Evaluating a Company’s Capital I ...

Sources and Uses of Capital Companies invest capital that they acquire from debt... Read More

Determining which industries will earn economic profits (return on invested capital in excess of the cost of capital) is typically dependent on understanding the competitive environment within the industry. Thus, strategic analysis is the competitive environment analysis, emphasizing the implications of the environment for corporate strategy. Michael Porter’s “five forces” framework is the classic starting point for strategic analysis.

Porter identified five determinants of competition intensity in an industry

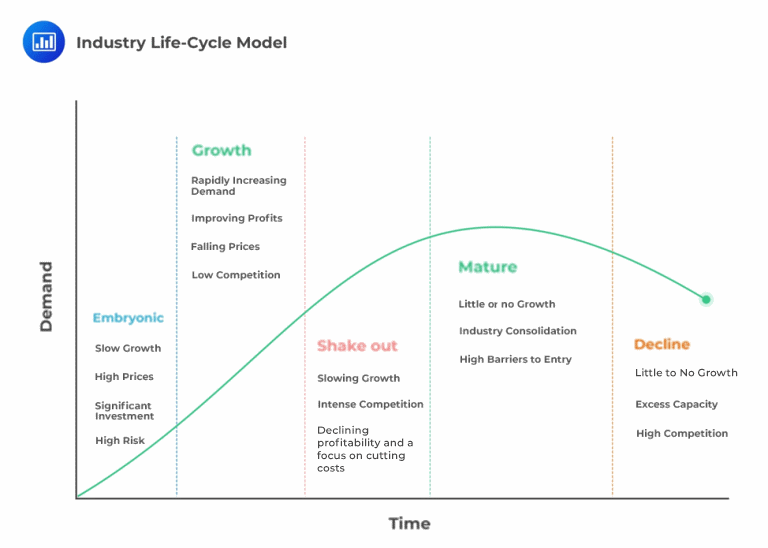

An industry’s life-cycle position often has a large impact on its competitive dynamics, making this position an important component of the strategic analysis of an industry. There are five stages in the industry life-cycle model: embryonic, growth, shakeout, mature, and decline. Each stage is characterized by different opportunities and threats, as we will see in a future learning objective.

Question

In which industry life cycle stage is there focus on cutting costs because the competition is intensifying?

- Mature stage.

- Decline stage.

- Shakeout stage.

Solution

The correct answer is C.

The maturity phase begins with a shakeout period, during which growth slows and focus shifts toward expense reduction. Shakeout usually refers to the consolidation of an industry where some businesses are naturally eliminated because they are unable to grow along with the industry.