaps and securitizations such as collateralized debt obligations.

In the years preceding the 2007/2009 financial crisis, the credit transfer market was growing at an incredibly fast rate. In fact, financial analysts and regulators believed the U.S. banking system emerged from the 2001-2002 credit downturn largely unscathed because most banks had transferred their exposures. In the immediate aftermath of the 2007/2009 financial crisis, however, credit transfer instruments were deeply implicated in the catastrophic buildup of risk in the banking system.

After dust had settled, a more measured view took hold. It has since become clear that although the credit transfer market played a role in the crisis, it was more of a problem with the abuse of instruments rather than the instruments themselves. Indeed, the CDS market performed quite robustly during and after the crisis and helped some banks to manage and transfer credit risk.

The credit transfer market has undergone extensive transformation post the 2007/2009 crisis. Some instruments were killed in the course of the turmoil and are unlikely to ever reappear. Yet, there are instruments that remained moribund for a couple of years before making a comeback. In addition, some instruments were never hurt at all and continue to thrive to this day. Interestingly, new credit transfer strategies have also emerged. The table below provides a quick summary of the state of the credit transfer markets.

$$ \textbf{Figure 1 – Status Report of the Credit Transfer Markets} $$

$$ \begin{array}{l|l} \hline \text{Under scrutiny but relatively robust} & \text{ Credit default swap} \\ {\text{ }\\ \text{ }} & {\text { Government-sponsored MBS } \\ \text { Asset-backed commercial paper } \\ \text{(traditional model)} \\ \text{ Non-real estate asset backed securities}}\\\hline \text{Moribund with low likelihood of re-emergence } & \text{ CDO-square} \\ {\text{ }\\ \text{ }} & {\text { Single-tranche CDOs } \\ \text { Asset-backed commercial paper } \\ \text{(non-traditional model)} \\ \text{ }}\\\hline \text{Low-state convalescence but } & \text{ Collateralized loan obligations, CLOs} \\ {\text{reforming with potentially fast revival }\\ \text{ }} & {\text { Private label mortgage-backed securities,MBS } \\ \text {} \\ \text{} \\ \text{ }}\\\hline \text{New and revived post-crisis markets} & \text{ Structured loans originated by banks} \\ {\text{ }\\ \text{ }} & {\text {but funded by insurance firms,} \\ \text {with insurance firm bearing most of/all of the risk } \\ \text{ Covered bonds} \\ \text{ Re-securitization of downgraded AAA products}\\ \text{e.g via re-securitized real estate mortgage investment}\\ \text{conduits,re-REMICS}}\\ \hline \end{array} $$

In this chapter, we are going to delve deeper into the securitization market.

Securitization is the practice of repackaging loans and other assets into securities that can then be sold to investors. It is the issuance of bonds that are repaid by the payments on a pool of assets, where the assets also serve as collateral. Securitization falls under the originate-to-distribute (OTD) model. It differs from the traditional “buy and hold” model where banks keep all of their assets on their balance sheet until maturity.

Potentially, the originate-to-distribute model removes considerable liquidity, interest rate, and credit risk from the originating bank’s balance sheet compared to a traditional “buy-and-hold” model.

Over a number of years, banking markets in major developed economies shifted quite significantly to the OTD business model, and the move gathered some good momentum in the years after the millennium.

The banking industry embraced the OTD model, in part, because it presented an opportunity for banks to avoid strict capital requirements imposed on them by the Basel Committee. By moving capital-hungry assets off their books, banks were able to hold less capital, allowing them to invest a bigger proportion of their funds. What’s more, accounting and regulatory standards tended to encourage banks to focus on generating upfront fee revenues associated with the securitization process.

The OTD model came with a benefit for originators, investors as well as borrowers:

In the years preceding the crisis, these benefits were progressively weakened and risks (and losses) began to accumulate. Although there’s no consensus as to what really triggered the change of fortunes, there are several flaws that have been cited as the weak links in the securitization process:

The OTD model created an avenue for parties along the securitization chain to make a quick short-term profit without retaining any risk. All lenders had to do was find a bunch of borrowers, pool the loans and create a securitized product, hire a third party to market the product, and ensure that the product receives a good rating from rating agencies. The gain came with the completion of the deal, albeit, with deliberate indifference to risk. In other words, there was a departure from the key tenets of the risk-reward tradeoff and parties had less incentive to keep an eye on risk.

