Characteristics of Commodity Sectors

The recommended approach for segmenting the various asset classes is by Thomson Reuters/Core... Read More

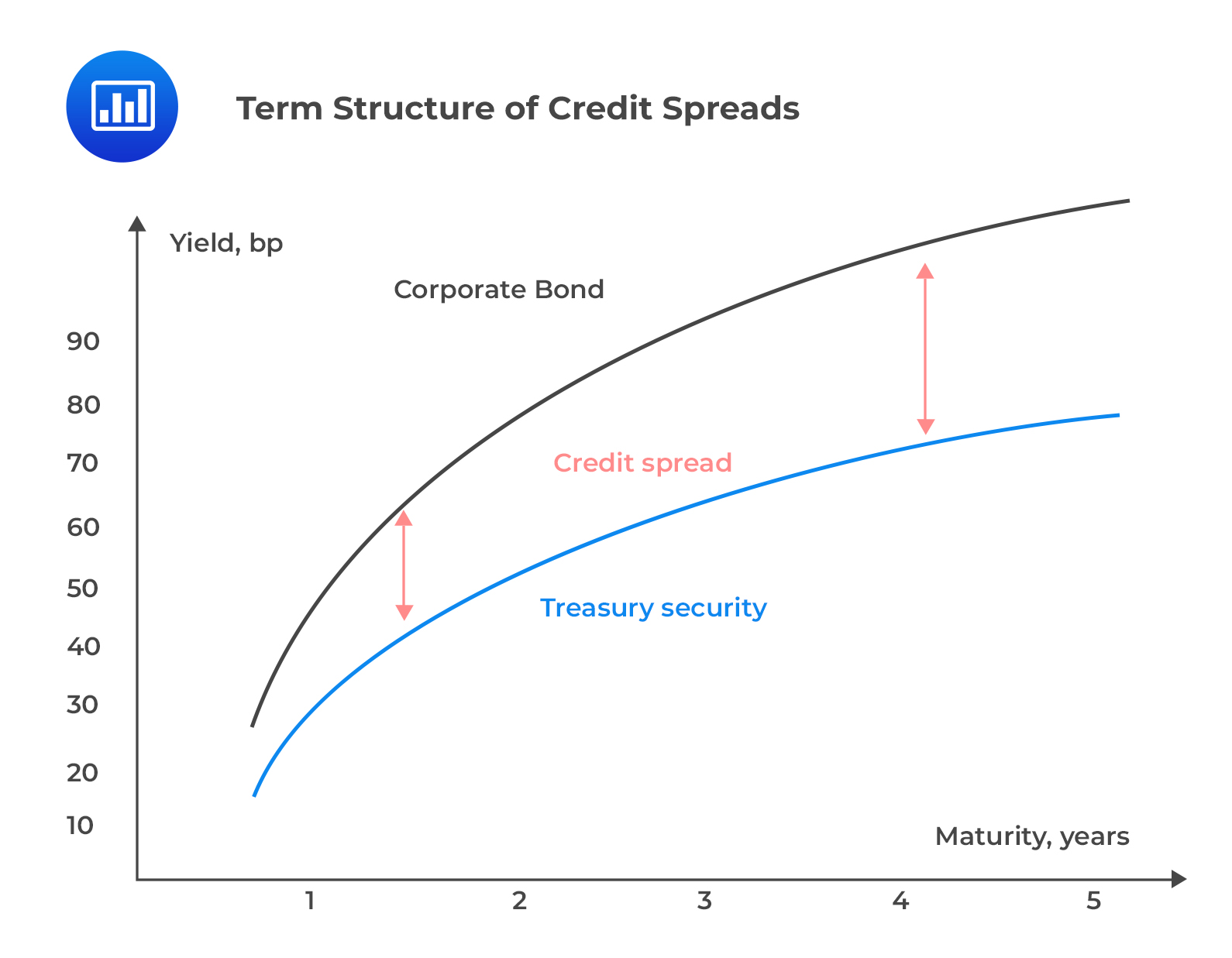

A credit curve is a graphical representation of the spread over benchmark security for an issuer of a credit risky bond across maturities.

The following shows the term structure of credit spreads:

The higher the time to maturity, the greater the probability of default and the lower the recovery rate. Recall from the previous section that credit spread is positively related to the probability of default and inversely related to the recovery rate. Therefore, the credit spread widens as the term to maturity increases.

The higher the time to maturity, the greater the probability of default and the lower the recovery rate. Recall from the previous section that credit spread is positively related to the probability of default and inversely related to the recovery rate. Therefore, the credit spread widens as the term to maturity increases.

Investment-grade bonds with the highest credit ratings have extremely low credit spreads. Further, their credit migration is possible only in one direction, given the implied lower bound of zero on credit spreads. Therefore, the credit term structure for the most highly rated securities tends to be flat or upward sloping.

On the other hand, securities with lower credit quality face greater sensitivity to the credit cycle, hence have steeper credit spread curves.

Credit spreads narrow with the expectation of economic growth and widen during cyclical downturns. This implies that there is a countercyclical relationship between credit spreads and benchmark rates over the business cycle.

A strong economic climate is associated with higher benchmark yields, but lower credit spreads because the probability of issuers defaulting declines in such good times.

The frequently traded securities heavily influence the shape of the credit curve. This is due to the low liquidity in most corporate debt issues. The credit curve flattens if a significant supply is expected and vice versa.

Company-specific factors such as the industry it operates in, cash flow, leverage, and profitability affect the credit spread. All else equal, any microeconomic factor that increases the default probability tends to steepen the credit spread curve, and vice versa.

Question

Credit spread curves of lower credit quality bonds are most likely:

- Flat or slightly upward sloping.

- Steeply upward sloping.

- Flat or slightly downward sloping.

Solution

The correct answer is B.

Lower credit quality securities have a steeper positive slope because they are more sensitive to the credit cycle.

A is incorrect. The credit term structure for the most highly rated securities tend to be flat or upward sloping.

Reading 31: Credit Analysis Models

LOS 31 (g) Explain the determinants of the term structure of credit spreads and interpret a term structure of credit spreads.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.