Market Efficiency

Market efficiency describes the extent to which available information is quickly reflected in... Read More

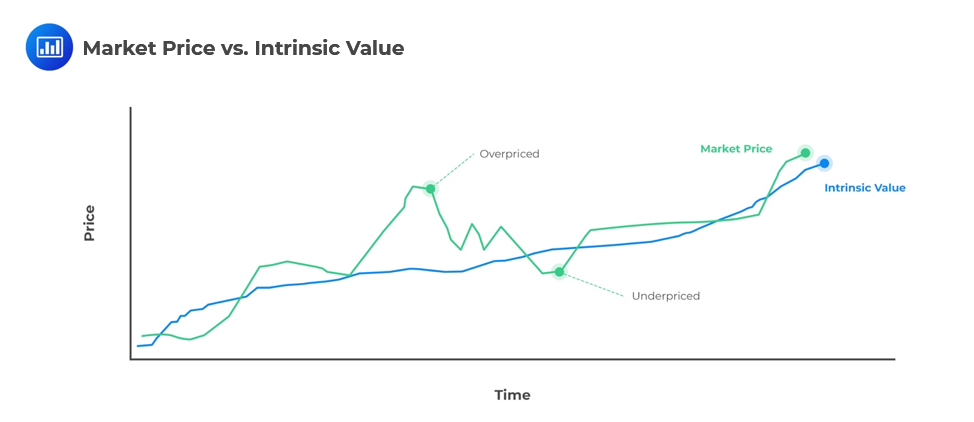

When a security’s current market price is approximately equal to its value estimate, the security is considered to be fairly valued. Conversely, when the market price exceeds the value estimate, the security is overvalued, and so the security is undervalued when the market price is lower than its estimated value.

Of course, there are many uncertainties in calculating an estimated valuation for a company. So while market prices should be treated with skepticism, they should also be treated with respect because an identified mispricing may reveal an error in the analyst’s valuation and not the market’s valuation.

Question

A share of Apple stock is currently selling for $117. An analyst calculates a share of Apple to be worth approximately $115 to $130.

The analyst thinks that Apple’s stock is currently:

- Overvalued.

- Fairly valued.

- Undervalued.

Solution

The correct answer is B.

Based on the analyst’s calculation that a share of Apple is worth approximately $115 to $130, and considering that the current market price is $117, the stock is within the analyst’s valuation range. Therefore, the stock can be considered fairly valued.