There was a general lack of understanding with respect to structured products. Even the most sophisticated investors could not describe what they were holding in good detail. Instead, investors made buy/sell decisions based on the opinions of rating agencies, credit enhancements made to the securities by financial guarantors (monolines and insurance companies such as AIG), and market sentiments of other investors and financial analysts alike. This lack of transparency of the securitized structures meant that there weren’t effective ways to monitor the quality of the underlying loans.

The growth of securitization coincided with the rapid growth of credit default swaps and related hedging markets. This increased the perceived liquidity of credit instruments. In addition, the credit risk premium demanded by protection providers was also low because of low default rates occasioned by seemingly ever-rising asset prices.

As mentioned earlier, most banks failed because they did not follow the OTD model. Instead of acting as intermediaries by transferring risk from mortgage lenders to capital market investors, many banks took on the role of investors. Those banks bought a large number of securitized products from other banks while at the same time selling some products of their own. It is estimated that by mid-2007, U.S. financial institutions were directly holding over $900 billion of subprime mortgage-backed products on their books.

Most of the risk that should have been dispersed under a classic OTD model ended up being concentrated in off-balance-sheet entities known as structured investment vehicles (SIVs). Setting up SIVs allowed banks to get around capital requirements. For instance, a bank would be subject to a lot less capital if it held an AAA-rated CDO tranche in an SIV rather than holding it on its books.

Although banks’ attempts to reduce capital charges succeeded, risks mounted up. To set up a conduit or SIV, a bank would transfer a small amount of equity to the new entity and then fund it by rolling over short-term debt in the asset-backed commercial paper markets, mainly bought by highly risk-averse money market funds. These investment vehicles were being set up in such a way that if things went wrong, the investment vehicles had immediate recourse to their sponsor bank’s balance sheet. For starters, failure of an SIV would result in reputational damage to a bank. For this reason, banks were keen to establish liquidity lines in advance through which the SIV would be supported without raising alarm.

Although banks were largely successful in the structured products market, sometimes they could not find buyers, particularly for some CDO tranches. In such a scenario, banks would set up investment vehicles to warehouse the undistributed CDO tranches. Banks also had an incentive to set up the vehicles to hold senior tranches of CDOs – rated AAA or AA – because the yield was much higher than the yield on corporate bonds with the same rating.

As mentioned earlier, banks funded their investments in structured products by rolling over short-term debt in the asset-backed commercial paper markets, mainly bought by highly risk-averse money market funds. It appears that there was a general belief that access to the short-term funding market would go on indefinitely, and there was no need to find alternative funding avenues. When the housing bubble burst, liquidity dried up, and most banks could not roll over their liabilities.

Both originators and investors abdicated their risk monitoring obligation. Instead, they relied on credit rating agencies (CRAs) to do most of the risk analysis. However, CRAs did not adequately review the data underlying securitized transactions. They actually underestimated the risks of subprime CDO structuring. The fact that CRAs were getting their remuneration directly from originators meant that there was a real chance of overlooking risk.

Bond insurance, also referred to as “financial guaranty insurance”, is a type of insurance policy that a bond issuer purchases that guarantees the repayment of the principal and all associated interest payments to the bondholders in the event of default. Bond insurance is common in the U.S. municipal bond market. About one-third of new municipal bond issues are insured, a move aimed at helping municipalities reduce their cost of financing.

In simple terms, collateral is an item of value used to secure a loan. Collateral pledges present one of the most ancient ways used to protect a lender from loss. The effectiveness of collateral in mitigating credit risk is hinged on the liquidity and market value of the collateral. It’s critical to note that most items that are used as collateral tend to have values that are quite volatile. In some cases, the value of the collateral may fall at the same time that the probability of a default event rises.

A bank guarantee and a letter of credit are both issued by financial institutions. The institution promises a third party that the borrower will be able to repay a debt no matter the financial situation of the borrower. In essence, therefore, the institution promises to step in on behalf of the borrower should the latter be unable to meet debt-related contractual obligations. A guarantee or letter of credit will reduce credit risk as long as the financial institution is of a higher credit quality than the counterparty.

When a counterparty has entered several transactions with the same institution, it is highly likely that some of the transactions will have positive values while others will have negative values. Under a valid netting agreement, it is possible to offset the two sets of transactions and replace them with a net amount that represents the true credit risk exposure.

