Time Value of Money With Different Fre ...

Time value of money calculations allow us to establish the future value of... Read More

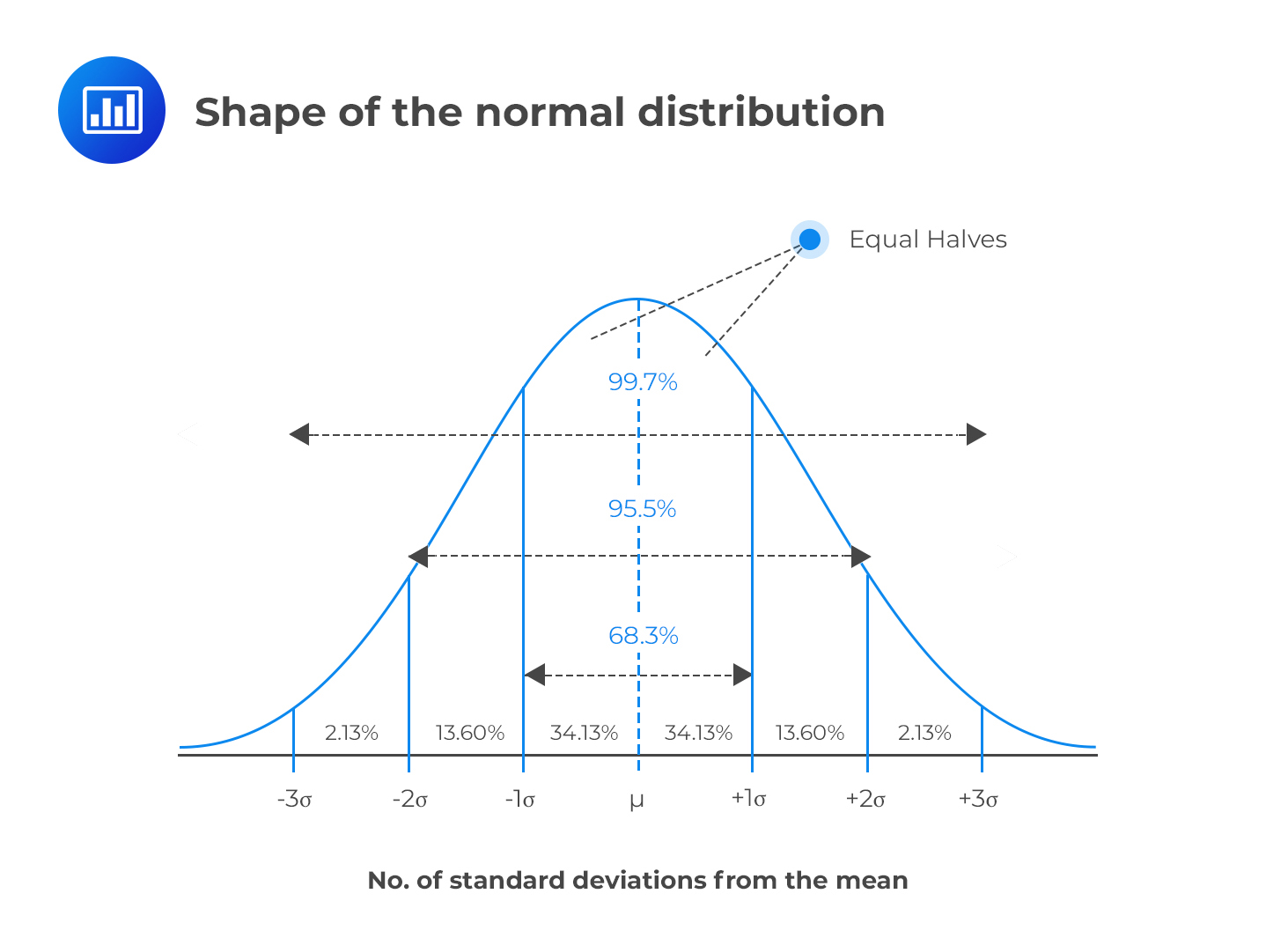

A random variable is said to have a normal distribution (Gaussian curve) if its values make a smooth curve that assumes a “bell shape.” A normal variable has a mean \(μ\), pronounced as “mu,” and a standard deviation \(σ\), pronounced as “sigma.” All normal distributions have a distinguishable bell shape regardless of the mean, variance, and standard deviation.

A normal distribution has certain properties that make it a useful tool in the world of finance.

To determine the probability that a random variable \(X\) lies between two points \(a\) and \(b\):

$$ P\left( a < X < b \right) =\int _{ a }^{ b }{ f\left( x \right)dx } $$

The normal distribution is very important in statistical analysis, especially because of the central limit theorem. The theorem asserts that any distribution becomes normally distributed when the number of variables is sufficiently large. For instance, the binomial distribution tends to “change” into the normal distribution with mean \(nθ\) and variance \(nθ (1 – θ)\).

Question

Which of the following is least likely a property of normal distribution?

- The excess kurtosis is equal to 3.

- The mean, mode, and median are all equal.

- About 68% of the total values lie within one standard deviation of the mean.

Solution

The correct answer is A.

The normal distribution has an excess kurtosis of 0. Excess kurtosis is a value above kurtosis of 3. Since the kurtosis of the normal distribution is 3, the excess kurtosis of 0.

B and C are incorrect. They are the true properties of the normal distribution.