Covariance and Correlation

Covariance Covariance is a measure of the degree of co-movement between two random... Read More

The probability distribution of a random variable \(X\) is a graphical presentation of the probabilities associated with the possible outcomes of \(X\). A random variable is any quantity for which more than one value is possible. The price of quoted stocks is a good example in this respect. Simply put, a probability distribution gathers all the outcomes and further indicates the probability associated with each outcome.

This reading covers the probability distributions listed below:

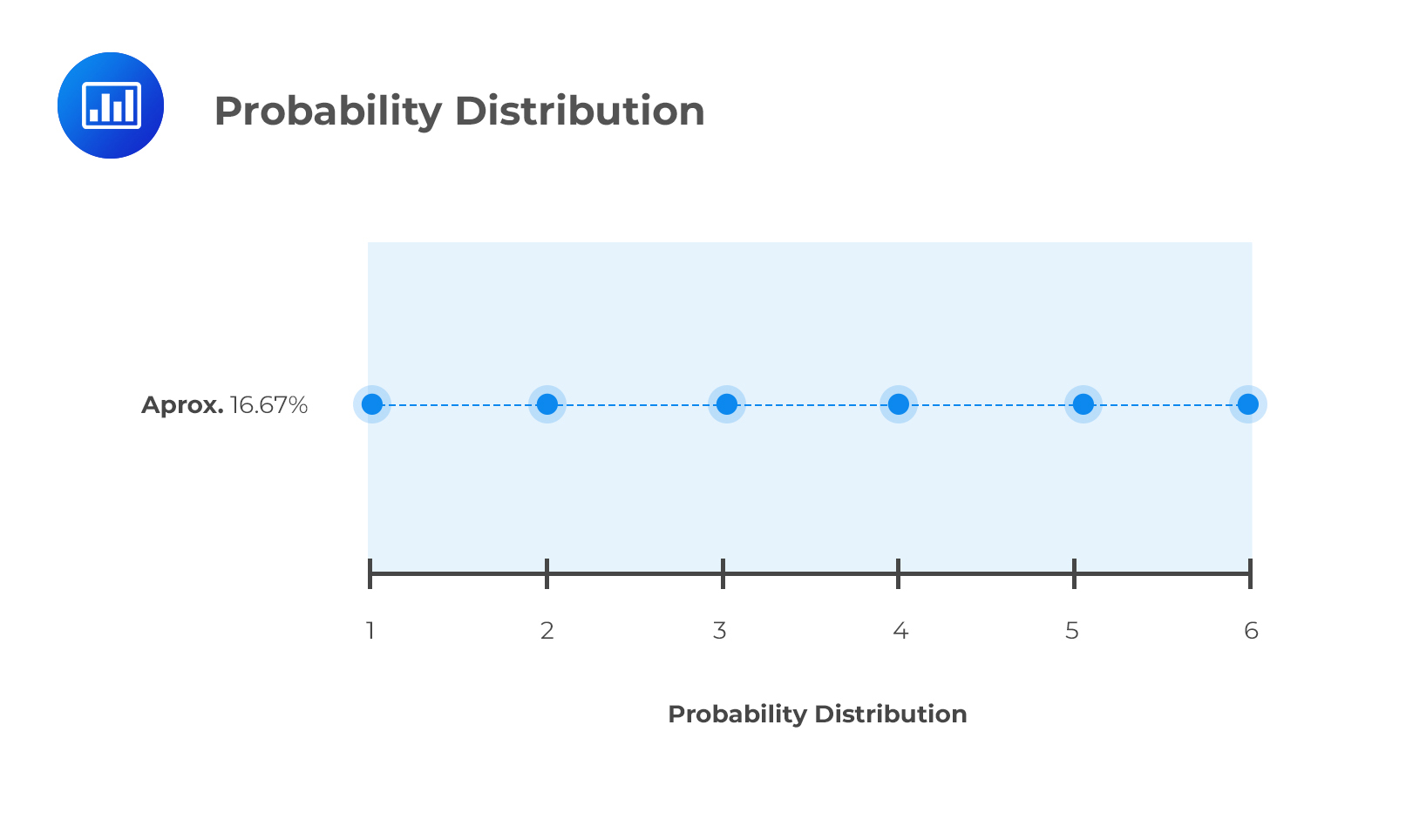

Suppose we roll a die. The set of possible outcomes is:

{ 1 2 3 4 5 6 }

Each of these outcomes would occur with a probability of 1/6 because each outcome has an equal chance of occurrence. Consequently, the probability distribution would be a straight line:

Note to candidates: Although the above distribution is a straight line, most real-life distributions are usually curved. We will particularly delve into the bell-shaped normal distribution later.

A discrete random variable can take on a finite number of outcomes. Examples include:

A continuous random variable is one that has an infinite number of possible outcomes. A good example can be the rate of return on a stock. For instance, the return can be 6%, or between 6% and 7%, in which case, it can take on 6.4%, 6.41%, 6.412%, or even 6.412325%, i.e., infinite values.

A probability function gives the probability of a random variable \(X\) taking on a value “\(x\).” The probability functions of discrete and continuous random variables are slightly different.

For a discrete random variable, the probability function, \(P(x)\), satisfies the following properties:

For a continuous random variable, the probability function, \(f(x)\), satisfies the following properties:

Question

Which of the following is least likely a property of probability mass function, P(x)?

- The probability mass function is nonnegative for all \(x\).

- The integral of the probability mass function is 1.

- The sum of the probabilities of all possible outcomes = 1.

Solution

The correct answer is B.

Option B is a property of probability density function (for continuous random variables) and not probability mass function.

A and C are incorrect. For a discrete random variable, the probability function is termed as probability mass function with the following properties:

- \(P(X = x) = P(x)\).

In statistics, \(P(x)\) is said to be a probability mass function.- \(P(x)\) is always nonnegative for all \(x\).

- The sum of the probabilities of all possible outcomes = 1.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.