This is the settlement of the gains and losses on a contract on a daily basis. It helps in the avoidance of the accumulation of large losses over time. Note that loss accumulation can lead to default by one of the parties. Although marking to market is highly efficient, its implementation requires sophisticated monitoring technology and back-office systems.

Traditionally, corporate debt securities incorporate put options that can be exercised in certain circumstances. The option gives an investor the right to force early redemption at a pre-specified price, e.g., par value.

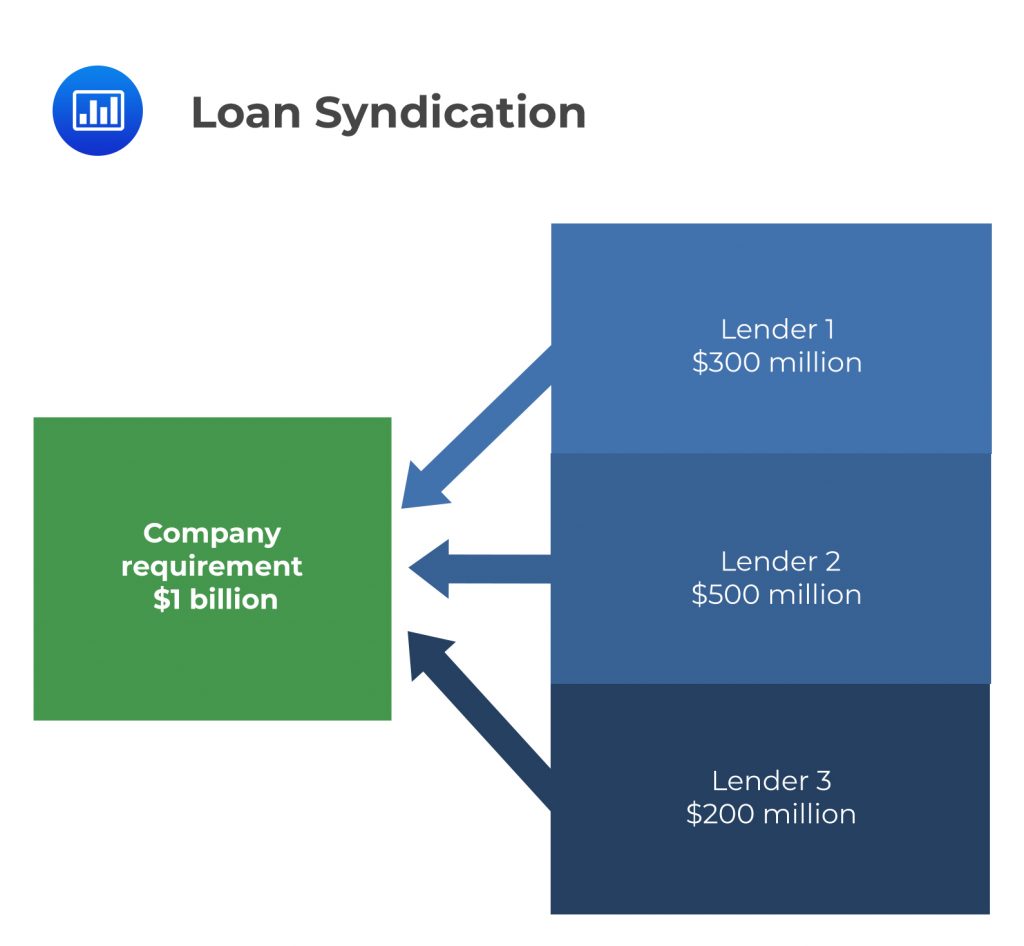

Syndication is a form of loan business where two or more lenders join hands to issue loans to one borrower on the same loan terms under one loan agreement. In most cases, one of the banks serves as the agency bank to manage the loan business on behalf of the syndicate members. This usually happens when the loan amount is too large such that no single bank is willing to absorb all of the credit exposure.

Under a syndication agreement, the liability of each lender is limited to its share of the loan interest. Loans that are traded by banks on the secondary loan market often begin life as syndicated loans. The pricing of syndicated loans has not always been transparent. This, however, has since changed and the market for credit derivatives become more liquid.

Under a syndication agreement, the liability of each lender is limited to its share of the loan interest. Loans that are traded by banks on the secondary loan market often begin life as syndicated loans. The pricing of syndicated loans has not always been transparent. This, however, has since changed and the market for credit derivatives become more liquid.

Traditionally, the bank lending business unit holds credit assets such as loans until they mature or until the borrowers’ creditworthiness deteriorates to a level considered unacceptable. The business unit keeps a close eye on the quality of the loans that enter a portfolio, but once a lending decision has been made, very little credit risk management is carried out. The credit portfolio remains basically unmanaged.

In the traditional business model, therefore, the focus is on the expected loss as a function of the notional value of a loan and the probability of default (PD). The loss reserves held by a bank are determined by the expected loss. In recent years, however, it has become clear that although risk management focused on the expected loss, it is far from perfect, and a bank remains exposed to losses that occur as a result of adverse unexpected events. In modern risk management, therefore, there’s a focus not just on expected loss but also, unexpected loss.

The other important point to note is that although traditional mechanisms perform quite well in mitigating credit risk by mutual agreement between the transacting parties, they lack flexibility. In particular, they do not separate or “unbundle” credit risk from the underlying positions so that it can be among a broader class of financial institutions and investors. This problem is solved by credit derivatives such as credit default swaps.

Historically, banks used to originate loans and then keep them on their balance until maturity. That was the originate-to-hold model. With time, however, banks gradually and increasingly began to distribute loans by selling them as securities to investors. By so doing, banks were able to limit the growth of their balance sheets by creating a somewhat autonomous investment vehicle to distribute the loans they originated.

Under the traditional credit model, banks originate and hold loans on the balance sheet until maturity. In the model, risk management is limited to a binary approval process at origination. The compensation attached to loans by the business unit is based more on volume rather than a pure risk-adjusted economic rationale. What’s more, the price level depends on the strength of competition in the local banking market rather than on risk-based calculations. When the competition is low, a bank will often settle on a price that is higher than the equilibrium market price. For banks that attempt to come up with a price that reflects risk, the business unit tends to use a simple grid, with prices varying according to the credit rating of the borrower and maturity of the loan.

In the underwrite and distribute business model, there are two main classes of loans:

Whereas core loans are managed by the business unit, noncore loans are managed and transfer-priced to the credit portfolio management group. The credit portfolio management unit is charged with the packaging and sale of loans to investors.

Each loan’s share of economic capital reflects its contribution to the risk of the portfolio. Each loan’s risk-adjusted return on capital should be higher than a hurdle rate specified by the capital and risk committee.

The credit portfolio management group works in liaison with traditional teams within a bank such as the business unit and the loan workout group. The workout group is responsible for exploring ways to deal with a loan issued to a borrower whose creditworthiness deteriorates to a level considered unacceptable by a bank. For such a loan, the workout group has various options:

The credit portfolio management group must keep an eye on loan concentrations that may have a serious impact on a bank’s solvency. The amount of risk capital held must take risk concentration across various sectors of the economy into account. In recent times, most banks have purposed to reduce risk concentration in order to avoid earnings volatility.

Credit derivatives are financial instruments that transfer the credit risk of an underlying portfolio of securities from one party to another without transferring the underlying portfolio. They are usually privately held negotiable contracts between two parties. A credit derivative allows a creditor to transfer the risk of a debtor’s default to a third party.

A covered bond is a type of debt obligation backed by cash generated from a specific underlying investment pool. A bank purchases or creates cash-generating assets, combines them, and then issues a bond backed by the pooled assets’ money.

However, covered bonds are not considered true securitization instruments because the underlying pool of assets (i.e., cover pool) never leaves the issuer’s balance sheet. The collection of investments backing the bond remains on the balance sheet of the issuing bank. The implication here is that investors have double recourse: a claim on the underlying pool of assets and a general claim on the issuer. There are no special-purpose entities involved, as is the case with true securitization instruments. If the issuer goes bankrupt, investors retain access to the cover pool.

The cover pool is ring-fenced, and its cash flows cannot be intercepted or diverted for any reason. If an investor buys a covered bond from a U.K. bank which, unfortunately, goes belly up just a couple of months into what should be a two-year deal, the investor is likely to get all interest payments as scheduled as well as the principal when the loan matures. There’s no risk transfer from the issuer to the investor, making covered bonds one of the safest funding instruments.

Covered bonds are not popular in the United States. Bank of America and Washington Mutual tried to issue covered bonds in 2006, but the 2007-2008 financial crisis jeopardized those efforts and stunted the covered bonds market’s growth. Most investors weren’t receptive to the idea of a new product after the “horrors” they suffered during the crisis, particularly concerning securitization instruments.

In Europe, covered bonds have a thriving market. In Germany, for example, they are readily available at the Frankfurt Stock Exchange. They go by the name “Pfandbriefe” and are rated AAA- or A.A. -. The cover pool includes long-term assets such as residential and commercial mortgages, ship loans, aircraft loans, and public sector loans. Investors are protected by the Pfandbrief Act, which ensures that the cover pools are available only to them in the event of the bank’s insolvency.

A funding CLO is an on-balance sheet CLO structured so that there are only two tranches: the senior (funding) tranche and the subordinate tranche. The senior tranche is usually rated by an external rating agency, and most of these tranches are rated AAA. The subordinate (junior) tranche, on the other hand, is unrated. The ladder loss-sharing mechanism applies, where the subordinate tranche bears the first loss.

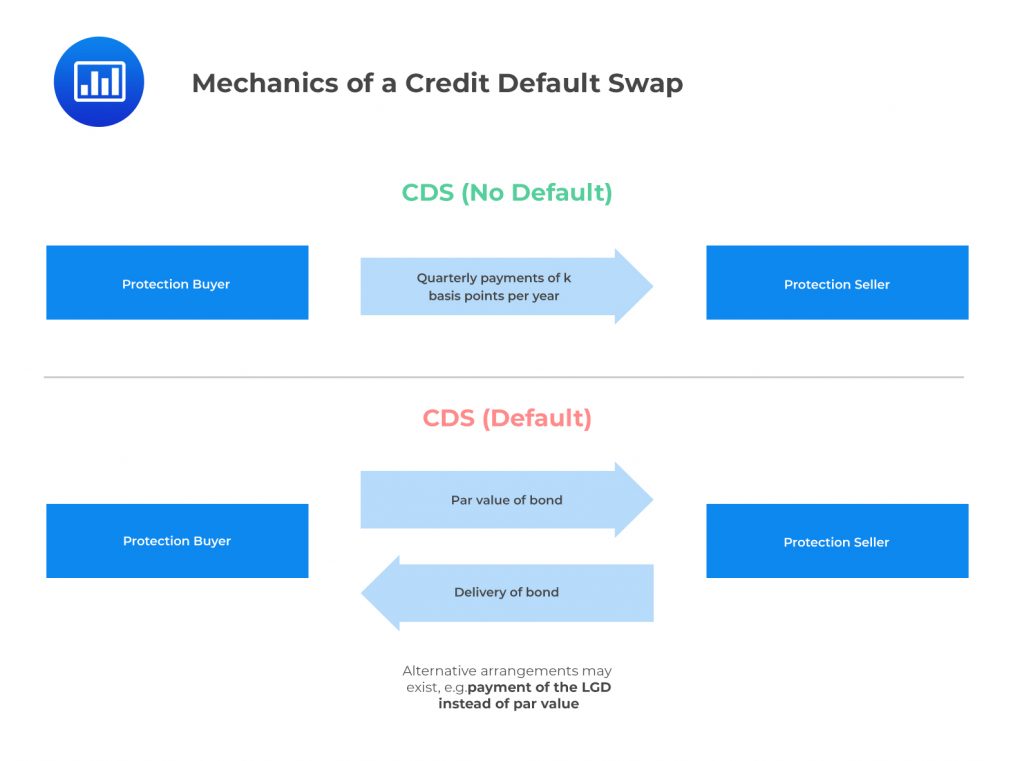

In a CDS, one party makes payments to the other and receives, in return, the promise of compensation if a third party defaults.

Example: Credit Default Swap (CDS)

Example: Credit Default Swap (CDS)Suppose Bank A buys a bond issued by ABC Company. In order to hedge the default of ABC Company, Bank A could buy a credit default swap (CDS) from insurance company X. The bank keeps paying fixed periodic payments (premiums) to the insurance company, in exchange for default protection.

Debt securities often have lengthy terms to maturity, sometimes as long as 30 years. It is very difficult for a creditor to come up with reliable credit risk estimates over such a long investment period. For this reason, credit default swaps have over the years become a popular risk management tool. As of June 2018, for example, a report by the office of the U.S. Comptroller of the Currency placed the size of the entire credit derivatives market at $4.2 trillion, of which credit default swaps accounted for $3.68 trillion (approx. 88%).

Like other derivatives, the payoff of a CDS is contingent upon the performance of an underlying instrument. The most common underlying instruments include corporate bonds, emerging market bonds, municipal bonds, and mortgage-backed securities.

The value of a CDS rises and falls as opinions about the likelihood of default change. In fact, an actual event of default might never occur. A default event can be difficult to define when dealing with CDSs. Although bankruptcy is widely seen as the “de facto” default, there are companies that declare bankruptcy and yet proceed to pay all of their debts. Furthermore, events that fall short of default can also cause damage to a creditor. These events include late payments or payments made in a form different from what was promised. Trying to determine the exact extent of damage a creditor suffers when some of these events happen can be difficult. CDSs are designed to protect creditors against such credit events.

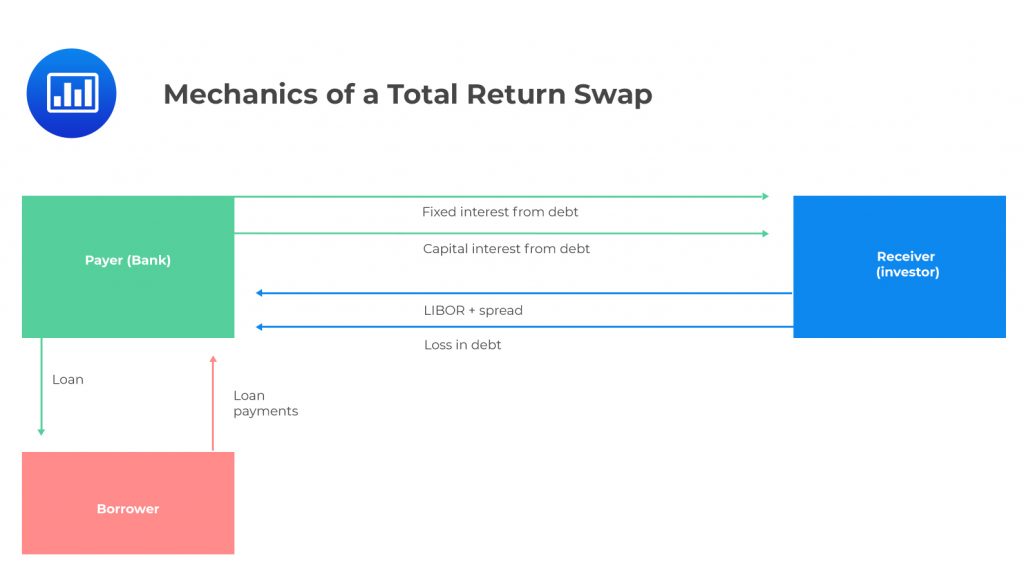

A total return swap is a credit derivative that enables two parties to exchange both credit and market risks. In a total return swap, one party, the payer, is able to confidently remove all the economic exposure of the asset without having to sell it. The receiver of a total return swap, on the other hand, is able to access the economic exposure of the asset without having to buy it.

For example, consider a bank that has significant (but risky) assets in the form of loans in its books. Such a bank may want to reduce its economic exposure with respect to some of its loans while still retaining a direct relationship with its customer base. The bank can enter a total return swap with a counterparty that desires to gain economic exposure to the loan market. What happens is that the bank (payer) pays the interest income and capital gains coming from its customer base to these investors. In return, the counterparty (receiver) pays a variable interest rate to the bank and also bears any losses incurred in the loan.

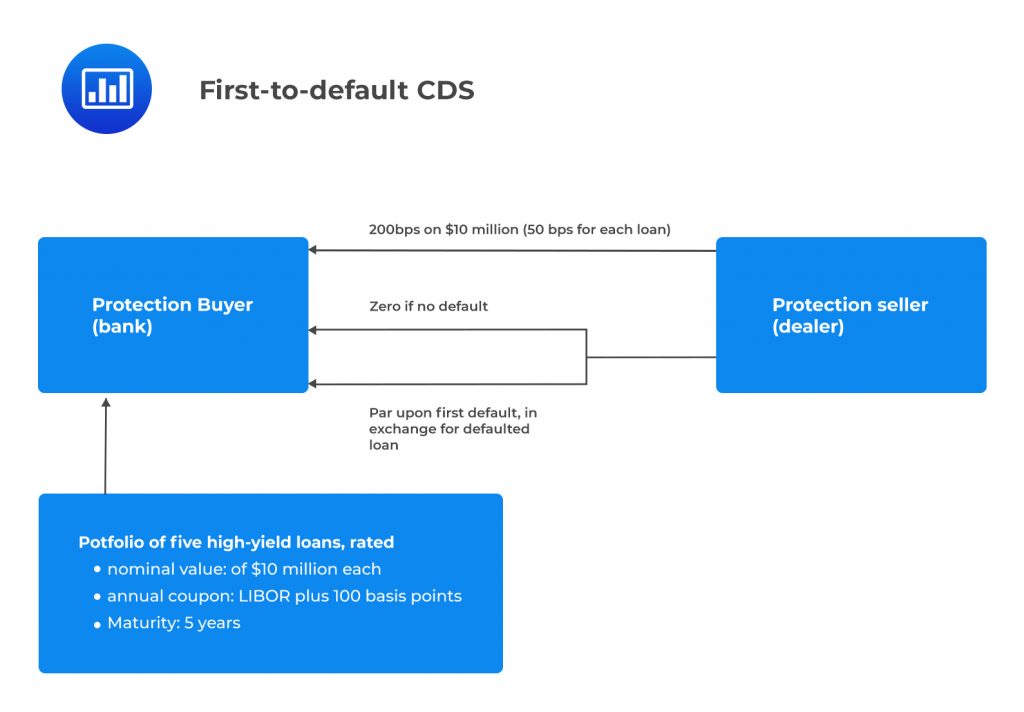

First to Default CDS

First to Default CDSA first-to-default CDS is an instrument that pays a predetermined amount when (and if) the first of a basket of credit instruments defaults.

For example, consider the case of a bank that holds the following portfolio:

In this scenario, the bank can purchase a first-to-default swap that expires in two years. This means that the bank will automatically be compensated if one of the loans in the pool of five loans defaults at any time during the two-year period. If there happens to be more than one default event during this period, the bank is compensated only for the first loan that defaults. The protection seller may demand a premium of 200 basis points (50 bps per loan). Given default, the protection seller often takes possession of the defaulted loan and compensates the protection buyer by paying par, i.e., $10 million. After the first default event, subsequent defaults are not considered.

In a first-to-default CDS, the loans are often chosen such that their default correlations are very small, i.e., there is a very low probability that there will be more than one default between the time the agreement is struck and the time the put expires.

In a first-to-default CDS, the loans are often chosen such that their default correlations are very small, i.e., there is a very low probability that there will be more than one default between the time the agreement is struck and the time the put expires.

The spread charged by the protection seller lies between the spread of the worst individual credit and the sum of the spreads of all the credits.

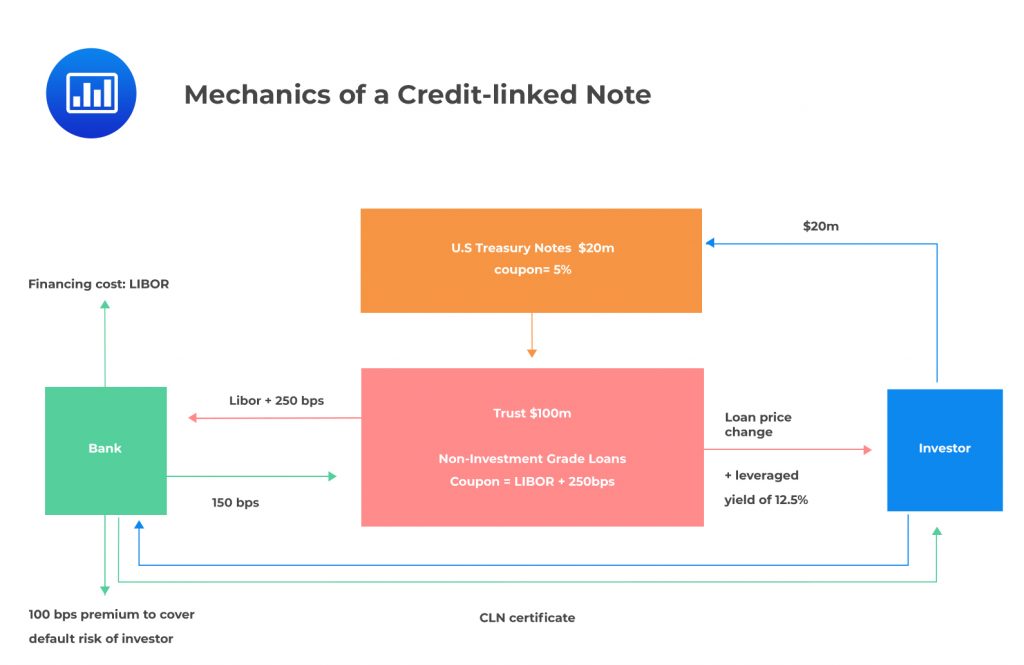

A credit-linked note is a security with an embedded credit default swap that permits the issuer to shift specific credit risk to credit investors. It is an instrument to hedge the default risk on the issuer’s credit.

The CLN’s coupon and principal risk are tied to an underlying debt instrument which could be a bond, a loan, or a government obligation. The principal is exchanged when a CLN is sold to an investor. However, the CLN seller retains ownership of the underlying debt instrument.

A bank buys an asset worth $100m in form of non-investment-grade loans with an average rating of BBB, yielding an aggregate LIBOR + 250 bps. The bank’s cost of funding for this investment is LIBOR. (That means the risk loading or, rather, the bank’s compensation for assuming credit risk is $250 bps). However, the bank is not very confident about the seller’s ability to service the loans to maturity and is worried there might be default. So, the bank feels there’s need to hedge this risk, even if that implies the risk loading will reduce. Luckily, the bank finds an investor who seeks $100m of exposure with a leverage ratio of 5, meaning that the investor is willing to invest $20m in form of collateral (leverage multiple = $25m/$100m = 5).

The bank, therefore, transfers the reference asset to a trust which then issues a CLN to the investor. The investor will then give the bank $20 million as promised. This amount is immediately invested in a risk-free U.S. government obligation yielding 5%. The bank promises to pay out 150 bps (on a notional amount of $100m) to the investor through the trust.

Let’s see what the bank eventually makes in terms of profit. Remember that the reference asset yields LIBOR + 250 bps. But the bank needs to deduct two types of cost: (I) the funding cost of LIBOR and (II) the CLN cost of 150 bps. At the end of the day, therefore, the net cash flow for the bank is 100 bps. This 100 bps applies to a notional amount of $105 million and is the bank’s compensation for retaining the credit risk of the issue above and beyond $20 million.

Let’s see what the bank eventually makes in terms of profit. Remember that the reference asset yields LIBOR + 250 bps. But the bank needs to deduct two types of cost: (I) the funding cost of LIBOR and (II) the CLN cost of 150 bps. At the end of the day, therefore, the net cash flow for the bank is 100 bps. This 100 bps applies to a notional amount of $105 million and is the bank’s compensation for retaining the credit risk of the issue above and beyond $20 million.

What does the investor take home? First, they receive a yield of 5% from the collateral of $20m. In addition, they receive 150 bps paid out by the bank on a notional of $100m. This churns out a yield of 12.5% as calculated below:

$$ \cfrac { 5\%\times $20m+1.5\%\times $100m }{ $20m } =0.125=12.5\% $$

In addition, any (positive) change in the value of the loan portfolio may eventually be passed through to the investor. The investor’s overall yield, therefore, can even be greater than 12.5%.

Now, the above scenario plays out only if the seller makes good on their promise and makes all the payments to the bank at the specified time. In these circumstances, the bank is bound to make all the payments to the investor. However if the seller defaults on the reference asset, there are two scenarios:

For the investor, this is equivalent to being long a credit default swap written by the bank.

Practice Question

Securitization involves the repackaging of loans and other assets into securities that can then be sold to investors. Which statement describes what went wrong with the securitization of subprime mortgages?

A. Some leveraged SIVs incurred significant liquidity and maturity mismatches.

B. There were misaligned incentives along the securitization chain driven by short-term profit.

C. Investors misunderstood the composition of the assets in the vehicles.

D. All the above.

The correct answer is D.

All the statements above describe the problem and underlying weakness that contributes to the crisis in the securitization of subprime.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.